Fill and Sign the Bookkeeping Service Agreement Form

Convenient tips for preparing your ‘Bookkeeping Service Agreement’ online

Are you fed up with the inconvenience of handling paperwork? Search no further than airSlate SignNow, the premier electronic signature solution for individuals and small to medium-sized businesses. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign documents online. Take advantage of the robust features integrated into this user-friendly and cost-effective platform and transform your method of document management. Whether you need to approve forms or gather signatures, airSlate SignNow manages it all seamlessly, needing just a few clicks.

Follow these comprehensive steps:

- Log into your account or register for a free trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template library.

- Open your ‘Bookkeeping Service Agreement’ in the editor.

- Click Me (Fill Out Now) to complete the form on your side.

- Add and assign fillable fields for additional parties (if necessary).

- Proceed with the Send Invite options to request electronic signatures from others.

- Save, print your copy, or convert it into a reusable template.

No need to worry if you require collaboration with your team on your Bookkeeping Service Agreement or send it for notarization—our platform offers everything you need to perform these tasks. Create an account with airSlate SignNow today and enhance your document management to a whole new level!

FAQs

-

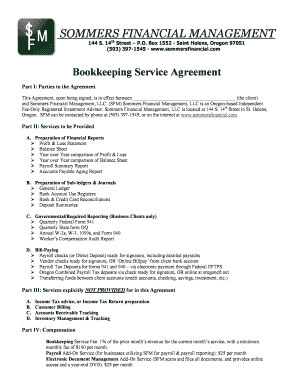

What is a Bookkeeping Service Agreement?

A Bookkeeping Service Agreement is a formal contract that outlines the terms and conditions between a business and a bookkeeping service provider. It defines the scope of services, payment terms, and responsibilities of both parties. This agreement ensures clarity and sets expectations, making it essential for any business looking to outsource bookkeeping.

-

How can airSlate SignNow help with my Bookkeeping Service Agreement?

airSlate SignNow simplifies the process of creating, sending, and eSigning your Bookkeeping Service Agreement. With its intuitive interface, you can easily customize templates and collect signatures electronically, saving time and streamlining your workflow. This efficient solution ensures that your agreements are secured and legally binding.

-

What features does airSlate SignNow offer for managing Bookkeeping Service Agreements?

airSlate SignNow offers features such as customizable templates, real-time tracking of document status, and automated reminders for signing. Additionally, you can integrate it with various business tools to enhance your workflow. These features make managing your Bookkeeping Service Agreement hassle-free and efficient.

-

Is there a free trial available for airSlate SignNow's services?

Yes, airSlate SignNow offers a free trial that allows you to explore its features for managing your Bookkeeping Service Agreement without any initial investment. This trial period gives you the opportunity to experience the platform’s capabilities in eSigning and document management before making a commitment.

-

What are the pricing options for airSlate SignNow's services?

airSlate SignNow provides flexible pricing plans designed to accommodate various business needs, including those managing a Bookkeeping Service Agreement. Pricing typically varies based on the number of users and features required. You can easily find a plan that fits your budget and operational requirements.

-

Can I integrate airSlate SignNow with other software for my bookkeeping needs?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and financial software, enhancing the management of your Bookkeeping Service Agreement. These integrations help streamline your business processes, allowing for easy data transfer and improved efficiency in handling financial documents.

-

What are the benefits of using airSlate SignNow for Bookkeeping Service Agreements?

Using airSlate SignNow for your Bookkeeping Service Agreement provides numerous benefits, including increased speed of document turnaround, enhanced security features, and reduced paper waste. Additionally, it enables easy tracking and management of agreements, ensuring that you never miss an important signature or deadline.

Find out other bookkeeping service agreement form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles