Fill and Sign the Bsp Online Loan Application Form

Practical advice on finalizing your ‘Bsp Online Loan Application Form’ online

Are you fed up with the burden of handling documentation? Look no further than airSlate SignNow, the leading eSignature solution for individuals and businesses. Bid farewell to the lengthy process of printing and scanning files. With airSlate SignNow, you can effortlessly complete and endorse documents online. Take advantage of the robust features packed into this user-friendly and affordable platform and transform your method of document management. Whether you need to approve forms or collect digital signatures, airSlate SignNow manages it all effortlessly, requiring merely a few clicks.

Follow this comprehensive guide:

- Access your account or initiate a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form repository.

- Open your ‘Bsp Online Loan Application Form’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

- Add and designate fillable fields for others (if necessary).

- Proceed with the Send Invite configurations to request eSignatures from others.

- Save, print your version, or convert it into a multi-usable template.

No need to worry if you require collaboration with your teammates on your Bsp Online Loan Application Form or need to send it for notarization—our solution equips you with everything necessary to complete such tasks. Sign up with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

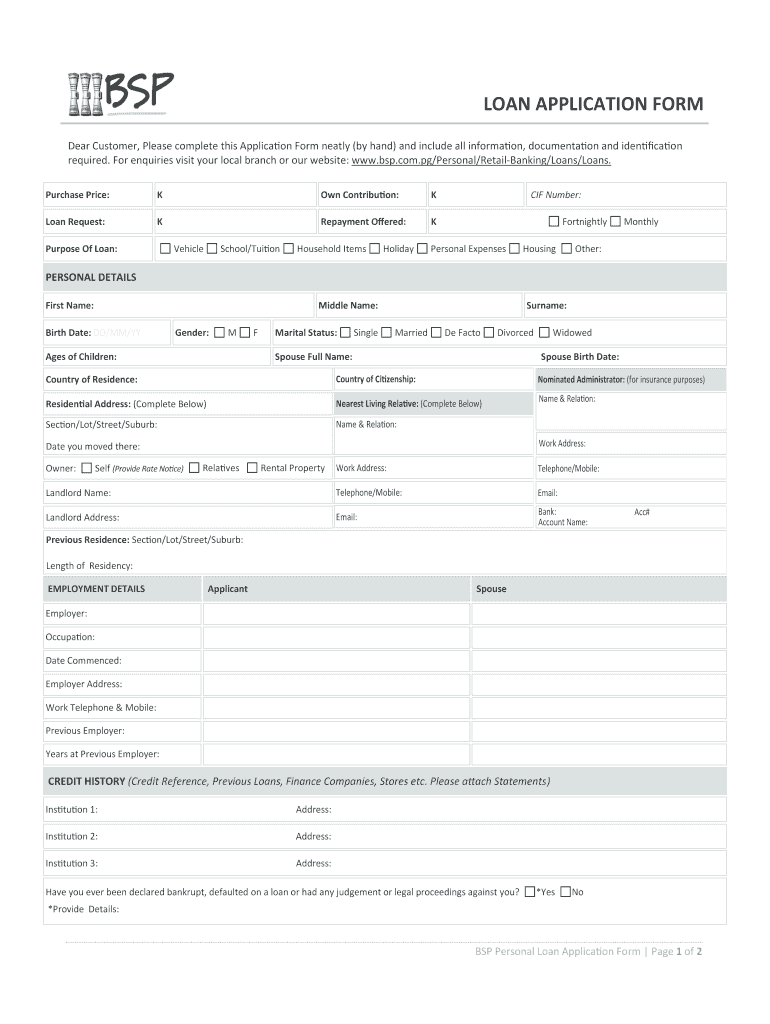

What is the Bsp Online Loan Application Form?

The Bsp Online Loan Application Form is a digital platform that allows users to apply for loans conveniently online. With this form, prospective borrowers can fill out their information, submit necessary documentation, and track their application status, all from the comfort of their home. It's designed to streamline the loan application process for both lenders and borrowers.

-

How can I access the Bsp Online Loan Application Form?

You can easily access the Bsp Online Loan Application Form through the airSlate SignNow platform. Simply visit our website, navigate to the loan application section, and you will find the form ready for you to fill out. Our user-friendly interface makes it simple to get started.

-

What features does the Bsp Online Loan Application Form offer?

The Bsp Online Loan Application Form includes features such as e-signature capabilities, document storage, and real-time tracking of your application status. Additionally, it allows for easy integration with other systems, making the loan application process efficient and hassle-free. These features ensure you can manage your loan applications seamlessly.

-

What are the benefits of using the Bsp Online Loan Application Form?

Using the Bsp Online Loan Application Form can signNowly speed up the loan application process. You can complete applications in minutes rather than hours, and the digital format minimizes errors. Moreover, the form is secure and ensures that your personal information is protected.

-

Is the Bsp Online Loan Application Form suitable for all types of loans?

Yes, the Bsp Online Loan Application Form is versatile and can be used for various types of loans, including personal, auto, and home loans. This flexibility makes it a great choice for lenders looking to standardize their application process across different loan products.

-

How much does it cost to use the Bsp Online Loan Application Form?

The Bsp Online Loan Application Form is available at competitive pricing through airSlate SignNow. We offer various pricing plans depending on the features and volume of usage you need. For specific pricing details, please visit our pricing page or contact our sales team.

-

Can the Bsp Online Loan Application Form be integrated with other software?

Absolutely! The Bsp Online Loan Application Form is designed to integrate seamlessly with various CRM and financial software. This integration helps streamline your entire loan process, from application to approval, ensuring that all your data is synchronized and easily accessible.

Find out other bsp online loan application form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles