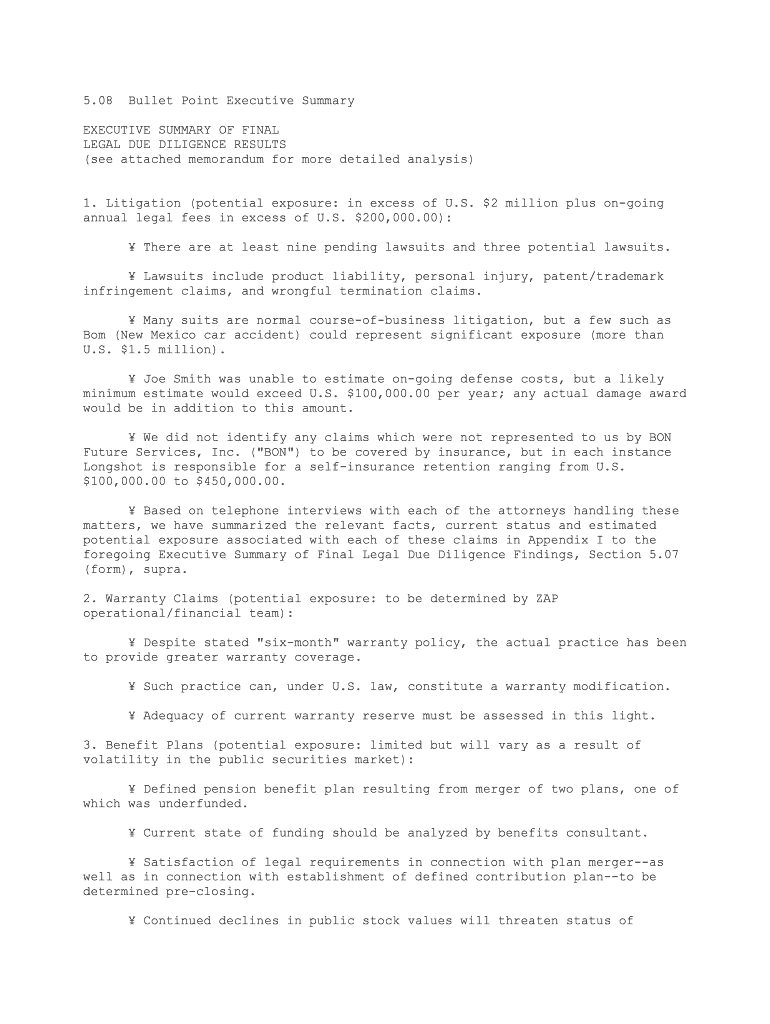

5.08 Bullet Point Executive SummaryEXECUTIVE SUMMARY OF FINAL

LEGAL DUE DILIGENCE RESULTS

(see attached memorandum for more detailed analysis)

1. Litigation (potential exposure: in excess of U.S. $2 million plus on-going

annual legal fees in excess of U.S. $200,000.00): ¥ There are at least nine pending lawsuits and three potential lawsuits.

¥ Lawsuits include product liability, personal injury, patent/trademark

infringement claims, and wrongful termination claims.

¥ Many suits are normal course-of-business litigation, but a few such as

Bom (New Mexico car accident) could represent significant exposure (more than

U.S. $1.5 million).

¥ Joe Smith was unable to estimate on-going defense costs, but a likely

minimum estimate would exceed U.S. $100,000.00 per year; any actual damage award

would be in addition to this amount.

¥ We did not identify any claims which were not represented to us by BON

Future Services, Inc. ("BON") to be covered by insurance, but in each instance

Longshot is responsible for a self-insurance retention ranging from U.S.

$100,000.00 to $450,000.00.

¥ Based on telephone interviews with each of the attorneys handling these

matters, we have summarized the relevant facts, current status and estimated

potential exposure associated with each of these claims in Appendix I to the

foregoing Executive Summary of Final Legal Due Diligence Findings, Section 5.07

(form), supra.

2. Warranty Claims (potential exposure: to be determined by ZAP

operational/financial team):

¥ Despite stated "six-month" warranty policy, the actual practice has been

to provide greater warranty coverage.

¥ Such practice can, under U.S. law, constitute a warranty modification.

¥ Adequacy of current warranty reserve must be assessed in this light.

3. Benefit Plans (potential exposure: limited but will vary as a result of

volatility in the public securities market): ¥ Defined pension benefit plan resulting from merger of two plans, one of

which was underfunded.

¥ Current state of funding should be analyzed by benefits consultant.

¥ Satisfaction of legal requirements in connection with plan merger--as

well as in connection with establishment of defined contribution plan--to be

determined pre-closing.

¥ Continued declines in public stock values will threaten status of

funding.¥ Substantial additional information needed to complete investigation in

this area.

4. Labor Matters (potential exposure: limited):

¥ Proposed reduction in work force to be undertaken upon completion of the

acquisition may trigger contract, race discrimination, sex discrimination or

Worker Adjustment and Retraining Notification Act ("WARN") litigation.

¥ Primary legal concern will be the issue of perceived age discrimination

and attendant claims under the Age Discrimination in Employment Act of 1967 ("ADEA").

¥ Labor counsel should be consulted in connection with the following

areas:

¥ Analyzing whether any minor structuring or timing changes in the planned

lay-off may allow Longshot to avoid triggering a WARN Act notice and assistance

in meeting notice requirements should such notice be required.

¥ Applicable New Mexico law, which places additional WARN-like

notification burdens on employers engaging in lay-offs.

¥ Any immigration arrangements to be made for foreign employees working in

the U.S.

¥ Developing a plan by which Longshot can retain the best-qualified

employees while avoiding or minimizing litigation potential.

5. Enforceability of Representations, Warranties and Indemnities Made by Magic

PLC ("Magic") and Magic Motor Company, Inc. ("MMC") (potential exposure: high):

¥ Uncertainty exists as to whether the representations, warranties and

indemnification provisions of the Amera Bank purchase agreement are enforceable

by Longshot against Magic.

¥ Such provisions may be held to accrue in favor of and be enforceable by

Longshot either through (a) Longshot as an intended third-party beneficiary of

the Agreement or (b) Longshot as successor-in-interest to all of the rights and

benefits enjoyed by Longshot Acquisition Corporation under the Agreement.

¥ Drafting ambiguities in previous documents and other errors render a

conclusive determination of the issue impossible, meaning that in the event of a

dispute, resolution would likely fall to a judge or jury.

¥ ZAP should consider seeking (a) an express acknowledgment by Magic that

Longshot is entitled to enforce the Agreement, (b) indemnification from Amera

Bank which would only be triggered in the event Longshot were held not to have

an enforcement right under the Agreement, and/or (c) an opinion of Joe Smith as

to matters of enforceability.

6. Leases/Performance Guaranties (potential exposure: in excess of U.S. $1 million):

¥ Prior Longshot management entered into a number of such arrangements

without proper authority.

¥ Because execution of such agreements was done as part of a course of

improper actions taken by prior management, Longshot is now unable to determine

precisely how many performance guaranties exist (Magic did not warrant the

accuracy of its disclosure in this regard).

¥ We reviewed four such arrangements, with total possible exposure to

Longshot in excess of U.S. $1.5 million.

7. Environmental (potential exposure: appears to be limited, but environmental

exposure should be considered a material risk in all transactions):

¥ Under applicable U.S. environmental laws and regulations, both owner and

non-owner operators (current and former) can be held liable for releases of

hazardous substances onto property.

¥ There do not appear to be any significant environmental conditions at

the Bunker facility.

¥ ZAP should verify that the remaining two underground storage tanks

("UST's") at Bunker have been properly removed and replaced with a single above-

ground storage tank.

¥ Transfers of industrial properties in New Mexico must comply with the

New Mexico Industrial Site Recovery Act ("ISRA").

¥ Pursuant to ISRA, MMC entered into a Remediation Agreement with the New

Mexico Department of Environmental Protection ("NMDEP"); ZAP and Amera Bank

should seek a Remediation in Progress Waiver from NMDEP and secure an

environmental consultant to verify that conditions at Bunker have not changed.

¥ ZAP and Amera Bank should review Magic's remediation plan, comply with

notification and funding requirements of ISRA, and seek other assurances from

the NMDEP that the proposed transfer remains in compliance with ISRA.

¥ ZAP must have contractual assurance that it need not and will not assume

any remedial obligation imposed on Magic by ISRA.

8. Accounting Irregularities (potential exposure: limited):

¥ Although Longshot has only limited third-party recourse, Longshot would

not appear to have material exposure as a result of the financial

irregularities.

¥ Potential tax liability exists to the extent that overstated reserves

affect tax filings (e.g., fraudulent overstatement of bad business debt

deductions) (see separate memorandum).

9. Required Refinancing (potential exposure: facility fees, commitment fees,

expenses, etc., could exceed U.S. $2 million if refinanced through a U.S. lender):

¥ The contemplated transaction will trigger a default under Longshot's

loan agreement with Rapid Corp ("Rapid").

¥ As a result, ZAP may either seek Rapid's consent to the transaction or

arrange for an alternative source of financing.

¥ Any refinancing will involve additional transaction costs and may

involve additional lender fees and expenses.

10. Intellectual Property (potential exposure: appears to be limited; in

addition, you have advised us that, from a business perspective, this is an area

of no concern to you):

¥ Only limited due diligence was performed by Amera Bank on intellectual

property.

¥ As a result, it is now impossible to value the portfolio or assess

exposure to infringement or other claims.

¥ Longshot owns intellectual property in addition to that disclosed

pursuant to the Amera Bank acquisition.

¥ Additional diligence is needed to ensure that title to the identified

properties can be transferred in connection with the proposed sale.

¥ Various threatened and actual infringements appear to be immaterial.

¥ The Hot Buy license is likely to be invalid and unenforceable.

¥ Magic has filed an opposition to the registration of the mark "LONGSHOT

COMPANIES, INC." as used in connection with tarpaulins and other textile

materials.

¥ We must determine whether any limitations the use of the "LONGSHOT"

trademark exist as a result of an "Agreement Not to Interfere" recorded in the

U.S. Patent and Trademark Office in conjunction with Magic's opposition.

11. Insurance Coverage/Risk Management (potential exposure: to be determined by

ZAP's English insurance consultant):

¥ The BON report concluded that Longshot's "catastrophic loss" risk is

"moderate."

¥ Longshot's single location creates serious business interruption

exposure from loss by fire or other natural disaster since no other Longshot

facility exists which could increase productivity to make up for a loss at the

Bunker location.

¥ Additional or revised coverages, including director and officer

liability insurance, were suggested by BON, as well as a recommendation that

additional reserves be added for various outstanding claims, including the Bom

claim (see description at Item 1 above).

12. Information Technology (potential exposure: if IT licenses are triggered,

potentially material; if not, then immaterial. Final assessment to be made pre-

closing based on precise structure and percentages):

¥ The Andersen Ernst Due Diligence Report ("AE Report") notes that IT expense is

currently 1.5% of revenues; 5% to 7% of revenues is more typical, according to

AE. Hence, is the target company antiquated vis-ˆ-vis information technology and

will that make it noncompetitive on a level playing field?¥ It is currently unclear whether change-of-control provisions in IT

licenses were triggered by the Amera Bank acquisition and, if so, whether

required consents were obtained.

¥ If change-of-control provisions in IT licenses were or will be

triggered, additional costs may be incurred.

13. Tax Matters (potential exposure: limited; however, valid tax indemnity is

essential):

¥ As noted in Item 5, whether the representations, warranties and

indemnities (including those relating to tax matters) made by Magic and MMC in

favor of Longshot and LAC under the Amera Bank Agreement will be enforceable by

Longshot cannot be determined with certainty.

¥ Amera Bank and MMC are still ascertaining the Section 1060 allocation of

consideration among Longshot's assets, which determines Longshot's basis in

assets it held as of the date of the Amera Bank Agreement.

¥ Longshot has not had any federal payroll tax audits in the last twenty-

five years, making determination of any potential exposure difficult; moreover,

AE noted that significant exposure may exist.

¥ Longshot is currently filing voluntary tax compliance with various

states and is negotiating amounts to be paid in connection with overdue state

income, sales and use taxes; we are awaiting AE's estimate of such tax exposure

for post-1998 taxable periods.

14. Foreign Joint Ventures (potential exposure: unable to estimate at present):

¥ Upon your instruction, no analysis of local filing, notification or

other requirements was undertaken in connection with the Amera Bank acquisition.

¥ Until local counsel is retained, it will be impossible to assess whether

there is any risk associated with these joint ventures or other exposures

resulting from the Amera Bank acquisition.

¥ No environmental information has been provided with respect to the joint

venture facilities.

Practical advice on finalizing your ‘Bullet Point Executive Summary’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the leading electronic signature solution for individuals and organizations. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign documents online. Take advantage of the powerful features integrated into this intuitive and cost-effective platform and transform your method of handling documents. Whether you need to sign forms or gather signatures, airSlate SignNow takes care of everything seamlessly, with just a few clicks.

Adhere to this comprehensive guide:

- Log into your account or initiate a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template repository.

- Edit your ‘Bullet Point Executive Summary’ in the editor.

- Select Me (Fill Out Now) to finish the document on your end.

- Add and assign fillable fields for others (if needed).

- Proceed with the Send Invite options to request eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

Don’t be concerned if you need to collaborate with your colleagues on your Bullet Point Executive Summary or send it for notarization—our platform offers everything necessary to achieve such tasks. Register with airSlate SignNow today and elevate your document management to new levels!