–––––

–––––

–––––

–––––

–––––

––––– –––––

–––––

–––––

–––––

–––––

–––––

–––––

–––––

–––––

–––––

–– –– –––––

––

–––––

–––––

–––––

––––– ––––– –––––

–––––

–––––

–– ––

–––––

–– –––––

––––– ––

–– –––––

––––– ––

–––––

––––– F L -

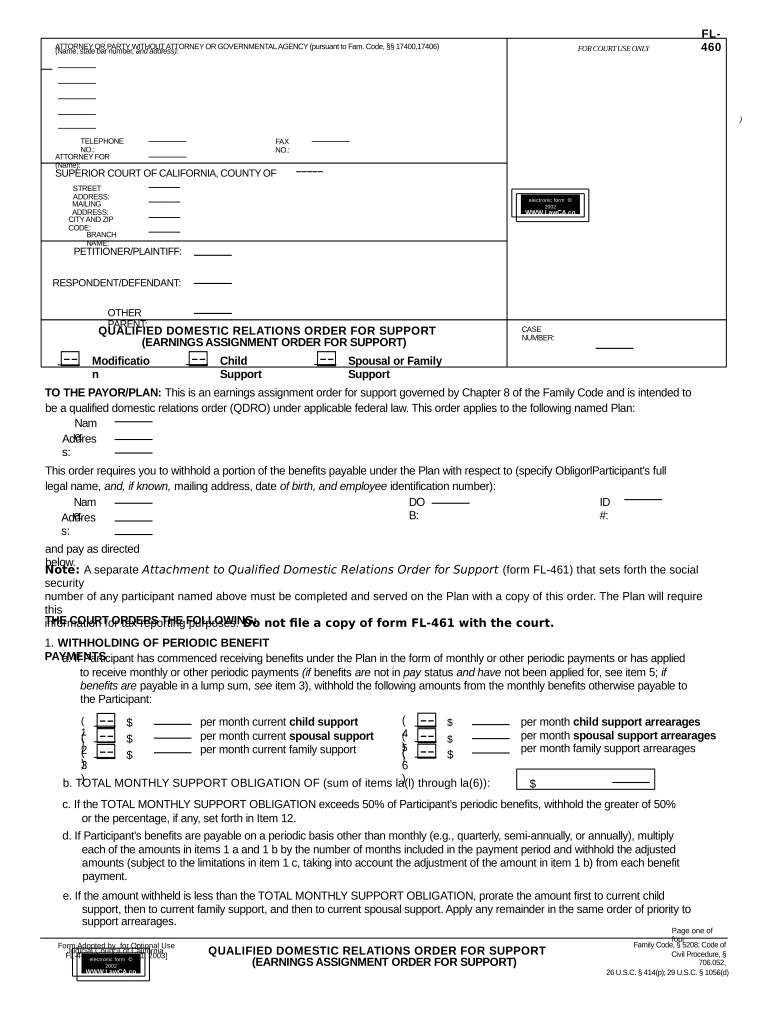

4 6 0ATTORNEY OR PARTY WITHOUT ATTORNEY OR GOVERNMENTAL AGENCY (pursuant to Fam. Code, §§ 17400,17406)

(Name, state bar number, and address): FOR COURT USE ONLY

)

TELEPHONE

NO.: FAX

NO.:

ATTORNEY FOR

(Name):

SUPERIOR COURT OF CALIFORNIA, COUNTY OF

STREET

ADDRESS:

MAILING

ADDRESS:

CITY AND ZIP

CODE:

BRANCH

NAME:

PETITIONER/PLAINTIFF:

RESPONDENT/DEFENDANT:

OTHER

PARENT:

QUALIFIED DO MESTIC RELATIO NS O RDER FOR SUPPO RT

(EARNINGS ASSIGNMENT ORDER FOR SUPPORT) CASE

NUMBER:

Modificatio

n Child

Support Spousal or Family

Support

TO THE PAYOR/PLAN: This is an earnings assignment order for support governed by Chapter 8 of the Family Code and is intended to

be a qualified domestic relations order (QDRO) under applicable federal law. This order applies to the following named Plan:

Nam

e:

Addres

s:

This order requires you to withhold a portion of the benefits payable under the Plan with respect to (specify ObligorlParticipant's full

legal name, and, if known, mailing address, date of birth, and employee identification number):

Nam

e: DO

B: ID

#:

Addres

s:

and pay as directed

below.

Note: A separate Attachment to Qualifed Domestic Relations Order for Support (form FL-461) that sets forth the social

security

number of any participant named above must be completed and served on the Plan with a copy of this order. The Plan will require

this

information for tax reporting purposes. Do not fie a copy of form FL-461 with the court.THE COURT ORDERS THE FOLLOWING:

1. WITHHOLDING OF PERIODIC BENEFIT

PAYMENTS

a. If Participant has commenced receiving benefits under the Plan in the form of monthly or other periodic payments or has applied

to receive monthly or other periodic payments (if benefits are not in pay status and have not been applied for, see item 5; if

benefits are payable in a lump sum, see item 3), withhold the following amounts from the monthly benefits otherwise payable to

the Participant:

(

1

) $ per month current child support

per month current spousal support

per month current family support (

4

) $

(

2

) $ (

5

) $

(

3

) $ (

6

) $ per month child support arrearages

per month spousal support arrearages

per month family support arrearages

b. TOTAL MONTHLY SUPPORT OBLIGATION OF (sum of items la(l) through la(6)):

$

c. If the TOTAL MONTHLY SUPPORT OBLIGATION exceeds 50% of Participant's periodic benefits, withhold the greater of 50%

or the percentage, if any, set forth in Item 12.

d. If Participant's benefits are payable on a periodic basis other than monthly (e.g., quarterly, semi-annually, or annually), multiply

each of the amounts in items 1 a and 1 b by the number of months included in the payment period and withhold the adjusted

amounts (subject to the limitations in item 1 c, taking into account the adjustment of the amount in item 1 b) from each benefit

payment.

e. If the amount withheld is less than the TOTAL MONTHLY SUPPORT OBLIGATION, prorate the amount first to current child

support, then to current family support, and then to current spousal support. Apply any remainder in the same order of priority to

support arrearages.

Page one of

four

Q UALIFIED DOMESTIC RELATIONS ORDER FO R SUPPORT

(EARNINGS ASSIGNMENT ORDER FOR SUPPORT) Family Code, § 5208; Code of

Civil Procedure, §

706.052,

26 U.S.C. § 414(p); 29 U.S.C. § 1056(d)Form Adopted by for Optional Use

Judicial Council of California

FL-460 [Rev. January 1, 2003] el ectr onic form ã

2002

WWW.LawCA.co

m

L a w

P u b l i s h e r s

el ectr onic form ã

2002

WWW.LawCA.co

m

L a w

P u b l i s h e r s

–––––

–––––

––––– –––––

––

–––––

–– –––––

–––––

–– –––––

––––– –––––

––––– –––––

––––– –––––

––––– –––––

––––– –––––

––––– –––––

–––––

–––––

––––– –––––

––

–––––

–– –––––

––––– –––––

–––––

––––– –––––PETITIONER/PLAINTIFF: CASE

NUMBER:

RESPONDENT/DEFENDANT:

OTHER

PARENT:

2. ARREARAGES: For purposes of this order, the total arrearages are set as follows (interest that has not been calculated or included

is not waived): )

Amoun

t As of

(date)

a

. Child

support: $

b

. Spousal

support: $

C

. Family

support: $

3. WITHHOLDING FROM LUMP SUM DISTRIBUTIONS: Withhold from any lump sum distributions currently payable to Participant

under the Plan as follows:

a. An amount equal to the total of the support arrearages, if any, set forth in item 2.

b. To the extent the amounts withheld under item 3a are for child support arrearages, withhold from the lump sum distribution and

pay over to the appropriate taxing authorities an additional amount sufficient to satisfy the Plan's mandatory federal and state

income tax withholding obligations with respect to those arrearages and with respect to all additional amounts withheld under

this item 3b. Any amounts withheld under this item 3b shall not be applied to reduce the amount of the child support arrearages.

c. To the extent the amounts withheld under item 3a are for support arrearages other than child support, withhold from those

amounts and pay over to the appropriate taxing authorities an additional amount sufficient to satisfy the Plan's mandatory federal

and state income tax withholding obligations with respect to those arrearages. Any amounts withheld under this item 3c shall be

applied proportionally to reduce the amount of the family support arrearages and spousal support arrearages.

Cl. If the amounts withheld under item 3a are less than the total of the support arrearages, if any, set forth in item 2, prorate the

amounts first to child support arrearages, then to family support arrearages, and then to spousal support arrearages.

e. If the amounts to be withheld under items 3a and 3b would exceed the total amount of the lump sum distribution currently

payable, withhold the entire amount of the lump sum distribution, allocate therefrom an amount sufficient to satisfy the Plan's

mandatory federal and state income tax withholding obligations with respect to the amount of such distribution, and allocate the

balance to satisfaction of the child support arrearages. Any income tax withheld under this item 3e shall not be applied to reduce

the amount of the child support arrearages.

f. The limitations on withholding set forth in item 1 and item 12 do not apply to the withholding provisions of this item 3.

4. DISTRIBUTE AMOUNTS WITHHELD OR ALLOCATED AS

FOLLOWS:

a. Child Support: All amounts withheld or payable for child support under this order are for the benefit of (specifyname(s) of each

Alternate Payee, with date of birth, if available):

Name of each child Date of birth of each child

b. Amounts withheld for child support shall be paid to (specify name, capacity, and mailing address of agent to receive payments)

(hereinafter ''Agent''):

Nam

e: Capacit

y:

Addres

s:

c. Spousal or Family

Support

(1) All amounts withheld or payable for spousal/family support under this order are for the benefit of (specify name of Spousal or

Family Alternate Payee, with date of birth, if available):

Nam

e: DO

B:

Note: A separate Statement of Confidential Information that sets forth the social security number of any Spousal or Family

Alternate Payee named in item 4c(l) must be completed and served on the Plan with a copy of this order. The Plan will re-

quire this information for tax reporting purposes. Do not file a copy of the Statement of Confidential Information with the court.

(2) Amounts withheld for spousal/family support shall be paid to (check one):

(

a

) Spousal or Family Alternate Payee at the following address (specify mailing address of Alternate Payee):

Addres

s:

(

b

) Spousal or Family Alternate Payee's Agent (specify name, capacity, and mailing address of agent to receive payments):

Nam

e: Capacit

y:

Addres

s:

QUALIFIED DOMESTIC RELATIONS ORDER FOR SUPPORT

(EARNINGS ASSIGNMENT ORDER FOR SUPPORT) Page two of

fourelec troni c form ã

2002

WWW.LawCA.co

m

L a w

P u b l i s h e r sFL-460 [Rev. January 1, 2003]

–––––

–––––

––––– –––––

––

––

––

–––––

––

–– ––––

––

––

––––– PETITIONER/PLAINTIFF:

CASE

NUMBER,

RESPONDENT/DEFENDANT:

OTHER

PARENT:

5

. IF BENEFITS ARE NOT CURRENTLY IN PAY STATUS:

a. If Participant applies for benefits (including a lump sum distribution) within 90 days after the Plan receives this order or while

the temporary restraining order in item 13 remains in effect, the withholding provisions of this order shall take effect once such

benefits become payable.

b. If Participant has not commenced receiving benefits under the Plan (other than by reason of the temporary restraining order in

item 13), and does not apply to receive benefits by the end of the period specified in item 5a, the Plan shall have no obligation

under this order to withhold payments from Participant's benefits, provided the Plan sends prompt written notice to Alternate

Payee(s) stating that no benefits are currently available for distribution under this order and specifying the earliest date on

which Participant could begin receiving benefits under the Plan if Participant terminated employment.

6

. Any notices required or permitted under this order to any Alternate Payee shall be sent by first-class mail, postage prepaid, to the

Alternate Payee or to the Alternate Payee's Agent, if one is designated, at the address set forth in item 4, or such other address as

the Alternate Payee/Agent may specify by written notice to the Plan.

7

. This order shall, upon approval as a QDRO (check appropriate box, if either is applicable):

(

a

)(

b

) amend/replace any existing QDRO with respect to support for any Alternate Payee(s) named herein.

supplement but not amend/replace any existing payment obligations under a previous QDRO issued with respect to any

Alternate Payee named herein.

8

. This order shall not be interpreted to require payment of benefits in any form not permitted by the Plan or in an amount in excess

of the actuarial value of Participant's benefits, less any benefits otherwise payable to another alternate payee under another order

previously determined to be a QDRO.

9

. Upon approval of this order as a QDRO, the Plan shall send to Alternate Payee(s) any forms or notices that the Plan may require

in order to effectuate the distribution of benefits as specified herein. This requirement does not apply if item 5b applies.

1 0. This order affects all benefits of Participant payable beginning as soon as possible but not later than 1 0 days after you receive it,

including any retroactive benefit payments, whether those payments relate to a period before or after the date you receive this

order. You must withhold from retroactive benefit payments according to the provisions of item 1 as if the payments had been

made when due. The payments ordered herein shall continue until further court order or notarized written notice from the Alternate

Payee(s).

11. The Plan shall give the Obligor/Participant a copy of this order and the accompanying blank Request for Hearing Regarding Wage

and Earnings Assignment (form 1299.28) within 1 0 days.

1

2

. MAXIMUM WITHHOLDING PERCENTAGE GREATER THAN 50% (if a maximum withholding percentage greater than 50%

has been authorized by court order, check the box to the left and complete the following):

By order entered on

(date): , pursuant to stipulation or following noticed motion and

appropriate proceedings, the court has determined, pursuant to Code of Civil Procedure section 706.052, that because

support arrearages exist and/or when Participant's disposable earnings from all sources are taken into account, the

maximum percentage of Participant's benefits under the Plan that are subject to withholding pursuant to item 1 of this order is

(check one):

(

a

) 100

%

(

b

) % (If this box is checked, fill in the maximum percentage specified in the order)

13. TEMPORARY RESTRAINING ORDER: During any period in which the status of this order as a QDRO is being determined (by

the Plan, a court of competent jurisdiction, or otherwise) and such further period as may be ordered by the court, the Plan is

hereby TEMPORARILY RESTRAINED from making any distribution to Participant or Participant's beneficiary (other than a

beneficiary under another QDRO) of any amount that would have been payable during such period to any Alternate Payee named

herein if this order had been determined to be a QDRO. In no event shall this temporary restraining order remain in effect for a

period of more than 18 months after the date of this order.

14. OTHER

PROVISIONS

(

a

)

(

b

) The Plan shall provide to Alternate Payee, or to Alternate Payee's Agent, a copy of the Summary Plan Description, and

any subsequent Summaries of Material Modifications with respect to the Plan, and the Plan's QDRO procedures, if any.

Other (specify):

Dat

e: JUDICIAL

OFFICER

QUALIFIED DOMESTIC RELATIONS ORDER FOR SUPPORT

(EARNINGS ASSIGNMENT ORDER FOR SUPPORT) Page three of

four el ectr onic form ã

2002

WWW.LawCA.co

m

L a w

P u b l i s h e r sFL-460 [Rev. January 1, 2003]

–––––

–––––

––––– –––––PETITIONER/PLAINTIFF: CASE

NUMBER:

RESPONDENT/DEFENDANT:

OTHER

PARENT:

)

INSTRUCTIO NS FO R QUALIFIED DO MESTIC RELATIO NS O RDER

(EARNINGS ASSIGNMENT ORDER FOR SUPPORT)

1. DEFINITIONS OF IMPORTANT WORDS IN THE

ORDER

(a) Alternate Payee: any spouse, former spouse, child, or

other dependent of the Participant.

(b) Participant/Obligor: any person ordered by a court to

pay child support, spousal support, or family support

who has an accrued benefit or account balance 2. TAX INFORMATION FOR PAYORS (continued)

You should consult with your professional tax advisor on the

specific tax treatment and reporting requirements applicable to

distributions under this order.

(whether or not vested) under a Plan.

(c) Agent: any person, including the district attorney or

other governmental agency, to whom the support is to

be paid on behalf of an Alternate Payee.

(d) Payor/Plan: any employee benefit plan described in

Family Code section 80 that is not a governmental plan

as defined in 29 U.S.C. § 1002(32). The term includes

plans benefiting self-employed individuals such as

partners and sole proprietors. If an entity other than the

Plan pays benefits to participants under the Plan, the 3. OTHER INFORMATION FOR PAYORS

This order, which is an earnings assignment order, and you as

the Payor, are governed by Chapter 8, beginning with section

5200 of the Family Code, and related provisions of that Code

and the Code of Civil Procedure. Your attention is directed

particularly to the provisions of Chapter 8 that set forth your

obligations as a Payor (referred to therein as the ''Employer'').

term Payor/Plan also includes that entity.

(e) QDRO: an order that has been approved by the plan

administrator of the Plan (or by a court of competent

jurisdiction) as meeting the requirements for a qualified

domestic relations order under 29 U.S.C. § 1056(d) or

26 U.S.C. §

414(p).

(f) Annuity: a form of benefit in which periodic payments

(usually monthly) are made for the life of the recipient

and/or the recipient's survivor. This order applies to

annuities and to any other form of benefit payment or

distribution allowable under the Plan (e.g., single sum,

installments, and other periodic payments). When benefits under the Plan are currently payable to the

Participant, withholding under this order should commence as

soon as possible but no later than 1 0 days after your receive

the Qualified Domestic Relations Order for Support. If benefits

are not currently payable but Participant has applied to receive

benefits, or applies within 90 days after you receive this order,

or while the temporary restraining order contained in item 13 of

this order is in effect, this order (including the temporary

restraining order) applies to the benefits Participant has applied

for and becomes entitled to receive under the terms of the

Plan.

2. TAX INFORMATION FOR PAYORS Once this order has been approved as a QDRO, all benefits

withheld pursuant to the temporary restraining order shall be

disbursed in accordance with the terms of this order or, to the

extent those benefits are not affected by this order, to the

person or persons entitled thereto under the terms of the Plan.

Generally speaking, for federal income tax purposes, the

Participant will be taxed on any child support paid from a

Plan pursuant to this order. Amounts paid by the Plan for

spousal or family support generally will be taxable to the

Alternate Payee for whose benefit those amounts are paid. If you have any questions about this order, please contact the

office that sent this form to you as shown in the upper left-hand

corner of the order.

4. INFORMATION FOR ALL PARTICIPANTS: You should have received a Request for Hearing Regarding Wage and Earnings

Assignment (form 1299.28) with the Qualified Domestic Relations Order (Earnings Assignment Order for Support). If not, you

may get one from either the court clerk or the district attorney. If you want the court to stop or modify the assignment of your

benefits under the Plan, you must file (hand-deliver or mail) an original copy of the form with the court clerk within 1 0 days of

the date you received this order. Keep a copy of the form for your records.

If you think your support order is wrong, you can ask for a modification of the order, or in some cases, you can have the order

set aside and have a new order issued. You can talk to any attorney or get information from the court about this.

Q UALIFIED DOMESTIC RELATIONS ORDER FO R SUPPORT

(EARNINGS ASSIGNMENT ORDER FOR SUPPORT) Page four of

four

el ectr onic form ã

2002

WWW.LawCA.co

m

L a w

P u b l i s h e r sFL-460 [Rev. January 1, 2003]