CALIFORNIA

SUPPLEMENTAL DISCLOSURES PACKAGE

REQUIRED FOR SALE OF RESIDENTIAL REAL ESTATE

CA-37014-B

The following Disclosures are contained herein:

1. Smoke Detector Statement of Compliance (required)

2. Military Ordnance Disclosure (may be required)

3. Industrial Use Disclosure (may be required)

4. “Homeowner’s Guide to Earthquake Safety” & Earthquake Hazards Disclosure (may be required – link provided)

5. Mello-Roos Disclosure and Disclosure of Supplemental Property Tax

(may be required)

6. Local Option Real Estate Transfer Disclosure (may be required)

7. Notice of San Francisco Bay Conservation and Development Commission Jurisdiction (may be required)

8. “Payment of Transfer Fee Required” Disclosure pursuant to Civ. Code 1102.6e (may be required)

9. “Payment of Transfer Fee Required” form for filing pursuant to Civ. Code 1098.5 (for recording by entity to whom special “transfer fee” is to be paid)

When selling residential real estate, the Smoke Detector Statement of Compliance

must be delivered to the Buyer prior to the sale.

The other Disclosures may be required in certain situations. See the instructions

preceding each of the three additional forms to determine if Seller must deliver these

disclosures to Buyer.

Please note that when selling residential real estate in California, other disclosures may be,

or will be, required, including (but not limited to): Real Estate Transfer Disclosure Statement (required)USLF control number CA-37014

Natural Hazard Disclosure Statement (required) USLF control number CA-37014-A

Lead-based Paint Disclosure (may be required) USLF control number CA-LEAD1

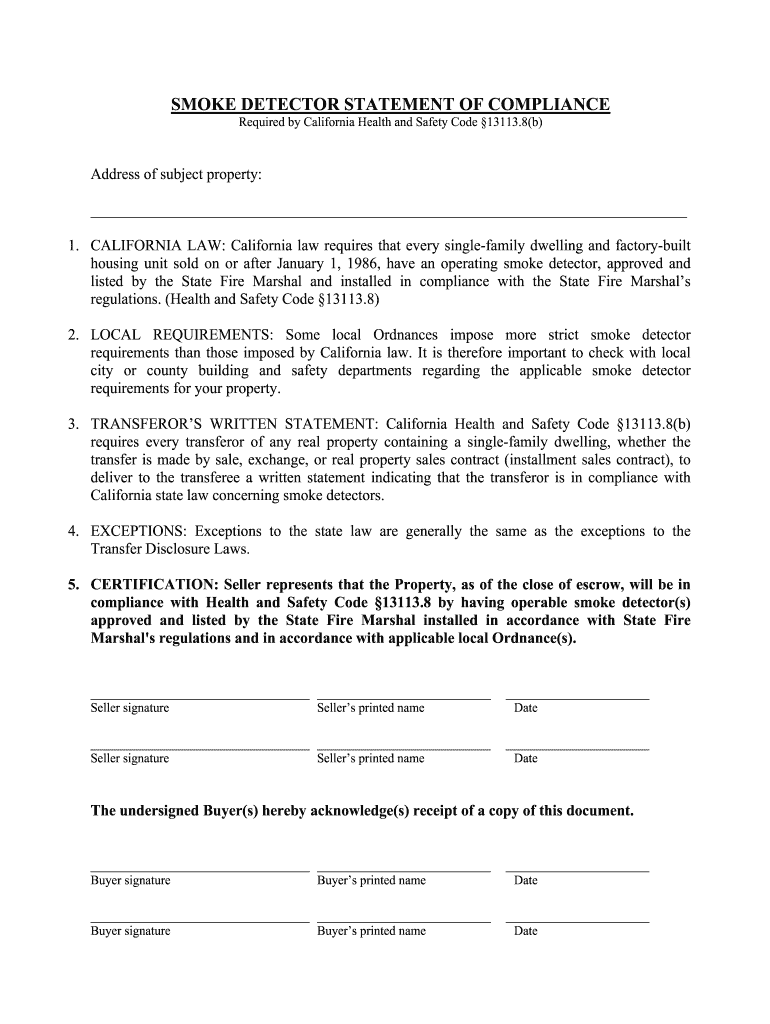

SMOKE DETECTOR STATEMENT OF COMPLIANCE

Required by California Health and Safety Code §13113.8(b)

Address of subject property: _______________________________________________________________________________

1. CALIFORNIA LAW: California law requires that every single-family dwelling and factory-bui lt

housing unit sold on or after January 1, 1986, have an operating smoke detector, approved and

listed by the State Fire Marshal and installed in compliance with the Sta te Fire Marshal’s

regulations. (Health and Safety Code §13113.8)

2. LOCAL REQUIREMENTS: Some local Ordnances impose more strict smoke detector requirements than those imposed by California law. It is therefore important to check wi th local

city or county building and safety departments regarding the applicable smoke detector

requirements for your property.

3. TRANSFEROR’S WRITTEN STATEMENT: California Health and Safety Code §13113.8(b) requires every transferor of any real property containing a single-family dwelling, whether the

transfer is made by sale, exchange, or real property sales contract (installment sales contract), to

deliver to the transferee a written statement indicating that the transferor is in compliance with

California state law concerning smoke detectors.

4. EXCEPTIONS: Exceptions to the state law are generally the same as the except ions to the

Transfer Disclosure Laws.

5. CERTIFICATION: Seller represents that the Property, as of the close of escrow, will be in compliance with Health and Safety Code §13113.8 by having operable smoke detector(s)

approved and listed by the State Fire Marshal installed in accordance with State Fire

Marshal's regulations and in accordance with applicable local Ordnance(s).

_____________________________ _______________________ ___________________

Seller signature Seller’s printed name Date

_____________________________ _______________________ ___________________

Seller signature Seller’s printed name Date

The undersigned Buyer(s) hereby acknowledge(s) receipt of a copy of this document.

_____________________________ _______________________ ___________________

Buyer signature Buyer’s printed name Date

_____________________________ _______________________ ___________________

Buyer signature Buyer’s printed name Date

MILITARY ORDNANCE DISCLOSURE (instructions)

The form is on the next page. These instructions are not part of the form.

§1102.15 Civ. of the California Civil Code states as follows:

The seller of residential real property subject to this article who has actual knowledge of any former federal or

state Ordnance locations within the neighborhood area shall give written notice of that knowledge as soon as

practicable before transfer of title.

For purposes of this section, "former federal or state Ordnance locations" means an area identified by an agency

or instrumentality of the federal or state government as an area once used for military training purposes which

may contain potentially explosive munitions. "Neighborhood area" means within one mile of the residential real

property.

The disclosure required by this section does not limit or abridge any obligation for disclosure created by any

other law or that may exist in order to avoid fraud, misrepresentation, or deceit in the transfer transaction.

If Seller has actual knowledge of former federal or state Ordnance locations (as defined above)

within one mile of the Property, Seller must deliver the Military Ordnance Disclosure to Buyer.

If Seller has no knowledge of such Ordnance location(s), the Military Ordnance Disclosure will

not be used.

MILITARY ORDNANCE DISCLOSURE

Address of real property: __________________________________________________________________________

Address or approximate address of former or current federal or state Ordnance location:__________________________________________________________________________

The seller of residential real property subject to this sale has actual knowledge of the above-

identified former federal or state Ordnance locations within one mile of the real property.

For purposes of this disclosure, "former federal or state Ordnance locations" means an area

identified by an agency or instrumentality of the federal or state government as an area once

used for military training purposes which may contain potentially explosive munitions.

The agency or instrumentality of the federal or state government that designated the area a

“former federal or state Ordnance location,” if known, is: __________________________________________________________________________

This disclosure is made pursuant to § 1102.15 Civ. of the California Civil Code.

_____________________________ _______________________ ___________________

Seller signature Seller’s printed name Date

_____________________________ _______________________ ___________________

Seller signature Seller’s printed name Date

The undersigned Buyer(s) hereby acknowledge(s) receipt of a copy of this document.

_____________________________ _______________________ ___________________

Buyer signature Buyer’s printed name Date

_____________________________ _______________________ ___________________

Buyer signature Buyer’s printed name Date

INDUSTRIAL USE DISCLOSURE (instructions)

The form is on the next page. These instructions are not part of the form.

§1102.17 Civ. of the California Civil Code states as follows:

The seller of residential real property subject to this article who has actual knowledge that the property is adjacent to,

or zoned to allow, an industrial use described in Section 731a Civ. Proc. Of the Code of Civil Procedure, or affected

by a nuisance created by such a use, shall give written notice of that knowledge as soon as practicable before transfer

of title.

§731a Civ. Pro. Of the California Code of Civil Procedure states as follows:

Whenever any city, city and county, or county shall have established zones or districts under authority of law wherein

certain manufacturing or commercial or airport uses are expressly permitted, except in an action to abate a public

nuisance brought in the name of the people of the State of California, no person or persons, firm or corporation shall

be enjoined or restrained by the injunctive process from the reasonable and necessary operation in any such industrial

or commercial zone or airport of any use expressly permitted therein, nor shall such use be deemed a nuisance without

evidence of the employment of unnecessary and injurious methods of operation.

Nothing in this act shall be deemed to apply to the regulation and working hours of canneries, fertilizing plants,

refineries and other similar establishments whose operation produce offensive odors.

If Seller has actual knowledge that Property is in, adjacent to, or affected by a zone or district

allowing manufacturing, commercial or airport use and/or affected by a nuisance created by such

use, then Seller must complete and deliver the Industrial Use Disclosure to Buyer.

If Seller has no knowledge of such industrial use, the Industrial Use Disclosure will not be used.

INDUSTRIAL USE DISCLOSURE

Address of real property: __________________________________________________________________________

Address or approximate address of zone or district allowing manufacturing, commercial or

airport use and/or affected by a nuisance created by such use: __________________________________________________________________________

Nature of industrial use: ______________________________________________________

Description of effect(s) on property: ____________________________________________ _________________________________________________________________________

The Seller of residential real property subject to this sale has actual knowledge of the above-

identified industrial use affecting the subject real property.

This disclosure is made pursuant to § 1102.17 Civ. of the California Civil Code.

_____________________________ _______________________ ___________________

Seller signature Seller’s printed name Date

_____________________________ _______________________ ___________________

Seller signature Seller’s printed name Date

The undersigned Buyer(s) hereby acknowledge(s) receipt of a copy of this document.

_____________________________ _______________________ ___________________

Buyer signature Buyer’s printed name Date

_____________________________ _______________________ ___________________

Buyer signature Buyer’s printed name Date

“Homeowner’s Guide to Earthquake Safety” & Earthquake Hazards Disclosure

If (and only if) the residential dwelling was built prior to 1960, Seller must

deliver to Buyer a copy of the “Homeowner’s Guide to Earthquake Safety”

published pursuant to Section 10149 Bus. & Prof. of the Business and Professions

Code and complete and deliver to Buyer the Earthquake Hazards Disclosure

contained therein . The Earthquake Hazards Disclosure is on page 29 of the

“Guide.” Print the Guide and Disclosure, complete, and deliver to Buyer.

Download the “Guide” (with enclosed “Disclosure”) for free from the following

link. Click the blue underlined download link (or copy the link into the address

window of your internet browser):

https://ssc.ca.gov/forms_pubs/cssc_2005_hogreduced.pdf

If this link fails, go to https://ssc.ca.gov/ (California Seismic Safety Commission) and

follow the links to the “ Homeowner’s Guide to Earthquake Safety 2005 ed. ” or use the

contact information to contact the Commission for help obtaining the form.

Instructions -- “Mello-Roos” Disclosure

A Mello-Roos District is an area where a special tax is imposed on those real property owners

within a Community Facilities District.

For more information, see:

http://en.wikipedia.org/wiki/Mello-Roos

or “google” Mello-Roos

MELLO-ROOS DISCLOSURE AND NOTICE OF SUPPLEMENTAL PROPERTY TAXFOR THE PROPERTY LOCATED AT:

Street Address:

City:

State, Zip:

Mello-Roos Community Facilities Act Disclosure Notice

The property is subject to Mello-Roos as described in the attached district discl osure

notice.

The property is subject to Mello-Roos. I have not been able to obtain a district di sclosure

notice after a good faith effort. However, I have attached a notice from a non-

governmental source that I believe clearly and accurately describes the related tax

liabilities.

The property is not subject to Mello-Roos.

Notice of Your “Supplemental” Property Tax Bill

California property tax law requires the Assessor to revalue real property at the ti me the

ownership of the property changes. Because of this law, you may receive one or two

supplemental tax bills, depending on when your loan closes.

The supplemental tax bills are not mailed to your lender. If you have arranged for your property

tax payments to be paid through an impound account, the supplemental tax bills will not be paid

by your lender. It is your responsibility to pay these supplemental bills directly to t he Tax

Collector.

If you have any question concerning this matter, please call your local Tax Collector's Office. _____________________________________________________________________________

Seller certifies that the information herein is true and correct to the best of the Seller's

knowledge as of the date signed by the Seller.

Seller _________________________________ Date ____________________

Seller _________________________________ Date ____________________

Buyer _________________________________ Date Received __________________

Buyer _________________________________ Date Received __________________

INSTRUCTIONS:

LOCAL OPTION - REAL ESTATE TRANSFER DISCLOSURE STATEMENT

Additional Disclosures that may be required by City or County Ordnances. It is

incumbent upon seller to comply with any such local regulations.

LOCAL OPTION - REAL ESTATE TRANSFER DISCLOSURE STATEMENT

THIS DISCLOSURE STATEMENT CONCERNS THE REAL PROPERTY SITUATED IN THE CITY O F

____________________________________, COUNTY OF __________________________, STATE OF CALIFORNIA,

DESCRIBED AS _____________________________________________________________ .

THIS STATEMENT IS A DISCLOSURE OF THE CONDITION OF THE ABOVE-DESCRIBED PRO PERTY IN

COMPLIANCE WITH ORDNANCE NO. _______________ OF THE ____________ COUNTY

CODE AS OF __________________, 20___. IT IS NOT A WARRANTY OF ANY KIND BY THE SELLER(S) OR ANY

AGENT(S) REPRESENTING ANY PRINCIPAL(S) IN THIS TRANSACTION, AND IS NOT A SUBSTIT UTE FOR ANY

INSPECTIONS OR WARRANTIES THE PRINCIPAL(S) MAY WISH TO OBTAIN. I

SELLER’S INFORMATION

The Seller discloses the following information with the knowledge that even though this is not a warranty, prospective

Buyers may rely on this information in deciding whether and on what terms to purchase the subject property. Seller

hereby authorizes any agent(s) representing any principal(s) in this transaction to provide a copy of this statement to any

person or entity in connection with any actual or anticipated sale of the property.

THE FOLLOWING ARE REPRESENTATIONS MADE BY THE SELLER(S) AS REQUIRED BY THE CITY OR COUNTY

OF __________ AND ARE NOT THE REPRESENTATIONS OF THE AGENT(S), IF ANY. THIS INF ORMATION

IS A DISCLOSURE AND IS NOT INTENDED TO BE PART OF A CONTRACT BETWEEN THE BUYER AND SELLER.

(Example: Adjacent land is zoned for timber production which may be subject to harvest.)

Seller certifies the information herein is true and correct to the best of Seller's knowledge as of the date signed by Seller.

Seller Date ____________________

Seller Date ____________________

II

BUYER(S) AND SELLER(S) MAY WISH TO OBTAIN PROFESSIONAL ADVICE AND/OR INSPECTIONS OF THE

PROPERTY AND TO PROVIDE FOR APPROPRIATE PROVISIONS IN A CONTRACT BETWEEN BUYER AND

SELLER(S) WITH RESPECT TO ANY ADVICE/INSPECTIONS/DEFECTS.

I/WE ACKNOWLEDGE RECEIPT OF A COPY OF THIS STATEMENT.

Seller _________________________ Date________ Buyer _______________________ Date_________

Seller _________________________ Date________ Buyer _______________________ Date_________

Agent (Broker Representing Seller) ________________________ By __________________________ Date_________ (Please Print) (Associate Licensee or Broker-Signature)

Agent (Broker Obtaining the Offer) ________________________ By __________________________ Date_________ (Please Print) (Associate Licensee or Broker-Signature)

A REAL ESTATE BROKER IS QUALIFIED TO ADVISE ON REAL ESTATE.

IF YOU DESIRE LEGAL ADVICE, CONSULT YOUR ATTORNEY.

Instruction: The seller or the seller’s agent(s) shall determine whether the property is within the

jurisdiction of the San Francisco Bay Conservancy and Development Commission, as defined in

Section 66620 of the Government Code. If the property is within the Commission’s jurisdiction,

the following notice shall be attached to the Local Option Transfer Disclosure Statement, or

rendered individually to the buyer.

NOTICE OF SAN FRANCISCO BAY CONSERVATIONAND DEVELOPMENT COMMISSION JURISDICTION

This property is located within the jurisdiction of the San Francisco Bay Conservation and Development Commission. Use and development of the property within the commission’s

jurisdiction may be subject to special regulations, restrictions, and permit requirements.

You may wish to investigate and determine whether they are acceptable to you and your

intended use of the property before you complete your transaction.

Seller _________________________ Date________ Buyer _______________________ Date_________

Seller _________________________ Date________ Buyer _______________________ Date_________

Agent (Broker Representing Seller) ________________________ By __________________________ Date_________ (Please Print) (Associate Licensee or Broker-Signature)

Agent (Broker Obtaining the Offer) ________________________ By __________________________ Date_________ (Please Print) (Associate Licensee or Broker-Signature)

“Payment of Transfer Fee Required” Disclosure

Instructions:

This disclosure is mandated by Civil Code Section 1102.6e in the unusual situation of the

property’s transfer being subject to a “transfer fee” as defined in Section 1098. The “Payment of

Transfer Fee Required” Disclosure shall be provided to the buyer at the same time a s the Real

Estate Transfer Disclosure Statement.

Additional Information:

Per Civil Code Section 1098 and 1098.5, a “transfer fee” includes any fee payment requireme nt imposed within a

covenant, restriction, or condition contained in any deed, contract, security instrument, or othe r document affecting

the transfer or sale of, or any interest in, real property that requires a fee be paid upon transfer of the real property.

However, there are many exceptions. See Section 1098.

Per 1098.5, the person or entity imposing the transfer fee, as a condition of payment of the fee, shall record in the

office of the county recorder for the county in which the real property is located, concurrentl y with the instrument

creating the transfer fee requirement, a separate document that meets all of the following requirements:

(1) The title of the document shall be "Payment of Transfer Fee Required" in at least 14-point boldface type.

(2) The document shall include all of the following information:

(A) The names of all current owners of the real property subject to the transfer fee, and the legal description

and assessor's parcel number for the affected real property.

(B) The amount, if the fee is a flat amount, or the percentage of the sales pri ce constituting the cost of the

fee.

(C) If the real property is residential property, actual dollar-cost examples of the fee for a home priced at

two hundred fifty thousand dollars ($250,000), five hundred thousand dollars ($500,000), and seven

hundred fifty thousand dollars ($750,000).

(D) The date or circumstances under which the transfer fee payment requirement expires, if any.

(E) The purpose for which the funds from the fee will be used.

(F) The entity to which funds from the fee will be paid and specific contact inform ation regarding where

the funds are to be sent.

(G) The signature of the authorized representative of the entity to which funds from the fee will be paid.

A form meeting the above-described characteristics is provided following the Disclosure form

below. Note that it is only for filing by the entity to whom the transfer fees shall be paid, and

need not be provided to the buyer. The form provided to the buyer is the Disclosure Pursuant

to Civil Code Section 1102.6e.

PAYMENT OF TRANSFER FEE REQUIREDDisclosure Pursuant to Civil Code Section 1102.6e

Address and/or description of Property subject to this Disclosure: _____________________________________________________________________________

1. Payment of a transfer fee is required upon transfer of the above-described property.

2. For the asking price of $_________________ for the above-described property, the amount of the transfer fee is $________________ in addition to, and distinct from,

said asking price. The transfer fee is calculated in the following manner: _____________________________________________________________________ __________________________________________________________________________________________________________________________________________

3. The final amount of the fee (as stated in 2., above) may differ if the fee is based upon a percentage of the final sale price.

4. The entity to which the transfer fee shall be paid is: ___________________________ _____________________________________________________________________

5. The purpose(s) for which funds from the fee will be used is/are: _______________________________________________________________________________________________________________________________________________________________________________________________________________

6. The date (if any) or circumstances (if any) upon which the obligation to pay the transfer fee expires is/are: _______________________________________________________________________________________________________________________________________________________________________________________________________________

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Signature of Seller: ___________________________________ Date: __________________

Signature of Seller: ___________________________________ Date: __________________

Signature of Buyer: ___________________________________ Date Received: __________

Signature of Buyer: ___________________________________ Date Received: __________

PAYMENT OF TRANSFER FEE REQUIRED

For Recording in the Office of the County Recorder Pursuant to Civil Code Section 1098.5

Address of Property subject to this Disclosure: _____________________________________________________________________________

1. Names of all current owners of the real property subject to the transfer fee are as follows:

2. The assessor’s parcel number of the above-described property is:

3. The legal description of the above-described property is as follows:

4. The amount of the transfer fee (if the fee is a flat amount) is: If the fee is a percentage of the sale price, the percentage is:

5. If the property is residential property, actual dollar-cost examples of the fee for variously priced homes are as follows:

Home price of $250,000 = additional transfer fee of $_____________________

Home price of $500,000 = additional transfer fee of $_____________________

Home price of $750,000 = additional transfer fee of $_____________________

6. The date or circumstances under which the requirement to pay the fee expires, if any, are as follows:

7. The purpose(s) for which the transfer fee funds will be used is/are as follows:

8. The entity to which funds from the fee will be paid and specific contact information regarding where the funds are to be sent, are as follows:

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Signature of Authorized Representative of Entity to which transfer fee funds will be paid:

Sign: ____________________________________ Print: _______________________________

Useful Advice for Finalizing Your ‘Ca Disclosure’ Digitally

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the premier eSignature solution for both individuals and businesses. Wave goodbye to the monotonous process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Take advantage of the powerful features included in this user-friendly and cost-effective platform, and transform your method of document handling. Whether you need to approve documents or gather signatures, airSlate SignNow makes it all seamless, requiring just a few clicks.

Adhere to this comprehensive guide:

- Access your account or register for a complimentary trial with our service.

- Select +Create to upload a file from your device, cloud storage, or our template repository.

- Open your ‘Ca Disclosure’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and designate fillable fields for other individuals (if required).

- Continue with the Send Invite options to request eSignatures from others.

- Download, print your copy, or convert it into a reuseable template.

Don’t be concerned if you need to collaborate with your colleagues on your Ca Disclosure or send it for notarization—our platform provides everything necessary to complete these tasks. Sign up for airSlate SignNow today and take your document management to the next level!