Instructions for Completing the

Articles of Incorporation of a Nonprofit Mutual Benefit Corporation (Form ARTS-MU)

A corporation organized for other than religious, charitable, civic league or social welfare purposes and planning to

obtain state tax exempt status under provisions other than California Revenue and Taxation Code section 23701d

and 23701f , and/or federal tax exempt status under Internal Revenue Code section 501(c)(4) or is not planning to be

tax exempt at all, is a nonprofit Mutual Benefit corporation. To form a Nonprofit Mutual Benefit Corporation in

California, y ou must file Articles of Incorporation with the California Secretary of State.

• Form ARTS- MU has been created for ease in filing, however, you can compose your own document, provided it

meets statutory requirements.

• Before submitting the completed form, you should consult with a private attorney for advice about your specific

business needs and whether additional article provisions for the corporation are needed.

Important Additional Steps to Obtain Tax Exemption and Avoid Paying the Minimum $800 Annual Tax:

• C

alifornia nonprofit corporations are not automatically exempt from paying California franchise tax or income tax

each year. Most corporations must pay a minimum tax of $800 to the California Franchise Tax Board (FTB) eac

h

y

ear. (California Revenue and Taxation Code section 23153.)

• A separate E xemption Application (Form FTB 3500) is required in order to obtain tax exempt status in California

.

F

or more information, go to https://www.ftb.ca.gov/businesses/Exempt- organizations.

• For information regarding FTB forms and publications visit their website at https://www.ftb.ca.gov or contact t

he

F

TB at (800) 852- 5711 (from within the U.S.) or (916) 845- 6500 (from outside the U.S.).

Fees:

• Filing Fee: The fee for filing Articles of Incorporation of a Nonprofit Mutual Benefit Corporation is $ 30.00 .

• Faster Service Fee:

- Counter and guaranteed expedite services are available only for documents submitted in person (drop off) t

o

our

Sacramento office.

- Counter Drop Off: A separate, non- refundable $15.00 counter drop off fee is required if you submit i

n

per

son (drop off) your completed document at our Sacramento office. The $15.00 counter drop off fee

provides priority service over documents submitted by mail. The special handling fee is not refundable

whether the document is filed or rejected.

- Guaranteed Expedite Drop Off: For more urgent submissions, documents can be processed within a

guarant eed timeframe for a non-refundable fee instead of the counter drop off fee . For detailed information

about this faster processing service through our P reclearance and Expedited Filing Services, go to

www.sos.ca.gov/business /be/service- options.

Copies: Upon filing, we will return one (1) plain copy of your filed document for free, and will certify the copy upon

request and payment of a $5 certification fee. To obtain additional copies or certified copies of the filed document,

include payment for copy fees and certification fees at the time the document is submitted. Additional copy fees are

$1.00 for the first page and $0.50 for each additional page. For certified copies, there is an additional $5.00

certification fee, per document.

Payment Type: Check(s) or money orders should be made payable to the Secretary of State. Do not send cash by

mail. If submitting the document in person in our Sacramento office, payment also may be made by credit card

(Visa ® or Master Card ®).

Processing Times: For current processing times, go to www.sos.ca.gov/business/be /processing-times .

ARTS -MU Instructions (REV 03/201 7) 2017 California Secretary of State www.sos.ca.gov/business/be

If you are not completing this form online, please type or legibly print in black or blue ink. Complete the Articles

of Incorporation of a Nonprofit Mutual Benefit C orporation (Form ARTS -MU ) as follows:

Item Instruction Tips

1. Enter the name of the proposed

corporation exactly as it is to appear on

the records of the California Secretary

of State . •

There are legal limitations on what name can be used for t he

c

orporation. For general corporation name requirements

and restrictions or for information on reserving a corporatio

n

na

me prior to submitting Form ARTS-MU , go t

o

w

ww.sos.ca.gov/business/be/name-availability.

• A name reservation is not required to submit Form

ARTS -MU .

•A preliminary search of corporation names already of recor d

c

an be made online through our Business Search at

BusinessSearch.sos.ca.gov . Please note: The Business

Search is only a preliminary search and is not intended t o

serve as a formal name availability search. For informati on

on checking or reserving a name, g o t o

www.sos.ca.gov/business/be/name- availability.

2a. Enter the complete street address, city,

state and zip code of the corporation’s

initial address. •

The complet e street address is required, including t he

s

treet name and number, city, state and zip code.

• Address must be a physical address.

• Do not enter a P.O. Box address , an “in care of” address, or

abbreviate the name of the city.

2b. If different from the address in Item 2a,

enter the corporation’s initial mailing

address. •

This address will be used for mailing purposes and may be a

P

.O. Box address or “in care of” an individual or entity .

• Do not abbreviate the name of the city.

3. The corporation must have an Agent

for Service of Process.

There are two ty pes of Agents that

c

an be named:

• an i

ndividual (e.g. officer, director, o

r

any

other individual) who resides i

n

Ca

lifornia with a physical California

street address; OR

• a registered corporate agent qualifi

ed

w

ith the California Secretary of State. •

An Agent for Service of Process is responsible for accepti ng

l

egal documents (e.g. service of process, lawsuits, other

types of legal notices, etc.) on behalf of the corporation.

• You must provide information for either an individual OR

a

r

egistered corporate agent, not both.

• If using a registered corporate agent, the corporation must

have a current agent registration certificate on file with t

he

C

alifornia Secretary of State as required by Section 1505.

3a & b. If Individual Agent:

• Enter the name of the initial agent

for service of process and t

he

agent

’s complete California stree

t

addr

ess, city and zip code

.

•I

f an individual is designated as the

initial a gent, complete Items 3

a and

3b

ONLY. Do not complete Ite

m

3c

. •

The complete street address is required, including t he

s

treet name and number, city and zip code.

• Do not enter a P.O. Box address, an “in care of” address, or

abbreviate the name of the city.

• Many times, a small corporation will designate an officer or

director as the agent for service of process.

• The individual agent should be aware that the name and t

he

phy

sical street address of the agent for service of process is

a public record, open to all (as are all the addresses of t

he

c

orporation provided in filings made with the Californi

a

S

ecretary of State.)

ARTS-MU Instructions (REV 03/201 7) 2017 California Secretary of State www.sos.ca.gov/business/be

3c. If Registered Corporate Agent :

• Enter the name of the initial

registered corporate agent exactly

as registered in California.

• If a registered corporate agent is

designated as the initial agent,

complete Item 3c ONLY. Do not

complete Items 3a and 3b. •

Before a corporation is designated as agent for another

corporation, that corporation must have a current agent

registration certificate on file with the California Secretary of

State as required by Section 1505 stating the address(es) of

the registered corporate agent and the authori z

ed

em

ployees that will accept service of process of legal

documents and notices on behalf of the corporation

.

• A

dvanced approval must be obtained from a register

ed

c

orporate agent prior to designating that corporation as your

agent for service of process.

• No California or foreign corporation may register as

a

C

alifornia corporate agent unless the corporation currently is

authorized to engage in business in California and is in go

od

s

tanding on the records of the California Secretary of State.

• Provide your Registered Corporate Agent’s exact name as

registered with the California Secretary of State. To confirm

that you are providing the exact name of the Register

ed

C

orporate Agent, go t

o

ht

tps://businessfilings.sos.ca.gov/frmlist1505s.asp.

• A corporation cannot name itself as agent.

4. The purpose statement is required. Do

not alter.

5. These additional statements must not

be altered. •

You may enter the specific purpose of the corporation i n

I

tem 5a.

• Items 5 b: Th is statement is required if you intend to apply

for tax exempt status from the Internal Revenue Service or

the California Franchise Tax Board under Internal Rev

enue

C

ode section 501(c)(4) and California Revenue and Taxation

Code section 23 701f.

• If the corporation is seeking other types of tax exemptions,

you must compose your own Articles of Incorporation.

6. Form ARTS- MU must be signed by

each incorporator. •

If you need more space for signatures:

- Place the additional signatures on only one side of a

standard letter -sized piece of paper (8 1/2" x 11")

clearly marked as an attachment to Form ARTS -MU

and attach the extra page(s) to the completed Form

ARTS -MU .

- All attachments are part of this documen

t.

•M

ultiple Form ARTS-MU s with differen t signatures will be

returned without being filed – use only one form.

• Do not include the title of the person signing.

ARTS -MU Instructions (REV 03/201 7) 2017 California Secretary of State www.sos.ca.gov/business/be

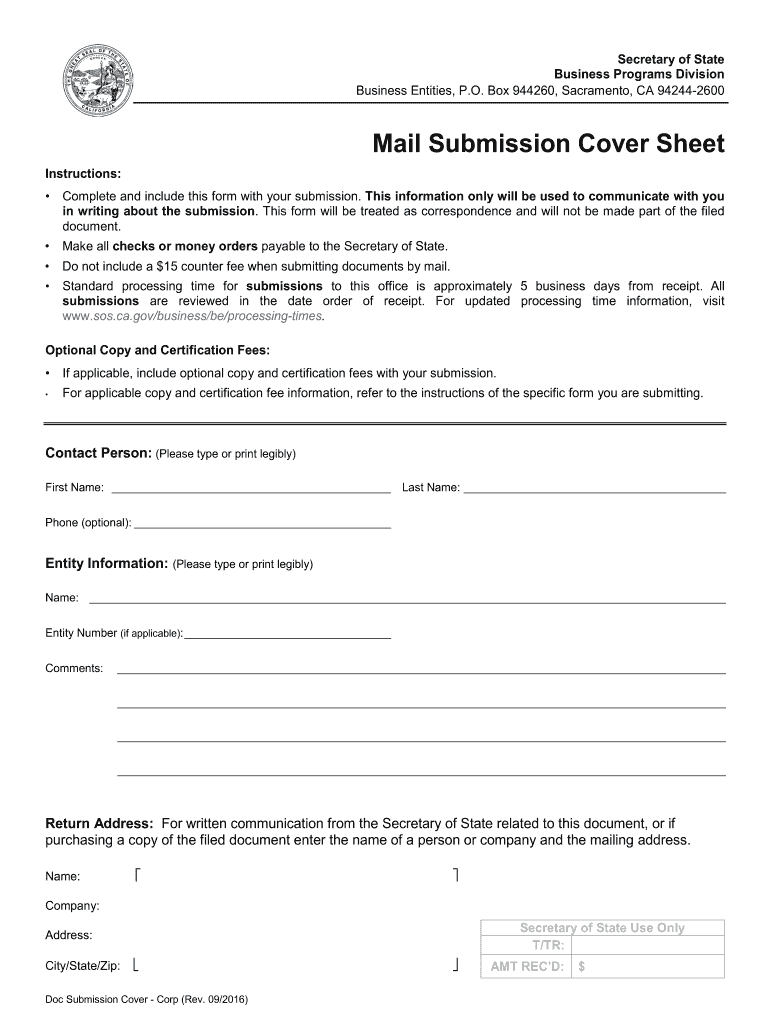

Mail Submission Cover Sheet (Optional): To make it easier to receive communication related to this document ,

including receipt of the copy of the filed document, complete the Mail Submission Cover Sheet. For the Return

Address: enter the name of a designated person and/or company and the corresponding mailing address. Please

note the Mail Submission Cover Sheet will be treated as correspondence and will not be made part of the filed

document.

Where to File: Completed forms along with the ap plicable fees, if any can be mailed to Secretary of State, Business

Entities Filings Unit, P.O. Box 9442 60, Sacramento, CA 94244-22 60 or delivered in person (drop off) to the

Sacramento office, 1500 11th Street, 3rd Floor, Sacramento, CA 95814. This form is filed only in the Sacramento

office.

Legal Authority: General statutory filing provisions are found in Section s 7120-7 122.3 et seq. and 7130 -7135 et seq.

All statutory references are to the California Corporations Code, unless otherwise stated.

Statement of Information: A Statement of Information (Form SI-100 ) must be filed with the California Secretary of

State within 90 days after filing the Articles of Incorporation and every two years thereafter during the applicable

filing period. The applicable filing period is the calendar month in which the Articles of Incorporation were filed and the

immediately preceding five calendar months. ( Section 8210.)

Additional Resources: For a list of other agencies you may need to contact to ensure proper compliance, go to

www.sos.ca.gov/business/be/resources . Note: The California Secretary of State does not license corporations. For

licensing requirements, please contact the city and/or county where the principal place of business is located and/or

the state agency with jurisdiction over the activities of the corporation.

ARTS -MU Instructions (REV 03/201 7) 2017 California Secretary of State www.sos.ca.gov/business/be

Secretary of State

Business Programs Division

Business Entities, P.O. Box 944260, Sacramento, CA 94244-2600

Mail Submission Cover Sheet

Instructions:

• Complete and include this form with your submission. This information only will be used to communicate with you

in writing about the submission . This form will be treated as correspondence and will not be made part of the filed

document.

• Make all checks or money orders payable to the Secretary of State .

• Do not include a $15 counter fee when submitting documents by mail.

• Standard processing time f or submissions to this office is approximately 5 business days from receipt . All

submissions are reviewed in the date order of receipt. For updated processing time information, visit

www. sos.ca.gov/business/be/processing- times.

Optional Copy and Certification Fees :

• If applicable, include optional copy and certification fees with your submission.

• For applicable copy and certification fee information, refer to the instructions of the specific form you are submitting.

Contact Person: (Please type or print legibly)

First Name: __________________________________________________ Last Name: _______________________________________________

Phone (optional) : ________________________________ ______________

Entity Information: (Please type or print legibly)

Name: ________________________________________________________________________\

__________________________________________

Entity Number (if applicable) : _____________________________________

Comments: ________________________________________________________________________\

_____________________________________

________________________________________________________________________\

_____________________________________

________________________________________________________________________\

_____________________________________

________________________________________________________________________\

_____________________________________

Return Address: For written communication from the Secretary of State related to this document, or if

purchasing a copy of the filed document enter the name of a person or company and the mailing address.

Name:

Company:

Address:

City/State/Zip:

Secretary of State Use Only

T/TR:

AMT REC

Useful advice on finalizing your 'California California Articles Of Incorporation For Domestic Nonprofit Nonstock Corporation' online

Are you fed up with the complications of handling paperwork? Look no further than airSlate SignNow, the premier eSignature solution for individuals and organizations. Bid farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign paperwork online. Take advantage of the powerful features integrated into this user-friendly and affordable platform and transform your approach to document management. Whether you need to sign forms or gather signatures, airSlate SignNow manages everything seamlessly, with just a few clicks.

Adhere to this comprehensive guide:

- Access your account or register for a no-cost trial with our service.

- Select +Create to upload a file from your device, cloud storage, or our template library.

- Open your 'California California Articles Of Incorporation For Domestic Nonprofit Nonstock Corporation' in the editor.

- Click Me (Fill Out Now) to set up the document on your side.

- Add and assign fillable fields for others (if necessary).

- Continue with the Send Invite settings to request eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

No need to worry if you must collaborate with your coworkers on your California California Articles Of Incorporation For Domestic Nonprofit Nonstock Corporation or send it for notarization—our platform has everything you require to accomplish these tasks. Create an account with airSlate SignNow today and elevate your document management to a new level!