- 1 -

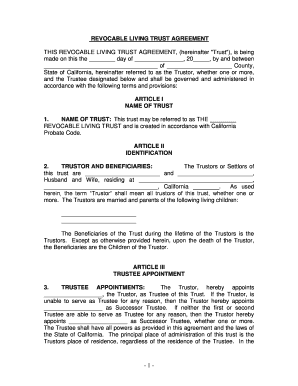

REVOCABLE LIVING TRUST AGREEMENT

THIS REVOCABLE LIVING TRUST AGREEMENT, (hereinafter "Trust"), is being

made on this the ________ day of _______________ , 20 _____ , by and between

___________________________________ of ____________________ County,

State of California, hereinafter referred to as the Trustor, whether one or more,

and the Trustee designated below and shall be governed and administered in

accordance with the followin g terms and provisions:

ARTICLE I

NAME OF TRUST

1. NAME OF TRUST: This trust may be referred to as THE ________

REVOCABLE LIVING TRUST and is created in accordance with California

Probate Code.

ARTICLE II

IDENTIFICATION

2. TRUSTOR AND BENEFICIARIES: The Trustors or Settlors of

this trust are _______________________ and _______________________ ,

Husband and Wife, residing at ___________________________________ ,

___________________________________ , California _______ _. As used

herein, the term “Trustor” shall mean all trustors of this trust, whether one or

more. The Trustors are married and parents of the following living children:

_______________________

_______________________

The Beneficiaries of the Trust during the lifetime of the Trustors is the

Trustors. Except as otherwise provided herein, upon the death of the Trustor,

the Beneficiaries are the Children of the Trustor.

ARTICLE III

TRUSTEE APPOINTMENT

3. TRUSTEE APPOINTMENTS: The Trustor, hereby appoints

__________________ , the Trustor, as Trustee of this Trust. If the Trustor, is

unable to serve as Trustee for any reason, then the Trustor hereby appoints

__________________ as Successor Trustee. If neither the first or second

Tru stee are able to serve as Trustee for any reason, then the Trustor hereby

appoints __________________ as Successor Trustee, whether one or more.

The Trustee shall have all powers as provided in this agreement and the laws of

the State of California. The principal place of administration of this trust is the

Trustors place of r esidence, regardless of the residence of the Trustee. In the

- 2 -

event a vacancy in the office of Trustee occurs and there is no successor trustee,

the existing Trustee, if one, and the beneficiaries, or the beneficiaries, if there is

no trustee, may agree to a non -judicial change in the trustee by amendment to

this Trust agreement.

ARTICLE IV

ASSETS OF TRUST

4. ASSETS OF TRUST: All rights, title, and interest in and to all real and

personal property, tangible or intangible, listed on the attached Exhibit “A”, is

hereby assigned, conveyed and delivered to the Trustee for inclusion in this

Trust.

5. ADDITIONS TO TRUST PROPERTY: Additional property may be

conveyed to the Trust by the Trustor, or any other third party at any time. Trustor

may execute such other documents as is necessary to effectuate the assignment

of property to this Trust.

6. RIGHTS TO TRUST ASSETS: Except as specifically provided herein,

the Beneficiaries of this trust shall have no rights to any assets of the trust.

7. HOMESTEAD EXEMPTION: Grantor(s) reserves the right to use,

occupy and reside upon any real property placed in this Trust as their permanent

residence during their lives. Grantor(s) shall have the right to reside in the

property rent free and without charge except for the payment of the following: (1)

all mortgages costs and expenses (2) all property taxes, and (3) reasonable

expenses of upkeep and maintenance. Grantor(s) retain the legal right to use

and benefit from the property in all respects. It is th e intent of this provision to

retain for the grantor(s) the requisite beneficial interest and possessor right in

and to such real property needed to retain their qualification for any exemption,

freeze of tax rates and/or valuation granted to any individua l or individuals so

qualifying.

ARTICLE V

TRUSTEE POWERS AND OTHER PROVISIONS

8. POWERS: The Trustor does hereby grant to the Trustee all powers

necessary to deal with any and all property of the Trust as freely as the Trustor

could do individually. The Trustee shall at all times and in all actions act as a

fiduciary in good faith. Trustee is hereby granted a ll powers contained herein

and all powers conferred upon Trustee under the applicable statutes and laws of

the State of California, to the broadest extent possible, including, but limited to all

of the powers authorized by the California Probate Code , all powers granted to

the Trustee by this Trust Agreement are ministerial in nature and are not

intended to create or alter substantial rights. Without limiting the foregoing

- 3 -

general statement of powers, the Trustee powers include, but shall not be limited

to the following:

(A) TRUST ASSETS : The Trustee is hereby authorized and granted all

powers necessary to retain as a permanent investment of the Trust,

or for such time as the Trustee shall deem advisable, the original

assets of the Trust and all other property later transferred, devised

or bequeathed to the Trustee, without liability for loss or

depreciation resulting from such retention.

(B) NONPRODUCTIVE ASSETS: The Trustee is hereby granted all

powers and authority necessary to hold uninvested cas h, and to

retain, acquire, and hold unproductive realty or personalty for any

periods deemed advisable by the Trustee, even though the total

amount so held is disproportionate under trust investment law or

would not be permitted without this section.

(C) INVESTMENT POWERS: The Trustee is hereby granted all powers

necessary to invest and reinvest any and all of the property of the

Trust in any and all types of property, security or other asset

deemed by the Trustee to be in the best interests of the Trust as a

whole, without limitation or regard to yield rates or income

production.

(D) SECURITIES: The Trustee is specifically authorized, in his or her

discretion, to maintain brokerage margin accounts, to buy, sell or

transfer options, warrants, puts, cal ls, commodities, futures

contracts, and repurchase contracts, and to exercise any options,

rights, and conversion privileges pertaining to any securities held by

the Trustee as Trust assets.

(E) ADDITIONAL PROPERTY: The Trustee is specifically authorize d

to receive additional property from any source and to hold and

administer this property as part of the Trust Estate.

(F) SELL AND LEASE: The Trustee is hereby granted all powers

necessary to sell, convey, lease, transfer, exchange, grant options

to pu rchase or otherwise dispose of any Trust asset on any terms

deemed by the Trustee to be in the best interests of the Trust, to

execute and deliver deeds, leases, bills of sale, and other

instruments of whatever character, and to take or cause to be taken

all action deemed necessary or proper by the Trustee in

furtherance of this authority.

(G) INSURANCE: The Trustee is specifically authorized to insure Trust

property and assets with any insurer against any hazards,

- 4 -

foreseeable or unforeseeable, including public liability, and to use

insurance proceeds to repair or replace the asset insured, at the

discretion of the Trustee. In addition, the Trustee may carry or

purchase life insurance on the life of any Trust beneficiary, and may

exercise or release any r ights with regard to such policy.

(H) BORROWING AND LENDING: The Trustee is specifically

authorized to lend Trust funds to any borrower, on any terms

deemed advisable, and to change the terms of these loans at any

time and for any reason. This authorizat ion includes the power to

extend loans beyond maturity with or without renewal and without

regard to the existence or value of any security, and to facilitate

payment, to change the interest rate, to consent to the modification

of any guarantee, and to for give loans in their entirety.

The Trustee is further granted all powers necessary to borrow

whatever money the Trustee deems desirable for any Trust on any

terms from any lender, and to mortgage, pledge or otherwise

encumber as security any assets of the borrowing Trust.

(I) MODIFICATION OF TERMS: The Trustee is specifically

authorized, incident to the exercise of any power, to initiate or

change the terms of collection or of payment of any debt, security,

or other obligation of or due to any Trust, up on any terms and for

any period, including a period beyond the duration or the

termination of any or all Trusts.

(J) CLAIMS: The Trustee is hereby granted all powers necessary to

compromise, adjust, arbitrate, sue on, defend, or otherwise deal

with any claim, upon whatever terms the Trustee deems advisable,

against or in favor of any Trust, and to abandon any asset the

Trustee deems of no value or of insufficient value to warrant

keeping or protecting. The Trustee is further authorized, in his or

her so le and absolute discretion, to refrain from paying taxes,

assessments, or rents, and from repairing or maintaining any asset;

and to permit any asset to be lost by tax sale or other proceeding.

(K) DISTRIBUTIONS: The Trustee is specifically authorized t o

distribute any shares of the Trust in cash or in property, or partly in

each, and the Trustee's valuations of and selection of assets upon

making distribution shall, if made in good faith, be final and binding

on all beneficiaries.

(L) NOMINEE: The Tr ustee is specifically authorized to hold any or all

of the Trust assets, real or personal, in the Trustee's own name, the

name of any Co -Trustee, corporation, partnership, or any other

- 5 -

person as the Trustee's nominee for holding the assets, with or

without disclosing the fiduciary relationship. A corporate Trustee

does hereby have the power necessary to appoint a Trustee to

administer property in any jurisdiction in which it shall fail to qualify.

(M) FORECLOSURE: The Trustee is specifically authorized t o

foreclose on any mortgage, to bid on the mortgaged property at the

foreclosure sale, or acquire mortgaged property from the mortgagor

without foreclosure, and to retain or dispose of the property upon

any terms deemed advisable by the Trustee.

(N) ENCU MBRANCES: The Trustee may pay off any encumbrance on

any Trust asset and may invest additional amounts of money in the

asset, as the Trustee deems appropriate, to preserve the asset or

to increase its productivity.

(O) VOTING: The Trustee may vote stoc k for any purpose, either in

person or by proxy, may enter into a voting trust, and may

participate in corporate activities related to a trust in any capacity

as permitted by law, including service as officer or director.

(P) REORGANIZATION: The Trustee is hereby granted all powers

necessary to unite with other owners of property similar to any

property held in this Trust in carrying out the foreclosure, lease,

sale, incorporation, dissolution, liquidation, reincorporation,

reorganization, or readjustmen t of the capital or financial structure

of any association or corporation in which any Trust has a financial

interest; to serve as a member of any protective committee; to

deposit Trust securities in accordance with any plan agreed upon;

to pay any assessm ents, expenses, or other sums deemed

expedient for the protection or furtherance of the interests of the

beneficiaries; and to receive and retain as Trust investments any

new securities issued pursuant to the plan, even though these

securities would not co nstitute authorized Trust investments without

this provision.

(Q) PURCHASE FROM ESTATE OR TRUST: The Trustee is

specifically authorized to purchase property of any type, whether

real or personal, from a Trustor or beneficiary's estate or Trust for

their benefit upon such terms and conditions, price and terms of

payment as the Trustee and the respective personal

Representative shall agree upon, and may hold any property so

purchased in Trust although it may not qualify as an authorized

Trust investment ex cept for this provision, and may dispose of such

property as and when the Trustee shall deem advisable.

- 6 -

(R) ASSISTANTS AND AGENTS: The Trustee is hereby granted all

powers necessary to employ any person or persons the Trustee

deems advisable for the pro per administration of any Trust,

including but not limited to: attorneys -at-law, accountants, financial

planners, brokers, investment advisors, realtors, managers for

businesses or farms, technical consultants, attorneys -in-fact,

agents and any other cons ultants and assistants.

(S) RESERVES: The Trustee is hereby authorized to set aside and

maintain reserves for the payment of present or future expenses,

including but not limited to: taxes, assessments, insurance

premiums, debt amortizations, repairs , improvements, depreciation,

obsolescence, maintenance, fees, salaries and wages, as well as

to provide for the effects of fluctuations in gross income, and to

equal or apportion payments for the benefit of income beneficiaries

under the Trust.

(T) MANAGEMENT OF REALTY: The Trustee is specifically

authorized to deal with real and personalty, including oil, gas, and

mineral rights in any manner lawful to an owner on any terms and

for any period, including periods beyond the duration or termination

of any Trusts.

(U) BUSINESS: With respect to any business that is part of or may

become part of any Trust, no matter how such business may be

organized, the Trustee is hereby granted the authority to:

a. hold, retain and continue to operate such business solely at the

risk of the Trust estate and without liability to the Trustee for any

resulting losses;

b. incorporate, dissolve, liquidate, or sell such business at any time

and upon any terms as the Trustee deems advisable. In

exercise of this authority, the Trustee may obtain a qualified

appraisal, although the Trustee is not obligated in any way to

seek other offers in contracting for sale to any person including

another shareholder, trust, or beneficiary; mortgage, pledge or

otherwise encumber any asse ts of any Trust to secure loans for

any business purposes;

c. engage in the redemption of stock and to take such actions as

are necessary to qualify the redemption under IRC Sections 302

or 303 and the applicable requirements of state law.

d. create a sp ecial lien for the payment of deferred death taxes

under IRC Section 6324, or similar provisions of state law.

- 7 -

e. create, continue, or terminate an S -Corporation election.

9. AUTHORITY TO ACT: The approval of any court, the Trustor, or any

benefici ary of any Trust created by this Trust shall not be required for any

dealings with the Trustee of this Trust, and any person so dealing with the

Trustee of this Trust shall assume that the Trustee has the same power and

authority to act as any individual d oes in the management of his or her own

affairs. Further, upon presentation of a copy of this page and any other page of

this Trust, any person shall accept same as conclusive proof of the terms and

authority granted by this Trust, and shall assume that n o conflicting terms or

directions are contained in any of the omitted pages.

ARTICLE VI

TRUST ADMINISTRATION DURING LIFE OF TRUSTOR

10. MANAGEMENT OF TRUST PROPERTY: All property of the Trust shall

be managed by the Trustee at the direction of the Trustor. The Trustee shall

collect all income of the Trust, and shall pay from the income such amounts and

to such persons as the Trustor may from time to time direct. In the absence o f

direction from the Trustor, the Trustee may accumulate the net income of the

Trust, or may disburse any portion of the net income to or for the benefit of the

Trustor. The Trustee is also authorized to pay from the principal of this Trust any

and all am ounts necessary for the health or maintenance of the standard of living

of the Trustor.

11. INCAPACITY OF TRUSTOR: During any period of incapacitation of the

Trustor, as defined by this Trust Agreement, the Successor Tr ustee may apply or

expend all or a part of the income and principal of this Trust, or both, for the

health and maintenance of the Trustor, in his or her accustomed manner of living.

Provided sufficient resources exist for the care and maintenance of the Tr ustor,

during any period of incapacity of the Trustor, the Successor Trustee is further

authorized to make distributions to or for the benefit of any issue of the Trustor

who has no other financial resources and who requires said distribution for their

hea lth or support. The Successor Trustee shall consider all financial resources

available to a beneficiary, including, but not limited to, the ability of said

beneficiary and his or her spouse, if any, to earn a living prior to making an

invasion of this Trus t. Under no circumstances may a Successor Trustee

exercise this power for his or her own benefit.

12. RESERVATION OF RIGHTS: Except during periods of incapacitation as

defined by this Trust Agreement, upon delivery to the Trustee of a written

instrument , signed and acknowledged by the Trustor, the Trustor does herby

reserve during his or her lifetime the following rights:

- 8 -

(A) To revoke this Trust Agreement in its entirety and to recover any

and all remaining property of the Trust after payment of all Tr ust

administration expenses in accordance with California Probate

Code Section 15401,

(B) To alter or amend this instrument in any and every particular at any

time and from time to time in accordance with California Probate

Code Section 15402,

(C) To cha nge, at any time and from time to time, the identity or

number, or both, of the Trustee and/or Successor Trustee,

(D) To withdraw from the operation of this Trust, at any time and from

time to time, any or all of the Trust property.

ARTICLE VII

DISTRIB UTIONS DURING LIFETIME OF TRUSTORS

13. GENERAL DISTRIBUTIONS: The following options are available to the

Trustee regarding the distribution of principal or income to or for a beneficiary:

(A) Payments may be made directly to the beneficiary as an al lowance,

in such amounts as the Trustee may deem advisable;

(B) Payments may be made to the Guardian of the beneficiary.

(C) Payments may be made to a relative of the beneficiary upon the

agreement of such relative to expend such income or principal

solely for the benefit of the beneficiary. Said agreement may

include a custodianship under the Uniform Transfers (or Gift) to

Minors Act of any state.

(D) The Trustee may expending such income or principal directly for

the beneficiary. After making a distribution as provided above, the

Trustee shall have no further obligation regarding the distribution.

(E) In making distributions of income or principal, the Trustee shall be

mindful of the Beneficiaries health, education, support,

maintenance, comfor t and general welfare needs.

14. RESIDENCE: A residence may be purchased or otherwise obtained by

the Trustee for the benefit of an income beneficiary of any Trust for use by the

beneficiary and his or her family. Rent shall not be charged to said bene ficiary

and expenses of maintaining such residence may be borne by the Trust, the

beneficiary, or partly by each, as the Trustee may deem proper.

- 9 -

15. OTHER PAYMENTS: At the request of any Trustor in writing, the

Trustee shall make lump sum or periodic pay ments to any third party designated

by such Trustor.

ARTICLE VIII

TRUST ADMINISTRATION AFTER TRUSTOR’S DEATH

16. TRUSTEE: Upon the death of the Trustor, the Successor Trustee shall

continue to administer the assets of this Trust, as well as any other property

received by this Trust from any source, and shall distribute said assets as

provided herein.

17. BENEFITS PAYABLE TO TRUST: Upon the death of the Trustor, the

Trustee is hereby authorized to take any and every action necessary to collect

any and all benefits payable to the Trust, including but not limited to proceeds

from life insurance policies, retirement plans, or IRA’s. The Trustee is further

authorized to c ollect any and all tax refunds, health insurance proceeds, refunds

under any contract, death benefits, or any other item payable to the Trustor’s

estate.

18. LIABILITIES OF TRUSTOR’S ESTATE: Prior to the distribution of any

assets of this Trust, the Trustee may, at his or her sole and absolute discretion,

pay to the Trustor’s estate, from the principal or income of the Trust, any or all of

the Trustor’s just debts, funeral expenses, and admini stration expenses of the

Trustor’s estate. Alternatively, the Trustee may, but is not obligated to, pay such

expenses directly.

19. TAXES: Upon the death of the Trustor, a ll estate and inheritance taxes

that become due and payable upon all of the proper ty comprising the Trustor’s

gross estate, without regard to how such property passes, shall be paid by the

Trustee either to the estate of the Trustor or to the appropriate tax agency. The

Trustee shall have the right of contribution as provided by Sectio n 2207 and

2207A IRC, if applicable.

20 . ADDITIONAL DISTRIBUTIONS: The Trustee is hereby authorized to pay

to the Probate Estate of the deceased Trustor as much of the income and

principal of this Trust as the Trustee deems necessary for any purpose, in

addition to the other distributions provided for in this Trust.

- 10 -

21. GIFTS: The Trustee shall, upon the death of the Trustor, make such gifts

of the tangible personal property of the Trustor held or acquired by this Trust as

may be directed by the Trustor ’s Will or any list, letter, or other writing of the

Trustor permitted by the Will of the Trustor, or as may be directed by a list, letter

or other writing designated as Schedule B of this Trust, whenever made. All

costs of storing, packing, shipping and insuring such gifts shall be paid by the

Trust.

ARTICLE IX

TRUSTOR’S DEATH

22. DISTRIBUTIONS: Upon the death of the Trustor, the following

distributions shall be made from the property of this Trust after payment of the

Trustor’s just debts, funeral expenses, expenses of any last illness, and the other

distributions otherwise provided for in this Trust:

(a) DISTRIBUTION UPON DEATH OF FIRST TRUSTOR: Following the

death of the first Trustor, and prior to the death of the Surviving Trustor, the

Trustee shall pay to or for the benefit of the Surviving Spouse (Surviving Trustor),

at the Trustee’s discretion, so much of the income and principal as the Trustee

deems necessary for the health, maintenance, education, support, and

happiness of the Surviving Tru stor.

If at any time before full distribution of the trust estate the Trustors and all the

Trustor’s issue are deceased and no other disposition of the property is directed

by this instrument, the remaining portion of the trust shall then be distributed t o

the Trustor’s legal heirs according to the laws of succession of the State of

California then in force.

(b) DISPOSITION OF TRUST ESTATE ON DEATH OF SURVIVING

TRUSTOR: If any of the children of the Trustors sur vives the Surviving Trustor,

but none of the children are under the age of twenty -one (21) years at the time of

the death of the Surviving Trustor, the Trustee shall divide the Trust property

(including all income then accrued but uncollected and all incom e then remaining

in the hands of the Trustee) into as many shares of equal market value as are

necessary to create one share for each of the Trustor’s children who survive the

Surviving Trustor and one share for each of the Trustor’s children who

predeceas e the Surviving Trustor but who leave issue surviving him or her. The

Trustee shall distribute one share outright to each of the Trustors’ surviving

children. The Trustee shall distribute each share created for a deceased child to

the then -living issue o f that child, with those issue to take that share of the trust

property as their deceased parent would have received. If all individual issue of

a deceased child have reached the age of 21 years at the death of the Surviving

Trustor, the Trustee shall dis tribute the share created for that deceased child

- 11 -

outright to those issue; if any individual issue of a deceased child has not

reached the age of 21 years at the death of the Surviving Trustor, the Trustee

shall continue to hold, administer, and distribute the share created for that

deceased child in a separate trust for all then -living issue of that deceased child

according to the terms set forth applicable to the Sprinkling Trust for Issue.

If any children of the Trustors surviving the Surviving Trustor are under the age of

21 years at the time of the death of the Surviving Trustor, the property shall be

held, administered, and distributed by the Trustee, in trust, according to the terms

set forth in this article applicable to the Sprinkling Trust.

If no issue of the Trustors survive the Surviving Trustor, the Trustee shall

distribute the property outright as follows: one half (1/2) to the heirs of the

deceased Trustor and one half (1/2) to the heirs of the Surviving Trustor.

(c) SPRINKLING TRUST: The Tr ustee shall hold, administer, and

distribute the assets of the Sprinkling Trust as follows:

(i) DISCRETIONARY PAYMENTS BEFORE DIVISION INTO

SHARES. At any time or times before the division of the Trust into shares as

provided below in this section, the Trustee shall pay to or apply for the benefit of

any one or more of the Trustors’ then -living children and the then -living issue of

any then –deceased children of the Trustors so much of the net income and

principal of the Trust as the Trustee deems proper for the health, education

support, and maintenance of each of them. In making these payments, the

Trustee may pay or apply more for some beneficiaries than for others, and may

make payments to or for one or more beneficiaries to the exclusion of others. No

amount paid or applied need thereafter be repaid to the Trustee or restored to

the Trust. In exercising discretion, the Trustee shall give the consideration that

the Trustee deems property to all other income and resources that are known to

the Trustee and that are readily available to the beneficiaries for use for these

purposes. All decisions of the Trustee regarding payments under this

subsection, if any, are within the Trustee’s discretion and shall be final and

incontestable by anyone. The Truste e shall accumulate and add to principal any

net income not distributed.

(ii) DISCRETIONARY PAYMENTS OF INDIVIDUAL TRUSTS. At any

time or times during the term of the individual Trust to be created for each of the

then -living children of the Trustors, the Trustee shall pay to or apply for the

benefit of the child so much of the net income and principal of the individual trust

as the Trustee deems proper for the child’s health, education, support, and

maintenance. In exercising discretion, the Trustee shal l give the consideration

that the Trustee deems property to all other income and resources that are

known to the Trustee and that are readily available to the child for use for these

purposes. All decisions of the Trustee regarding payments under this

sub section, if any, are within the Trustee’s discretion and shall be final and

- 12 -

incontestable by anyone. The Trustee shall accumulate and add to principal any

net income not distributed.

(iii) TERMINATION AND DISTRIBUTION OF INDIVIDUAL TRUSTS .

The individua l trust shall terminate when the child reaches the age of 21 years or

on the death of the child, whichever occurs first.

(iv) TERMINATION OF INDIVIDUAL TRUST ON DEATH OF CHILD.

The Trust shall terminate on the death of the child for whom the trust was

created. On termination of the Trust, the Trustee shall distribute the remaining

Trust property to the then -living issue of the child. However, if any individual

issue of that child has not reached the age of 21 years at the termination fo this

Trust, the Trustee is to continue to hold, administer, and distribute the Trust

property in a separate Trust for all of the then -living issue of that child according

to the terms set forth applicable to the Sprinkling Trust for Issue.

(v) FINAL DISPOSITION. If th e trust property is not completely

disposed of by the preceding provisions, the indisposed -of portion shall be

distributed outright as follows: one half (1/2) to the heirs of the deceased Trustor

and one half (1/2) to the heirs of the Surviving Trustor.

(d) SPRINKLING TRUST FOR ISSUE. Each share or portion of the Trust

estate, or of the Trust property of any other Trust created by this Trust

instrument, that is allocated to a Sprinkling Trust for Issue for the benefit of the

beneficiaries when any benefic iary is under the age of twenty -one (21) years

shall be held, administered, and distributed by the Trustee as a separate Trust,

as follows:

(i) BENEFICIARIES. The beneficiaries of this Trust are all the issue

of a deceased child of the Trustors or all i ssue of the Trustors, as the case may

be, for whom this Trust is created pursuant to the other provisions of this Trust

instrument.

(ii) DISCRETIONARY PAYMENTS. At any time or times during the

Trust term, the Trustee shall pay t o or apply for the benefit of each of the

beneficiaries so much of the net income and principal of the Trust as the Trustee

deems proper for the health, education, support, and maintenance of each of

them. In making these payments, the Trustee may pay or apply more for some

of the beneficiaries than for others, and may make payments to or for one or

more beneficiaries to the exclusion of others. No amount paid or applied need

thereafter be repaid to the Trustee or restored to the Trust. In exercising

dis cretion, the Trustee shall give the consideration that the Trustee deems proper

to all other income and resources that are known to the Trustee and that are

readily available to the beneficiaries for use for these purposes. All decisions of

the Trustee re garding payments under this subsection, if any, are within the

- 13 -

Trustee’s discretion and shall be final and incontestable by anyone. The Trustee

shall accumulate and add to principal any net income not distributed.

(iii) DISTRIBUTION ON TERMINATION . The Trust shall terminate

when there are no living beneficiaries who are under 25 years of age. On

termination, the Trustee shall distribute the Trust property (including all income

then accrued but uncollected and all net income then remaining in the hands of

the Trustee) outright to the then -living beneficiaries.

(iv) FINAL DISPOSITION . If the Trust property is not completely

disposed of by the preceding provisions, the indisposed -of portion shall be

distributed outright as follows: one half (1/2) to t he heirs of the deceased Trustor

and one half (1/2) to the heirs of the Surviving Trustor.

23. DEATH OF BENEFICIARY: Should a named beneficiary die before a

complete distribution of this Trust is made, and that Beneficiary leave no living

issue, then that beneficiary’s share shall go to the surviving Beneficiaries.

ARTICLE X

TRUSTEE PROVISIONS

24. THIRD PARTIES: Any person dealing in good faith with the Trustee shall

deal only with the Trustee and shall presume the Trustee has full power and

authority to act on behalf of the Trust. Confirmation or approval of any

beneficiary shall not be required for any transaction with the Trustee. No Trustee

of this trust shall be personally liable for contracts entered into on behalf of the

trust unless the Truste e fails to reveal his or her representative capacity and

identify the trust estate in the contract. Further, the Trustee shall not be

personally liable for contracts or torts in connection with the administration of the

trust unless the Trustee is persona lly at fault.

25. COMPENSATION: Any beneficiary of this Trust serving as Trustee shall

do so without compensation for his or her services, except that the Trustee shall

be reimbursed for reasonable expenses incurred in the administration of the

Trust. An y Trustee not a beneficiary hereunder shall be compensated at the rate

customarily charged by commercial trust companies for services as a trustee of

an inter vivos trust in the State of California, unless such compensation is waived

by the Trust ee.

26. BOND AND QUALIFICATIONS : Bond shall not be required of the

Trustee or any Successor Trustee. The Trustee and any Successor Trustee shall

not be required to qualify in any court and is hereby relieved of the requirement

of filing any document an d accounting in any court or beneficiary.

- 14 -

27. SUCCESSOR TRUSTEE(S): No Successor Trustee shall be responsible

for acts of any prior Trustee. In the event a vacancy in the office of Trustee

occurs and there is no successor trustee, the existing Trustee, if one, and the

beneficiaries may agree to a non -judicial change in the trustee by amendment to

this trust agreement . No person shall be required to apply to any court in any

jurisdiction for confirmation of said appointment. A successor trustee of a trust

shall succeed to all the powers, duties and discretionary authority of the original

trustee. Any appointment of a specific bank, trust company, or corporation as

trustee is conclusively presumed to authorize the appointment or continued

service of that entity's successor in interest in the event of a merger, acquisition,

or reorganization, and no court proceeding i s necessary to affirm the

appointment or continuance of service.

28. REMOVAL OF SUCCESSOR TRUSTEES: A Successor Trustee may be

removed by the last individual to serve as Trustee; however, if that person is

deceased or incapacitated, the Successor Truste e may be removed by a majority

vote in interest in Trust income. Said removal must be in writing, stating the

reasons for removal and indicate the successor Trustee, which must be a

corporate trustee.

Removal of a Successor Trustee shall be permitted only for the convenient

administration of the Trust and not for the purpose of influencing the exercise of

the discretionary powers of a Successor Trustee as granted by this instrument.

Removal of a Succe ssor Trustee shall be effective upon delivery of the notice of

removal. The removed Trustee shall have a reasonable period of time to transfer

assets to his or her successor. In the event the successor Trustee believes that

his or her removal is improper, he or she may, but shall not be required to, apply

to a court of competent jurisdiction, at his or her expense, for a declaration of the

propriety of the removal. In that event, the removal shall be effective only upon

the order of said court and after an y appeal. In the event the Successor Trustee

prevails, he or she shall be entitled to reimbursement from the Trust for

reasonable costs and attorneys fees associated with such action.

29. DELEGATION OF POWERS: Any management function of any Trust

may be delegated by any Trustee to any Successor Trustee, even if such

Successor Trustee is not then serving as Trustee. The terms of such delegation

of power shall be any conditions agreed to by the Trustees which are not

detrimental to the Trust. Provided, ho wever, that the Trustee shall not delegate

ALL of the trustee’s duties and responsibilities.

30 . LIMITED AMENDMENT POWER: The Trustee shall enjoy a limited

power to amend management functions of this Trust only as may be required to

facilitate the conve nient administration of this Trust, to deal with the unexpected

or the unforeseen, or to avoid unintended or adverse tax consequences. Any

amendment under this provision shall be in writing and must be consented to by

- 15 -

the Trustor, if not then deceased or incapacitated, or the beneficiaries of any

Trust if the Trustor is deceased or incapacitated. The amendment may be

retroactive. This limited power to amend shall not affect the rights of any

beneficiary to enjoy Trust income or principal without the consen t of said

beneficiaries. The dispositive provisions of any Trust shall not be affected by this

limited power to amend, and such power shall not be exercisable in such any

manner as to create gift, estate, or income taxation to the Trustee or any

beneficia ry. No amendment shall affect the rights of third persons who have dealt

or may deal with the Trustee without their consent.

31. RESIGNATION OF TRUSTEE: Any Trustee may resign by writing filed

among the trust papers effective upon the trustees’ discharge . The resigning

Trustee, or other interested party, shall provide notice to all adult income

beneficiaries and other adult beneficiaries of the Trust. The resignation shall be

effective upon agreement of all parties entitled to notice, or thirty days aft er

notice, whichever occurs first.

32 . NONLIABILITY FOR ACTION OR INACTION BASED ON LACK OF

KNOWLEDGE OF EVENTS. When the happening of any event, including but not

limited to such events as marriage, divorce, performance of educational

requirements, or de ath, affects the administration or distribution of the trust, a

trustee who has exercised reasonable care to ascertain the happening of the

event is not liable for any action or inaction based on lack of knowledge of the

event. A corporate trustee is not l iable prior to receiving such knowledge or

notice in its trust department office where the trust is being administered.

33. TRUSTEE AS BENEFICIARY . Notwithstanding any other provision

herein or of California Laws , a trustee who is also a beneficiary of the trust may

exercise powers to make:

(1) Discretionary distributions of either principal or income to or for the benefit

of the trustee;

(2) Discretionary allocations of receipts or expenses as between principal and

income;or

(3) Discre tionary distributions of either principal or income to satisfy a legal

obligation of the trustee.

34. WAIVER OF ACCOUNTING. Except as otherwise provided herein,

neither this trust, nor any Trustee, shall be required to provide an accounting to

any Benefic iary.

- 16 -

ARTICLE XI

TRUST ADMINISTRATION

35 . ALLOCATION TO PRINCIPAL AND INCOME – SEPARATE TRUSTS:

All expenses and all receipts of money or property paid or delivered to the

Trustee may be allocated to principal or income in the sole discretion of the

Trustee. The Trustee, in a reasonable and equitable manner, shall also have the

discretion to allocate , in whole or in part:

(A) Expenses of administration of the Trust to income or principal.

(B) Fees of the Trustee to income or principal.

(C) Any expense of Trust administration or administration of its assets

which are deductible for Federal Income Tax purposes to income.

(D) The gains or losses from option trading, and capital gains

distributions from utility shares, on mutual funds, or tax m anaged

funds to income; and

(E) To income or principal, distributions from qualified or non -qualified

pension plans, profit sharing plans, IRA accounts or deferred

compensation arrangements.

To the extent that division of any Trust is directed, the Trust ee may administer

any Trust physically undivided until actual division becomes necessary. Further,

the Trustee may add the assets of the Trust for any beneficiary to any other trust

for such beneficiary having substantially the same provisions for the disp osition

of trust income and principal, whether or not such trust is created by this

agreement. The Trustee may commingle the assets of several trusts for the

same beneficiary, whether or not created by this agreement, and account for

whole or fractional tr ust shares as a single estate, making the division thereof by

appropriate entries in the books of account only, and to allocate to each whole or

fractional trust share its proportionate part of all receipts and expenses; provided,

however, this carrying of several trusts as a single estate shall not defer the

vesting of any whole or fractional share of a trust for its beneficiary at the times

specified.

36. ALIENATION: Excepting the Trustor, n o income or principal beneficiary

of any Trust shall have a ny right or power to anticipate, pledge, assign, sell,

transfer, alienate or encumber his or her interest in the Trust, in any way. No

interest in any Trust shall, in any manner, be liable for or subject to the debts,

liabilities or obligations of such ben eficiary or claims of any sort against such

beneficiary.

- 17 -

37. TERMINATION OF TRUST: Should the aggregate principal of any Trust

at any time be valued at Twenty Thousand Dollars ($20,000) or less, the Trustee

may, in his or her sole discretion, terminate s uch Trust and distribute the assets

of the Trust to the beneficiaries in proportion to each beneficiary’s share of the

Trust.

38. ELECTIONS: The Trustee and the Personal Representative of the

Trustor's estate will have various options in the exercise of discretionary powers,

and may exercise any such discretion without incurring liability to any beneficiary,

nor shall any beneficiary have the right to demand a reallocation or redistribution

of Trust income or principal as a result of the proper action of the Trustee or

Personal Representative, subject only to the requirement that the Trustee and

the Personal Representative act in good faith and within the bounds of their

fiduciary duty. Specifically, the Trustee or Personal Representative may make

certain elections for Federal Income Tax and Estate Tax purposes which may

affect the administration of Trust income or principal.

39. BENEFICIARY DESIGNATION: Upon written designation by the Trustor

of a beneficiary for a qualified plan or IRA benefits made p ayable to this Trust,

the Trustee shall distribute the right to receive such benefits to the designated

beneficiary. If no such designation of beneficiary exists, the Trustor grants to the

Trustee the power, on behalf of the Trustor, to distribute the rig ht to receive such

benefits as a part of the share which is otherwise to be distributed to any

beneficiary, and such person shall be the Trustor's designated beneficiary. It is

intended that the operation of this paragraph qualify under the requirements of

401(a) (9) and 408(a) (6) IRC and it shall be interpreted in all regards in

accordance with this intent.

40. CERTIFICATE OF TRUST: The Trustee is hereby authorized and

granted all powers necessary to execute a Certificate of Trust, describing any

Trust matter, including but not limited to a description of the Trust terms, the

administrative powers of the Trustee and the identity of any current Trustee. Any

person receiving an original or photocopy o f said Certificate of Trust shall be held

harmless from relying on same, and shall not be obligated to inquire into the

terms of the Trust or maintain a copy of the Trust.

41. REGISTRATION OF TRUST ASSETS: Assets of this Trust during the

Trustor’s lifet ime shall be registered as follows: __________________ , Trustee,

or his or her succ essors in trust, under THE __________________ REVOCABLE

TRUST, dated the _____ day of ______________ , 20 ___ , and any amendments

thereto.

42. TAX IDENTIFICATION: This Trust shall be identified during the Trustor’s

lifetime by the Trustor's Social Security Number __________________ . Upon the

Trustor’s death, the Trustee shall then apply to the IRS for a tax identification

number for the Trust and any other Trust created by this Trust Agreement.

- 18 -

43. SPENDTHRIFT CLAUSE: The interest of any Beneficiary of this Trust in

the income and principal shall not be subject to claims of his or her creditors, or

others, or be liable to attachment, execution, or other process or law and no

Beneficiary shall have the right to encumber, hypothecate, or alienate his or her

interest in any of the trust in any manner except as provided herein.

44. PERPETUITIES CLAU SE: All Trusts created by this instrument and

interests therein shall vest in their then beneficiary twenty -one years after the

death of the last of the issue of the Trustor who was alive when the Trustor died,

notwithstanding any provision of this Trust to the contrary. No provision of an

instrument creating a trust, including the provisions of any further trust created,

and no other disposition of property made pursuant to exercise of a power of

appointment granted in or created through authority under s uch instrument is

invalid under the rule against perpetuities, or any similar statute or common law,

during the said time period.

ARTICLE XII

TERMS AND DEFINITIONS

The terms below, as used throughout this Trust Agreement, shall have the

following meanin g

45. INCAPACITATED: For the purposes of this Trust Agreement, if a Trustee

or a beneficiary, is under a legal disability, or by reason of illness, mental or

physical disability is, in the written opinion of two doctors currently practicing

medicine, una ble to properly manage her affairs, he or she shall be deemed

incapacitated.

46. REHABILITATION: For the purposes of this Trust Agreement, as a

Trustee or as a beneficiary, shall be deemed rehabilitated when he or she is no

longer under a legal disabilit y or when, in the written opinion of two doctors

currently practicing medicine, he or she is able to properly manage his or her

own affairs. Upon rehabilitation, his or her successors shall relinquish all powers

and be relieved of all duties, and the rehab ilitated party shall resume the duties

and powers he or she had prior to incapacity.

47. GUARDIANSHIP: During any period of incapacity or incompetence, t he

Trustor does hereby nominate as Guardian of the Trustor’ s property the same

person(s) in name and order of succession who serve as Trustee as provided

herein.

48. SURVIVORSHIP: This Agreement shall be binding upon the heirs,

personal representatives, successors and assigns of the parties hereto.

- 19 -

49. APPLICABLE LAW: This Agreement shall in all respects be construed

and regulated according to the laws of the State of California. Should any Trust

or asset of any Trust be administered in another State, this Trust may be

regulated by the laws o f that State if required to avoid excessive administration

expenses or to uphold the validity of any terms of this Trust.

50 . TRUSTEE AND TRUST: The term “Trustee" refers to the single, multiple

and Successor Trustee, who at any time may be appointed and acting in a

fiduciary capacity under the terms of this agreement. Where appropriate, the

term `Trust" refers to any trust created by this agreement.

51. GENDER - SINGULAR AND PLURAL: Where appropriate, words of the

masculine gender include the feminine and neuter; words of the feminine gender

include the masculine and neuter; and words of the neuter gender include the

masculine and feminine. Where appropriate, words used in the plural or

collective sense include the singular and vice -versa.

52. IRC: Th e term "IRC" refers to the Internal Revenue Code and its valid

regulations.

53. SERVE OR CONTINUE TO SERVE: A person cannot "serve or continue

to serve" in a particular capacity if they are incapacitated, deceased, have

resigned, or are removed by a cour t of competent jurisdiction.

54. ISSUE: The term "issue", unless otherwise designated herein, shall

include adopted "issue" of descendants and lineal descendants, both natural and

legally adopted indefinitely. Such term shall specifically exclude indivi duals

adopted out of the family of the Trustor or out of the family of a descendant of the

Trustor. The word "living" shall include unborn persons in the period of gestation.

55. NOTICE: No person shall have notice of any event or document until

receipt of written notice. Absent written notice to the contrary, all persons shall

rely upon the information in their possession, no matter how old, without

recertification, verification, or further inquiry.

56. MERGER: The doctrine of merger shall not apply to any interests under

any Trust.

57. REPRESENTATION: In any Trust matter a beneficiary whose interest is

subject to a condition (such as survivorship) shall represent the interests in the

Trust of those who would take in default of said condition. The mem bers of a

class shall represent the interests of those who may join the class in the future

(e.g. living issue representing unborn issue). The legal natural guardian of a

person under a legal disability shall represent the interests of the disabled

person.

- 20 -

IN WITNESS WHEREOF, on this the ____day of __________, 20___, Trustor,

and Trustee have signed this Instrument.

____________________________

TRUSTOR

______________________________

TRUSTOR

_____________________________

TRUSTEE

- 21 -

State of California

County of

On before me,

(here insert name and title of the officer), personally appeared

, who proved to me on the basis of

satisfactory evidence to be the person(s) whose name(s) is/are subscrib ed to the

within instrument and acknowledged to me that he/she/they executed the same

in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on

the instrument the person(s), or the entity upon behalf of which the person(s)

acted, executed the instrument. I certify under PENALTY OF PERJURY under

the laws of the State of California that the foregoing paragraph is true and

correct.

WITNESS my hand and official seal.

Signature (Seal)

- 22 -

THE __________________ REVOCABLE LIVING TRUST

Schedule A

The sum of One Hundred Dollars ($100.00 ) in cash.

TOGETHER WITH:

- 23 -