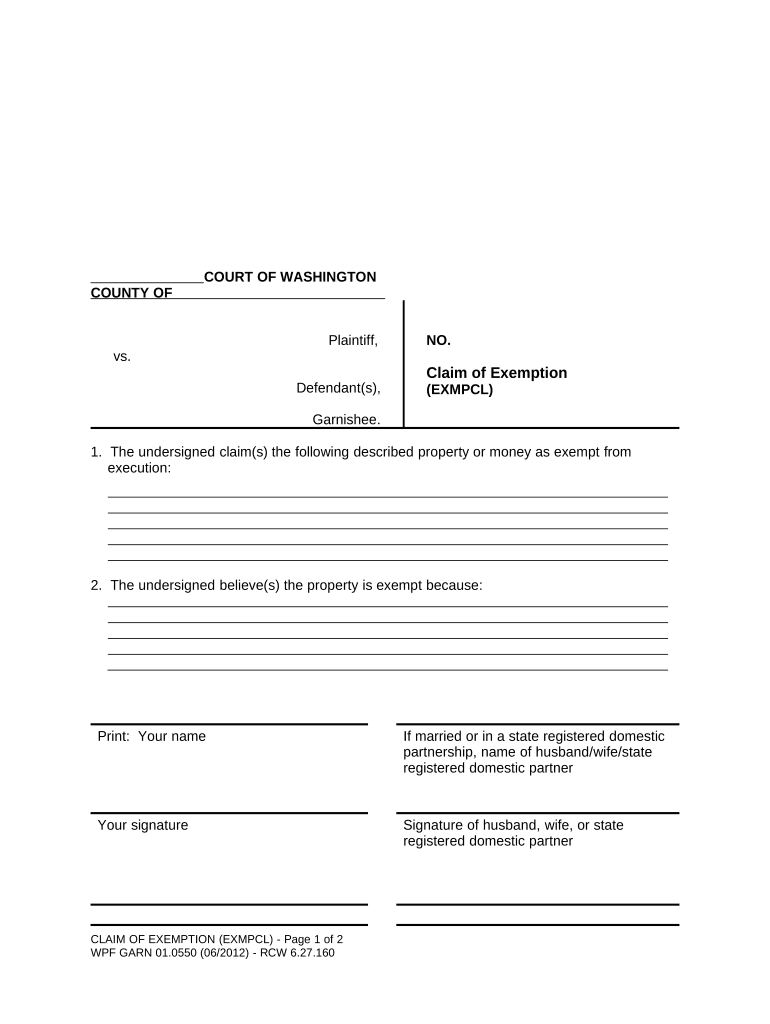

Fill and Sign the Claim Exemption Form 497429541

Practical advice on preparing your ‘Claim Exemption Form 497429541’ online

Are you frustrated with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and small to medium-sized businesses. Bid farewell to the monotonous task of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Leverage the powerful tools embedded in this user-friendly and cost-effective platform to transform your document management strategy. Whether you need to approve forms or collect electronic signatures, airSlate SignNow manages it all with ease, needing just a few clicks.

Follow this step-by-step guide:

- Log into your account or initiate a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template collection.

- Open your ‘Claim Exemption Form 497429541’ in the editor.

- Click Me (Fill Out Now) to fill out the form on your end.

- Add and assign fillable fields for others (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

Don’t fret if you need to collaborate with your teammates on your Claim Exemption Form 497429541 or send it for notarization—our platform has everything you require to accomplish such tasks. Register with airSlate SignNow today and take your document management to a new height!

FAQs

-

What is a Claim Exemption Form and how does it work?

A Claim Exemption Form is a document used to declare that a taxpayer meets certain criteria to be exempt from certain taxes. Using airSlate SignNow, you can easily create, send, and eSign your Claim Exemption Form securely online. This simplifies the process, ensuring that you can manage your tax exemptions efficiently.

-

How much does it cost to use airSlate SignNow for a Claim Exemption Form?

airSlate SignNow offers a range of pricing plans to accommodate various business needs, starting with a free trial to test our features. Pricing for using airSlate SignNow to manage your Claim Exemption Form is competitive, allowing you to choose a plan that best fits your budget while enjoying the benefits of eSigning and document management.

-

What features does airSlate SignNow offer for processing a Claim Exemption Form?

airSlate SignNow provides a comprehensive suite of features for processing a Claim Exemption Form, including templates, customizable workflows, and secure eSigning capabilities. These features streamline the document signing process, making it easy for users to fill out and send their Claim Exemption Form without hassle.

-

Can I integrate airSlate SignNow with other software for my Claim Exemption Form?

Yes, airSlate SignNow integrates seamlessly with a variety of popular applications such as Google Drive, Dropbox, and Salesforce. This allows you to manage your Claim Exemption Form alongside your other business tools, enhancing productivity and collaboration.

-

Is airSlate SignNow secure for sending a Claim Exemption Form?

Absolutely! airSlate SignNow prioritizes security and complies with industry standards to protect your documents. When sending a Claim Exemption Form, you can trust that your information is encrypted and secure, ensuring confidentiality and compliance.

-

How can I track the status of my Claim Exemption Form with airSlate SignNow?

With airSlate SignNow, you can easily track the status of your Claim Exemption Form in real-time. The platform provides notifications and updates when your form is viewed, signed, or completed, giving you full visibility into the signing process.

-

Can I customize my Claim Exemption Form templates in airSlate SignNow?

Yes, you can customize your Claim Exemption Form templates in airSlate SignNow to fit your specific needs. The platform allows you to add fields, adjust layouts, and include branding to ensure that your forms align with your business identity.

The best way to complete and sign your claim exemption form 497429541

Find out other claim exemption form 497429541

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles