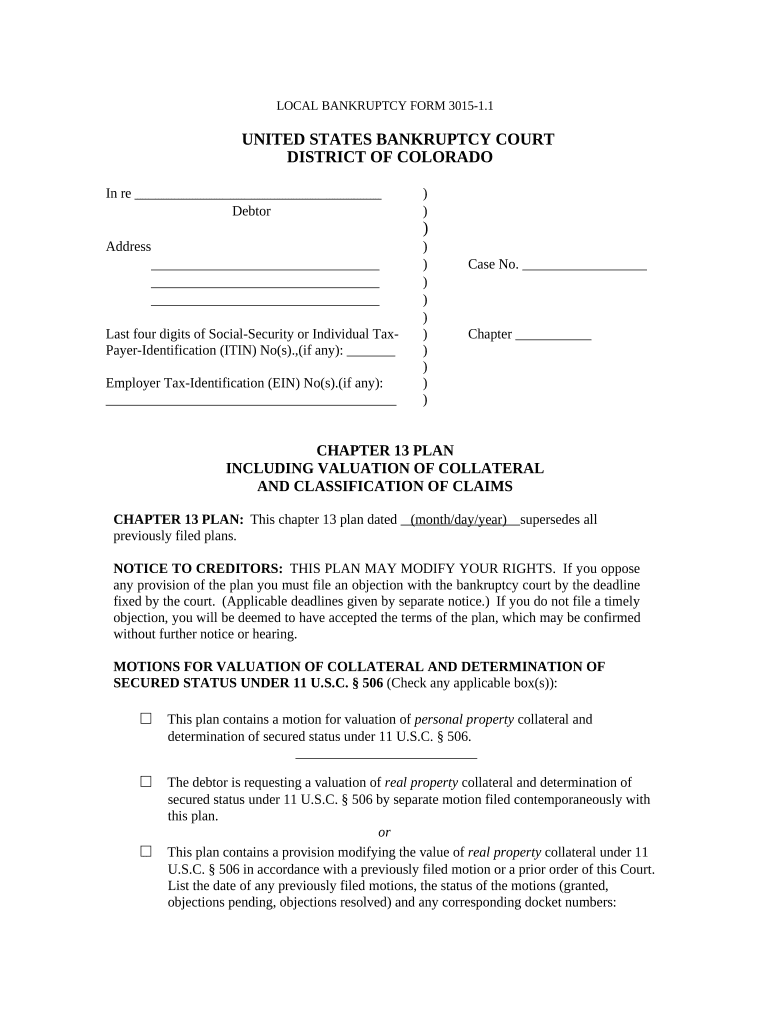

LOCAL BANKRUP T CY FORM 3015-1.1

UNITED STATES BANKRUPTCY COURT

DISTRICT OF COLORADO

In re ____________________________________ )

Debtor )

)

Address )

_________________________________ ) Case No. __________________

_________________________________ )

_________________________________ )

)

Last four digits of Social-Security or Individual Tax- ) Chapter ___________

Payer-Identification (ITIN) No(s).,(if any): _______ )

)

Employer Tax-Identification (EIN) No(s).(if any): )

__________________________________________ )

CHAPT E R 13 PLAN

INC L UDING VALUATION OF COLLAT E RAL

AND C L A S SIFICAT IO N OF C L AIMS

CHA P TER 13 PLAN: This chapter 13 plan dated ( m onth/da y / y ear) supersedes all

previous l y fi l ed plans.

NO T ICE T O CR E D IT ORS: THIS PLAN MAY MODIFY Y OUR R I GH T S. If y o u oppose

any pro v ision of the plan y ou m u st file an objection w ith the bank ru p tcy court b y the deadline

fixed b y t h e court. (App l icable deadlines given by separate notice.) If y o u do not file a time l y

objection, you will be deemed to have accepted t h e te r m s of the plan, which m ay be confir m ed

without fur th er notice or h earing.

MOTIONS FOR VALUATION OF CO L LAT E RAL AND DETER M INATION OF

SECU R ED STATUS U NDER 11 U . S.C. § 506 ( C heck any app l icable box(s)):

□ This plan co n tains a m o tion for valuation of personal property collateral and

dete r m ination of secured status under 11 U.S.C. § 506.

□ The debtor is requesting a valuation of r eal property collateral and deter m ination of

secured status under 11 U.S.C. § 506 by separate m o ti o n filed cont e m poraneous l y with

this plan.or

□ This plan co n tains a provision m odif y in g the value of real property collateral under 11

U.S.C. § 506 in accordance with a previously f iled m o tion or a prior order of this Court.

List the date of a n y prev io usly filed m o tions, the stat u s of the m o tions (granted,

objections p e ndin g , object i ons resolved) and a n y cor r esponding d o cket nu m bers:

SECU R ED CLAIMS SU BJECT T O VAL U AT I ON OF C OL L ATE R AL A ND DET E RMI N AT I ON OF

SECU R ED STATUS U NDER 11 U . S.C. § 506 (additional detail m u st be prov i ded at Part IV of the plan):

Na m e of Creditor Des c ription of Collateral (pursuant to L.B.R. 3012 - 1)

I. BACKGROUND IN FO RMATION

A. Prior bankruptcies pending within one y e ar of the petition date for this case:

Case N u mb e r & Chapter Discharge or Dismi s sal/ C onversionDate

B. The debtor(s): [ ] is eligible for a discharge; or

[ ] i s not eligible for a di s charge and is not seeking a discharge.

C. Prior

states of do m icile: within 730 days

within

910 da ys

The debtor is cla i m ing ex e m ptions avai l able in the [ ] sta t e of

o r [ ] federal exe m ptions.

D.

The debtor o wes or anticipates owing a Domestic S u pport Obl i gation as defined in 11

U.S.C. § 101 ( 14A). Notice will/should be provided t o these parties i n interest:

1. Spouse/Parent

2. Governmen t

3. Assignee

or other

E . The debtor [ ] has provided the Trustee with the address and phone nu m ber of the

D o m est i c Support Obl i gation recipient or [ ] cannot prov i de the address or phone nu m ber

because it/they is/are not availabl e .

F. The current m onthly inc o me of the debtor, as reported on I n terim Form B22C is: [ ]

below, [ ] equal to, or [ ] above t h e applicable median income.

II. PLAN A N A LYSIS

A. Total Debt Provided for under the P l an and Administrative Expenses

1. Total Priori t y Cla i m s (C l ass One)a. Unpaid

attorney ’s fees $

Total

attorney ’s fees ar e est i m a ted to be $

of which $ _ has been p repaid.

b. Unpaid

attorney’s costs (estimated) $

c. Total

Taxes $

Federal:

$ ; State: $

d, Other $

2. Total

of payments to cure defaults (Class Two) $

3. Total

paymen t on secured cla i ms (C lass Three) $

4. Total

of payments on unsecur ed cla i ms (Class Four) $

5. Sub-total

$

6. Total

trustee's compensation (10% of d e btor 's pa yments) $

7. Total

debt and ad m i nistrative expenses $

B. Reconciliation with Chapter 7

THE NET P ROPERTY VALUES SET FOR T H B E LOW ARE L IQUIDATION

VALUES

RATH E R T HAN R EP L ACEM E NT VALUES. T HE REP LA CEMENT

V ALUES M A Y APPEAR IN CLASS TH R EE OF THE

PLAN.

1. Asse t s avail a ble to Class Four unsecured creditors if Chapter 7 filed:

a. Value

of debtor 's interest in non-exe mpt proper ty $

Property Value Less costs of

sale Less L i ens X

D e btor's

Inter est

Less

Exemptions

= Net Value

b. Plus: value of property r ecoverable under avoiding powers

$

c. Less: e st i m a t ed Chapter 7 a d m inistrative expenses

$

d. Less: a m oun t s pa y able to priori t y creditors other than costs of a d m i nistration

$

e. Equals: est i mated a m ount pa y able t o Class Four cre d itors if Chap t er 7 filed

(if negative, enter zero)

$

2. Est i m ated pa y m ent to Class Four unsecured creditors under the Chapter 13 Plan

plus any funds recovered f r om “other p r op e rt y ” described in Section III.A.3

below.

III. PRO PE RTIES A ND FUTU R E E AR N I N GS SUBJECT T O THE SU P ERVI S ION AND

CONTROL OF THE TRUSTEE

A. The debtor s u b m its to the supervision a n d control of t h e Trustee all or such por ti on of

the debtor's future earnings or other future income as is neces s ary for the execution of

the Plan, including:

1. Future earnings of $ _ per m onth which shall be paid to the

trustee for a period of app r oxi m ately m onths,

beginni n g , 2 0 .Amount

Number of Months Total

One time payment and date

2. A m ounts for the p a y m ent of Class Five post-petition cla i ms included in above

$

3. Other property (specif y ):

___________________________________________________________________

___________________________________________________________________

AT THE TIME THE FINAL PLAN PA Y MENT IS SUBMIT T ED TO THE TRUSTEE, THE

DEBTOR SHALL FI L E WITH THE COURT TH E CERTIFICATION R E GARDING DOMEST I C

SUPPORT

O BLIGA T IO N S REQU I R E D BY 11 U.S.C. § 1328(a) AND, IF N O T ALREADY F ILED,

INT ERIM

FORM B23 REGA R DING CO M PLETION OF FIN A NCIAL MANAGEMENT

INSTRUCTION

REQUIRED BY 11 U.S.C. § 1328 (g)(1).

B . Debtor agrees to m ake pa y ments under the Plan as follows:

VOLUNTARY WAGE ASSIGN M ENT TO EMPLOYER:

E m plo y e r ’s Name, address, telephone n u m b er

( )

OR

DIRECT PAYMENT from debtor to Trustee:

Paid in the f o llowing m anner: $ _to be

d e ducted (weekl y,

m onth l y , per p a y period, etc.)

IV. CLA S SIF I CATION AND T R EATMENT O F CLAIMS

CREDITOR RIGHTS M A Y BE AFFECTED. A WRITTEN O B JECTION M UST BE FI L ED

IN O R DER TO CON T EST THE TE R MS OF THIS PLAN. CREDI T ORS OTH E R THAN

THOSE IN CLASS TWO A AND CL A SS THREE MUST FILE TIMELY P R OOFS OF

CLAIM IN ORDER

TO RECEIVE THE APPLICABLE PA YMENTS.

A. Class One – Claims entit l ed to priority under 11 U .S.C. § 507. Unless other

provision is made in par a graph V.(C), each c r editor in Class One shall be paid in full in

deferred cash pa y m ents prior to the co m menc e ment of distributions to any other class

(except that the pa y m ents to the Trustee s h all be m ade b y de d u ction from each pa y m ent

made by the debtor to t h e Trustee) as f o llows:

1. Allowed administrative expenses

a. Trustee ' s c o mpensation (1 0 % of a m ounts paid b y deb t or under this Pl a n )

$

b. Attorne y 's Fees (est i mated and subject to allowance)

$

c. Attorne y 's Costs (est i mated and subject to allowance)

$

2. Other prior i ty claims to be paid in t h e order of distribution provided by 11

U.S.C. § 507 (if none, ind i cate)

a. D o m estic Support Obl i gations: A proof of claim m ust be ti m ely filed in

order for the Trustee to distribute amounts provi d ed by the plan.

Priority support arrearage: Debtor owes past due support to

i n the total a m o unt of $

that will be paid as follows:

[ ] Distributed by the Trustee pursuant to the te r m s of the Plan; or

[ ] Debtor is m a king m onth l y pa y m ents via a wage order [ ] or directly [ ]

(reflected on Schedule I or J) in the amount of $________________________

to ______________________________. Of that monthly amount, $________

is for current support payments and $_______________ is to pay the arrearage.

Other: For the durat i on of t h e pla n , duri n g the a nniversary m onth of confi r mation, the

d ebtor shall file with the Court a n d sub m it to t h e Trustee an update of the required

info r mation regarding D o m estic Support Obl i gations and t h e s tatus of requ i red

pa y m ents.

b. Federal Taxes

$

c. State Ta x es

$

d. Other

Taxes (describe):

$

e, Other

Class One Cla i ms ( if an y) (describe):

$

[ ] N on e

1

The less e r o f this a m ount or t h e a m ount spe c i f i e d in the Pr o of of Clai m .B. Class Two – Defaults

1. Class Two A (if none, i nd i cate) – Claims set forth below are secured on l y b y an

interest in real proper t y t h at is the debto r' s principal r e sidence loca t ed at (street

address, cit y , state, and zip) . Defaults shall be cured and regular pa y m ents shall

be made:

[ ] N on e

Creditor T o t a l D ef a ult

Am o u n t t o be

Cured 1 Intere s t

R a te T o t a l Amount to

Cure Arr e arage N o . of

M o nt h s t o

Cure Regular Pay m ent per

(i.e. m o nth,

week, et c .) to be Made

Direct l y to C r editor and

Date of First Payment

2

The less e r o f this a m ount or t h e a m ount spe c i f i e d in the Pr o of of Clai m .2. Class Two B (if none, i nd i cate) – Pursuant to 11 U.S.C. § 1322(b) ( 5 ), secured

(other than cla i m s s ecured only by an inte r est in real p roperty that is the debtor's

principal residence) or unsecured cla i ms set forth below on which the last pa y m en t

is due after the date on which the final pa y m ent under the Plan is d u e. Defaults

shall be cured and regular pa y m ents shall be made:

[ ] N on e

Credit o r C o llater a l T o t a l D ef a ult

Am o u n t t o be

Cured 2 Intere s t

R a te Total Amount

to Cu r e

Arrea ra ge N o . of

M o nt h s t o

Cure Regular Pay m ent per

(i.e.

month, week, etc.) to

be Made Dir e ctly to

Credi t or a n d D a te of

First P a yment

3. Class Two C – Executory contracts and unexpired leases. Exe c utory contracts

and unexpired leases a r e r ejected, exc e pt the following which are ass u med:

[ ] N on e

Other Pa rt y t o L e ase or

C o nt r a ct Prope r t y , if a ny, S u bje c t t o

the C o nt r a c t o r Le a se T o t a l Amount to

Cure, if any N o . of

M o nt h s t o

Cure Re g ular M o nt hly

P a yme n t M ad e

Directly to C r editor

a nd D a te o f P a yment

IN THE EVENT T HAT DEB T OR REJECTS TH E LEASE OR CONTRACT, CR E DITOR

SHA L L FI L E A PROOF OF CL A IM OR AM EN DED P R OOF OF CL AI M REFLE C TI N G

THE R EJ E CT I ON OF THE L EA S E OR C O NT RACT WI T HIN 30 DA Y S OF THE

ENT R Y OF THE OR DE R CONFI R MING T HIS PLAN, FA I LI N G WH I CH T HE C L AIM

MAY BE

BARR ED.

C.

Class Thr e e – All other allowed secu r ed claims (o th er than tho s e designated in

Classes Two A and Two B above) shall be divided i n t o separate classes to which 11

U.S.C. § 5 0 6 shall or shall not app l y as follows:

1. Secured clai m s subject to 11 U.S.C. § 506 (Real P r operty): Real Property: In

accordance w ith F ED . R. B ANKR . P. 30 1 2, 7 0 04 and L .B.R. 3012 - 1, the debtor has

filed and served a separa t e m o tion for valu a tion of co l lateral and deter m ination of

secured status under 11 U.S.C. § 506 as to the real pr o p erty a n d claims listed on

page 1 of t h is plan and below. The deb t or is requesting an o r der t h at the value o f

the collateral is zero ($0) and the creditor ’ s claim i s unsecured. The plan is subject

to the cour t ’ s order on t h e d ebtor’s m o tion. If the court grants the debto r ’s m o tion,

the creditor will have an unsecured cla i m in either the a m ount of the debt as listed

in the debto r ’s schedules or on a n y al lo wed proof of claim filed by the creditor

(whichever is greater). The creditors listed on page 1 and below s h all retain the

liens securing their cla i m s until discha r ge under 11 U.S.C. § 1328 or payment in

full .

Na m e of Cre d itor Descript i o n of C o ll a ter a l

(pursuant to L.B.R. 30 1 2-1) Am o u n t of D e bt

as S c heduled Pro o f of

Claim a m ou n t,

i f a n y

2. Secured claims sub j ect t o 11 U.S.C. § 506 (Personal Property): The debtor

moves the court, thr o ugh t h is chapter 13 plan, f o r a valuation of collateral and

dete r m ination of secured status und e r 11 U.S.C. § 506 regarding the personal

property and cla i ms below. The following creditors shall retain the liens securing

their cla i m s u n til discharge under 11 U . S.C. § 1328 or payment in full under

non b ankrupt c y law , and th e y shall be pa i d the a m ount specified wh i ch represents

the lesser of: (a) the value of their interest in collater a l or (b) the remaining

balance pa y able on the debt over the period required to p a y the s u m in full. Any

r e m aining portion of the allowed cla i m sh all be treat e d as a general unsecured

cla i m . Any secured cla i m with a value of $0 shall be treated as a g eneral

unsecured cl ai m .

Creditor Descript i o n of

C o llater a l Specify

Treatm e nt

(select a or

b in ¶ 2

a b ov e ) Deb t o r ’s

C o nte n ti o n of

Value

(replacem e nt

valu e ) Am o u n t of

Debt a s

Scheduled Intere s t

R a te T o t a l

Am o u n t

Payable

3. Secured claims to which 11 U.S. C. § 506 shall not apply (personal property).

The following creditors shall retain the liens securing their cla i m s, and th e y shall

be paid the a m ount specif i ed which rep r esents the remaining balance pa y able on

the debt over the period required to p a y t h e sum in full:

Creditor Descript i o n of Collate r a l Am o u n t of D e bt

as S c heduled Intere s t

R a te Total Amount Payable

4. Property be i ng surrend e red: The debtor surrenders the followi n g proper ty

securing

an allowed secur e d cla i m to the holder of su c h cla i m :

Creditor Prope r ty Anticipat e d Date of Surrender

Relief fr o m th e auto m at i c stay to per m it enforc e m ent of the liens encu m b ering

surrendered proper t y shall be dee m ed g r anted by the Court at the t i me of

confirmation of this

Plan. With respect to pr o p er t y s u rrendered, no distribution o n

the creditor ’ s cla i m shall be made unless that creditor files a proof of cla i m or an

a m ended proof of claim to take into account t h e surrender of the p r oper t y .

5. Adequate Protection: The following creditor(s) shall receive payments in the

nature of adequate protection p u rsuant t o L.B.R. 2 08 3 -1, if ap p licable, or u pon

confirmation of the plan as follows:

Credit o r C o llater a l Adequate P r otection

Payment P a id

Thr o u g h the Trustee Adequate P r otection

Payment P a id By the

d eb t o r (s) T o t a l P a y a ble

Month l y in Equal

Periodic P ayments

[ ] None

IF DEB T OR IS PRO P OSING T O MODIFY T HE RIGHTS OF CRE D I TO RS IN C L A S S

TWO A ND / OR T HR E E, DEB T OR MUST SP E CIFI C AL L Y SER V E SUCH CR ED ITOR

IN

THE MANNER S P ECIFIED IN FED. R. BANKR. P. 9014 AND 7004.

D.

Class Four – Allowed un s ecured claims not otherwise re f er r ed t o in the Pla n.

Class Four Cla i m s a r e provided for in an a m ount not l ess than the greater

of:

1. The a m ount necessary to meet the best i n terests of c r editors pursu a n t to 11 U.S.C.

§ 1325(a)(4) as set forth in Part II; or

2. Total disposable inco m e f o r the applicable c o m m itment period defined b y 11

U.S.C. § 1325(b)(1)-(4).

The m onthly disposable i n c o m e of $ has been calculated on

Form B22C (Chapter 13). Total disposable inco m e is $ which

is the product of m onth l y d isposable income of ti m es

the applicable commitment period of .

a. [ ] Class Four clai m s are of one class and shall be paid pro rata the

sum of $ and shall be paid all funds re m a i ning after

pay m ent by the Trustee of all prior classes; or

A ti m ely filed clai m , fou n d b y t h e Cou r t to be n on-d i schargeable p u rsuant to

11 U.S.C. § 523(a)(2), (4), or (6), will share pro-rata i n the distribu t ion to

Class Four. Collection of the balance is sta y ed until the case is dismissed,

converted to a Chapter 7 or discharge enters, unless ordered othe r wise.

b. [ ] Class Four c l a i m s a r e divided into m o re than one class as follows:

E. Class Five (if none, indicate) – Post-petition claims allowed under 11 U.S.C. § 1305.

Post-petition cla i ms allowed under 11 U.S . C. § 1305 s h all be paid a s follows:

[ ]

None

V. OTHER P R OVI S IONS

A. Pa y m ent will be made directly t o the c r editor by the debtor(s) on the following c l a i m s:

Creditor Collateral, if any Monthly

Payment

Amount

No. of Mon t hs to Payoff

B. The effective date of this P l an shall be t h e date of entry of the Ord e r of Confir m a tion.

C. Order of Distribution:

1. [ ] The a m ounts to be paid t o t h e Class One creditors sha l l be paid in fu ll, except

that the Chapter 13 Trustee ’ s fee shall be paid up to, but not m o re than, the a m o unt

accrued

on a c tual p a y m ents made to date. After pa y m ent of the Class One

creditors, the a m ounts to be paid to cure the defaults of the Class Two A, Class

Two B and Class Two C c r editors shall be p a id in full before distributions to

creditors in Class e s Three, Four, and Five (strike any portion of this sentence

which is not a pplicable). T h e a m ounts to be paid t o t h e Class Three creditors shall

be paid in full before distributions to creditors in Classes Four and Five.

Distributions under

the plan to unsecured creditors will on l y be m a de to credito r s

whose cla i ms are allowed a nd are timely filed pursuant to Fed. R. B a nkr. P. 3002

and 3004 and after pa y m e n ts are made to Class e s One, Two A, Two B, Two C and

Three above in the m anner specified in Section IV.

2. [ ] Distributions to classes of c redit o rs shall be in accordance with the order set

forth above, e xcept:

D. Motions to V o id Liens under 11 U.S.C. § 522(f). In accordance w ith Fed. R. Bankr. P.

4003 ( d), the debtor inten d s to file or h a s filed, b y se p arate m o tion served in accordance

with Fed. R. Bankr. P. 7 00 4 , a m o tion to void l ien pu r suant to 11 U.S.C. § 5 22(f) as to

the secured c r editors listed below:

Credit o r C o llater a l, if any D a te M o ti o n t o Void Lien

Filed Date of Order Granti n g

Motion or P e nding

E. Student Loans:

[ ] No student loans

[ ] Student loans are to be t r eated as an unsecu r ed C l ass Four claim or as

follows :

F. Restitution:

[

] No restitution owed.

[

] Debtor owes restitution in the total a m o unt of $ which is paid

directly t o in the a m ount of

$ _per m onth for a per i od of m onths.

[

] Debtor owes restitution to be paid as follows:

.

G. Other

(list all additional provisions he r e):

.

VI. REVE S T M ENT OF PR OPE R TY IN DEB T OR

All proper t y of the estate shall vest in t h e debtor at t h e ti m e of confir m ation of t h is Plan.

VII. IN S U R ANCE

Insurance in an a m ount to protect liens of credit o rs holding secured cla i m s is c u rrently in effect

and

will [ ] will not [ ] (check one) be ob t ained and kept in f o rce throughout the period of the

Plan.

Credi t or to W hom T his

Applies Collate r a l Covered Cove r age A m ount Insu r a nce Company, P o licy No.

and Agent Name, Address and

Telephone No.

[ ] Applicable policies will be endorsed to p r ovide a clause m aking the applicable creditor a

loss pa y ee of the poli c y .

VIII. P OST - CON F IR M AT I ON MODIFI C AT I ON

The debtor must file and serve upon all parties in interest a m odified plan which will provide f o r

allowed priority and allo w ed secured c l a i m s which w ere not filed and/or liquidated at the time of

confirmation. The value of property to s atisfy 11 U.S.C. § 1325(a)(4) may be increased or

reduced with the m odificat i on if app r opr i ate. The m odification will be filed no la t er than one

y ear after the petition date. Failure of the deb t or to file the m odification m ay be g r ounds for

dis m i s s a l.

Dated:

By:

Signature of debtor

Dated:

By:

Signature of joint debtor

Dated:

By:

Counsel to

Attorney re g i stration n u mber (if ap p lica b le)

Business a d dress ( o r h o m e address for pro se )

Telephone nu m ber

Facsi m ile nu m ber

E- m ail address

Comment a ry

The entire Chapter 13 P l an m ust be co m pleted a n d filed with the original and each

a m ended chapter 13 plan. Do not delete any p r ovision of this for m . M a rk provisions that

do not apply as n/a. Other than expressing a m ore det a iled s t r ucture f or fu ture e arnin g s

and pay m ents in Part III.A.1., no other m od i fications are allowed and any additional non-

contradictory provisions m ust be recit e d in Part V. G.

Valuable advice for setting up your ‘Colorado 13’ online

Are you fed up with the frustration of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and small to medium-sized businesses. Say farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can seamlessly finalize and sign documents online. Take advantage of the robust features integrated into this user-friendly and cost-effective platform and transform your document management strategy. Whether you need to approve forms or gather signatures, airSlate SignNow manages it all effortlessly, with just a few clicks.

Adhere to these comprehensive instructions:

- Sign in to your account or sign up for a complimentary trial with our service.

- Select +Create to upload a file from your device, cloud storage, or our template collection.

- Open your ‘Colorado 13’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

- Add and assign fillable fields for others (if required).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Save, print your version, or convert it into a reusable template.

Don’t fret if you need to collaborate with your peers on your Colorado 13 or send it for notarization—our platform offers everything you need to accomplish such tasks. Register with airSlate SignNow today and enhance your document management to a new level!