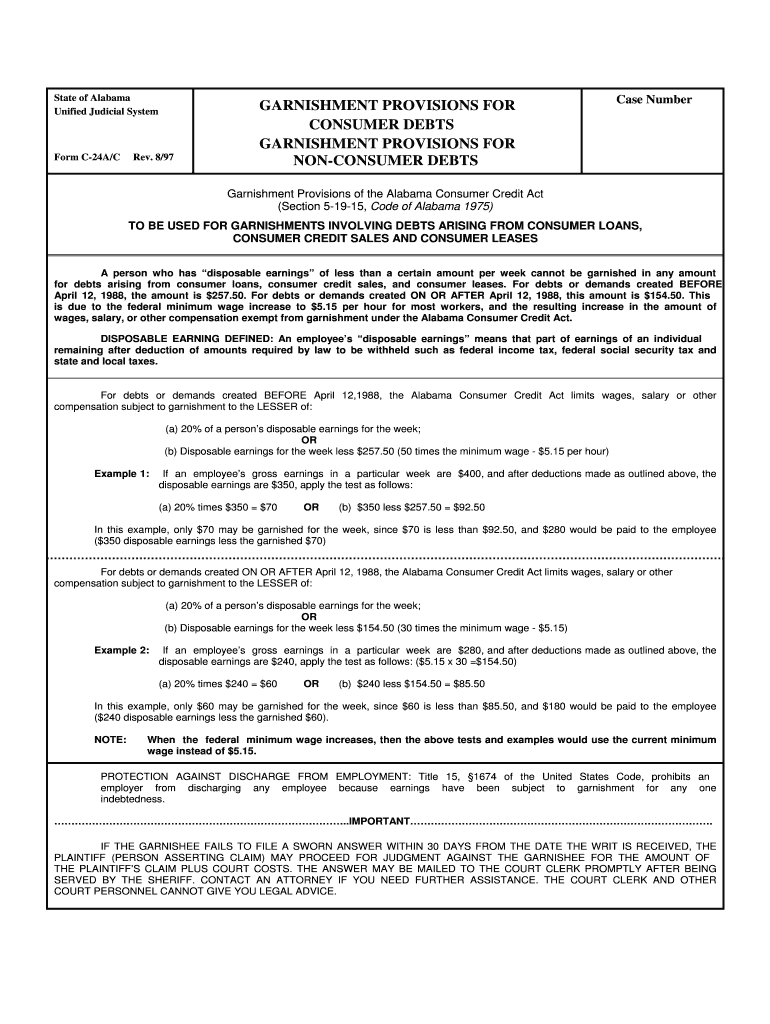

State of Alabama

Unified Judicial System

Form C-24A/C Rev. 8/97

GARNISHMENT PROVISIONS FOR

CONSUMER DEBTS

GARNISHMENT PROVISIONS FOR

NON-CONSUMER DEBTS

Case Number

Garnishment Provisions of the Alabama Consumer Credit Act

(Section 5-19-15, Code of Alabama 1975) TO BE USED FOR GARNISHMENTS INVOLVING DEBTS ARISING FROM CONSUMER LOANS,

CONSUMER CREDIT SALES AND CONSUMER LEASES

A person who has “disposable earnings” of less than a certain amount per week cannot be garnished in any amount

for debts arising from consumer loans, consumer credit sales, and consumer leases. For debts or demands created BEFORE

April 12, 1988, the amount is $257.50. For debts or demands created ON OR AFTER April 12, 1988, this amount is $154.50. This

is due to the federal minimum wage increase to $5.15 per hour for most workers, and the resulting increase in the amount of

wages, salary, or other compensation exempt from ga rnishment under the Alabama Consumer Credit Act.

DISPOSABLE EARNING DEFINED: An employee’s “disposable earnings” means that part of earnings of an individual

remaining after deduction of amounts required by law to be withheld such as federal income tax, federal social security tax and

state and local taxes.

For debts or demands created BEFORE April 12,1988, the Alabama C onsumer Credit Act limits wages, salary or other

compensation subject to garnishment to the LESSER of:

(a) 20% of a person’s disposable earnings for the week; OR (b) Disposable earnings for the week less $257.50 (50 times the minimum wage - $5.15 per hour) Example 1: If an employee’s gross earnings in a particular week are $400, and after deductions made as outlined above, the

disposable earnings ar e $350, apply the test as follows:

(a) 20% times $350 = $70 OR (b) $350 less $257.50 = $92.50 In this example, only $70 may be garnished for the week, si nce $70 is less than $92.50, and $280 would be paid to the employee

($350 disposable earnings less the garnished $70)

For debts or demands created ON OR AFTER April 12, 1988, the Alabama Consumer Credit Act limits wages, salary or other

compensation subject to garnishment to the LESSER of:

(a) 20% of a person’s disposable earnings for the week; OR (b) Disposable earnings for the w eek less $154.50 (30 times the minimum wage - $5.15) Example 2: If an employee’s gross earnings in a particular week are $280, and after deductions made as outlined above, the

disposable earnings are $240, appl y the test as follows: ($5.15 x 30 =$154.50)

(a) 20% times $240 = $60 OR (b) $240 less $154.50 = $85.50 In this example, only $60 may be garnished for the week, si nce $60 is less than $85.50, and $180 would be paid to the employee

($240 disposable earnings less the garnished $60).

NOTE: When the federal minimum wage increases, then the above tests and examples would use the current minimum

wage instead of $5.15.

PROTECTION AGAINST DISCHARGE FROM EMPLOYMENT: Ti tle 15, §1674 of the United States Code, prohibits an

employer from discharging any em ployee because earnings have been subject to garnishment for any one

indebtedness.

………………………………………………\

…………………………..IMPORTANT………………………………………………\

……………………………. IF THE GARNISHEE FAILS TO FILE A SWORN ANSWER WITHIN 30 DAYS FROM THE DATE THE WRIT IS RECEIVED, THE

PLAINTIFF (PERSON ASSERTING CLAIM) MAY PROCEED FOR JUDGMENT AGAINST THE GARNISHEE FOR THE AMOUNT OF

THE PLAINTIFF’S CLAIM PLUS COURT COSTS. THE ANSWER MA Y BE MAILED TO THE COURT CLERK PROMPTLY AFTER BEING

SERVED BY THE SHERIFF. CONTACT AN ATTORNEY IF YOU NEED FURTHER ASSISTANCE. THE COURT CLERK AND OTHER

COURT PERSONNEL CANNOT GIVE YOU LEGAL ADVICE.

Form C-24A/C (Back) Rev. 8/97

Garnishment Provisions of 15 U.S.C. § 1673 and §6-10-7, Code of Alabama 1975

TO BE USED FOR GARNISHMENTS INVOLVING DEBTS NOT ARISING FROM CONSUMER LOANS,

CONSUMER CREDIT SALES AND CONSUMER LEASES

A person who has “disposable earnings” of less than a certain amount per week cannot be garnished in any amount

for debts arising from consumer loans, consumer credit sales, and consumer leases. For debts or demands created BEFORE

April 12, 1988, the amount is $257.50. For debts or demands created ON OR AFTER April 12, 1988, this amount is $154.50. This

is due to the federal minimum wage increase to $5.15 per hour for most workers, and the resulting increase in the amount of

wages, salary, or other compensation exempt from ga rnishment under the Alabama Consumer Credit Act.

DISPOSABLE EARNING DEFINED: An employee’s “disposable earnings” means that part of earnings of an individual

remaining after deduction of amounts required by law to be withheld such as federal income tax, federal social security tax and

state and local taxes.

Alabama and federal law limit wages, salary or other co mpensation subject to garnishment to the LESSER of:

(a) 25% of a person’s disposable earnings for the week;

OR

(b) Disposable earnings for the week less $154.50 (30 times the minimum wage - $5.15 per hour)

The following examples illustrate how to determine how much of an employee’s wages, salary or other compensation can be

garnished:

Example 1: If an employee’s gross earnings in a particular week are $270, and after deductions made as outlined above, the

disposable earnings ar e $230, apply the test as follows:

(a) 20% times $230 = $46 OR (b) $230 less $154.50 = $75.50 In this example, only $46 may be garnished for the week, si nce $46 is less than $75.50, and $184 would be paid to the employee

($230 disposable earnings less the garnished $46)

Example 2: If an employee’s gross earnings in a particular week are $280, and after deductions made as outlined above,

the disposable earnings are $240, apply the test as follows: ($5.15 x 30 =$154.50)

(a) 25% times $240 = $60 OR (b) $240 less $154.50 = $85.50 In this example, only $60 may be garnished for the week, si nce $60 is less than $85.50, and $180 would be paid to the employee

($240 disposable earnings less the garnished $60).

NOTE: When the federal minimum wage increases, then the above tests and examples would use the current minimum wage

instead of $5.15.

PROTECTION AGAINST DISCHARGE FROM EMPLOYMENT: Title 15, §1674 of the United States Code, prohibits

an employer from discharging any employee because earnings have been subj ect to garnishment for any one

indebtedness.

………………………………………………\

…………………………..IMPORTANT………………………………………………\

……………………………. IF THE GARNISHEE FAILS TO FILE A SWORN ANSWER WITHIN 30 DAYS FROM THE DATE THE WRIT IS RECEIVED, THE

PLAINTIFF (PERSON ASSERTING CLAIM) MAY PROCEED FOR JUDGMENT AGAINST THE GARNISHEE FOR THE AMOUNT OF

THE PLAINTIFF’S CLAIM PLUS COURT COSTS. THE ANSWER MA Y BE MAILED TO THE COURT CLERK PROMPTLY AFTER BEING

SERVED BY THE SHERIFF. CONTACT AN ATTORNEY IF YOU NEED FURTHER ASSISTANCE. THE COURT CLERK AND OTHER

COURT PERSONNEL CANNOT GIVE YOU LEGAL ADVICE.

State of Alabama

Unified Judicial System

Form C-24D Rev. 8/97

NOTICE TO DEFENDANT OF RIGHT TO

CLAIM EXEMPTION FROM GARNISHMENT

Case Number

IN THE ___________________________COURT OF _______________________________COUNT\

Y, ALABAMA

___________________________________________ v. _________________________\

______________________________

Plaintiff (Person Asserting Claim) : Defendant (Person Whose Property is Subject to Garnishment) :

Address: Address:

A Process of Garnishment has been delivered to you. This means that a court may order your wages, money in a bank,

sums owned to you, or other property belonging to you, to be paid into court to satisfy a judgment against you.

Laws of the State of Alabama and of the United Stat es provide that in some circum stances certain money and property

may not be taken to pay certain types of court judgments, because certain money or property may be “exempt” from

garnishment. For example, under state law, in some circumstances, up to $3,000.00 in w ages, personal property, including

money, bank accounts, automobiles, appliances, etc., may be exempt from proce ss of garnishment. Similarly, under federal

law, certain benefits and certain welfare payments may be exempt from garnishment. Benefits and payments ordinarily exempt

from garnishment include, for example, social security paym ents, SSI payments, veteran’s benefits, TANF (welfare) payments,

unemployment compensati on payments, and worker’s compensation payments.

THESE EXAMPLES ARE FOR PURPOSE OF ILLUSTRATION ONLY. WHETHER YOU WILL BE ENTITLED TO CLAIM

ANY EXEMPTION FROM THE PROCESS OF GARNISHMENT, A ND, IF SO, WHAT PROPERTY MAY BE EXEMPT, WILL

BE DETERMINED BY THE FACTS IN YOUR PARTICULAR CASE. IF YOU ARE UNCERTAIN AS TO YOUR POSSIBLE

EXEMPTION RIGHTS, YOU SHOULD CONSULT A LAWYER FOR ADVICE.

TO CLAIM ANY EXEMPTION THAT MAY BE AVAILABLE TO YOU, YOU MUST PREPARE A “CLAIM OF EXEMPTION”

FORM LISTING ON IT ALL YOUR WAGES AND PERSONAL PROPERTY; HAVE THE CLAIM OF EXEMPTION

NOTARIZED; AND FILE IT IN THE CLERK’S OFFICE. ALS O, IT IS YOUR RESPONSIBILITY TO MAIL OR DELIVER A

COPY OF THE CLAIM OF EXEMPTION TO THE PLAINTI FF WHO HAS A JUDGMENT AGAINST YOU. YOU MUST

INDICATE ON THE CLAIM OF EXEMPTION THAT YOU FILE IN THE CLERK’S OFFICE WHETHER YOU MAILED OR

DELIVERED THE COPY TO THE PLAINTIFF AND THE DATE ON WHICH YOU MAILED OR DELIVERED IT. THE CLERK

CANNOT GIVE YOU LEGAL ADVICE. IF YOU NEED ASSISTANCE, YOU SHOULD SEE A LAWYER.

If you file a claim of exemption, the pl aintiff will have approximately ten (10) days to file a “c ontest” of your claim of

exemption. If a contests is filed, a court hearing will be scheduled and you will be notified of the time and place of the hear ing.

If the plaintiff does not file a contest, the property claimed by you as exempt will be released from the garnishment.

If you do not file a claim of exemption, your property may be turned over to the court and paid to the plaintiff on the

judgment against you.

TO PROTECT YOUR RIGHTS, IT IS IMPORTANT THAT YOU ACT PROMPTLY. IF YOU HAVE ANY QUESTIONS, YOU

SHOULD CONSULT A LAWYER.

NOTE: This form must be included with any locally-generated “Process of Garnishment” form.

State of Alabama

Unified Judicial System

Form C-24J Rev. 8/98

CONDITIONAL JUDGMENT AGAINST

GARNISHEE AND NOTICE TO GARNISHEE

(§ 6-6-457, Code of Alabama 1975)

Case Number

IN THE ______________________________________COURT OF _____________________________________, ALABAMA (Circuit or District) (Name of County)

___________________________________________ v. _________________________\

______________________________

Plaintiff Defendant

Garnishee: ____________________________________________________________________\

_______________________

Address: __________________________________________________________________\

_________________________

Comes the plaintiff, by his or her attorney, and move s for conditional judgment against the above-named garnishee;

and it appearing to the court that on (date) __________________________, the plaintiff recovered a judgment against the

defendant for the sum of $ ____________________, plus court costs, and that a Writ of Garnishment on the judgment was

duly issued in this cause by the clerk of this court, and duly served upon the garnishee on (date) _______________________

and that the garnishee has failed to file an Answer thereto within the time required by law;

IT IS, THEREFORE, considered, ordered and adjudged by the c ourt that the plaintiff have and recover of the garnishee

the sum of $ _____________________, plus court costs, unless within thirty (30) days of service of process of this conditional

judgment against Garnishee and Notice to Garnishee, the gar nishee appears and shows cause why this conditional judgment

should not be made final and absolute.

_______________________________________ __________________________________________________

Date Judge

To Any Sheriff or Any other Authorized Person: You are hereby commanded to serve this Conditional Judgment against Garnishee and Notice to Garnishee on the above-named

garnishee and make proper return to this court.

_______________________________________ __________________________________________________

Date Clerk

RETURN ON SERVICE

Return receipt of certified ma il received in this office on _______________________________________________________

(Date)

I certify that I personally delivered a copy of the Conditional Judgment against Garnishee and Notice to Garnishee to

_______________________________________ on ________________________\

_______________.

(Date)

_______________________________________ _________________________________________________________

Date Server’s Signature

_______________________________________ _________________________________________________________

Business Address of Server Type of Process Server

_______________________________________

City State Zip Code

State of Alabama

Unified Judicial System

Form C-24K Rev. 8/98

FINAL JUDGMENT AGAINST GARNISHEE

Case Number

IN THE __________________________________COURT OF _________________________________________, ALABAMA (Circuit or District) (Name of County)

_______________________________________________ v. _____________________\

_______________________________

Plaintiff Defendant

On__________________(date), a Conditional Judgment was entered against the garnishee, ________

_____________________________________________.

The above-name garnishee was served with the C onditional Judgment against Garnishee and Notice of

Garnishee on ________________(date), by delivering a copy of same to _\

________________________________.

Because the garnishee failed to appear and answer the Conditional Judgment within 30 days of the service

date, judgment is hereby made final of the sum of $ __________________________ plus court costs in this matter.

____________________________________________

Judge

____________________________________________

Date