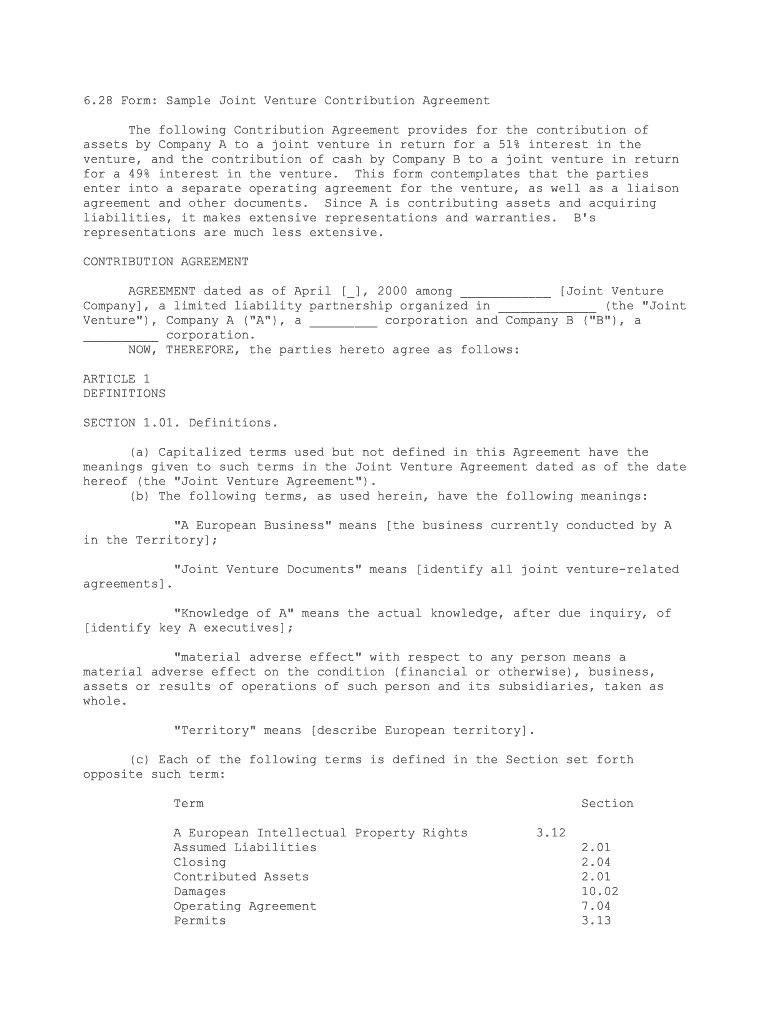

6.28 Form: Sample Joint Venture Contribution AgreementThe following Contribution Agreement provides for the contribution of

assets by Company A to a joint venture in return for a 51% interest in the

venture, and the contribution of cash by Company B to a joint venture in return

for a 49% interest in the venture. This form contemplates that the parties

enter into a separate operating agreement for the venture, as well as a liaison

agreement and other documents. Since A is contributing assets and acquiring

liabilities, it makes extensive representations and warranties. B's

representations are much less extensive.

CONTRIBUTION AGREEMENT

AGREEMENT dated as of April [_], 2000 among ____________ [Joint Venture

Company], a limited liability partnership organized in _____________ (the "Joint

Venture"), Company A ("A"), a _________ corporation and Company B ("B"), a

__________ corporation. NOW, THEREFORE, the parties hereto agree as follows:

ARTICLE 1

DEFINITIONS

SECTION 1.01. Definitions. (a) Capitalized terms used but not defined in this Agreement have the

meanings given to such terms in the Joint Venture Agreement dated as of the date

hereof (the "Joint Venture Agreement").

(b) The following terms, as used herein, have the following meanings:

"A European Business" means [the business currently conducted by A

in the Territory];

"Joint Venture Documents" means [identify all joint venture-related

agreements].

"Knowledge of A" means the actual knowledge, after due inquiry, of

[identify key A executives];

"material adverse effect" with respect to any person means a

material adverse effect on the condition (financial or otherwise), business,

assets or results of operations of such person and its subsidiaries, taken as whole.

"Territory" means [describe European territory].

(c) Each of the following terms is defined in the Section set forth

opposite such term:

Term Section

A European Intellectual Property Rights 3.12 Assumed Liabilities 2.01

Closing 2.04

Contributed Assets 2.01

Damages 10.02

Operating Agreement 7.04

Permits 3.13

Tax8.01

Tax Sharing or Indemnity Agreement 8.01

Trade Secrets 3.12

ARTICLE 2

CONTRIBUTION

SECTION 2.01. Contribution by A (a) Upon the terms and subject to the conditions of this Agreement, A

agrees (i) to transfer, assign and deliver, or cause to be transferred, assigned

and delivered, to the Joint Venture at the Closing, as a contribution, all of

the right, title and interest of A and its affiliates in, to and under the

tangible assets of A, of every kind and description, located in the Territory or

otherwise primarily used or held for use in the A European Business, as such A

European Business shall exist on the Closing Date, and (ii) to grant, or cause

to be granted by its affiliates, to the Joint Venture a perpetual, fully paid-

up, royalty free, exclusive license to use certain intellectual property on the

terms set forth in the License Agreement (together the "Contributed Assets").

Notwithstanding anything else contained herein, the Contributed Assets shall not

include any intellectual property covered by the License Agreement

(b) A agrees to deliver to the Joint Venture, or cause to be delivered,

such deeds, bills of sale, endorsements, consents, assignments and other good

and sufficient instruments of conveyance and assignment as the parties shall

deem reasonably necessary or appropriate to vest in the Joint Venture all right,

title and interest of A and its affiliates in, to and under the Contributed Assets. (c) In consideration of and in exchange for such contribution by A and its

affiliates, and upon the terms and subject to the conditions of this Agreement,

the Joint Venture agrees

(i) to issue and sell to A a 51% common interest in the Joint

Venture, free and clear of all liens, and

(ii) effective as of the Closing Date, to assume all liabilities and

obligations of any kind, character or description (whether known or unknown,

accrued, absolute, contingent or otherwise) relating to or arising out of the

conduct of the A European Business or the ownership or use of the Contributed

Assets, in each case solely to the extent such liabilities or obligations arise

after the Closing Date (the "Assumed Liabilities"). Notwithstanding anything

else contained herein, the Assumed Liabilities shall not include (A) any

liabilities or obligations arising on or prior to the Closing Date and (B) any

liabilities or obligations (1) for or with respect to Taxes or (2) arising as a

result of a Tax Sharing or Indemnity Agreement of A or any of its affiliates.

SECTION 2.02. Contribution by B. Upon the terms and subject to the conditions of

this Agreement, B agrees to purchase from the Joint Venture, and the Joint

Venture agrees to issue and sell to B, at the Closing, a 49% common interest in

the Joint Venture, free and clear of all Liens, in consideration of and in

exchange for US$__________ in cash.

SECTION 2.03. Assignment of Contracts and Rights. Anything in this Agreement to

the contrary notwithstanding, this Agreement shall not constitute an agreement

to assign any Contributed Asset or any claim or right or any benefit arising

thereunder or resulting therefrom if such assignment, without the consent of a

third party thereto, would constitute a breach or other contravention of such

Contributed Asset or in any way adversely affect the rights of the Joint Venture

or A or its affiliates thereunder. A and the Joint Venture will use their best

efforts (but without any payment of money) to obtain the consent of the other

parties to any such Contributed Asset or any claim or right or any benefit

arising thereunder for the assignment thereof to the Joint Venture as the Joint

Venture may request. If such consent is not obtained, or if an attempted

assignment there of would be ineffective or would adversely affect the rights

thereunder so that the Joint Venture would not in fact receive all such rights,

A and the Joint Venture will cooperate in a mutually agreeable arrangement under

which the Joint Venture would obtain the benefits and assume the obligations

thereunder in accordance with this Agreement, including subcontracting,

sublicensing, or subleasing to the Joint Venture or under which A and its

affiliates would enforce for the benefit of the Joint Venture, with the Joint

Venture assuming the obligations of A and its affiliates. A will promptly pay to

the Joint Venture when received all monies received by A and its affiliates

under any Contributed Asset or any claim or right or any benefit arising

thereunder.

SECTION 2.04. Closing. The closing (the "Closing") of the contributions

hereunder shall take place at ______________________ subject to satisfaction or

waiver of the conditions in the Joint Venture Operating Agreement dated as of

_______, ______ between A and B (the "Operating Agreement") and simultaneously

with the closing thereunder (the "Closing Date"). ARTICLE 3

REPRESENTATIONS AND WARRANTIES OF D

D represents and warrants to B and to the Joint Venture as of the date hereof

and as of the Closing Date that:

SECTION 3.01. Corporate Existence and Power. (a) A is a [corporation] duly organized, validly existing and in good

standing under the laws of its jurisdiction of organization, and has all powers

and all material governmental licenses, authorizations, consents and approvals

required to carry on its business as now conducted. A is duly qualified to do

business as a foreign company and is in good standing in each jurisdiction where

the character of the property owned or leased by it or the nature of its

activities make such qualification necessary, except for those jurisdictions

where failure to be so qualified would not individually or in the aggregate,

have a material adverse effect on A. A has delivered to B and the Joint Venture

true and complete copies of the articles of incorporation and bylaws of A as

currently in effect. (b) Each of A's subsidiaries that is being contributed to, or is

transferring any of the Contributed Assets to, the Joint Venture is a

corporation duly organized, validly existing and in good standing under the laws

of its jurisdiction of incorporation, and has all corporate power and all

material governmental licenses, authorizations, consents and approvals required

to canyon its business as it is now being conducted.

SECTION 3.02. Corporate Authorization. The execution, delivery and performance

by A of this Agreement and the other [Joint Venture Documents] to which it is a

party and the consummation by A of the transactions contemplated hereby and

thereby are within A's corporate powers and have been duly authorized by all

necessary corporate action on the part of A. When executed and delivered by A,

each of the [Joint Venture Documents] to which A is a party will constitute a

valid and binding agreement of A, enforceable in accordance with its terms.

SECTION 3.03. Governmental Authorization. Except as disclosed in Schedule 3.03,

the execution, delivery and performance by A of this Agreement and the other

[Joint Venture Documents] to which it is a party and the consummation of the

transactions contemplated hereby and thereby require no action by or in respect

of, or filing with, any governmental body, agency, official or authority other

than: (i) compliance with any applicable requirements of the Hart-Scott-Rodino

Antitrust Improvements Act; (ii) [identify foreign filings] and (iii) such other

actions or filings, the failure to make which would not, individually or in the

aggregate, reasonably be expected to result in a material adverse effect on A or

the Joint Venture.

SECTION 3.04. Noncontravention. Except as disclosed in Schedule 3.04, the

execution, delivery and performance by A of this Agreement and the other [Joint

Venture Documents] to which it is a party and the consummation of the

transactions contemplated hereby and thereby do not and will not (i) contravene

or conflict with the articles of incorporation or bylaws of D; (ii) assuming

compliance with the matters referred to in Section 3.03, contravene or conflict

with or constitute a violation of any provision of any law, rule, regulation,

judgment, injunction, order or decree binding upon or applicable to A or any of

its subsidiaries; (iii) constitute a default under or give rise to any right of

termination, cancellation or acceleration of any right or obligation of A or any

of its subsidiaries or to a loss of any benefit to which A or any of its

subsidiaries is entitled under any provision of any agreement, contract or other

instrument binding upon A or any of its subsidiaries or any license, franchise,

permit or other similar authorization held by A or any of its subsidiaries; or

(iv) result in the creation or imposition of any Lien on any asset of A or any

of its subsidiaries, except, in the case of those items specified in (ii) or

(iii), for such matters as would not, individually or in the aggregate,

reasonably be expected to result in a material adverse effect on A or the Joint Venture.

SECTION 3.05. Financial Statements. The unaudited balance sheet as of

___________________ and the related unaudited statements of income and cash flow

for the years then ended and the unaudited interim balance sheet (the "Balance

Sheet") as of ______________ (the "Balance Sheet Date") and the related

unaudited statements of income and cash flow for the period then ended of the A

European Business have been prepared in accordance with D's internal policies

and procedures consistently applied and, except as set forth in Schedule 3.05,

fairly present the financial position of the A European Business as of the dates

thereof and its results of operations and cash flows for the periods then ended

(subject, in the case of interim financial statements, to normal year-end

adjustments) in accordance with U.S. GAAP consistently applied.

SECTION 3.06. Absence of Certain Changes. Except as disclosed in Schedule 3.06,

since the Balance Sheet Date, the A European Business has been conducted in the

ordinary course of business consistent with past practices and to the extent

related to the A European Business, there has not been:(a) any event, occurrence, development or state of circumstances or facts

which individually or in the aggregate has had or could reasonably be expected

to have a material adverse effect on the A European Business; (b) any creation or other incurrence of any Lien on any asset with a book

value in excess of [US$______] other than in the ordinary course of business

consistent with past practices; (c) any damage, destruction or other casualty loss (whether or not covered

by insurance) affecting the A European Business or any of the Contributed Assets

which individually or in the aggregate has had or could reasonably be expected

to have a material adverse effect on the A European Business;(d) any transaction or commitment made, or any contract or agreement

entered into, by A or any of its affiliates (including the acquisition or

disposition of any assets) or any relinquishment by A or any of its affiliates

of any material contract or other right, in either case, other than transactions

and commitments in the ordinary course of business consistent with past

practices and those contemplated by this Agreement; (e) any change in any method of accounting or accounting practice by A or

any of their respective affiliates, except for any such change required by

reason of a concurrent change in generally accepted accounting principles;

(f) any (i) employment, deferred compensation, severance, retirement or

other similar agreement entered into with any officer or employee of the A

European Business (or any amendment to any such existing agreement), (ii) grant

of any severance or termination pay to any officer or employee of the A European

Business or (iii) change in compensation or other benefits payable to any

officer or employee of the A European Business, in each case, other than in the

ordinary course of business consistent with past practice;

(g) any capital expenditure, or commitment for a capital expenditure,

other than in the ordinary course of business.

SECTION 3.07. Material Contracts.

(a) Except as disclosed in Schedule 3.07 and only to the extent primarily

related to the A European Business, neither A nor any of its affiliates is a

party to or bound by:

(i) any lease of personal property which requires annual payments of

[US$______] or more or any lease of real property; (ii) any agreement for the purchase by A or its affiliates of

materials, supplies, goods, services, equipment or other assets providing for

aggregate payments of [US$_____] or more; (iii) any sales, distribution or other similar agreement providing

for the sale by A or any of its affiliates of materials, supplies, goods,

services, equipment or other assets that provides for aggregate payments of

[US$________] or more; (iv) any partnership, joint venture or other similar agreement or

arrangement;

(v) any agreement relating to the prospective acquisition or

disposition of any business (whether by merger, sale of stock, sale of assets or

otherwise); (vi) any option for the rental, purchase or sale of real property;

(vii) any marketing or similar agreement with agents, dealers and

sales representatives; (viii) any agreement that limits the freedom of A or any of its

affiliates to compete in any line of business or with any person or in any area

and which would so limit the freedom of the Joint Venture after the Closing Date; or (ix) any other agreement, commitment, arrangement or plan not made

in the ordinary course of business that is material to the A European Business,

taken as a whole.

(b) Except as disclosed in Schedule 3.07, each contract disclosed on any

Schedule to this Agreement or required to be disclosed pursuant to this Section

is a valid and binding agreement of A or its affiliates and, to the Knowledge of

A, the other parties thereto and is in full force and effect and will continue

to be valid and binding and in full force and effect on identical terms

following the execution and delivery of this Agreement and the other Joint

Venture Documents and the consummation of the transactions contemplated hereby

and thereby, and neither A nor any of its affiliates, nor, to the Knowledge of

A, any other party thereto is in default or breach in any material respect under

the terms of any such contract, and to the Knowledge of A no event or

circumstance has occurred that, with notice or lapse of time or both, would

constitute such a default thereunder or give rise to any right of termination,

acceleration, damages or any other remedy under any such contract. True and

complete copies of each contract listed in Schedule 3.07 have been made

available to B and the Joint Venture.

SECTION 3.08. Litigation. Schedule 3.08 lists all actions, suits, investigations

and proceedings relating to the A European Business pending against, or to the

Knowledge of A, threatened against, A or any of its affiliates before any court

or arbitrator or any governmental body, agency or official.

SECTION 3.09. Compliance with Laws and Court Orders. Except as set forth in

Schedule 3.09 and except for any violations that have not had and are not

reasonably expected to have a material adverse effect on the A European

Business, neither A nor any of its affiliates is in violation of and has not

violated any law, rule, regulation, judgment, injunction, order or decree in

connection with the A European Business.

SECTION 3.10. Properties. A and its affiliates have good and valid title to, or

in the case of leased property a valid leasehold interests in all Contributed

Assets (whether real, personal tangible or intangible) related to the A European

Business and reflected on the Balance Sheet or acquired after the Balance Sheet

Date, except for properties and assets sold since the Balance Sheet Date in the

ordinary course of business consistent with past practices. None of such

property or assets is subject to any Lien that will not be released in

connection with the consummation of the transactions contemplated hereby.

SECTION 3.11. Sufficiency of Assets. The Contributed Assets relating to the A

European Business constitute all of the property, assets and resources necessary

and adequate for the Joint Venture to conduct the A European Business as

conducted immediately prior to the consummation of the transactions contemplated

by this Agreement. Upon consummation of the transactions contemplated hereby,

the Joint Venture will have acquired good and marketable title in and to, or a

valid leasehold or license interest in, each of the Contributed Assets related

to the A European Business free and clear of all Liens and the same title or

leasehold or license interest in all other Contributed Assets free and clear of

all liens as was transferred by B to A pursuant to the Securities Purchase

Agreement.

SECTION 3.12. Intellectual Property. (a) Schedule 3.12(a) sets forth a list of all trademarks, service marks,

trade names, copyrights, mask works, patents, inventions, trade secrets, know-

how, processes, formulae, research and development data, computer software

programs, domain names/ URLs, or any other similar type of proprietary

intellectual property rights (including any registrations or applications for

any of the foregoing) used or held for use primarily in connection with the

European Businesses and owned by or licensed to A or any of its affiliates other

than the intellectual property covered by the License Agreement ("A European

Intellectual Property Rights").

With respect to each item of A European Intellectual Property Rights that

is owned by A or any of its affiliates, Schedule 3.12(a) sets forth: (i) the

nature of such Right, (ii) the owner, (iii) the jurisdictions by or in which

such Right has been issued or registered or in which an application for such

issuance or registration has been filed, (iv) the issue, registration or

application number, and (v) the date of issue, registration or application.With respect to each item of A European Intellectual Property Rights that

is licensed to A or any of its affiliates, Schedule 3.12(a) sets forth: (i) the

nature and identity of the Rights licensed, (ii) the owner, (iii) the applicable

fees and royalties, (iv) the territory covered by the license agreement and (v)

an identification of the applicable license agreement. True and complete copies

of each license listed in Schedule 3.12(a) have been made available to B and the

Joint Venture prior to the date of the Joint Venture Formation Agreement. (b) Schedule 3.l2(b) sets forth a list of all material licenses,

sublicenses and other agreements pursuant to which A or any of its affiliates

has licensed any other person to use any item of A European Intellectual

Property Rights, including (i) the identity of all parties to the agreement,

(ii) the nature and identity of the Rights licensed, (iii) the applicable fees

and royalties, (iv) the territory covered by the agreement, and (v) an

identification of the applicable license agreement. True and complete copies of

each such license, sublicense or other agreement have been made available to B

and the Joint Venture prior to the date of the Joint Venture Formation

Agreement. (c) Except as set forth in Schedule 3.12(c), (i) since [__________],

neither A nor any of its affiliates has been a defendant in any action, suit,

investigation or proceeding relating to, or otherwise has been notified of: any

alleged claim that the conduct of the A European Business infringes or

misappropriates intellectual property rights of others, and, to the Knowledge of

A, there is no other such infringement or misappropriation by A or any of its

affiliates, (ii) neither A nor any of its affiliates is a party to any

outstanding action, suit or proceeding alleging infringement or misappropriation

by any other person of any item of the A European Intellectual Property Rights

and to the Knowledge of A, there is no such continuing infringement, (iii) no

item of A European Intellectual Property Rights is the subject of any pending

opposition, interference, or cancellation proceeding and (iv) none of the

registrations or issuances included in the A European Intellectual Property

Rights identified in Schedule 3.12(a) has been abandoned or cancelled. Except as

disclosed in Schedule 3.12(c), no A European Intellectual Property Right is

subject to any outstanding judgment, injunction, order, decree or agreement

restricting the use thereof by A or any of its affiliates or restricting the

transfer or licensing thereof by A or any of its affiliates to any person.

Except for as set forth in Schedule 3.12(c), neither A nor any of its affiliates

has entered into any agreement to indemnify any other person against any charge

of infringement of any A European Intellectual Property Right. (d) Except as set forth in Schedule 3.12(d) and only to the extent related

to the A European Business, none of the processes and formulae, research and

development results and other know-how of A or any of its affiliates, the value

of which to A or such affiliates is contingent upon maintenance of the

confidentiality thereof (the "Trade Secrets"), has been disclosed by A or any of

its affiliates to any person other than employees, representatives and agents of

A, who are bound by written confidentiality agreements substantially in the form

disclosed to B and the Joint Venture prior to the date of the Securities

Purchase Agreement. (e) The A European Intellectual Property Rights that are registered by or

issued to A or its affiliates are owned by A or its affiliates free and clear of

any liens, claims, charges or encumbrances, except as set forth in Schedule

3.12(e). No present or former employee of A or its affiliates and no other

person owns or has any proprietary, financial or other interest, direct or

indirect, in whole or in part in the A European Intellectual Property Rights or

the material Trade Secrets.

SECTION 3.13. Licenses and Permits. Schedule 3.13 sets forth a list of all

material governmental licenses, authorizations, permits, consents and approvals

required to carry on the A European Business as presently conducted (the

"Permits"), together with the name of the government agency or entity issuing

such Permit and the expiration date of such Permit. Except as set forth in

Schedule 3.13, (i) the Permits are valid and in full force and effect, (ii)

neither A nor any of its affiliates is in default, and no condition exists that

with notice or lapse of time or both would constitute a default, under the

Permits and (iii) none of the Permits will be terminated or impaired or become

terminable, in whole or in part, as a result of the transactions contemplated

hereby or by the other Joint Venture Documents.

SECTION 3.14. Joint Venture Affiliates. Schedule 3.14 sets forth (i) the name of

each person in which A or any of its subsidiaries holds a direct or indirect

equity, profit, voting or other similar interest that is related to the A

European Business, (ii) a description of the interests held, and (iii) the name

of each record owner of any such interest and its percentage interest. Schedule

3.14 sets forth each partnership, joint venture or other similar agreement or

arrangement relating to the formation, creation, operation, management or

control of any such entity.

SECTION 3.15. Finders' Fees. There is no investment banker, broker, finder or

other intermediary which has been retained by or is authorized to act on behalf

of A or its affiliates who might be entitled to any fee or commission in

connection with the transactions contemplated by this Agreement.

SECTION 3.16. Product Liability. Except as set forth in Schedule 3.16, to the

Knowledge of A, there are no systemic defects in the engineering or

manufacturing of the systems or information technology currently utilized by the

A European Business that would adversely affect the performance or quality of

such systems or information technology provided by A and its affiliates to any

third parties. ARTICLE 4

CERTAIN OTHER REPRESENTATIONS AND WARRANTIES

SECTION 4.01. Representations of B. B represents and warrants as of the date

hereof and as of the Closing Date:(a) B is a corporation duly incorporated, validly existing and in good

standing under the laws of its jurisdiction of incorporation and has all

corporate powers and all material governmental licenses, authorizations,

consents and approval is required to carry on its businesses as now conducted.

(b) The execution, delivery and performance by B of this Agreement, and

the consummation of the transactions contemplated hereby are within B's

corporate powers and have been duly authorized by all necessary corporate action

on the part of B. This Agreement constitutes a valid and binding agreement of B.

SECTION 4.02. Representations of the Joint Venture. The Joint Venture represents

and warrants as of the date hereof and as of the Closing Date:

(a) The Joint Venture is a [identify jurisdiction] [limited liability

partnership] duly organized, validly existing and in good standing under the

laws of [identify jurisdiction] and has all powers and all material governmental

licenses, authorizations, consents and approvals required to carry on its

business as proposed to be conducted.

(b) The execution, delivery and performance by the Joint Venture of this

Agreement and the other Joint Venture Documents to which it is a party and the

consummation of the transactions contemplated hereby and thereby are within the

powers of the Joint Venture and have been duly authorized by all necessary

action on the part of the Joint Venture, and this Agreement has been duly

executed and delivered by the Joint Venture and constitutes a valid and binding

agreement of the Joint Venture. ARTICLE 5

COVENANTS OF A

SECTION 5.01. Access to Information. On and after the Closing Date, A and its

affiliates will afford promptly to the Joint Venture and its agents reasonable

access to its books of account, financial and other records (including, without

limitation, accountant's work papers), information, employees and auditors to

the extent such information is not in the possession of the Joint Venture and is

necessary or useful for the Joint Venture in connection with any audit,

investigation, dispute or litigation or any other reasonable business purpose

relating to the A European Business; provided that any such access by the Joint

Venture shall not unreasonably interfere with the conduct of business of A and

its affiliates.

SECTION 5.02. Best Efforts. After the Closing, A agrees to execute and deliver

and to take such other actions as may be necessary or desirable in order to

consummate or implement expeditiously the transactions contemplated by this

Agreement. ARTICLE 6

COVENANT OF B

SECTION 6.01. Best Efforts. After the Closing, B agrees to execute and deliver

and to take such other actions as may be necessary or desirable in order to

consummate or implement expeditiously the transactions contemplated by this

Agreement. ARTICLE 7

COVENANTS OF THE JOINT VENTURE, A AND B

SECTION 7.01. Public Announcements. The Joint Venture, A and B agree to consult

with each other before issuing any press release or making any public statement

with respect to this Agreement or the transactions contemplated hereby and,

except as may be required by applicable law or any listing agreement with any

national securities exchange, will not issue any such press release or make any

such public statement prior to such consultation. ARTICLE 8

TAX MATTERS

SECTION 8.01. Tax Definitions. The following terms, as used herein, have the

following meanings:

(a) "Pre-Closing Tax Period" means (i) any Tax period ending on or before

the Closing Date and (ii) with respect to a Tax period that commences before but

ends after the Closing Date, the portion of such period up to and including the

Closing Date. (b) "Tax" means any (i) net income, alternative or add-on minimum tax,

gross income, gross receipts, sales, use, ad valorem, value added, transfer,

franchise, profits, license, registration, recording, documentary, conveyancing,

gains, withholding on amounts paid to or by A or its affiliates, payroll,

employment, excise, severance, stamp, occupation, premium, property,

environmental or windfall profit tax, custom duty or other tax, governmental fee

or other like assessment or charge of any kind whatsoever, together with any

interest, penalty, addition to tax or additional amount imposed by any

governmental authority (a "Taxing Authority") responsible for the imposition of

any such tax (domestic or foreign), (ii) liability for the payment of any

amounts of the type described in (i) as a result of being party to any agreement

or any express or implied obligation to indemnify any other person or (iii)

liability of A or any of its affiliates for the payment of the type described in

(i) as a result of being a member of an affiliated, consolidated, combined or

unitary group or being a party to any agreement or arrangement whereby liability

of A or any affiliate for payment of such amounts was determined or taken into

account with reference to the liability of any other person.(c) "Tax Sharing or Indemnity Agreement" means all Tax sharing or Tax

indemnity agreements or arrangements (whether or not written) created or entered

into before the Closing Date and binding any of the [define entities covered]

(the "Tax Indemnity Entities"), including without limitation any agreements or

arrangements (other than agreements and arrangements clearly contemplated by

this Agreement) which (i) afford any other person the benefit of any Tax asset

of any of the Tax Indemnity Entities; (ii) require any Tax Indemnity Entities to

take into account any income, revenues, receipts, gain, or any Tax items of any

other person in determining the Tax Indemnity Entities' Tax liability; or (iii)

require any Tax Indemnity Entities to make any payment to or otherwise indemnify

any other person in respect of any Tax.

SECTION 8.02. Tax Matters. A hereby represents and warrants to the Joint Venture

that A and its affiliates have timely filed all Tax returns and reports

(including returns for estimated Taxes) and have timely paid all Taxes, and all

interest and penalties due thereon, required to be filed or paid on or prior to

the Closing Date except for such matters as would not result in a Lien on any

Contributed Asset, or would not otherwise adversely affect the A European Business.

SECTION 8.03. Tax Cooperation; Allocation of Taxes.

(a) The Joint Venture and A agree to furnish or cause to be furnished to

each other, upon request, as promptly as practicable, such information and

assistance relating to the A European Business or the Contributed Assets or

Assumed Liabilities (including, without limitation, access to books and records)

as is reasonably necessary for the filing of all Tax returns, the making of any

election relating to Taxes, the preparation for any audit by any Taxing

Authority, and the prosecution or defense of any claim, suit or proceeding

relating to any Tax. The Joint Venture and A shall retain or cause to be

retained all books and records with respect to Taxes pertaining to the A

European Business or the Contributed Assets or Assumed Liabilities for a period

of at least six years following the Closing Date. At the end of such period,

each party shall provide the other with at least 30 days' prior written notice

before destroying any such books and records, during which period the party

receiving such notice can elect to take possession, at its own expense, of such

books and records. A and the Joint Venture shall cooperate with each other in

the conduct of any audit or other proceeding relating to Taxes involving the

European Businesses or the Contributed Assets or Assumed Liabilities.

(b) All real property taxes, personal property taxes and similar ad

valorem obligations levied on the Contributed Assets, the Joint Venture or any

of its subsidiaries or A or any of its affiliates, to the extent related to the

Contributed Assets, for a taxable period which includes (but does not end on)

the Closing Date shall be apportioned between A or its affiliates on the one

hand and the Joint Venture or its subsidiaries on the other hand based on the

number of days of such taxable period included in the Pre-Closing Tax Period and

the number of days of such taxable period after the Closing Date (with respect

to any such taxable period, the "Post-Closing Tax Period"). A shall be liable to

payor reimburse the Joint Venture for the proportionate amount of such taxes

that is attributable to the Pre-Closing Tax Period, and the Joint Venture shall

be liable to payor reimburse A for the proportionate amount of such taxes that

is attributable to the Post-Closing Tax Period, in each case within 10 days

after the later of the date on which a statement setting forth the amount of

reimbursement to which the presenting party is entitled along with such

supporting evidence as is reasonably necessary to calculate the amount of

reimbursement has been presented to the other party and the date on which all

disputes, if any, relating to the reimbursement are resolved.(c) With respect to all other Taxes imposed on the Joint Venture or its

subsidiaries with respect to the Contributed Assets to the extent related to the

A European Business for a taxable period which includes (but does not end on)

the Closing Date ("Straddle Taxes"), if any, the amount of such Straddle Taxes

relating to the Pre-Closing Tax Period shall be deemed equal to the amount which

would be payable if the relevant Tax period ended on the Closing Date, and the

amount of such Straddle Taxes relating the Post-Closing Tax Period shall be

deemed to equal the amount thereof which should be payable if the relevant Tax

period began on the day following the Closing Date. For purposes of computing

the amounts described in the preceding sentence, (i) income, deductions, credits

and losses shall be computed in a manner consistent with past practices of A or

its affiliates or the Joint Venture, as the case may be: and (ii) the applicable

Tax rates shall be the appropriate statutory rates in effect during the relevant

Tax Period. A shall be liable for the position of any Straddle Tax that relates

to a Pre-Closing Tax Period, and the Joint Venture shall be liable for the

portion of any Straddle Tax that relates to a Post-Closing Tax Period. The Joint

Venture shall file all returns relating to, and make all payments to the

applicable Taxing Authorities of, such Straddle Taxes. Upon preparation of the

returns relating to Straddle Taxes, the Joint Venture shall submit such returns

{and all related schedules, statements and work papers, to the extent requested)

to A for review and shall present a statement to A setting forth the amount of

reimbursement to which the Joint Venture is entitled. A shall make the

reimbursement promptly but in no event later than 10 days after the later of the

date on which A receives the statement for reimbursement and the date on which

all disputes, if any, relating to the reimbursement are resolved.

(d) All excise, sales, use, value added, registration, stamp, recording,

documentary, conveyancing, franchise, property, transfer, gains and similar

Taxes, levies, charges and fees (collectively, 'Transfer Taxes") incurred in

connection with the transactions contemplated by this Agreement shall be borne

by A. The Joint Venture and A shall cooperate in providing each other with any

appropriate resale exemption certifications and other similar documentation. The

party that is required by applicable law to make the filings, reports, or

returns with respect to any applicable Transfer Taxes shall do so, and the other

party shall cooperate with respect thereto as necessary. ARTICLE 9

EMPLOYEE BENEFITS

Comment: This agreement should include provisions relating to employee benefits

matters with respect to A's employees who work in the A European Business.

ARTICLE 10

SURVIVAL; INDEMNIFICATION

SECTION 10.01. Survival. The representations and warranties of the parties

hereto contained in this Agreement or in any certificate or other writing

delivered pursuant hereto or in connection herewith shall survive the Closing

until [_______]; provided that the representations and warranties contained in

Article 8 and 9 shall survive until 30 days after the expiration of the statute

of limitations applicable to the matters covered thereby (giving effect to any

waiver, mitigation or extension thereof), if later. Notwithstanding the

preceding sentence, any representation or warranty in respect of which indemnity

may be sought under this Agreement shall survive the time at which it would

otherwise terminate pursuant to the preceding sentence, if notice of the

inaccuracy thereof giving rise to such right of indemnity shall have been given

to the party against whom such indemnity may be sought prior to such time.

SECTION 10.02. Indemnification. (a) A hereby indemnifies the Joint Venture, B and their respective

subsidiaries and their respective directors, officers, employees and agents

against and agree to hold each of them harmless from any and a11 damage, loss,

liability and expense (including, without limitation, reasonable expenses of

investigation and reasonable attorneys' fees and expenses in connection with any

action, suit or proceeding) ("Damages") incurred or suffered by the Joint

Venture, B or their respective subsidiaries arising out of:

(i) any misrepresentation or breach of a representation or warranty

contained in this Agreement by A,

(ii) any breach of covenant or agreement made or to be performed by

A pursuant to this Agreement, or

(iii) any liability or obligation attributable to the Contributed

Assets that is not an Assumed Liability.

(b) The Joint Venture hereby indemnifies A and its respective affiliates,

directors, officers, employees and agents against and agrees to hold each of

them harmless from any and all Damages incurred or suffered by A or its

subsidiaries arising out of:

(i) any breach of covenant or agreement made or to be performed by

the Joint Venture pursuant to this Agreement; or

(ii) any Assumed Liability; provided, however, nothing herein shall

prevent the Joint Venture from exercising its rights under Sections 10.02(a).

SECTION 10.03. Procedures.

(a) The party seeking indemnification under Section 10.02 (the

"Indemnified Party") agrees to give prompt notice to the party against whom

indemnity is sought (the "Indemnifying Party") of the assertion of any claim, or

the commencement of any suit, action or proceeding in respect of which indemnity

may be sought under such Section. The Indemnifying Party may participate in and,

if it so elects, assume control of the defense of any such suit, action or

proceeding at its own expense. If the Indemnifying Party has assumed the defense

of the applicable third party claim, the Indemnifying Party shall not be liable

under Section 10.02 for any settlement effected without its consent. (b) In the event that B or its affiliates pursue a claim against A on

behalf of the Joint Venture and its subsidiaries pursuant to Section 10.02, the

Joint Venture agrees to cause its officers and employees to cooperate with B or

its affiliate in the investigation and assertion of such claim and, if such

claim is successful, A shall reimburse B or its affiliate for any and all

expenses (including, without limitation, reasonable expenses of investigation

and reasonable attorneys' fees and expenses in connection with any action, suit

or proceeding) incurred by B or its affiliate in connection with such claim.

SECTION 10.04. Calculation of Damages. The Indemnifying Party shall not be

liable under Section 10.02 for any (i) consequential or punitive damages or (ii)

damages for lost profits.

ARTICLE 11

MISCELLANEOUS

SECTION 11.01. Notices. All notices, requests or other communications to any

party hereunder shall be in writing (including facsimile transmission) and shall

be given, if to B. to:

Attention:

Facsimile:

with a copy (which shall not constitute notice) to:

Attention:

Facsimile:

if to A, to:

Attention:

Facsimile:

with copies (which shall not constitute notice) to:

Attention:

Facsimile:

if to the Joint Venture, to:

Attention:

Facsimile:

and, if such notice is sent to the Joint Venture by D, with a copy (which shall

not constitute notice) to B, or by B, with a copy (which shall not constitute

notice) to A. All such notices, requests and other communications shall be deemed

received on the date of receipt by the recipient thereof if received prior to 5

p.m. on any business day in the place of receipt. Otherwise, any such notice,

request or communication shall be deemed not to have been received until the

next succeeding business day in the place of receipt.

SECTION 11.02. Amendments and Waivers.

(a) Any provision of this Agreement may be amended or waived if, but only

if, such amendment or waiver is in writing and is signed, in the ease of an

amendment, by each party to this Agreement, or in the case of a waiver, by the

party against whom the waiver is to be effective.

(b) No failure or delay by any party in exercising any right, power or

privilege hereunder shall operate as a waiver thereof nor shall any single or

partial exercise thereof preclude any other or further exercise thereof or the

exercise of any other right, power or privilege. The rights and remedies herein

provided shall be cumulative and not exclusive of any rights or remedies

provided by law.

SECTION 11.03. Expenses. Except as otherwise provided herein, all costs and

expenses incurred in connection with this Agreement shall be paid by the party

incurring such cost or expense.

SECTION 11.04. Successors and Assigns. The provisions of this Agreement shall be

binding upon and inure to the benefit of the parties hereto and their respective

successors and assigns; provided that no party may assign, delegate or otherwise

transfer any of its rights or obligations under this Agreement without the prior

written consent of each other party hereto.

SECTION 11.05. Dispute Resolution. (a) If a dispute relating to this Agreement arises between the parties,

the following procedure shall be implemented before either party pursues other

available remedies. The parties shall promptly hold a meeting attended by

representatives of the Joint Venture, A and B, who have decision-making

authority regarding the dispute to attempt in good faith to negotiate a

resolution of the dispute. If not resolved at such meeting, the parties shall

continue to attempt in good faith to negotiate a resolution of the dispute for

30 days after such meeting. If within 30 days after such meeting the parties

have not succeeded in negotiating a resolution of the dispute, the chief

executive officers of A and B and an appropriate representative of the Joint

Venture shall meet in good faith to determine if a mutually acceptable course of

action can be agreed. The parties agree to participate in good faith

negotiations related thereto for a period of 30 days. The parties agree that

they will enter into one or more agreements tolling any applicable statute of

limitations during periods of negotiation pursuant to this Section 11.05(a). If

the parties are not successful in resolving the dispute through this procedure,

then any party may seek to resolve the dispute pursuant to the procedures

described in Section 11.05(b) and (c). (b) Except as set forth in Section 11.05(c), any and all disputes,

controversies, claims or differences arising out of or in connection with this

Agreement shall be finally and exclusively resolved by arbitration under the

Rules of Conciliation and Arbitration of the International Chamber of Commerce,

which award shall be final and binding on the parties. Except as otherwise

agreed by the parties, the arbitration tribunal shall be formed by three

arbitrators appointed in accordance with said Rules. The arbitral proceedings

shall be conducted in the English language and the arbitrators shall be required

to submit a written statement of their findings and conclusions. The arbitration

shall take place at a time noticed by the International Chamber of Commerce. The

exclusive venue of arbitration shall be [_____]. The parties shall make their

agents, employees and witnesses available upon reasonable notice at reasonable

times for deposition and shall answer written interrogatories and requests

without the necessity of subpoenas or other court orders. To the extent

permitted by applicable law, the arbitrators shall issue subpoenas to compel the

attendance of, and the production of documents by, third-party witnesses at

depositions or at the arbitration hearings. In order to minimize delays, the

tribunal chairperson shall decide all discovery requests. (c) Notwithstanding Section 11.05(b), the parties shall have the right to

initiate and pursue litigation seeking to restrain or enjoin preliminarily or

otherwise any alleged breach of Article 5 and Section 7.01 of this Agreement.

The parties agree that any such litigation shall only be brought in [indicate

jurisdiction], and each of the parties hereby consents to the jurisdiction of

such courts (and of the appropriate appellate courts therefrom) in any such

litigation and irrevocably waives, to the fullest extent permitted by law, any

objection which it may now or hereafter have to the laying of the venue of any

such litigation in any such court or that any such litigation which is brought

in any such court has been brought in an inconvenient forum. Each party agrees

that service of process on such party as provided in Section 11.01 shall be

deemed effective service of process on such party.

SECTION 11.06. Governing Law. This Agreement shall be governed by and construed

in accordance with the laws of [_________], without regard to the conflicts of

law rules of such state.

SECTION 11.07. Counterparts; Third Party Beneficiaries. This Agreement may be

signed in any number of counterparts, each of which shall be an original, with

the same effect as if the signatures thereto and hereto were upon the same

instrument. This Agreement shall become effective when each party hereto shall

have received a counterpart hereof signed by the other party hereto. No

provision of this Agreement is intended to confer upon any person other than the

parties hereto any rights or remedies hereunder.

SECTION 11.08. Entire Agreement, etc. (a) This Agreement and the other Joint Venture Documents constitute the

entire agreement between the parties with respect to the subject matter hereof

and thereof and supersede all prior agreements and understandings, both oral and

written, between the parties with respect to the subject matter of this

Agreement.

(b) References in this Agreement to Schedules means schedules delivered to

the Joint Venture and B prior to the date of the Joint Venture Formation

Agreement.

SECTION 11.09. Captions. The captions herein are included for convenience of

reference only and shall be ignored in the construction or interpretation hereof.

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly

executed by their respective authorized officers as of the day and year first

above written.

The Joint Venture

By: ________________________Name: Title:

Company A

By: ________________________ Name: Title:

Company B

By: ________________________

Name: Title: