Fill and Sign the Cooperative Loan Application Form PDF

Useful suggestions for preparing your ‘Cooperative Loan Application Form Pdf’ online

Are you exhausted by the complications of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for both individuals and businesses. Bid farewell to the monotonous task of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Take advantage of the extensive features included in this user-friendly and cost-effective platform and transform your strategy for document management. Whether you need to approve forms or collect signatures, airSlate SignNow manages everything effortlessly, with just a few clicks.

Adhere to this comprehensive guide:

- Log into your account or initiate a free trial with our service.

- Hit +Create to upload a file from your device, cloud storage, or our template library.

- Access your ‘Cooperative Loan Application Form Pdf’ in the editor.

- Select Me (Fill Out Now) to finalize the document on your end.

- Add and designate fillable fields for other participants (if necessary).

- Move forward with the Send Invite options to request eSignatures from others.

- Save, print your version, or convert it into a reusable template.

Rest assured if you need to work with your colleagues on your Cooperative Loan Application Form Pdf or send it for notarization—our platform provides everything necessary to accomplish such tasks. Register with airSlate SignNow today and enhance your document management to a higher level!

FAQs

-

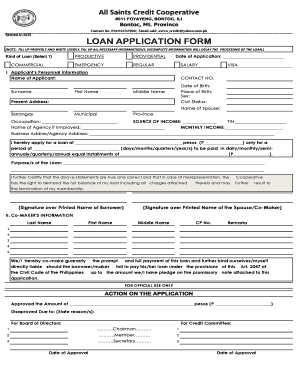

What is a Cooperative Loan Application Form Pdf?

A Cooperative Loan Application Form Pdf is a document that individuals or businesses use to apply for loans through cooperative banks or credit unions. This form typically requires personal and financial information and can be easily filled out and submitted electronically using platforms like airSlate SignNow.

-

How can airSlate SignNow help with the Cooperative Loan Application Form Pdf?

airSlate SignNow streamlines the process of completing and submitting a Cooperative Loan Application Form Pdf by allowing users to eSign documents securely. Our platform eliminates the need for printing and scanning, making it faster and more efficient for both applicants and lenders.

-

Is airSlate SignNow cost-effective for managing Cooperative Loan Application Form Pdfs?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business needs, making it a cost-effective solution for managing Cooperative Loan Application Form Pdfs. With our service, you can save on printing and mailing costs while benefiting from a range of features that enhance document management.

-

What features does airSlate SignNow offer for Cooperative Loan Application Form Pdfs?

airSlate SignNow provides features such as customizable templates, secure eSignature options, and cloud storage for your Cooperative Loan Application Form Pdfs. These features enhance the document workflow, making it easy to track the application process and reduce turnaround times.

-

Can I integrate airSlate SignNow with other applications for my Cooperative Loan Application Form Pdf?

Absolutely! airSlate SignNow offers seamless integrations with various applications, including CRM systems and financial software. This allows you to manage your Cooperative Loan Application Form Pdfs alongside your other business operations without any hassle.

-

What are the benefits of using airSlate SignNow for my Cooperative Loan Application Form Pdf?

Using airSlate SignNow for your Cooperative Loan Application Form Pdf means faster processing, enhanced security, and improved accessibility. You can complete and sign documents from anywhere, ensuring you never miss a deadline and maintain the integrity of sensitive information.

-

How secure is my data when using airSlate SignNow for Cooperative Loan Application Form Pdfs?

airSlate SignNow prioritizes data security by implementing robust encryption and compliance with industry standards. When you use our platform for your Cooperative Loan Application Form Pdf, you can trust that your personal and financial information is protected from unauthorized access.

Find out other cooperative loan application form pdf

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles