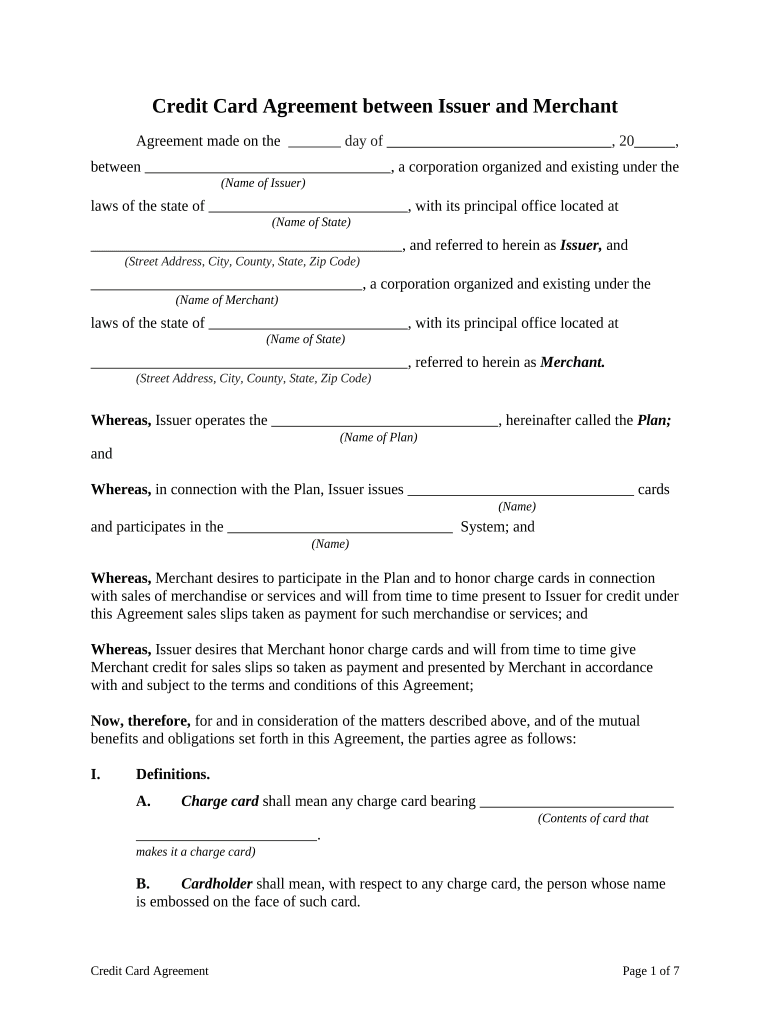

Credit Card Agreement between Issuer and Merchant

Agreement made on the day of , 20 ,

between , a corporation organized and existing under the

(Name of Issuer)

laws of the state of , with its principal office located at

(Name of State)

, and referred to herein as Issuer, and

(Street Address, City, County, State, Zip Code)

, a corporation organized and existing under the

(Name of Merchant)

laws of the state of , with its principal office located at

(Name of State)

, referred to herein as Merchant.

(Street Address, City, County, State, Zip Code)

Whereas, Issuer operates the , hereinafter called the Plan;

(Name of Plan)

and

Whereas, in connection with the Plan, Issuer issues cards

(Name)

and participates in the System; and

(Name)

Whereas, Merchant desires to participate in the Plan and to honor charge cards in connection

with sales of merchandise or services and will from time to time present to Issuer for credit under

this Agreement sales slips taken as payment for such merchandise or services; and

Whereas, Issuer desires that Merchant honor charge cards and will from time to time give

Merchant credit for sales slips so taken as payment and presented by Merchant in accordance

with and subject to the terms and conditions of this Agreement;

Now, therefore, for and in consideration of the matters described above, and of the mutual

benefits and obligations set forth in this Agreement, the parties agree as follows:

I. Definitions.

A. Charge card shall mean any charge card bearing

(Contents of card that

.

makes it a charge card)

B. Cardholder shall mean, with respect to any charge card, the person whose name

is embossed on the face of such card.

Credit Card Agreement Page 1 of 7

C. Authorized user shall mean, with respect to any charge card, the person whose

signature appears in the signature panel on the reverse side of such card, provided that

such person has the same surname as the cardholder of such card.

D. Issuer shall mean, with respect to any charge card, the party identified above that

has issued such card.

E. Charge card sale shall mean each sale by Merchant of merchandise or services

through the use of a charge card.

F. Sales slip shall mean a sales slip in a form provided by Issuer to be used by

Merchant in making a charge card sale.

II. Honor of Valid Charge Card. Subject to the provisions of Sections III through VI,

Merchant agrees to make charge card sales to any cardholder or other authorized user of a charge

card and agrees to honor any valid charge card properly tendered for use, regardless of the

identity of Issuer.

III. Void or Revoked Cards. Merchant shall not make any charge card sale where the charge

card presented has been voided or revoked by Issuer of such card, according to the current list of

such cards furnished to Merchant by Issuer.

A. Unless otherwise specifically authorized in accordance with the procedure set

forth in Section VI, Merchant shall not make any charge card sale to a customer present

in Merchant's place of business in any one or more of the following circumstances:

1. Where a charge card is not presented at time of sale;

2. Where the charge card presented has expired, according to the expiration

date shown on the face of the card;

3. Where the signature on the sales slip does not correspond to the signature

appearing in the signature panel on the reverse side of the charge card; and/or

4. Where the total amount of any charge card sale is in excess of the floor

limit established for such sales, as determined in accordance with Section XX.

B. All sales made in one department or by any one salesperson in any one day,

through the use of a charge card of the same cardholder, shall constitute a single sale to

which the floor limit applies.

C. If Merchant does not obtain authorization in any circumstances described in this

section, acceptance of the sales slip by Issuer arising out of such a sale shall be subject to

the provisions of Section XIV.

Credit Card Agreement Page 2 of 7

V. Telephone or Mail Order Charges. Unless otherwise specifically authorized in

accordance with the procedure set forth in Section VI, Merchant shall not make any charge card

sale on the basis of a telephone or mail order where the total amount of such sale is in excess of

the floor limit established for such sales in accordance with Section XX. All such sales made in

one department or by any one salesperson in any one day, through the use of a charge card of the

same cardholder, shall constitute a single sale to which the floor limit applies. If Merchant does

not obtain authorization under the circumstances described in this section, the acceptance of the

sales slip, by Issuer, arising out such a sale, shall be subject to the provisions of Section XIV.

VI. Authorization by Authorization Center.

A. If Merchant desires to make a charge card sale described in Sections IV and V,

Merchant shall telephone the appropriate authorization center designated by Issuer in

accordance with Section XX and shall advise such authorization center of the specific

respects in which waiver of the provisions of Sections IV and V is requested.

B. If the authorization center authorizes such waiver, Merchant may consummate the

sale, noting the authorization code number at the appropriate place on the sales slip. Such

authorization shall be binding on Issuer only as to the specific respect for which waiver

was requested and given by the authorization center, and shall not constitute any waiver

of any of the other provisions of Sections IV and V .

VII. Use of Sales Slips.

A. A sales slip shall be used by Merchant in each charge card sale. Each such sales

slip shall be imprinted by Merchant with Merchant's name and number and with the

charge card presented by the purchaser, shall state the date of the sale and the total cash

price of the sale (including any applicable state or federal taxes), shall contain a short

description of the merchandise or services sold, and shall be signed by the cardholder or

other authorized user presenting the charge card (except where the sale is made pursuant

to a telephone or mail order).

B. If a purchaser is unable to present a charge card at the time of sale, Merchant shall

print on the sales slip the cardholder's name and account number. Merchant shall deliver

the customer copy of the sales slip to the purchaser. Merchant agrees it will not, in

connection with any charge card sale, accept any cash or other form of payments, make

any special charge, or extract any special Agreement or security from the purchaser.

VIII. Account with Issuer. Merchant shall establish and maintain with Issuer a commercial

banking account to be known as , hereinafter called the

(Name of Banking Account of Merchant)

Merchant's account. Merchant may designate any existing account maintained by it with Issuer

for this purpose. Merchant authorizes Issuer to charge from time to time against Merchant's

account any amount payable by Merchant to Issuer under the terms of this Agreement and

Merchant agrees to deposit and maintain at all times in Merchant's account a balance in an

amount not less than that estimated by Issuer as desirable to cover all charges to such account

that are likely to arise.

Credit Card Agreement Page 3 of 7

IX. Acceptance of Sales Slips by Issuer.

A. Subject to Section XIV, Issuer agrees to accept from Merchant all sales slips complying

with the terms and conditions of this Agreement arising from charge card sales by

Merchant and to pay Merchant (by credit to Merchant's account) the total face amount of

each sales slip accepted under and pursuant to this Agreement, less the discount

percentage determined by Issuer from time to time in accordance with Section XX.

B. The cardholder bank copy of each sales slip shall be delivered to Issuer not

later than the close of business on the second banking business day following the date of

the sale and giving rise to such slips. All figures are subject to audit and final checking by

Issuer. Prompt adjustment shall be made for any inaccuracy discovered.

C. Merchant warrants that each sales slip delivered by Merchant to Issuer under and

pursuant to this Agreement will represent a bona fide sale of merchandise or services by

Merchant to the cardholder or other authorized user of the charge card for the amount

shown on such sales slip. If any breach of the preceding warranty shall occur with respect

to any sales slip deposited under and pursuant to this Agreement, Issuer may refuse to

accept such sales slip, or revoke its prior acceptance of such sales slip. In the event of

such revocation, Merchant agrees to pay Issuer the total face amount of such sales slip.

X. Sales Slip as Constituting Payment. Merchant agrees that the sales slip arising from

each charge card sale shall constitute payment to Merchant for merchandise or services sold in

such sale and further agrees that it will not have any claim against, or receive payment from, the

cardholder or any other purchaser in such sale unless Issuer refuses to accept such slip or revokes

its prior acceptance of such sales slip in accordance with this Agreement.

XI. All disputes between Merchant and any purchaser relating to any charge card sale shall

be settled between Merchant and such purchaser.

XII. Refunds and Adjustments.

A. Merchant shall establish and maintain a fair policy for the exchange or return of,

or adjustments on, merchandise or services sold in charge card sales. Merchant shall

make no cash refunds or payments to any person for returns or adjustments on charge

card sales; instead, when a refund or payment is due for any return or adjustment,

Merchant shall issue a credit slip on a form provided by Issuer. Each such credit slip shall

be imprinted by Merchant with Merchant's name and number and with the charge card

presented by the person to whom the refund or adjustment is to be made, shall state the

date it is issued and the total amount of the refund or adjustment, shall contain a

description of the merchandise or services in connection with which the refund or

adjustment is to be made, and shall be signed by Merchant's authorized representatives

and also by the person requesting the refund or adjustment.

B. Merchant shall deliver the customer copy of such credit slip to such person. The

cardholder bank copy of each credit slip shall be delivered to Issuer by Merchant not

later than the close of business on the second banking business day following the date of

its issuance.

Credit Card Agreement Page 4 of 7

C. Merchant agrees to pay Issuer the total face amount of each credit slip received

from Merchant less the discount percentage determined by Issuer from time to time in

accordance with Section XX. Issuer agrees to arrange for a credit to the charge card

account of the cardholder named on the credit slip of the total face amount of such

slip. Merchant warrants that each credit slip delivered by Merchant to Issuer will

represent a bona fide refund or adjustment on a charge card sale by Merchant with

respect to which a sales slip shall have been accepted by Issuer.

XIII. Member’s Obligations. Merchant agrees that:

A. Merchant will not discriminate as to price, service, or otherwise against any

person using or desiring to use a charge card;

B. Representatives of Issuer, during normal business hours, may inspect, audit, and

make copies of Merchant's books, accounts, records, and files pertaining to charge card

sales and refunds or adjustments on such sales, and Merchant agrees to preserve its

records of any charge card sale and any refund or credit adjustment for at least

from date of such sale, refund, or adjustment; and

(Period of time)

C. Merchant will fulfill completely all of its obligations to purchasers under the

terms of any charge card sale.

XIV. Refusal or Revocation by Issuer. Issuer may refuse to accept any sales slip, or revoke

its prior acceptance of any sales slip, and in the event of such revocation Merchant agrees to pay

Issuer the total face amount of such sales slip, in any one or more of the following

circumstances:

A. The charge card sale giving rise to such sales slip was not made in compliance

with all the terms and conditions of this Agreement (including the provisions of Sections

IV and V, unless such provisions were waived by the appropriate authorization center in

accordance with Section VI ) as well as all applicable laws and regulations of any

governmental authority.

B. The cardholder of the charge card used in such sale disputes liability to Issuer on

any one or more of the following grounds:

1. That the merchandise or services covered by such sales slip

were returned, rejected, or defective in some respect, or Merchant has failed to

perform any obligation on its part in connection with such merchandise or

services, and Merchant has refused to issue a credit slip in the proper amount; or

2. That the signature on the sales slip was not that of the cardholder or any

authorized user, and Issuer in good faith believes that Merchant should have

discovered this fact by examination of the signature appearing in the signature

Credit Card Agreement Page 5 of 7

panel on the reverse of the cardholder's charge card (unless the appropriate

authorization center waived this defect in accordance with Section VI ).

XV. Initial Membership Fee. Merchant agrees to pay Issuer an initial merchantship fee

which shall be in effect on the effective date of this Agreement for becoming a Merchant of the

.

(Name of Plan)

XVI. Lease of Imprinters. Issuer agrees to lease to Merchant any number of imprinters

Merchant may desire at an annual rental fee to be determined by Issuer from time to time in

accordance with Section XX. All such imprinters shall remain the property of Issuer and shall be

returned to Issuer on termination of this Agreement.

XVII. Promotional Material, Forms, and the Like. Issuer will furnish to Merchant, without

charge, promotional material and advertising displays indicating Merchant's participation in the

, and Merchant agrees to display such materials and

(Name of Plan)

displays prominently in Merchant's place or places of business. Issuer will also furnish Merchant,

without charge, with sales slips, credit slips, and any other forms that may be required by Issuer.

All promotional materials, advertising displays, sales slips, credit slips, and other forms supplied

to Merchant under and pursuant to this Agreement and used by Merchant shall remain the

property of Issuer, and shall be returned to Issuer on termination of this Agreement.

XVIII. Termination. This Agreement shall be and continue in full force and effect from the

effective date stated above until terminated by either party by written notice to the other, such

termination to become effective on the later of the day of such notice or the termination date

specified in such notice. All obligations of Merchant with respect to sales slips accepted by

Issuer prior to the effective date of termination shall survive such termination.

XIX. Binding Effect. This Agreement shall be binding on and inure to the benefit of the

parties to this Agreement and their respective personal representatives, successors, and assigns.

XX. Operating Guide. Merchant acknowledges receipt of the current edition of the

, issued by Issuer, hereinafter called the operating

(Name of Operating Guide)

guide , showing floor limits, imprinter rentals, authorization procedures, and other operating

procedures in effect as of the effective date of this Agreement. Issuer reserves the right to change

the provisions, in full or in part, of the operating guide from time to time, on written notice to

Merchant, but no change shall be effective for any period prior to the time of giving such notice.

Provisions set forth in the operating guide from time to time are incorporated into and made a

part of this Agreement to the same effect as if set out in this Agreement in their entirety. In the

event of any conflict between such provisions and any other provisions of this Agreement, the

provisions of the operating guide shall govern.

XXI. Discount Rate. The discount rate applicable to Merchant's deposits of sales slips under

this Agreement is %. Issuer reserves the right to change such discount rate on written

Credit Card Agreement Page 6 of 7

notice to Merchant, but no change shall be effective for any period prior to the time of giving

such notice.

XXII. Indemnification. Merchant agrees to indemnify and hold Issuer harmless from any claim

or liability relating to any sale made by Merchant under and pursuant to this Agreement.

XXIII. Governing Law. This Agreement shall be governed by, construed, and enforced in

accordance with the laws of .

(Name of State)

XXIV. No Waiver. The failure of either party to this Agreement to insist on the performance of

any of the terms and conditions of this Agreement, or the waiver of any breach of any of the

terms and conditions of this Agreement, shall not be construed as subsequently waiving any such

terms and conditions, but the terms and conditions shall continue and remain in full force and

effect as if no such forbearance or waiver had occurred.

WITNESS our signatures as of the day and date first above stated.

(Name of Issuer) (Name of Merchant)

By: By:

(Signature of Officer) (Signature of Officer)

(P rinted Name & Office in Corporation) (P rinted Name & Office in Corporation)

Credit Card Agreement Page 7 of 7