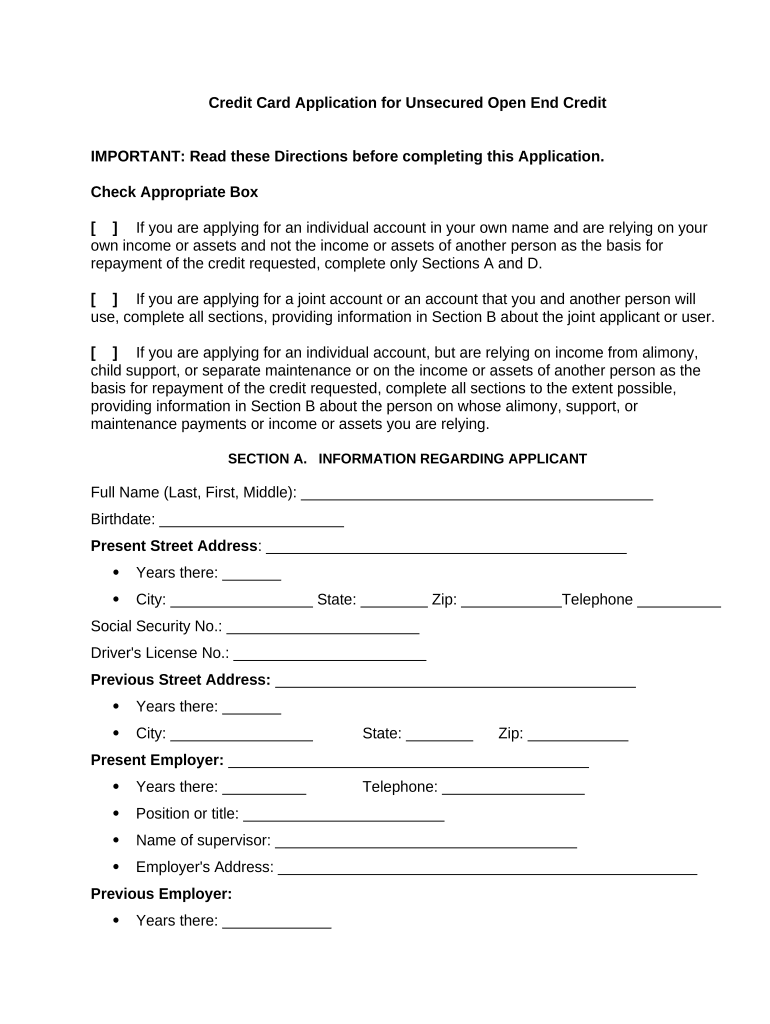

Credit Card Application for Unsecured Open End Credit

IMPORTANT: Read these Directions before completing this Application.

Check Appropriate Box

[ ] If you are applying for an individual account in your own name and are relying on your

own income or assets and not the income or assets of another person as the basis for

repayment of the credit requested, complete only Sections A and D.

[ ] If you are applying for a joint account or an account that you and another person will

use, complete all sections, providing information in Section B about the joint applicant or user.

[ ] If you are applying for an individual account, but are relying on income from alimony,

child support, or separate maintenance or on the income or assets of another person as the

basis for repayment of the credit requested, complete all sections to the extent possible,

providing information in Section B about the person on whose alimony, support, or

maintenance payments or income or assets you are relying.

SECTION A. INFORMATION REGARDING APPLICANT

Full Name (Last, First, Middle): __________________________________________

Birthdate: ______________________

Present Street Address : ___________________________________________

Years there: _______

City: _________________ State: ________ Zip: ____________Telephone __________

Social Security No.: _______________________

Driver's License No.: _______________________

Previous Street Address: ___________________________________________

Years there: _______

City: _________________ State: ________ Zip: ____________

Present Employer: ___________________________________________

Years there: __________ Telephone: _________________

Position or title: ________________________

Name of supervisor: ____________________________________

Employer's Address: __________________________________________________

Previous Employer:

Years there: _____________

Previous Employer's Address: ____________________________________________

Present net salary or commission: $__________ per (e.g., weekly, bi-weekly, monthly)

Number of Dependents: _______ A ges: _________

Alimony, Child Support, or Separate Maintenance Income

Alimony, child support, separate maintenance income need not be revealed if you do

not wish to have it considered as a basis for repaying this obligation.

Alimony, child support, separate maintenance received under:

[ ] Court Order [ ] Written Agreement [ ] Oral Understanding

[ ] Other income: $__________ per (e.g., weekly, bi-weekly, monthly)

Source(s) of other income: _________________________________________________

_________________________________________________

__________________________________________________

Is any income listed in this Section likely to be reduced in the next two years?

[ ] Yes (Explain in detail on a separate sheet.) [ ] No

Have you ever received credit from us? [ ] Yes When? (date)

Office: (Name of Office)

Checking Account No.: ___________________________________

Institution and Branch: ______________________________________________

Savings Account No.: _____________________________________________________

Institution and Branch: _______________________________________________

Name of nearest relative not living with you: _____________________________________

Telephone: ___________________________

Relationship: ___________________________

Address: ___________________________________________________________

SECTION B. INFORMATION REGARDING JOINT APPLICANT, USER, OR OTHER PARTY

(Use separate sheets if necessary.)

Full Name:

Last _______________________

First __________________________

Middle _________________________

SECTION C. MARITAL STATUS

Do not complete if this is an application for an individual account.

Applicant:

[ ] Married

[ ] Separated

[ ] Unmarried (including single, divorced, and widowed)

SECTION D. ASSET AND DEBT INFORMATION

(If Section B has been completed, this section should be completed giving information about

both the Applicant and Joint Applicant, User, or Other Person. Please mark Applicant-related

information with an "A." If Section B was not completed, only give information about the

Applicant in this section.)

Description of Assets Value Subject to Debt? Name(s) of

Yes/No Owner(s)

Cash $____________ [ ] Yes [ ] No (List Names)

Automobiles (Make, Model, Year) $____________ [ ] Yes [ ] No (List Names)

Cash Value of Life Insurance

(Issuer, Face Value) $____________ [ ] Yes [ ] No (List Names)

Real Estate

(Location, Date Acquired) $____________ [ ] Yes [ ] No (List Names)

Marketable Securities

(Issuer, Type, No. of Shares) $____________ [ ] Yes [ ] No (List Names)

Other (List assets) $____________ [ ] Yes [ ] No (List Names)

Total Assets $____________

Liabilities

Rent or mortgage (include association fees) Monthly Payment $____________

Vehicle insurance (circle one): 1 3 6 9 12 month)

(Name of other Creditor) Monthly Payment $____________

(Name of other Creditor) Monthly Payment $____________

Are any of the above past due? [ ] Yes (Explain in detail on a separate sheet.) [ ] No

Credit References

(Name and Address) (Relationship, e.g., personal or professional)

Are you a co-maker, endorser, or guarantor on any loan or contract?

[ ] Yes [ ] No

If "yes" for whom? (name of debtor) To whom? (name of creditor)

Are there any unsatisfied judgments against you?

[ ] Yes [ ] No

If "yes" to whom owed? (names of creditors for whom there are unsatisfied judgments)

Have you been declared bankrupt in the last 14 years?

[ ] Yes [ ] No

If "yes" where? (place of bankruptcy) Year _________________________

Other Obligations (E.g., liability to pay alimony, child support, separate maintenance. Use

separate sheet if necessary.) _______________________________________________

Everything that I have stated in this application is correct to the best of my knowledge. I

understand that you will retain this application whether or not it is approved. You are

authorized to check my credit and employment history and to answer questions about your

credit experience with me.

Witness my signature this the ____ day of _____________, 2010.

_____________________________

(Printed Name of Applicant)

(Signature of Applicant)

IMPORTANT INFORMATION REGARDING RATES, FEE, AND OTHER COST INFORMATION

Interest Rates and Interest Charges 0.0% introductory APR for the first 6 months

Annual Percentage Rate

(APR) for Purchases

After that, your APR will be 15.24, 17.24 or

19.24% based on your creditworthiness as

determined at the time of account opening. This APR

will vary with the market based on the Prime Rate.

APR for Balance Transfers 15.24, 17.24 or 19.24% I ntroductory APR on balance

transfers requested within 30 days of account

opening.

After that, your APR for those transactions and any

other balance transfer requests, if we accept them,

will be 15.24, 17.24 or 19.24% based on your

creditworthiness.

APR for Cash Advances 25.24%

This APR will vary with the market based on

the Prime Rate

Penalty APR for Cash Advances

and When it Applies 27.24%

This APR will vary with the market based on

the Prime Rate.

This APR will apply to your account if you:

1) Make one or more late payments; or

2) Make a payment that is returned.

How Long Will the Penalty APR Apply? If

the Penalty APR is applied for any of these

reasons, it will apply for at least 12 billing

periods in a row, and will continue to apply until

after you have made timely payments, with no

returned payments, for 12 billing periods in a

row.

Paying Interest Your due date is at least 25 days after the

close of each billing period. We will not charge

you interest on purchases if you pay your

entire balance by the due date each month.

We will begin charging interest on cash

advances and balance transfers on the

transaction date.

For Credit Card Tips from the

Federal Reserve Board To learn more about factors to consider when

applying for or using a credit card, visit the

website of the Federal Reserve Board at

http://www.federalreserve.gov/creditcard

Fees

Annual Membership Fee: $__________________

Additional Card Fee: $__________________

Transaction Fees

Balance Transfer: Either $5 or 3% of the amount of each transfer,

whichever is greater.

Cash Advance: Either $5 or 3% of the amount of each cash advance,

whichever is greater.

Foreign Transaction: 2.7% of each transaction after conversion to US

dollars.

Penalty Fees

Late Payment: $19 if balance is less than $250; $39 if balance is

$250 or more

Returned Payment: $ __________

How We Will Calculate Your Balance: We use a method called "average daily balance

(including new purchases)."

Loss of Introductory APR: We may end any Introductory APR and apply the Penalty APR if

you make a late payment.

Variable APRs for each billing period are based on the Prime Rate published in The Wall

Street Journal 2 days before the Closing Date of the billing period. The Wall Street Journal

may not publish the Prime Rate on that day. If it does not, we will use the Prime Rate from the

previous day it was published. If the Prime Rate increases, variable APRs will increase. In that

case, you may pay more interest and have a higher Minimum Payment Due. When the Prime

Rate changes, the resulting changes to variable APRs take effect as of the first day of the

billing period. Variable APRs are accurate as of 05/15/10.

Optional Payment Protection

Your purchase of protection under the (Name) Payment Protection Plan (hereinafter referred to

as the “Program”) is voluntary and will not be considered in whether to grant credit. We will

give you additional information upon receipt of your enrollment form. This information will

include a copy of the (Name) Payment Protection Plan Contract (the “Contract”) which contains

the terms and conditions of your protection under the Program. There are eligibility

requirements, conditions, and exclusions that could prevent you from receiving benefits under

the Program. You should carefully read the Contract for a full explanation of the terms and

conditions of your protection under the Program. Within 30 days of receiving the Contract, you

may cancel the protection and any fee paid by you will be returned. After the initial 30 days,

you may cancel your protection at any time.

PROGRAM FEE: The cost per $1,000 of the monthly outstanding loan balance is $2.25. If the

outstanding loan balance is greater than $100,000, the rate will not be applied to the amount

that exceeds $100,000.

ELIGIBILITY: You are eligible for the Program if you are a borrower on the loan and under age

70 on the effective date of protection. A co-signer or guarantor is not eligible for protection. The

Program protects the first two borrowers listed on the lending agreement.

EFFECTIVE DATE OF PROTECTION: The effective date of protection means the later of the

date you enrolled in the Program option, the date your protection under the Program is

reinstated, or the date of the advance. ( Advance means each extension of credit we provide to

you under a loan.)

You elect (chose only one box):

[ ] Loss of Life & Disability Protection

[ ] No protection

PROTECTED EVENTS:

Loss of Life — If you die, we will cancel 100% of the loss of life amount. For each protected

borrower, the loss of life amount is the lesser of the protected balance or $100,000.

Disability — If you are employed full-time and become disabled, we will cancel the daily

payment for each day that you are disabled beginning with the 31st day of disability; for the

next 120 months or until the entire protected balance is cancelled, but not more than $120,000

per period of disability.

NON-PROTECTED EVENTS:

An advance is not protected by the Program if the event:

is due to the commission of a felony or caused by or results from an atomic explosion or

any other release of nuclear energy (except when used solely for medical treatment);

occurs within the 6 months immediately following the effective date of protection for the

advance and is related to a pre-existing condition for which you received advice,

diagnosis, or treatment (including medication) within the 6 months immediately

preceding the effective date of protection for the advance; or

occurs after age 70.

An advance is not protected by Loss of Life protection if the event is the result of a suicide or

an intentionally self-inflicted injury that occurs within the 12 months immediately following the

effective date of protection for the advance.

An advance is not protected by Disability protection if the event is related to normal

pregnancy or due to an intentionally self-inflicted injury.

Your signature means that: Your election will remain in effect, according to the terms of the

Contract, unless subsequently modified. You authorize the Program fee to be added to your

outstanding balance each month. You understand that your protection under the Plan is

subject to the terms and conditions of the Contract.

Witness my signature this the ____ day of _____________, 2010.

_____________________________

(Printed Name of Applicant)

(Signature of Applicant)

Helpful advice on finalizing your ‘Credit Card Application For Unsecured Open End Credit’ online

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the premier eSignature platform for individuals and organizations. Bid farewell to the tedious process of printing and scanning documents. With airSlate SignNow, you can smoothly complete and sign paperwork online. Utilize the robust tools equipped in this user-friendly and budget-friendly platform and transform your method of paperwork administration. Whether you need to sign forms or gather electronic signatures, airSlate SignNow manages it all effortlessly, needing just a few clicks.

Adhere to this step-by-step guide:

- Log into your account or sign up for a complimentary trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our form repository.

- Open your ‘Credit Card Application For Unsecured Open End Credit’ in the editor.

- Click Me (Fill Out Now) to finish the document on your end.

- Add and designate fillable fields for other participants (if necessary).

- Proceed with the Send Invite options to solicit eSignatures from others.

- Save, print your version, or convert it into a multi-usable template.

No need to worry if you must work together with your colleagues on your Credit Card Application For Unsecured Open End Credit or send it for notarization—our platform provides everything you need to accomplish such tasks. Register with airSlate SignNow today and enhance your document management to new levels!