Fill and Sign the Credit Deed Caddo Parish Clerk of Court Form

Useful tips on preparing your ‘Credit Deed Caddo Parish Clerk Of Court’ online

Are you fed up with the burden of managing paperwork? Look no further than airSlate SignNow, the premier eSignature solution for both individuals and businesses. Bid farewell to the monotonous task of printing and scanning documents. With airSlate SignNow, you can easily complete and sign forms online. Leverage the powerful features integrated into this user-friendly and cost-effective platform and transform your method of document management. Whether you need to authorize forms or gather electronic signatures, airSlate SignNow manages everything smoothly, requiring merely a few clicks.

Follow this comprehensive guide:

- Sign in to your account or sign up for a complimentary trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template library.

- Open your ‘Credit Deed Caddo Parish Clerk Of Court’ in the editor.

- Click Me (Fill Out Now) to set up the form on your end.

- Add and designate fillable fields for others (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

Don’t be concerned if you need to collaborate with others on your Credit Deed Caddo Parish Clerk Of Court or send it for notarization—our platform provides you with everything required to accomplish such tasks. Create an account with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

What is a Credit Deed and how is it processed by the Caddo Parish Clerk Of Court?

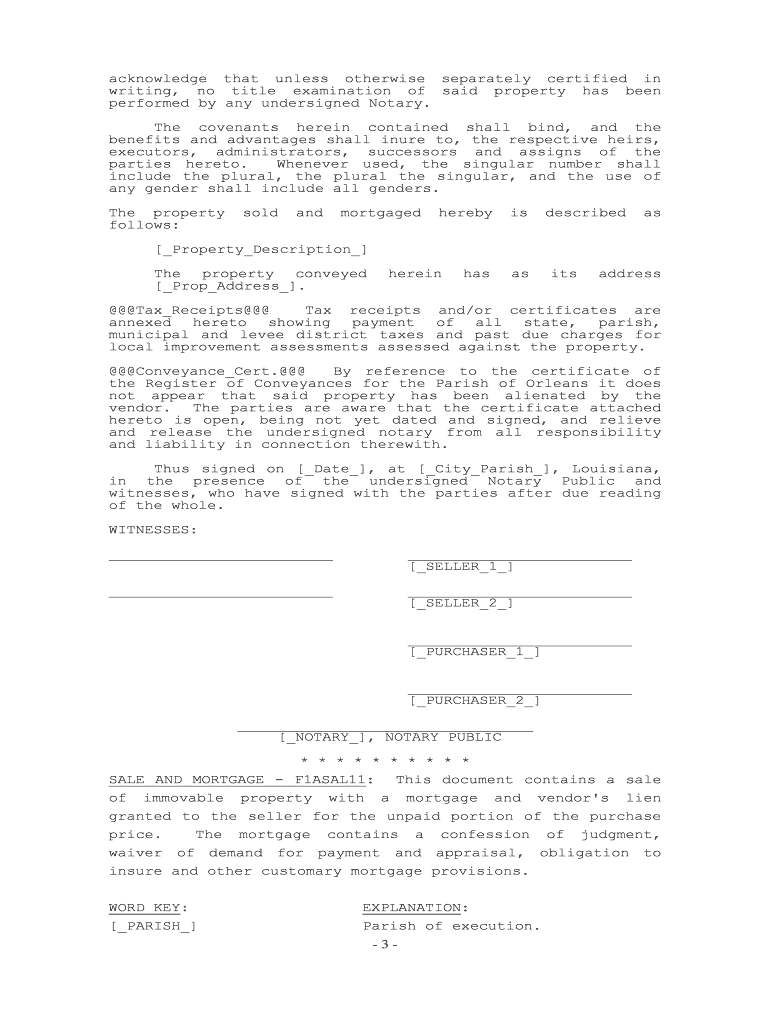

A Credit Deed is a legal document that transfers ownership of property and is recorded by the Caddo Parish Clerk Of Court. The process involves drafting the deed, signing it in the presence of a notary, and then submitting it to the Clerk's office for official recording. This ensures that the transfer is legally recognized and protects the rights of the new owner.

-

How can airSlate SignNow help with the Credit Deed process in Caddo Parish?

airSlate SignNow simplifies the Credit Deed process by allowing users to create, send, and eSign documents securely online. With our platform, you can easily prepare your Credit Deed and ensure all necessary parties can sign it electronically, streamlining the process and reducing paperwork. This efficiency is particularly beneficial for those dealing with the Caddo Parish Clerk Of Court.

-

What are the costs associated with filing a Credit Deed with the Caddo Parish Clerk Of Court?

The costs for filing a Credit Deed with the Caddo Parish Clerk Of Court can vary based on the specific requirements and any additional services needed. Typically, there are filing fees and potential costs for notarization. Using airSlate SignNow can help reduce overall costs by minimizing the need for physical paperwork and in-person visits.

-

What features does airSlate SignNow offer for managing Credit Deeds?

airSlate SignNow offers a range of features for managing Credit Deeds, including customizable templates, secure eSigning, and document tracking. These features ensure that your Credit Deed is completed accurately and efficiently, while also providing a clear audit trail for compliance with Caddo Parish Clerk Of Court requirements.

-

Can I integrate airSlate SignNow with other software for managing Credit Deeds?

Yes, airSlate SignNow can be integrated with various software solutions to enhance your workflow for managing Credit Deeds. This includes CRM systems, document management tools, and cloud storage services. Such integrations can streamline the process of preparing and filing your Credit Deed with the Caddo Parish Clerk Of Court.

-

What are the benefits of using airSlate SignNow for Credit Deeds?

Using airSlate SignNow for Credit Deeds offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. The platform allows for easy collaboration among parties involved in the Credit Deed process, ensuring that all necessary signatures are obtained quickly and securely, which is essential for compliance with the Caddo Parish Clerk Of Court.

-

Is airSlate SignNow compliant with legal standards for Credit Deeds in Caddo Parish?

Yes, airSlate SignNow is designed to comply with legal standards for electronic signatures and document management, including those applicable to Credit Deeds in Caddo Parish. Our platform ensures that all eSigned documents meet the necessary legal requirements, providing peace of mind when filing with the Caddo Parish Clerk Of Court.

The best way to complete and sign your credit deed caddo parish clerk of court form

Find out other credit deed caddo parish clerk of court form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles