Fill and Sign the Do Not File Form Ct 8857 with Your Tax Return Ct

Pragmatic advice on getting your ‘Do Not File Form Ct 8857 With Your Tax Return Ct’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the leading eSignature service for individuals and small to medium-sized businesses. Say farewell to the monotonous task of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and approve documents online. Make use of the robust features embedded in this user-friendly and cost-effective platform and transform your document management methodology. Whether you need to approve forms or collect signatures, airSlate SignNow manages everything seamlessly, needing just a few taps.

Adhere to this comprehensive guide:

- Log in to your account or register for a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

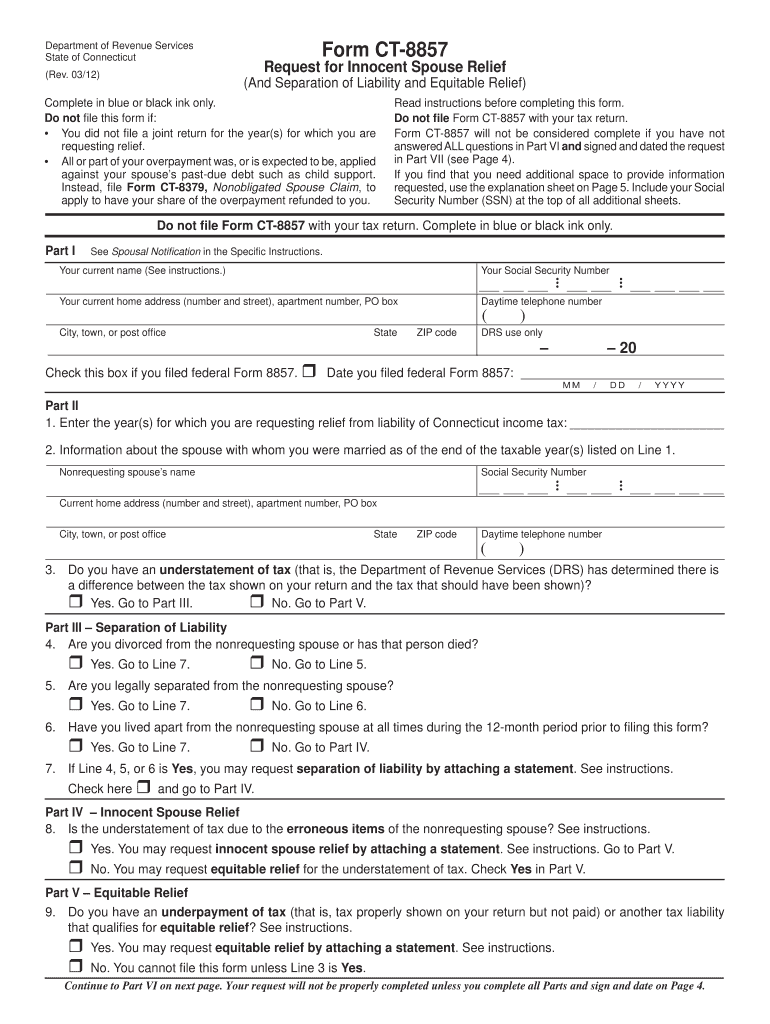

- Open your ‘Do Not File Form Ct 8857 With Your Tax Return Ct’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your side.

- Insert and allocate fillable fields for other parties (if needed).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

No need to worry if you need to collaborate with your colleagues on your Do Not File Form Ct 8857 With Your Tax Return Ct or send it for notarization—our platform offers everything you need to accomplish those tasks. Create an account with airSlate SignNow today and elevate your document management to a new standard!

FAQs

-

What is the importance of not filing Form CT 8857 with your tax return?

It is crucial to understand that you should do not file Form CT 8857 with your tax return, CT, as it may lead to unnecessary complications. Filing this form incorrectly can delay your tax processing and create potential issues with the Connecticut Department of Revenue Services. Ensure you follow the appropriate guidelines to avoid mistakes.

-

How can airSlate SignNow help with tax document management?

airSlate SignNow simplifies the process of managing tax documents, allowing you to securely eSign and send forms without hassle. By using our platform, you can easily organize and track your tax-related documents, ensuring you do not file Form CT 8857 with your tax return, CT, incorrectly. This efficiency can save you time and reduce errors in your tax submissions.

-

What features does airSlate SignNow offer to streamline eSigning?

airSlate SignNow offers a variety of features designed to streamline the eSigning process, including customizable templates and an intuitive user interface. These features ensure that you can efficiently manage all your documents, helping you remember to do not file Form CT 8857 with your tax return, CT. Our solution enhances productivity while maintaining compliance with tax regulations.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow provides a cost-effective solution tailored for small businesses looking to manage their document signing processes. Our pricing plans are designed to fit various budgets, ensuring that even small operations can efficiently handle eSignatures without the need to file unnecessary forms like CT 8857. Enjoy the benefits of a professional eSignature tool at an affordable rate.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various popular software applications, allowing you to seamlessly connect your document management processes. This integration capability ensures that you can manage your tax documents efficiently and remember to do not file Form CT 8857 with your tax return, CT, by keeping everything organized in one platform.

-

What are the benefits of using airSlate SignNow for legal documents?

Using airSlate SignNow for legal documents provides numerous benefits, including enhanced security, compliance, and ease of use. Our platform ensures that your legal agreements are signed and stored securely, helping you avoid filing unnecessary forms like CT 8857. This focus on compliance allows you to focus on your business rather than worrying about paperwork.

-

How does airSlate SignNow ensure document security?

airSlate SignNow prioritizes document security by implementing industry-standard encryption and compliance measures. This ensures that all your sensitive documents, including tax-related forms, are protected while you manage your signatures. As a result, you can confidently handle your tax matters, including the important reminder to do not file Form CT 8857 with your tax return, CT.

Find out other do not file form ct 8857 with your tax return ct

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles