Fill and Sign the Dr 1151 Amend of Agreement on Claiming Tax Exemption for Children 10 15 Domestic Relations 490101904 Form

Valuable tips on finalizing your ‘Dr 1151 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations 490101904’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier eSignature solution for individuals and organizations. Bid farewell to the tedious process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Utilize the comprehensive tools integrated into this user-friendly and affordable platform and transform your approach to document management. Whether you need to approve forms or gather signatures, airSlate SignNow manages it all seamlessly, needing just a few clicks.

Adhere to this comprehensive guide:

- Log into your account or register for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form library.

- Access your ‘Dr 1151 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations 490101904’ in the editor.

- Click Me (Fill Out Now) to finish the form on your end.

- Add and designate fillable fields for other individuals (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

Don’t fret if you need to collaborate with others on your Dr 1151 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations 490101904 or send it for notarization—our platform provides everything you need to accomplish such tasks. Establish an account with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

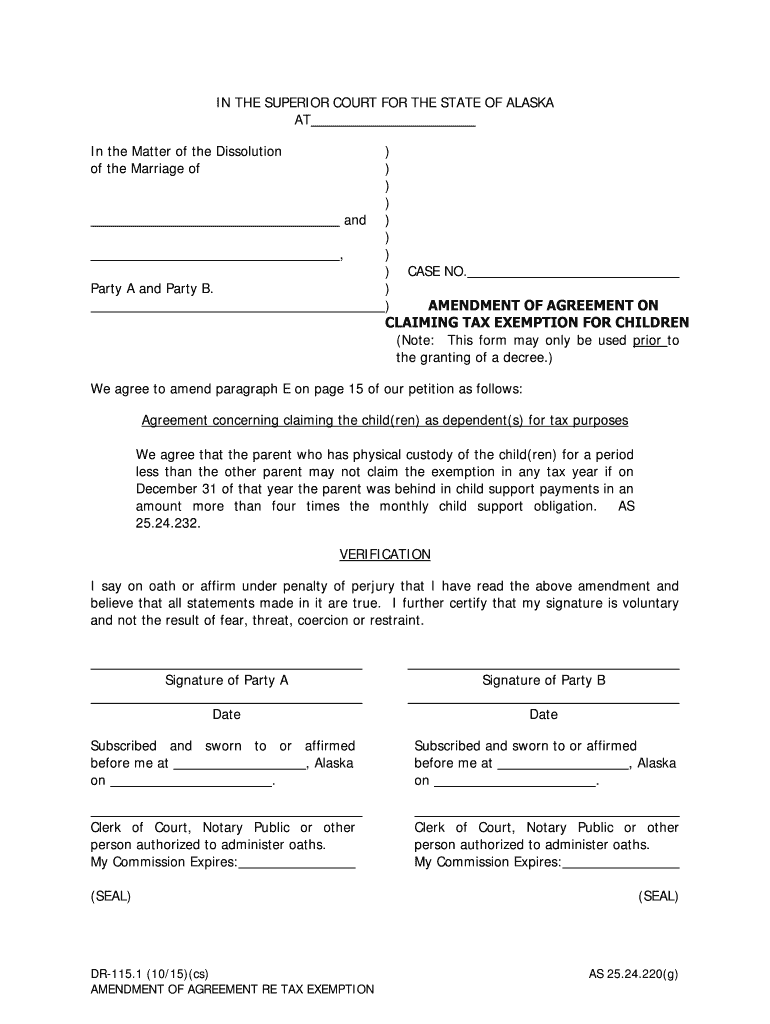

What is the DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations?

The DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations is a legal document that allows parents to amend their agreement regarding tax exemptions for their children. This form is essential for ensuring that both parties are in agreement about who claims the tax exemption, which can signNowly impact tax filings.

-

How can airSlate SignNow help with the DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations?

airSlate SignNow provides a streamlined platform for creating, sending, and eSigning the DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations. Our user-friendly interface ensures that you can easily manage your documents and obtain necessary signatures without hassle.

-

What are the pricing options for using airSlate SignNow for the DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations?

airSlate SignNow offers various pricing plans to accommodate different needs, starting from a basic plan to more advanced options. Each plan provides access to essential features for managing documents like the DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations, ensuring you find a solution that fits your budget.

-

What features does airSlate SignNow offer for the DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations?

With airSlate SignNow, you can enjoy features such as customizable templates, secure eSigning, and document tracking for the DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations. These features enhance efficiency and ensure that your documents are handled securely and professionally.

-

Is airSlate SignNow compliant with legal standards for the DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations?

Yes, airSlate SignNow is designed to comply with all relevant legal standards for electronic signatures and document management. This compliance ensures that your DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations is legally binding and recognized by authorities.

-

Can I integrate airSlate SignNow with other applications for managing the DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when managing the DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations. This flexibility helps you connect with tools you already use, enhancing productivity.

-

What are the benefits of using airSlate SignNow for the DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations?

Using airSlate SignNow for the DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations offers numerous benefits, including time savings, reduced paperwork, and enhanced security. Our platform simplifies the process, allowing you to focus on what matters most while ensuring compliance and efficiency.

The best way to complete and sign your dr 1151 amend of agreement on claiming tax exemption for children 10 15 domestic relations 490101904 form

Find out other dr 1151 amend of agreement on claiming tax exemption for children 10 15 domestic relations 490101904 form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles