Fill and Sign the Employee Contractor Tax Form

Practical instructions for finishing your ‘Employee Contractor Tax’ online

Are you exhausted from the trouble of dealing with paperwork? Look no further than airSlate SignNow, the premier electronic signature platform for individuals and businesses. Bid farewell to the tedious process of printing and scanning documents. With airSlate SignNow, you can smoothly complete and sign documents online. Utilize the extensive features embedded in this user-friendly and cost-effective platform and transform your approach to document management. Whether you need to approve paperwork or gather electronic signatures, airSlate SignNow manages everything seamlessly, with just a few clicks.

Follow this comprehensive guide:

- Sign in to your account or enroll for a free trial with our service.

- Click +Create to upload a file from your device, cloud, or our template library.

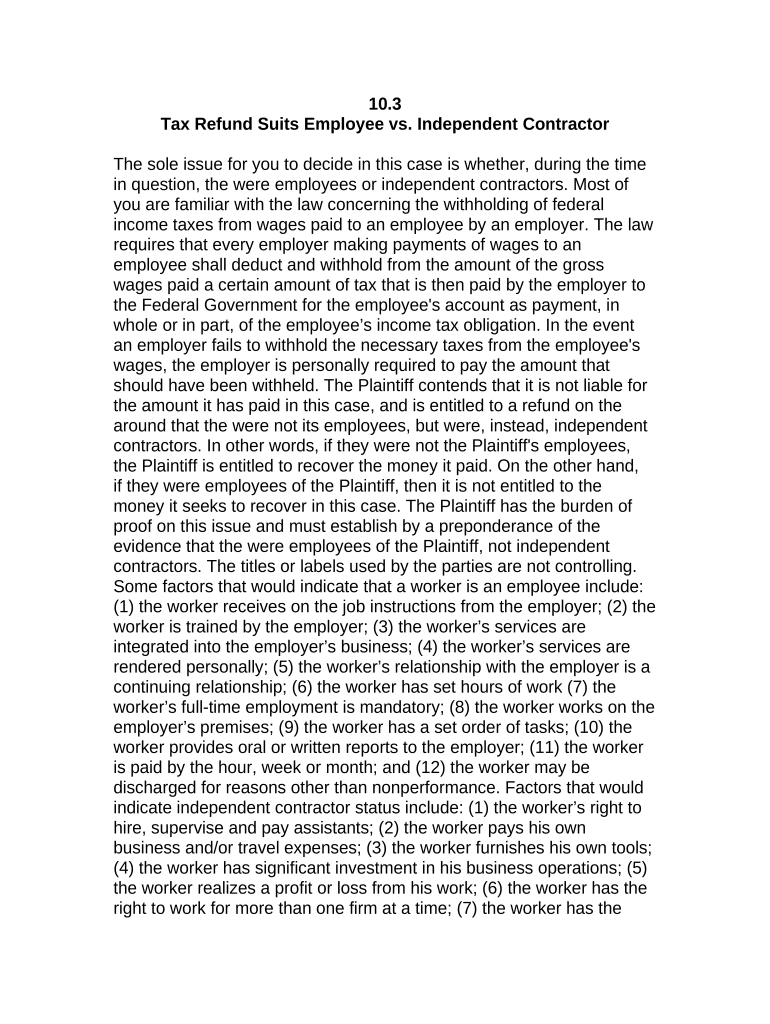

- Open your ‘Employee Contractor Tax’ in the editor.

- Select Me (Fill Out Now) to set up the document on your end.

- Add and designate fillable fields for other participants (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download and print your copy, or convert it into a reusable template.

Don't fret if you need to collaborate with others on your Employee Contractor Tax or send it for notarization—our solution has all you require to accomplish these tasks. Create an account with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

What is Employee Contractor Tax and how does it affect my business?

Employee Contractor Tax refers to the tax obligations that businesses must manage when hiring independent contractors versus employees. Understanding this distinction is crucial for compliance and financial management. Misclassifying workers can lead to penalties, so using tools like airSlate SignNow can help streamline document processes related to contractor agreements.

-

How can airSlate SignNow assist with Employee Contractor Tax documentation?

airSlate SignNow simplifies the management of Employee Contractor Tax documentation by allowing businesses to create, send, and eSign contracts effortlessly. This digital solution ensures that all necessary tax forms and agreements are properly prepared and signed, reducing the risk of errors and compliance issues. With our platform, you can easily track document statuses and maintain organized records.

-

Is there a cost associated with using airSlate SignNow for Employee Contractor Tax forms?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs, including options for managing Employee Contractor Tax forms. Our competitive pricing ensures you get a cost-effective solution for your document signing needs. You can choose a plan that scales with your business, providing value as you grow.

-

What features does airSlate SignNow offer to help manage Employee Contractor Tax processes?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time status tracking that are essential for managing Employee Contractor Tax processes. These features enable efficient document creation and ensure that all parties stay informed throughout the signing process. Ultimately, this reduces delays and enhances compliance.

-

Can airSlate SignNow integrate with accounting software for Employee Contractor Tax?

Yes, airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage Employee Contractor Tax obligations. This integration allows you to sync signed documents directly with your accounting system, ensuring that all tax-related information is accurately captured and maintained. Simplifying your workflow in this manner saves time and reduces errors.

-

How secure is airSlate SignNow for handling Employee Contractor Tax documents?

Security is a top priority for airSlate SignNow, especially when handling sensitive Employee Contractor Tax documents. We utilize advanced encryption and compliance protocols to protect your data at all stages of the signing process. You can trust that your documents are safe and secure with our platform.

-

What benefits does airSlate SignNow provide for managing Employee Contractor Tax?

Using airSlate SignNow for Employee Contractor Tax management offers numerous benefits, including increased efficiency, reduced paperwork, and improved compliance. Our platform streamlines the signing process, enabling faster turnaround times for contracts and forms. Additionally, the digital nature of our solution minimizes the risk of physical document loss or mismanagement.

The best way to complete and sign your employee contractor tax form

Find out other employee contractor tax form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles