Fill and Sign the Fill in PDF Single Member Llc in State of Nj Form

Useful advice on preparing your ‘Fill In Pdf Single Member Llc In State Of Nj Form’ online

Are you fed up with the burden of handling paperwork? Look no further than airSlate SignNow, the leading eSignature solution for individuals and organizations. Bid farewell to the monotonous task of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign paperwork online. Take advantage of the powerful tools integrated into this user-friendly and affordable platform and transform your method of document administration. Whether you need to sign forms or gather electronic signatures, airSlate SignNow manages it effortlessly, requiring only a few clicks.

Follow this detailed guide:

- Sign in to your account or sign up for a complimentary trial with our service.

- Select +Create to upload a file from your device, cloud storage, or our form collection.

- Access your ‘Fill In Pdf Single Member Llc In State Of Nj Form’ in the editor.

- Click Me (Fill Out Now) to set up the form on your end.

- Add and designate fillable fields for others (if necessary).

- Proceed with the Send Invite options to request eSignatures from others.

- Download, print your version, or convert it into a reusable template.

Don’t worry if you need to collaborate with your colleagues on your Fill In Pdf Single Member Llc In State Of Nj Form or send it for notarization—our platform provides everything you require to achieve such tasks. Register with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

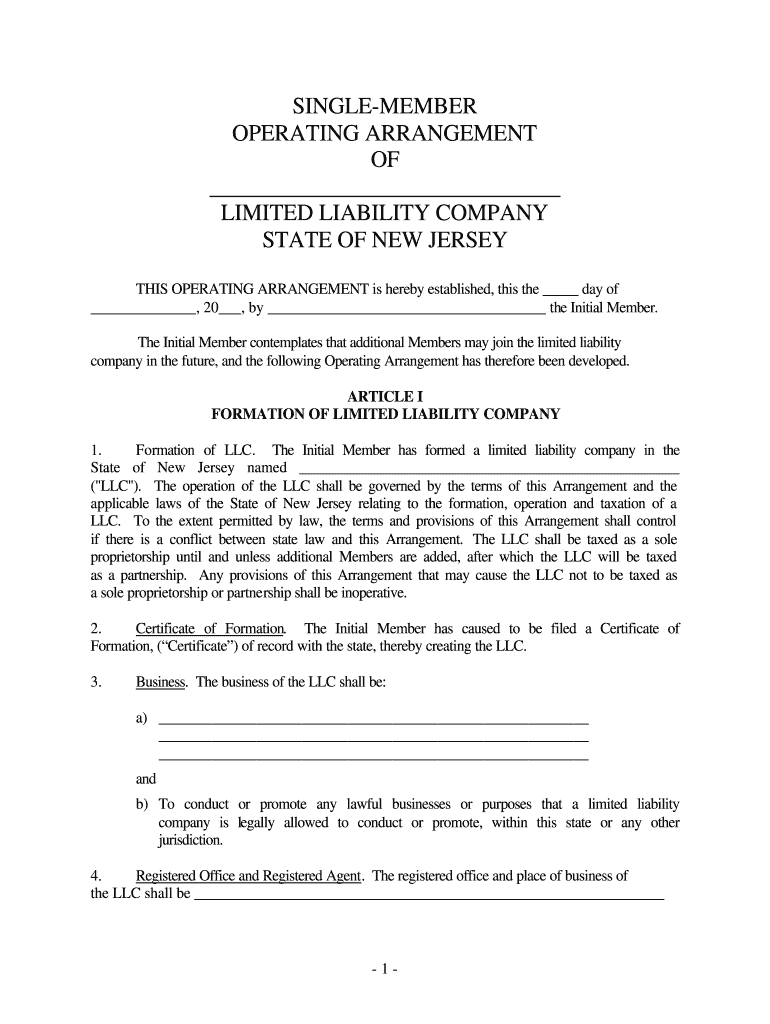

What is a Single Member LLC Operating Agreement in NJ?

A Single Member LLC Operating Agreement in NJ is a legal document that outlines the management structure and operational guidelines for a single-member limited liability company. This agreement is essential for defining the member's rights, responsibilities, and the LLC's financial arrangements, ensuring clarity and protection for the business owner.

-

Why do I need a Single Member LLC Operating Agreement in NJ?

Having a Single Member LLC Operating Agreement in NJ is crucial for establishing your business as a separate legal entity, which can help protect your personal assets. This document also helps in maintaining compliance with state laws and can enhance your credibility with banks and potential investors.

-

How can airSlate SignNow help me create a Single Member LLC Operating Agreement in NJ?

airSlate SignNow provides an easy-to-use platform to create, customize, and eSign your Single Member LLC Operating Agreement in NJ. With our templates and user-friendly interface, you can quickly draft an agreement that meets your specific needs, ensuring that your LLC is set up correctly.

-

What are the costs associated with obtaining a Single Member LLC Operating Agreement in NJ?

The cost of creating a Single Member LLC Operating Agreement in NJ can vary depending on whether you choose to draft it yourself or hire a professional. Using airSlate SignNow, you can create and eSign your agreement at a fraction of the cost compared to traditional legal services, making it a cost-effective solution.

-

Can I modify my Single Member LLC Operating Agreement in NJ later?

Yes, you can modify your Single Member LLC Operating Agreement in NJ at any time to reflect changes in your business structure, management, or operations. airSlate SignNow allows you to easily edit and re-eSign your agreement, ensuring that it remains up-to-date and compliant with your current business needs.

-

What features does airSlate SignNow offer for managing my Single Member LLC Operating Agreement in NJ?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document storage specifically for managing your Single Member LLC Operating Agreement in NJ. These tools streamline your workflow and ensure that your documents are easily accessible and legally binding.

-

Is airSlate SignNow secure for creating legal documents like a Single Member LLC Operating Agreement in NJ?

Absolutely! airSlate SignNow employs advanced security measures to protect your data and documents, making it a safe choice for creating your Single Member LLC Operating Agreement in NJ. With encryption and secure cloud storage, you can trust that your information is protected.

Find out other fill in pdf single member llc in state of nj form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles