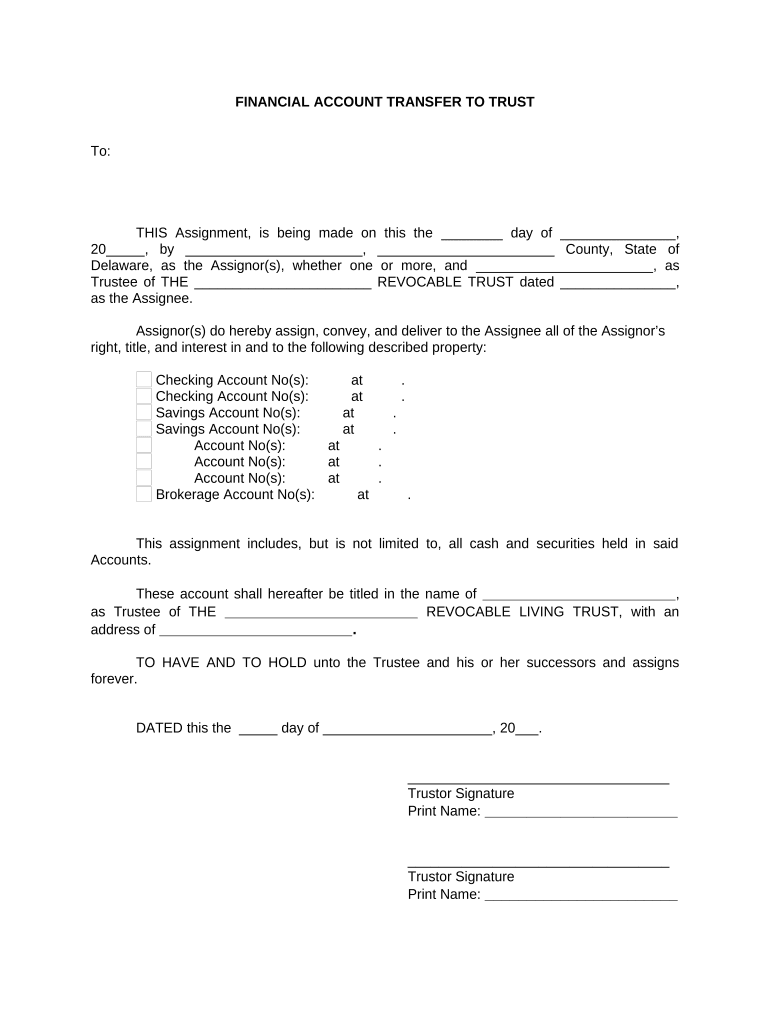

Fill and Sign the Financial Account Transfer to Living Trust Delaware Form

Useful suggestions for preparing your ‘Financial Account Transfer To Living Trust Delaware’ online

Feeling overwhelmed by the burden of paperwork? Look no further than airSlate SignNow, the leading eSignature solution for individuals and companies. Bid farewell to the tedious routine of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign paperwork online. Utilize the robust features integrated into this user-friendly and cost-effective platform to transform your paperwork management approach. Whether you need to sign forms or collect digital signatures, airSlate SignNow simplifies the entire process with just a few clicks.

Adhere to this comprehensive guide:

- Access your account or initiate a free trial with our service.

- Hit +Create to upload a document from your device, cloud storage, or our template collection.

- Open your ‘Financial Account Transfer To Living Trust Delaware’ in the editor.

- Select Me (Fill Out Now) to fill out the form on your end.

- Insert and allocate fillable fields for others (if needed).

- Continue with the Send Invite settings to request digital signatures from others.

- Download, print your copy, or transform it into a reusable template.

Don’t fret if you need to collaborate with your coworkers on your Financial Account Transfer To Living Trust Delaware or send it for notarization—our solution encompasses everything you need to achieve those tasks. Register with airSlate SignNow today and enhance your document management to new levels!

FAQs

-

What is the process for a Financial Account Transfer To Living Trust in Delaware?

The process for a Financial Account Transfer To Living Trust Delaware typically involves creating a trust document, funding the trust, and then transferring your financial accounts into the trust. This process ensures your assets are managed according to your wishes after your passing. It’s advisable to work with a legal professional to ensure compliance with state laws.

-

How can airSlate SignNow assist with the Financial Account Transfer To Living Trust Delaware?

airSlate SignNow simplifies the Financial Account Transfer To Living Trust Delaware by allowing you to easily create, sign, and manage your trust documents online. Our platform provides templates and ensures that all necessary signatures are obtained quickly and securely, streamlining the entire process.

-

What are the benefits of transferring my financial accounts to a living trust in Delaware?

Transferring your financial accounts to a living trust in Delaware can provide benefits such as avoiding probate, maintaining privacy, and ensuring a smooth transition of assets. With the Financial Account Transfer To Living Trust Delaware, you can also manage your assets during your lifetime and protect your beneficiaries.

-

Are there any costs associated with the Financial Account Transfer To Living Trust Delaware?

Yes, there can be costs associated with the Financial Account Transfer To Living Trust Delaware, including legal fees for drafting the trust document and potential filing fees. However, using airSlate SignNow can help reduce costs by providing a cost-effective solution for managing and eSigning necessary documents.

-

Can I integrate airSlate SignNow with other financial management tools during the Financial Account Transfer To Living Trust Delaware?

Absolutely! airSlate SignNow offers integrations with various financial management tools and platforms to facilitate the Financial Account Transfer To Living Trust Delaware. This ensures that you can seamlessly manage your documents and financial accounts in one place.

-

What features does airSlate SignNow offer for managing my living trust documents?

airSlate SignNow provides features such as templates for trust documents, secure eSigning, document tracking, and easy sharing options. These features make the Financial Account Transfer To Living Trust Delaware process more efficient and user-friendly.

-

Is it necessary to hire a lawyer for the Financial Account Transfer To Living Trust Delaware?

While it's not strictly necessary, hiring a lawyer for the Financial Account Transfer To Living Trust Delaware can be beneficial, especially for complex situations. Legal professionals can provide guidance specific to Delaware laws and ensure that your trust is structured correctly.

The best way to complete and sign your financial account transfer to living trust delaware form

Find out other financial account transfer to living trust delaware form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles