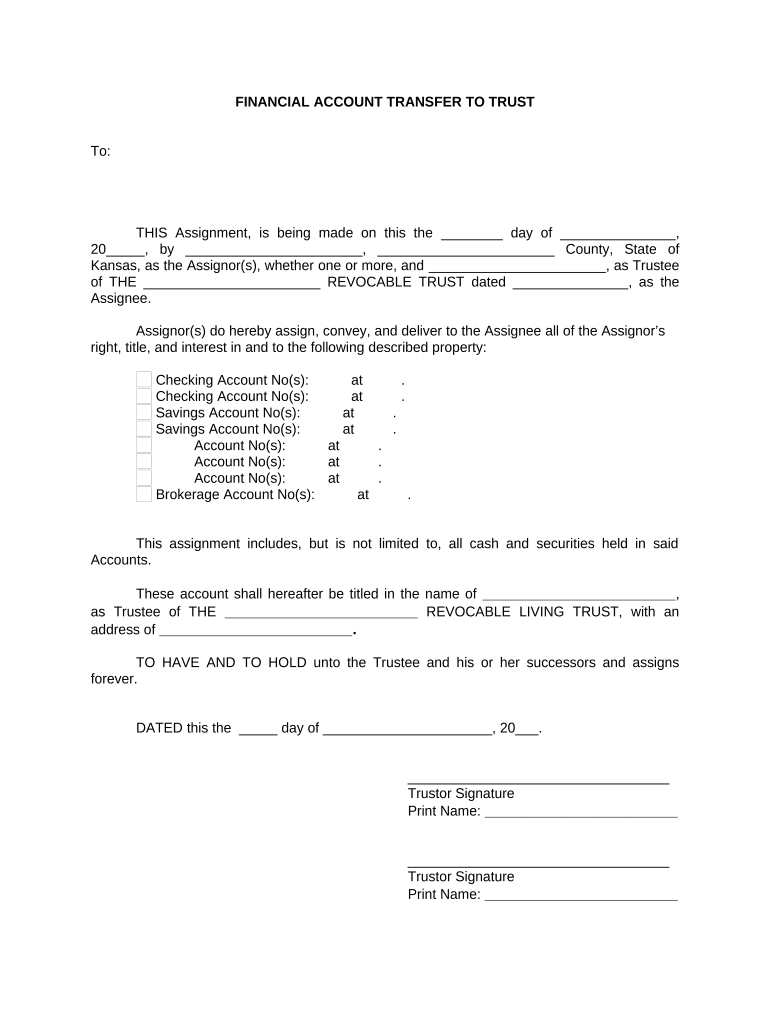

Fill and Sign the Financial Account Transfer to Living Trust Kansas Form

Valuable tips on setting up your ‘Financial Account Transfer To Living Trust Kansas’ online

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the premier electronic signature tool for individuals and businesses. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can easily finalize and authorize paperwork online. Take advantage of the powerful features integrated into this user-friendly and cost-effective platform and transform your method of managing paperwork. Whether you need to authorize forms or collect signatures, airSlate SignNow takes care of everything with just a few clicks.

Follow this detailed guide:

- Access your account or sign up for a complimentary trial of our service.

- Click +Create to upload a document from your device, cloud, or our template repository.

- Edit your ‘Financial Account Transfer To Living Trust Kansas’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and designate fillable fields for other participants (if necessary).

- Proceed with the Send Invite options to solicit eSignatures from others.

- Download, print your version, or convert it into a multi-usable template.

No need to worry if you want to collaborate with others on your Financial Account Transfer To Living Trust Kansas or send it for notarization—our solution provides all the tools you need to complete these tasks. Register with airSlate SignNow today and elevate your document management to a new height!

FAQs

-

What is involved in a Financial Account Transfer To Living Trust in Kansas?

A Financial Account Transfer To Living Trust in Kansas involves legally transferring ownership of your financial accounts to your living trust. This process ensures that your assets are managed according to your wishes after your passing. Utilizing airSlate SignNow can simplify this procedure by allowing you to eSign necessary documents quickly and securely.

-

How can airSlate SignNow assist with the Financial Account Transfer To Living Trust Kansas process?

airSlate SignNow provides an efficient platform for managing the Financial Account Transfer To Living Trust Kansas process. Our service allows you to easily create, send, and eSign the required documents online, streamlining the transfer of financial accounts to your living trust without the hassle of paper forms.

-

Are there any fees associated with using airSlate SignNow for Financial Account Transfer To Living Trust Kansas?

Yes, while airSlate SignNow offers a cost-effective solution, there may be fees associated with certain features or plans. We recommend reviewing our pricing options to find the best fit for your needs when handling a Financial Account Transfer To Living Trust Kansas.

-

What types of financial accounts can be transferred to a living trust in Kansas?

In Kansas, you can transfer various types of financial accounts to your living trust, including bank accounts, investment accounts, and retirement accounts. It's essential to ensure that all necessary paperwork is completed accurately, which airSlate SignNow can help facilitate through its user-friendly eSigning process.

-

What are the benefits of transferring financial accounts to a living trust in Kansas?

Transferring financial accounts to a living trust in Kansas offers several benefits, including avoiding probate, ensuring privacy, and providing better control over asset distribution. With airSlate SignNow, you can easily manage this transfer process, making it more convenient and efficient.

-

Can I integrate airSlate SignNow with other tools for managing my living trust documents?

Yes, airSlate SignNow offers various integrations with popular tools and platforms, enhancing your ability to manage your living trust documents effectively. This can simplify the Financial Account Transfer To Living Trust Kansas process, allowing for better organization and accessibility of your documents.

-

Is legal assistance required for a Financial Account Transfer To Living Trust Kansas?

While it's not strictly necessary to have legal assistance for a Financial Account Transfer To Living Trust Kansas, consulting a legal professional can provide peace of mind and ensure compliance with state laws. Using airSlate SignNow can help simplify the process, but having an attorney review your documents is advisable.

The best way to complete and sign your financial account transfer to living trust kansas form

Find out other financial account transfer to living trust kansas form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles