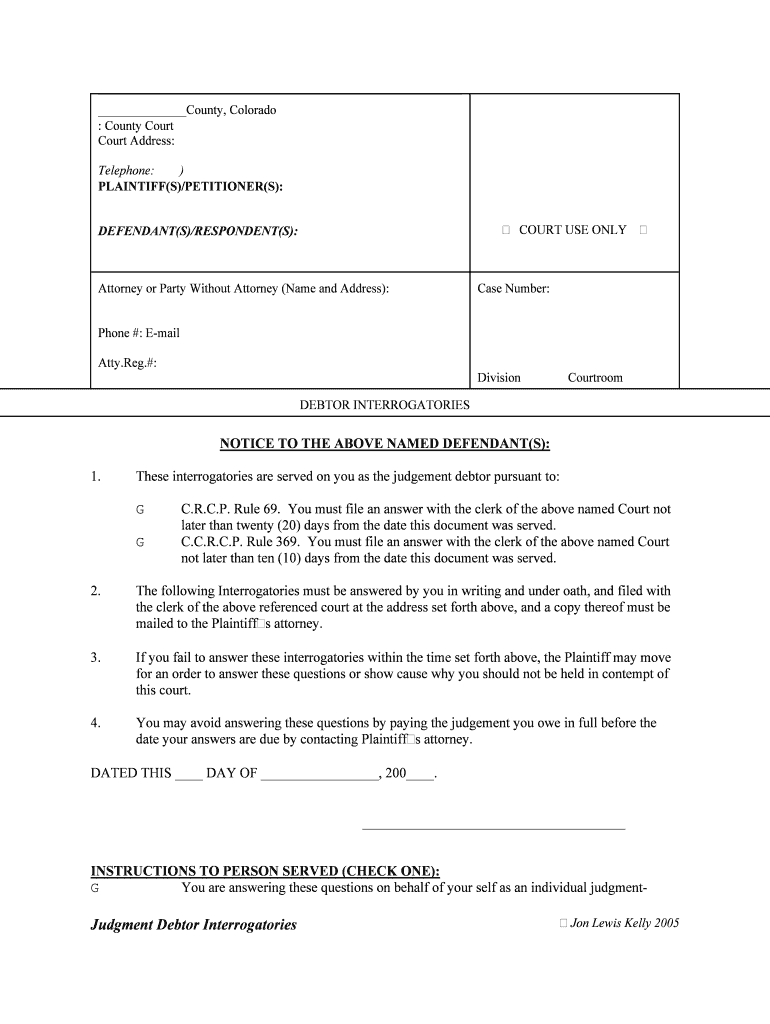

Jon Lewis Kelly 2005 Judgment Debtor Interrogatories______________County, Colorado� County CourtCourt Address:Telephone: )PLAINTIFF(S)/PETITIONER(S):DEFENDANT(S)/RESPONDENT(S): COURT USE ONLY Attorney or Party Without Attorney (Name and Address):Phone #: E-mailAtty.Reg.#: Case Number: Division Courtroom DEBTOR INTERROGATORIES NOTICE TO THE ABOVE NAMED DEFENDANT(S): 1. These interrogatories are served on you as the judgement debtor pursuant to:GC.R.C.P. Rule 69. You must file an answer with the clerk of the above named Court not

later than twenty (20) days from the date this document was served.GC.C.R.C.P. Rule 369. You must file an answer with the clerk of the above named Court

not later than ten (10) days from the date this document was served.2. The following Interrogatories must be answered by you in writing and under oath, and filed with

the clerk of the above referenced court at the address set forth above, and a copy thereof must be

mailed to the Plaintiffs attorney.3. If you fail to answer these interrogatories within the time set forth above, the Plaintiff may move

for an order to answer these questions or show cause why you should not be held in contempt of

this court.4. You may avoid answering these questions by paying the judgement you owe in full before the

date your answers are due by contacting Plaintiff s attorney.DATED THIS ____ DAY OF _________________, 200____.______________________________________INSTRUCTIONS TO PERSON SERVED (CHECK ONE):G You are answering these questions on behalf of your self as an individual judgment-

Jon Lewis Kelly 2005 Judgment Debtor Interrogatoriesdebtor: you are required to answer only questions 1 through 28.GYou are answering these questions on behalf of an entity: you are required to answer

only questions 29 through 40.G You are answering these questions on behalf of both yourself and an entity: you are

required to answer questions 1 through 40.PART A: QUESTIONS FOR INDIVIDUAL JUDGEMENT-DEBTORS:1. Please provide the following information about yourself:a. Your full legal name:b. List any other names, aliases or

nicknames you use:c. Your current physical address:________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zipd. Your current mailing address:________________________ _________Street or Box No. Unit or Apt No.________________________ _________ ________City State Zipe. Your social security number:______-_____-_________f. Your date of birth:______/_______/________ (DD/MM/YYYY)g. State your home, cell and other

telephone numbers where you may be contacted.(______) _______-_____________ Home(______) _______-_____________ Cell(______) _______-_____________ Otherh. Indicate if you reside in a house,

apartment, or mobile home: House; Apartment; Mobile Home; Other (specify): ___________________________2. Do you own the home you live in? __________ (Yes/No) If Yes please answer the following:a. The address of that home:________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zipb. The current market value:c. The balance due on any

mortgages:1st

Mortgage: _____________________2nd

Mortgage: _____________________d. The name and address of each 1st

Mortgage:

Jon Lewis Kelly 2005 Judgment Debtor Interrogatoriesmortgage holder:_________________________________________2nd

Mortgage: _________________________________________e. List the name and address of any

person or business to whom you

lease or rent all or any portion of

this property (including oil and gas

leases.) Provide amount of rent._________________________________ _________________Name of tenant Amount of monthly rent________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zipf. State the name and address of

any person who owns an interest in your home with you._________________________________ Name of tenant________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zip3. How many other tracts of real property (including but not limited to fee interests, mineral interests, transferable development rights, time shares, and contingent interests) do you have an ownership

interest in (whether held individually or with another, and whether mortgaged or not)? ____________.

For each such property, please answer the following (attach additional pages as necessary):a. The address:________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zipb. The current market value:c. The balance due on any

mortgages:1st

Mortgage: _____________________2nd

Mortgage: _____________________d. The name and address of each

mortgage holder:1st

Mortgage: ________________________________________2nd

Mortgage: _________________________________________e. List the name and address of any

person or business to whom you

lease or rent all or any portion of

this property (including oil and gas

leases.) Provide amount of rent._________________________________ _________________Name of tenant Amount of monthly rent________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zipf. State the name and address of

any person who also owns an interest in this property._________________________________ Name of tenant________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zip4. If you lease or rent property, provide the following information:

Jon Lewis Kelly 2005 Judgment Debtor Interrogatoriesa. The name of your landlordb. The address of your landlord________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zipc. The amount of your deposit5. Are you employed? _______ (Yes/No). If yes please answer the following:a. The name of your employerb. The address of your employer________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zipc. The amount you earn per month

(including salary, wages, overtime,

incentive pay, benefits, commissions, tips, and bonuses):6. Do you have other employment besides that listed above? __________ (yes/no). If yes , for each

such additional employment, please provide the following (attach the additional pages as necessary):a. The name of your employerb. The address of your employer________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zipc. The amount you earn per month

(including salary, wages, overtime,

incentive pay, benefits, commissions, tips, and bonuses):7. Are you self-employed, own an interest in a closely held corporation, are a member of a limited

liability company, are a partner in any kind of a partnership, or a member of a nonprofit corporation?

_______ (yes/no). If yes, how many such entities do you have an ownership interest in? ________. For

each such business, please provide the following information (attach additional pages as necessary):a. Name of this business or entity:b. Address of the business or

entity:c. State the average monthly gross

income of the business or entity for

the past six months.

Jon Lewis Kelly 2005 Judgment Debtor Interrogatoriesd. List all personal property and

intangible property owned by the business or entity (including by way of example: tools, machinery, automobiles, inventory, supplies,

equipment, trade names and trade marks). Indicate whether each is

encumbered by a lien and where it

is located. (Attach additional pages as necessary).e. List all accounts receivable of the business or entity, including the

name and address of each debtor and the amount owed (attach

additional pages as necessary).__________________________ __________________Name of debtor Amount owed________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zip__________________________ __________________Name of debtor Amount owed________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zipf. List all real property in which

the business has an ownership

interest.g. State the amount of cash

reserves, retained earnings and capital accounts of the business.h. List the name of the bank,

account number and balance of

each checking or other bank

account held by the business or

entity (attached additional pages as necessary)._______________________ ______________________Name of Financial Institution Account Number_______________________Account Balance_______________________ ______________________Name of Financial Institution Account Number_______________________Account Balancei. List the names, addresses and telephone numbers of any person

besides yourself who has an __________________________ __________________Name of Co-Owner % Ownership________________________ _________

Jon Lewis Kelly 2005 Judgment Debtor Interrogatoriesownership interest in this business or entity and describe the percentage of their ownership

interest.Street Unit or Apt No.________________________ _________ ________City State Zip__________________________ __________________Name of Co-Owner % Ownership________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zipj. How much of this business or

entity do you own?k. What type of entity is this

business (ie: corporation, sole proprietorship, LLC, partnership?)l. What does this business do?8. Are you (or do you expect that you will be in the next 12 months) the beneficiary of any decedents

estate, trust, annuity, class action lawsuit settlement, or insurance policy proceeds? _____ (yes/no). If

yes please state the following for each (attach additional pages as necessary):a. Describe the nature of each

interest in which you are a

beneficiary. (For example, if you

expect to inherit money form a

decedents estate, please state the

name of the decedent, the court in

which the estate is probated, and the amount you expect to inherit).b. State the name and address of

the of personal representative, trustee, insurer, or other administrator involved in each interest. __________________________Name________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zip9. Presently, or in the next twelve months, do you expect to perform services in any of the building

trades, work as a consultant in any field, or perform contract labor or services of any kind? ______

(yes/no). If yes please answer the following questions (attach additional pages as necessary).a. Provide the name and address

of each and every person or entity

with whom you currently have (or _________________________ [Project 1]Name

Jon Lewis Kelly 2005 Judgment Debtor Interrogatories________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zipexpect to have) a bid, contract, or

other agreement to perform work for as a builder, tradesman,

consultant, or contract laborer in

the next twelve months._________________________ [Project 2]Name________________________ _________Street Unit or Apt No.________________________ _________ ________City State ZipProject 1: Time and materials; Contract or bid price; Other manner of payment (specify)______________________Dates/amount of payment:___________________________________________________________________________________b. For each project (the person or

entity you identified above) state

the manner of payment, how much,

and when you expect to be paid.Project 2: Time and materials; Contract or bid price; Other manner of payment (specify) _____________________Dates/amount of payment:____________________________________________________________________________________________________________ [Project 1]Name________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zipc. For each project (the person or

entity you identified above) identify

the name and address of the person or entity who will be paying you

(for example, identify the bank or

general contractor who will make

payments directly to you on a building project)._________________________ [Project 2]Name________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zip10. Do you have any other sources of income, including, but not limited to: gifts, royalties, contest or

lottery winnings, yard sales, hobbies, or Ebay trades; or government benefits such as workman s

compensation, disability, old age pension, Medicare, Medicaid, means-tested welfare, or

unemployment)? _____ (yes/no). If yes, for each, state the following (attach additional pages as

necessary):a. Description of source of income:

Jon Lewis Kelly 2005 Judgment Debtor Interrogatoriesb. Name and address of person or entity paying you this income:__________________________Name________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zipc. Ave. monthly amount paid from

this source of income:11. Does anyone owe you money, or have possession of anything of value that is yours (including for

example, someone you loaned money to, someone you are suing, people who are holding or storing

property that belongs to you, and utilities who are holding refundable deposits)? ______ (Yes/no). If

yes, state the following for each (attach additional pages as necessary):a. Description and amount or

value:b. Name and address of person who owes this to you:__________________________ Name________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zip__________________________Name________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zip12. What is the amount of the income tax refund you expect to receive this year: ______________.13. What were the gross earnings you reported on your last Federal Tax Return: ______________.14. Do you own an interest in any of the following: stocks (whether publicly or privately traded),

bonds, mutual funds, brokerage accounts, trusts, limited partnerships, certificates of deposits, securities, promissory notes, deeds of trust, or other investments? _______ (yes/no). If yes, for each, state the

following (attach additional pages as necessary).a. Description of each investment

described above, including amount.b. Name and address of person or entity involved (for example, the __________________________ ___________________Name Value

Jon Lewis Kelly 2005 Judgment Debtor Interrogatoriesname of company in which you own stock or the brokerage or

investment firm holding these investments) and value of each________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zip__________________________ ___________________Name Value________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zip15. What is the dollar amount of cash you have on hand: ____________________________________.16. How many bank accounts (including checking, savings and money market accounts) do you have an interest in or are authorized to sign

checks for (whether individually or with another)? _______. For each state the following (attach additional pages as necessary):a. Description of your interest in

each such account:1st

Account: __________________________________________2nd

Account: __________________________________________3rd

Account: __________________________________________b. Name and address of the financial institution holding the account, the balance of each such

account and the account number:_______________________ ______________________Name of Financial Institution Account NumberAddress:_______________________Account Balance_______________________ ______________________Name of Financial Institution Account NumberAddress:_______________________Account Balance_______________________ ______________________Name of Financial Institution Account NumberAddress:_______________________Account Balance17. Do you own or have an interest in any IRA, 401(k), retirement plan, pension, credit union, or profit sharing plans? _________ (Yes/no). If

yes, please state the following:a. Name and address of the financial institution or other entity holding or managing these funds, the balance of each such account

and the account number:_______________________ ______________________Name of Financial Institution/Entity Account NumberAddress:_______________________

Jon Lewis Kelly 2005 Judgment Debtor InterrogatoriesAccount Balance/Value_______________________ ______________________Name of Financial Institution/Entity Account NumberAddress:_______________________Account Balance/Value_______________________ ______________________Name of Financial Institution/Entity Account NumberAddress:_______________________Account Balance/Value18. Describe all insurance policies which you own, or have an interest in, and which have a cash surrender value, including the name and

address of the insurer and the value.19. List and describe all copyrights, published or unpublished writings or works, inventions, patents, trade names, trademarks, internet domain

names, and other intellectual or intangible property in which you own or have an interest in.20. How many motor vehicles (cars, trucks, vans, motorcycles), boats, snowmobiles, water craft, aircraft, all terrain vehicles or off highway

vehicles (ATVs or OHVs), mobile homes, manufactured homes, motor homes, camping trailers, utility trailers, livestock trailers, or like

vehicles, trailers, or recreational vehicles do you own or have an interest in (whether individually or with another person)? ___________. For

each, state the following information (attach additional pages as necessary):a. Describe each and state the year,

make, model, VIN or serial

number, value, location, and name

and address of any lien holder:_______________________________ ____________ Description Year _____________ ___________ ___________________ Make Model VIN or Serial Number________________________ ___________________________Value Location____________________________________________________

Jon Lewis Kelly 2005 Judgment Debtor InterrogatoriesName and address of lien holder (if any)_______________________________ ____________ Description Year _____________ ___________ ___________________ Make Model VIN or Serial Number________________________ ___________________________Value Location____________________________________________________Name and address of lien holder (if any)_______________________________ ____________ Description Year _____________ ___________ ___________________ Make Model VIN or Serial Number________________________ ___________________________Value Location____________________________________________________Name and address of lien holder (if any) _______________________________ ____________ Description Year _____________ ___________ ___________________ Make Model VIN or Serial Number________________________ ___________________________Value Location____________________________________________________Name and address of lien holder (if any)21. Describe and provide the location of all jewelry, lawfully possessed Native American antiquities, precious metals, rare coins, antiques, art,

sporting goods, firearms, mountain or road bicycles, skis, snow boards, Native American rugs or folk art, horse tack, electronics, tools, and

other collectibles and like property, in which you have an ownership interest (attach additional pages as necessary):

Jon Lewis Kelly 2005 Judgment Debtor Interrogatories22. Describe and state the location of all horses, cattle, and other livestock, registered brands, farm and ranch machinery tools and equipment,

grazing permits, agricultural leases, and crops in which you have an ownership interest.23. Describe and list the location of all of your furnishings and appliances.24. Describe and provide the location of any bank safe deposit box or storage units which you own or

lease and describe the contents of each.

Jon Lewis Kelly 2005 Judgment Debtor Interrogatories25. Describe all other real, personal, or intangible assets which you have not listed elsewhere.26. Have you given, sold, transferred, or assigned to any person or entity any money, real property,

personal property, intangible property, or anything else of value during the past 36 months? _______

(yes/no). If so, for each, state the following (attach additional pages as necessary):Using the form on the right answer these questions:a. Describe separately all property and things of value that you have

given, sold, transferred or assigned.b. Provide the name and address of the person or entity to whom it was

transferred.c. The date transferred.d. The value of the property

transferred.e. The amount you where paid for

the property.f. Describe how the person or

entity who received the property is

related to you. In doing so, indicate if that person or entity falls into one ____________________________________________________Description of property transferred____________________________________________________Name and Address of Person to Whom Property Transferred ________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zip______________________ ____________________________Date of Transfer Value of Property Transferred______________________ ____________________________Amount You Were Paid Description of relationship___________________________________________________Description of property transferred____________________________________________________Name and Address of Person to Whom Property Transferred ________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zip______________________ ____________________________Date of Transfer Value of Property Transferred

Jon Lewis Kelly 2005 Judgment Debtor Interrogatoriesof the following three categories:(i) Creditor: The person or entity

is a creditor (someone you owed

money to);

(ii) Relative: The person to whom

you transferred the property is a

relative of yours by blood or marriage. In which case, describe

how you are related.

(iii) Insider/Affiliate: The entity to

which you transferred the property

is a business entity (partnership, LLC, corporation, etc.) in which you are an officer, director, owner, or otherwise have control over.

______________________ ____________________________Amount You Were Paid Description of relationship___________________________________________________Description of property transferred____________________________________________________Name and Address of Person to Whom Property Transferred ________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zip______________________ ____________________________Date of Transfer Value of Property Transferred______________________ ____________________________Amount You Were Paid Description of relationship___________________________________________________Description of property transferred____________________________________________________Name and Address of Person to Whom Property Transferred ________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zip______________________ ____________________________Date of Transfer Value of Property Transferred______________________ ____________________________Amount You Were Paid Description of relationship27. State the name and current address of your spouse and/or former spouse:28. How many pages have you attached to these interrogatories? ________________.PART B: SMALL BUSINESS DEBTOR INTERROGATORIES:29. Please state the following information about the person answering these interrogatories on behalf of a corporate debtor (defined as any

corporation, limited liability company, partnership, limited partnership, limited liability partnership, or non profit corporation):a. Your name:b. Your address:________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zip

Jon Lewis Kelly 2005 Judgment Debtor Interrogatoriesc. Your telephone number:(______) _______-_____________d. Your title and relationship to

the debtor company30. If corporate debtor leases real property, provide the following information:a. The name of landlordb. The address of landlord________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zipc. The amount of security deposit31. Answer all of the following questions about the corporate debtor (attach additional pages as

necessary):a. All names and trade names used

by this business:b. Addresses of all business locations:c. State the average monthly gross

income of the business for the past

twelve months.d. List all personal property and

intangible property owned by the corporate debtor (including by way of example: tools, machinery,

automobiles, inventory, supplies,

equipment, trade names and trade marks). Indicate which property

is encumbered by a lien. Describe

the location of each. (Attach

additional pages as necessary).

Jon Lewis Kelly 2005 Judgment Debtor Interrogatoriese. List all accounts receivable of the debtor, including the name,

address, and phone number of each

debtor (attach additional pages as

necessary).__________________________ __________________Name of debtor Amount owed________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zip__________________________ __________________Name of debtor Amount owed________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zip

Jon Lewis Kelly 2005 Judgment Debtor Interrogatoriesf. List all real property in which

the debtor has an ownership

interest.

Jon Lewis Kelly 2005 Judgment Debtor Interrogatoriesg. State the amount of cash

reserves, capital accounts and retained earnings of the debtor.h. List the bank, account number

and balance of each checking or

other bank account held by the debtor (attached additional pages

as necessary)._______________________ ______________________Name of Financial Institution Account Number_______________________Account Balance_______________________ ______________________Name of Financial Institution Account Number_______________________Account Balancei. List the names, addresses and telephone numbers of every person who has an ownership interest in

the debtor entity (shareholders, members, partners, etc.)__________________________ __________________Name of Co-Owner % Ownership________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zip__________________________ __________________Name of Co-Owner % Ownership________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zip

Jon Lewis Kelly 2005 Judgment Debtor Interrogatoriesj. What type of entity is this

business (ie: sole proprietorship, LLC, partnership, non profit

corporation?)k. What is the EIN or tax ID

number for this business?l. List the names and addresses of the mangers, directors, or partners of the debtorm. List the names and addresses of the president, secretary, treasurer,

CEO, CFO and other officers of

the debtor.

Jon Lewis Kelly 2005 Judgment Debtor Interrogatoriesn. State the dates the members or

shareholders of the debtor have

met during the past 36 months.o. State the dates the managers or

directors of the debtor have met

during the past 36 monthsp. Provide the name and address of the person who has possession

of the minutes other corporate

records of the debtor.q. Provide the name and address of the person who has possession

of the books and financial records

of this business.32. What type of entity is corporate debtor taxed as for Federal Tax purposes?: ______________33. State the amount of gross income reported for corporate debtor on its last Federal Tax return:

__________________.34. List all other assets for the corporate debtor which have not already listed.35. How many employees does this debtor have? __________________________________________36. What kind of business is this debtor engaged in?

_________________________________________

Jon Lewis Kelly 2005 Judgment Debtor Interrogatories37. If any single contract, customer or client of the debtor company is expected to be the source of

more than 10% of its total gross income over the next twelve months, please describe nature of the

products to be sold or services to be performed and state the name and address of each such customer or

client.38. Except in the usual course of its business, has the debtor sold, given, transferred, or assigned to any

person or entity any of its assets, capital, or other property (including money, real property, personal

property or other thing of value) during the past 36 months? _______ (yes/no). If yes , for each, state

the following (attach additional pages as necessary):Using the form on the right answer these questions:a. Describe separately all property and things of value that debtor has

given, sold, transferred or

assigned.b. Provide the name and address of the person or entity to whom it

was transferred.c. The date transferred.d. The value of the property

transferred.____________________________________________________Description of property transferred____________________________________________________Name and Address of Person to Whom Property Transferred ________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zip______________________ ____________________________Date of Transfer Value of Property Transferred______________________ ____________________________Amount You Were Paid Description of relationship___________________________________________________Description of property transferred____________________________________________________

Jon Lewis Kelly 2005 Judgment Debtor Interrogatoriese. The amount debtor was paid for

the property.f. Describe how the person or

entity who received the property is

related to the debtor. In doing so, indicate if that person or entity

falls into one of the following

categories:(i) Creditor: The person or entity

is a creditor of the debtor;

(ii) Insider: The person to whom

debtor transferred the property is a

relative by blood or marriage of

any director, partner, manger,

officer or person having control of

the debtor. In which case, describe

how they are related.

(iii) Affiliate: The entity to which

the property was transferred is controlled by the debtor or any of

its directors, managers, partners, officers, or other persons who have

control of the debtor.

Name and Address of Person to Whom Property Transferred ________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zip______________________ ____________________________Date of Transfer Value of Property Transferred______________________ ____________________________Amount You Were Paid Description of relationship___________________________________________________Description of property transferred____________________________________________________Name and Address of Person to Whom Property Transferred ________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zip______________________ ____________________________Date of Transfer Value of Property Transferred______________________ ____________________________Amount You Were Paid Description of relationship___________________________________________________Description of property transferred____________________________________________________Name and Address of Person to Whom Property Transferred ________________________ _________Street Unit or Apt No.________________________ _________ ________City State Zip______________________ ____________________________Date of Transfer Value of Property Transferred______________________ ____________________________Amount You Were Paid Description of relationship39. List and describe debtors other debts and liabilities:40. How many pages have you attached to these interrogatories on behalf of corporate debtor?

________________.

Jon Lewis Kelly 2005 Judgment Debtor InterrogatoriesSTATE OF COLORADO ))ss.COUNTY OF _________________ )I swear under penalty of perjury that the forgoing answers to these interrogatories when

are true and complete, to the best of my knowledge, information and belief as of this date._____________________________________Signature of Defendant/Judgement DebtorSubscribed and sworn to before me this _____ day of ________, 200___, by ____________________.Witness my hand and official seal. My commission expires: _________________.____________________________________Notary PublicAddress:

Jon Lewis Kelly 2005 Judgment Debtor Interrogatories AFFIDAVIT OF SERVICE STATE OF COLORADO ))ss.COUNTY OF _________________ )I ___________________________, being first duly sworn do hereby declare to the

undersigned authority that I personally served a true and correct copy of the forgoing RULE 69/369

DEBTOR INTERROGATORIES on _________________________________, by

_____________________________________________________________ on the ______ day of ________________________, 200____.I state that I am over the age of 18 years and that I am not a party to this case.I have charged the Plaintiff the sum of $_______ for service and $______ for millage for

a total of $_______________._____________________________________Signature of Process ServerSubscribed and sworn to before me this _____ day of ________, 200___, by ____________________.Witness my hand and official seal. My commission expires: _________________.____________________________________Notary PublicAddress: