Fill and Sign the Form 706 Rev October 2006 Fill in Capable United States Estate and Generation Skipping Transfer Tax Return

Useful suggestions for finishing your ‘Form 706 Rev October 2006 Fill In Capable United States Estate And Generation Skipping Transfer Tax Return’ online

Are you fed up with the inconvenience of dealing with documents? Look no further than airSlate SignNow, the premier eSignature option for both individuals and businesses. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign documents digitally. Take advantage of the extensive features available on this straightforward and budget-friendly platform, and transform your approach to document management. Whether you need to authorize forms or gather signatures, airSlate SignNow manages it all seamlessly, with just a few clicks.

Adhere to this step-by-step guide:

- Log into your account or sign up for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud, or our template repository.

- Access your ‘Form 706 Rev October 2006 Fill In Capable United States Estate And Generation Skipping Transfer Tax Return’ in the editor.

- Click Me (Fill Out Now) to finalize the form on your end.

- Insert and allocate fillable fields for additional parties (if required).

- Continue with the Send Invite options to solicit eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

Don’t fret if you need to collaborate with others on your Form 706 Rev October 2006 Fill In Capable United States Estate And Generation Skipping Transfer Tax Return or send it for notarization—our solution supplies everything you need to accomplish such tasks. Create an account with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

What is the Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return?

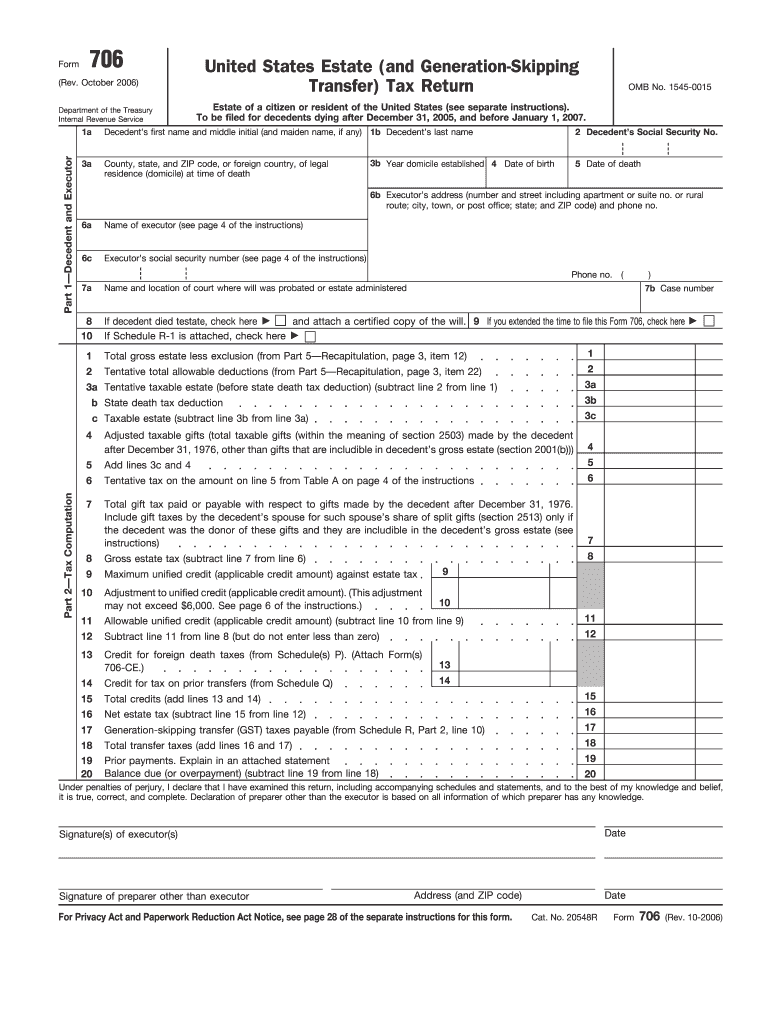

The Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return is a tax form used to report estate and generation-skipping transfer taxes. This comprehensive form helps executors calculate the value of the taxable estate and any applicable deductions or credits. Understanding this form is crucial for compliance with federal tax laws.

-

How can airSlate SignNow help with the Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return?

airSlate SignNow simplifies the process of managing and eSigning the Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return. Our platform allows users to easily fill out the form electronically, ensuring that all necessary sections are completed accurately. Additionally, you can securely send the completed form to any relevant parties for signatures.

-

Is there a cost associated with using airSlate SignNow for the Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return?

Yes, airSlate SignNow offers a variety of pricing plans to accommodate different user needs, including options for individuals and businesses. Each plan provides access to features that facilitate the completion and signing of the Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return. We recommend checking our website for detailed pricing information.

-

What features does airSlate SignNow offer for filling out tax forms like Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return?

airSlate SignNow provides a range of features that enhance the experience of completing the Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return. These features include customizable templates, real-time collaboration, and secure document storage. Additionally, users can track the status of their documents and receive notifications when forms are signed.

-

Can I use airSlate SignNow on mobile devices for the Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return?

Absolutely! airSlate SignNow is fully optimized for mobile devices, allowing you to fill out and eSign the Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return on the go. Our mobile app provides a seamless experience, ensuring you can manage your documents anytime, anywhere.

-

Does airSlate SignNow integrate with other software for tax preparation related to the Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return?

Yes, airSlate SignNow seamlessly integrates with various tax preparation software and business applications, making it easier to manage the Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return. This integration helps streamline workflows, ensuring that all necessary data is accurately transferred and easily accessible.

-

What are the benefits of using airSlate SignNow for the Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return?

Using airSlate SignNow for the Form 706 Rev October Fill In Capable United States Estate and Generation Skipping Transfer Tax Return offers several benefits, including time savings, increased accuracy, and enhanced security. Our platform minimizes errors with user-friendly templates and ensures that your data is protected with advanced encryption. Additionally, the eSigning feature accelerates the process of obtaining necessary signatures.

Find out other form 706 rev october 2006 fill in capable united states estate and generation skipping transfer tax return

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles