Fill and Sign the Form El101b Income Tax Declaration for Businesses

Convenient instructions on setting up your ‘Form El101b Income Tax Declaration For Businesses ’ online

Are you fed up with the burden of handling documents? Look no further than airSlate SignNow, the top eSignature platform for individuals and small businesses. Bid farewell to the lengthy routine of printing and scanning files. With airSlate SignNow, you can effortlessly complete and authorize documents online. Leverage the powerful capabilities built into this user-friendly and cost-effective solution and transform your method of document management. Whether you need to validate forms or gather eSignatures, airSlate SignNow takes care of it all smoothly, with just a few clicks.

Adhere to this comprehensive guide:

- Access your account or register for a complimentary trial of our service.

- Click +Create to upload a document from your device, cloud storage, or our template library.

- Edit your ‘Form El101b Income Tax Declaration For Businesses ’ in the editor.

- Select Me (Fill Out Now) to complete the form on your end.

- Add and designate fillable fields for other participants (if needed).

- Continue with the Send Invite options to solicit eSignatures from others.

- Save, print your version, or convert it into a reusable template.

Don’t fret if you need to work with your colleagues on your Form El101b Income Tax Declaration For Businesses or send it for notarization—our platform provides everything you require to achieve such tasks. Register with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

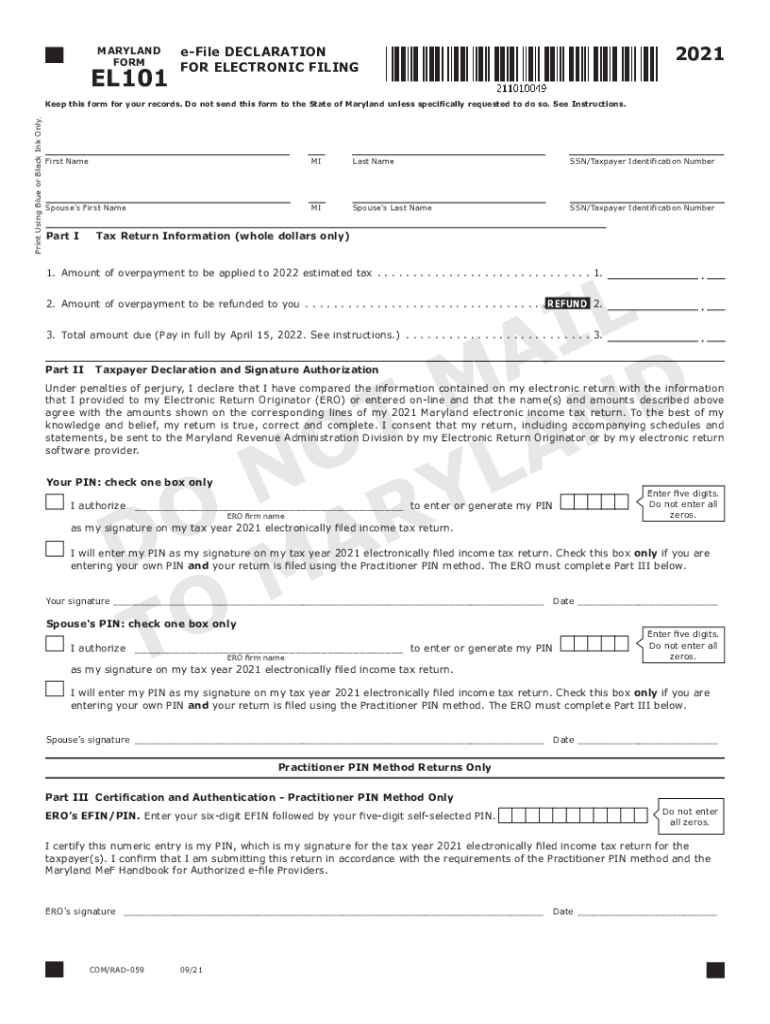

What is Form EL101B Income Tax Declaration For Businesses?

Form EL101B Income Tax Declaration For Businesses is a crucial document used by businesses to declare their income and calculate their tax obligations. This form ensures compliance with tax regulations and helps businesses accurately report their earnings. Using airSlate SignNow, you can easily prepare and eSign this form, streamlining your tax filing process.

-

How does airSlate SignNow simplify the process of filling out Form EL101B Income Tax Declaration For Businesses?

airSlate SignNow simplifies the process of completing Form EL101B Income Tax Declaration For Businesses by providing an intuitive platform for document creation and eSigning. With features like templates and automated workflows, you can quickly fill out the necessary information and ensure that your form is correctly completed. This efficiency saves time and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for Form EL101B Income Tax Declaration For Businesses?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses. Our pricing plans accommodate various business needs, allowing you to choose a plan that fits your budget. The investment in our platform ultimately streamlines your workflow, making it easier to manage forms like the EL101B.

-

Can I integrate airSlate SignNow with my existing accounting software for Form EL101B Income Tax Declaration For Businesses?

Absolutely! airSlate SignNow offers integrations with several popular accounting software solutions, allowing you to seamlessly manage your Form EL101B Income Tax Declaration For Businesses alongside your other financial documents. This integration helps maintain accurate records and simplifies your tax preparation process.

-

What are the benefits of using airSlate SignNow for Form EL101B Income Tax Declaration For Businesses?

Using airSlate SignNow for Form EL101B Income Tax Declaration For Businesses provides numerous benefits, including enhanced efficiency, reduced paperwork, and secure eSigning capabilities. Our platform ensures that your documents are processed quickly and securely, allowing you to focus on running your business rather than getting bogged down by administrative tasks.

-

How secure is the information submitted through airSlate SignNow when filling out Form EL101B Income Tax Declaration For Businesses?

Security is a top priority at airSlate SignNow. When filling out Form EL101B Income Tax Declaration For Businesses, your information is protected with advanced encryption and security protocols. We comply with industry-standard security measures to ensure that your sensitive data remains confidential and secure throughout the signing process.

-

Can multiple users collaborate on Form EL101B Income Tax Declaration For Businesses using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on Form EL101B Income Tax Declaration For Businesses. This feature is particularly beneficial for teams, as it enables real-time editing, comments, and eSigning by authorized personnel, ensuring that everyone involved can contribute efficiently to the completion of the form.

Find out other form el101b income tax declaration for businesses

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles