FORMS AND RATES BULLETIN NO. 24

VOLUNTARY EXPEDITED FILING PROCEDURES FOR INSURANCE

APPLICATIONS DEVELOPED TO ALLOW DEPOSITORY INSTITUTIONS

TO MEET THEIR DISCLOSURE OBLIGATIONS UNDER SECTION 305 OF

THE GRAMM-LEACH-BLILEY ACT

Issued: July 23, 2001

TO:

ALL INSURANCE COMPANIES AND OTHER REGULATED ENTITIES

FROM:

Donna Lee H. Williams, Insurance Commissioner

State of Delaware Insurance Department

Background

The four principal banking regulatory agencies published final consumer protection rules regarding bank

insurance sales on Dec. 4, 2000. The published rules may be obtained from the Federal Register,

Volume 65, Number 233. The federal regulators recently agreed to postpone the effective date for

implementation of the consumer protection rules from April 1, 2001 to Oct. 1, 2001. This was done to

accommodate requests from depository institutions for more time to prepare to implement the

regulations.

The federal banking agencies promulgated consumer protection regulations pursuant to Section 305 of

the Gramm- Leach-Bliley Act (GLBA), governing the sale of insurance products by depository

institutions. Among other things, the regulations require depository institutions that sell insurance

products to make certain disclosures and receive consumer acknowledgements, which are intended to

reduce consumer confusion in the sale of insurance products by depository institutions. To best ensure

that these requirements are met, depository institutions may prefer to have these disclosures included on

insurance application forms. In order to comply with the federal regulations in this fashion, depository

institutions that sell insurance products will need to ask insurers to make the necessary filings in the

State of Delaware. Changes in insurance application forms are subject to review under 18 Del. C. § 2712

and related statutes. The filing of such form must be made a minimum of thirty (30) days prior to its

use. Form filings are to be made at the office of the Delaware Insurance Department, 841 Silver Lake

Boulevard, Dover, Delaware 19904-2465. The contact person in the Delaware Insurance Department is

Libby Miller. The telephone number is 302-739-4251.

It is in the best interest of this state and the producers, insurers and depository institutions that operate

within its boundaries to adopt an expedited process for reviewing these application forms. This bulletin

�is promulgated consistent with the spirit of functional regulation to make it more efficient for depository

institutions to comply with their obligations to their functional regulators. The purpose of this bulletin is

to provide regulated entities with the appropriate forms and instructions to receive expedited approval

for insurance application forms that are revised only to add notice to allow depository institutions to

meet their disclosure obligations under Section 305 of the GLBA if this method of compliance is

chosen. This process is voluntary. It is up to you to choose whether or not to use this process to

expedite the filings of such amended insurance applications

In pertinent part, Section 305 of the GLBA requires:

The Federal banking agencies shall prescribe and publish in final form . . . customer protection

regulations (which the agencies jointly determine to be appropriate) tha t –

(A) apply to retail sales practices, solicitations, advertising, or offers of any insurance

product by any depository institution or any person that is engaged in such activities at an

office of the institution or on behalf of the institution; and

(B) are consistent with the requirements of this Act and provide such additional

protections for customers to whom such sales, solicitations, advertising, or offers are

directed.

Explanation and Instructions for Expedited Review

The following are two model notices for use by depository institutions and other “covered persons” in

complying with the written disclosure requirements related to insurance sales that are imposed by

Section 305 of the GLBA and the corresponding regulations promulgated by the federal banking

agencies. (In addition to depository institutions, a “covered person” is any other person who sells,

solicits, advertises, or offers an insurance product or annuity to a consumer at an office of the depository

institution or on behalf of a depository institution.) 1 One notice provides the written disclosures that

must be given to a consumer in connection with an initial purchase of an insurance or annuity product

that is unrelated to an extension of credit. The other notice provides the written disclosures that must be

given to a consumer in connection with the solicitation, offer or sale of an insurance or annuity product

that is related to an extension of credit.

The federal banking agencies have reviewed the content of both notices and determined that it meets the

requirements of 12 C.F.R. 14.40 (a) and (b) in the case of national banks; 12 C.F.R. 208.84 (a) and (b) in

the case of state member banks; 12 C.F.R. 343.40 (a) and (b) in the case of state non- member banks; and

12 C.F.R. 536.40 (a) and (b) in the case of savings associations.

1

Activities on behalf of a depository institution include activities where a person, whether at an office of the

depository institution or at another location sells, solicits, advertises, or offers an insurance product or annuity and at least

one of the following applies:

(i) The person represents to a consumer that the sale, solicitation, advertisement, or offer of any insurance product or

annuity is by or on behalf of the depository institution;

(ii) The depository institution refers a consumer to a seller of insurance products or annuities and the depository

institution has a contractual arrangement to receive commissions or fees derived from a sale of an insurance product or

annuity resulting from that referral; or

(iii) Documents evidencing the sale, solicitation, advertising, or offer of an insurance product or annuity identify or

refer to the depository institution.

2

�In addition to the content of the notices, the disclosures required by these regulations must be “readily

understandable” and in a “meaningful” form. Examples of the types of methods that an institution could

use to call attention to the nature and significance of the information provided include: (i) a plainlanguage heading to call attention to the disclosures; (ii) a typeface and type size that are easy to read;

(iii) wide margins and ample line spacing; (iv) boldface or italics for key words; and (v) distinctive type

style, and graphic devices, such as shading or sidebars, when the disclosures are combined with other

information. See 12 C.F.R. 14.40(c)(6) in the case of national banks; 12 C.F.R. 208.84(c)(6) in the case

of state member banks; 12 C.F.R. 343.40(c)(6) in the case of state non- member banks; and 12 C.F.R.

536.40(c)(6) in the case of savings associations.

References to “the bank” should be to “the savings association” in the case of a savings association, or

may be to the actual name of the bank or savings association.

Forms with Instructions

Attached to this bulletin is a uniform filing transmittal form that has been agreed upon by this state and

other states. An insurer wishing to receive expedited treatment of its filing for approval shall so indicate

on the face of the special purpose form relating to LIFE, ACCIDENT AND HEALTH INSURANCE

FILING CERTIFICATION attached. In addition, the insurer(s) submitting this filing must certify that

the only change made from the previous application form is the addition of the disclosure notices

required by Section 305 of the Gramm- Leach-Bliley Act for depository institutions.

To be complete, a form filing must include the following:

1.

2.

3.

4.

A completed, certified Form Filing Transmittal Header for each insurer

One copy of each application form to be reviewed for the reviewer’s records for each insurer.

The filing fee of $50.00 per form.

A postage-paid, self- addressed envelope large enough to accommodate the return. If this

filing is for multiple companies, please provide a copy of the transmittal header for each

company and an extra copy for return to the company. (i.e. 7 companies = 8 copies)

To ensure meeting the October 1, 2001 compliance date set forth in the federal regulations, such forms

should be filed with the Delaware Insurance Department no later than September 15, 2001.

Effective Date

This bulletin shall take immediate effect and shall expire on January 1, 2002.

3

�DISCLOSURE NOTICE 1: Model Written Disclosure for the Initial Purchase of

Insurance or Annuity Products that are Not Sold in Connection with an Extension of

Credit

Insurance products and annuities:

•

Are not a deposit or other obligation of, or guaranteed by, the bank or any

affiliate of the bank;

•

Are not insured by the Federal Deposit Insurance Corporation (FDIC) or any

other agency of the United States, the bank, or any affiliate of the bank;

•

Involve investment risk, including the possible loss of value. Note: This

disclosure may not be required for all products.

Please sign to acknowledge receipt of these disclosures:

Name of Customer: _____________________________________________

Customer Signature: _____________________________________________

Date: ___________

4

�DISCLOSURE NOTICE 2: Model Written Disclosure for Insurance Products that Are

Solicited, Offered, or Sold in Connection with an Extension of Credit

In connection with your credit application, [name of bank or savings association]

advises you of the fo llowing:

•

[Name of bank or savings association] may not condition the extension of

credit you are applying for on whether you purchase an insurance product or

annuity from the bank or the bank’s affiliate.

•

[Name of bank or savings association] may not condition the extension of

credit you are applying for on your agreement not to obtain, or a prohibition

on your obtaining, an insurance product or annuity from an entity not

affiliated with the bank.

Insurance products and annuities:

•

Are not a deposit or other obligation of, or guaranteed by, the bank or any

affiliate of the bank;

•

Are not insured by the Federal Deposit Insurance Corporation (FDIC) or any

other agency of the United States, the bank, or any affiliate of the bank;

•

Involve investment risk, including the possible loss of value. Note: This

disclosure may not be required for all products.

Please sign to acknowledge receipt of these disclosures:

Name of Customer: _______________________________________________

Customer Signature: ______________________________________________

Date: _______________

5

�STATE OF DELAWARE

DEPARTMENT OF INSURANCE

LIFE, ACCIDENT AND HEALTH INSURANCE FILING CERTIFICATION

SPECIAL FORM—BULLETIN NO.

VOLUNTARY EXPEDITED FILING PROCEDURES FOR INSURANCE APPLICATIONS DEVELOPED TO

ALLOW DEPOSITORY INSTITUTIONS TO MEET THEIR DISCLOSURE OBLIGATIONS UNDER

SECTION 305 OF THE GRAMM-LEACH-BLILEY ACT

____________________________________________________________________________________________________

COMPANY NAME

Line or subline of insurance: (Circle One)

Credit Life, Credit A & H; Group Life; Group A & H; Other Life; Other A & H; Individual A & H-, Group Annuity;

Other Annuity.

Filing pertains to: (Circle one or more)_______ Rates ______Forms ______Rules _______Other

This Filing is submitted in accordance with Section 305 of the Gramm-Leach-Bliley Act, P.L. 106-102

DATE OF FILING: ___________________________________________________________

List form numbers included in filing: ______________________________________________

Do the filed forms contain any provisions previously disapproved by the Delaware Insurance Department or

conflict with present statutes or regulations? _________ YES _____________ NO

Any other Insurance Department? ___________ YES _________ NO

State of domicile: _________________________________________

Has this filing been approved in the state of domicile? ____________ YES ___________________ NO

Date of approval: _________________________________________. Is the filing legally used in the state of

domicile if approval is not required? _________________YES _________________NO

The undersigned certifies that the only change made from the previous application form is the addition of the

disclosure notices required by Section 305 of the Gramm-Leach-Bliley Act for depository institutions.

Pursuant to the requirements of 18 Del. C. Section 2528 and subject to the penalties found in 18 Del. C. Section 106, I hereby

certify that the information stated above and in the attachments consisting of ______ pages is correct and complete to my best

knowledge and belief and fully conforms to all applicable laws, regulations, and requirements of the State of Delaware.

___________________________________________

Signature

_________________________________

Date

_________________________________________

Name

_________________________________________

Title (Must be an officer of Company)

6

�

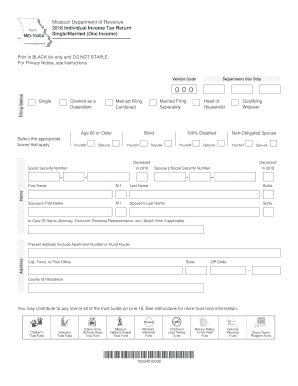

Helpful suggestions for finalizing your ‘Form Mo 1040a 2018 Individual Income Tax Return Singlemarried One Income’ online

Are you exhausted by the burden of handling paperwork? Look no further than airSlate SignNow, the premier eSignature solution for individuals and small to medium-sized businesses. Bid farewell to the monotonous tasks of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Leverage the robust features embedded in this user-friendly and cost-effective platform and transform your method of document management. Whether you need to approve forms or collect signatures, airSlate SignNow manages it all seamlessly, with merely a few clicks.

Follow this straightforward step-by-step guide:

- Log into your account or sign up for a free trial of our service.

- Click +Create to upload a document from your device, cloud storage, or our template collection.

- Open your ‘Form Mo 1040a 2018 Individual Income Tax Return Singlemarried One Income’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and designate fillable fields for other individuals (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Save, print your version, or transform it into a reusable template.

Don’t be concerned if you need to collaborate with others on your Form Mo 1040a 2018 Individual Income Tax Return Singlemarried One Income or submit it for notarization—our solution provides everything you require to accomplish such tasks. Create an account with airSlate SignNow today and enhance your document management to a new level!