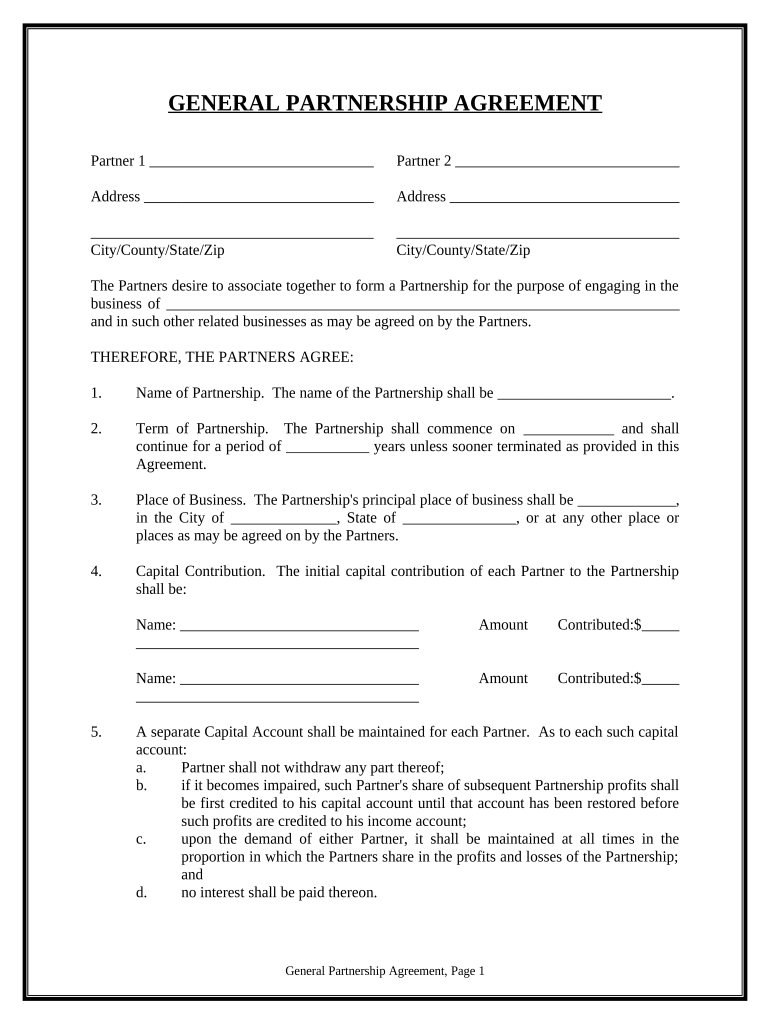

GENERAL PARTNERSHIP AGREEMENT

Partner 1 Partner 2

Address Address

City/County/State/Zip City/County/State/Zip

The Partners desire to associate together to form a Partnership for the purpose of engaging in the

business of ____________________________________________________________________

and in such other related businesses as may be agreed on by the Partners.

THEREFORE, THE PARTNERS AGREE:

1. Name of Partnership. The name of the Partnership shall be _______________________ .

2. Term of Partnership. The Partnership shall commence on ____________ and shall

continue for a period of ___________ years unless sooner terminated as provided in this

Agreement.

3. Place of Business. The Partnership's principal place of business shall be _____________ ,

in the City of ______________ , State of _______________ , or at any other place or

places as may be agreed on by the Partners.

4. Capital Contribution. The initial capital contribution of each Partner to the Partnership

shall be:

Name: Amount Contributed:$

Name: Amount Contributed:$

5. A separate Capital Account shall be maintained for each Partner. As to each such capital

account:

a. Partner shall not withdraw any part thereof;

b. if it becomes impaired, such Partner's share of subsequent Partnership profits shall

be first credited to his capital account until that account has been restored before

such profits are credited to his income account;

c. upon the demand of either Partner, it shall be maintained at all times in the

proportion in which the Partners share in the profits and losses of the Partnership;

and

d. no interest shall be paid thereon.

General Partnership Agreement, Page 1

6. Profits and Losses. The net profits and net losses of the Partnership shall be divided or

borne between the Partners in the following proportions:

Name: Profit or Loss: %

Name: Profit or Loss: %

7. Salary. No salary shall be paid to the Partners, but each Partner shall be entitled to

withdraw from the receipts of the business of the Partnership, such amounts as the

Partners shall from time to time agree. Such withdrawals shall be credited against each

Partner's share of the profits of the Partnership.

8. Income Accounts. A separate income account shall be maintained for each of the

Partners. As to each Partner's income account:

a. each Partner's share of the profits of the Partnership shall be credited;

b. each Partner's share of the losses of the Partnership shall be charged;

c. each Partner's withdrawals from the receipts of the business of the Partnership be

charged.

9. Financial Statements. At the end of each year during the Partnership, a balance sheet and

income statement shall be prepared in accordance with generally accepted accounting

practices showing the assets and liabilities of the Partnership as of such date and the

profits and losses for the year then ended. Each Partner shall be provided with a copy of

the financial statements. If it appears that during any year a Partner has withdrawn from

the receipts of the business of the Partnership more than the others or has withdrawn a

sum in excess of his share of the Partnership profits, then such Partner shall repay such

overpayment to the Partnership. Further, if it appears that there are profits in excess of the

amount necessary to maintain the working capital of the Partnership and to pay any

outstanding debts, such profits shall be divided between and paid to the Partners.

10. Management. The Partners shall have equal rights to participate in the management of the

Partnership business, and each Partner shall devote his entire time to the conduct thereof.

11. Bank Account. All funds of the Partnership shall be deposited in its name in the

_______________ Bank, __________________ branch or such other depository as may

hereafter be agreed upon between the Partners, in such account as shall be designated by

them. All withdrawals therefrom are to be made by checks signed by both Partners.

12. Books and Records. The Partnership shall keep proper accounting of all transactions of

the Partnership, and such books shall be at all times open to the inspection of either

Partner.

13. Restrictions on Partners' Powers. Neither Partner shall without the consent of the other:

a. compromise or release any debt due the Partnership except upon full payment

thereof;

b. engage in any transaction on behalf of the Partnership of any kind other than those

necessary for the transaction of the business of the Partnership;

General Partnership Agreement, Page 2

c. make any contract on account of the Partnership requiring the expenditure of

more than $ _______________ ;

d. make or endorse either in the name of the Partnership or the other Partners, any

note, or act as an accommodation party or otherwise become surety for any

person;

e. on behalf of the Partnership borrow or lend money, make, deliver or accept any

commercial paper or execute any mortgage, bond, lease or other obligation

requiring the payment of money, or purchase or contract to purchase or sell any

property for or of the Partnership other than the type of property bought and sold

in the regular course of its business;

f. assign, mortgage, grant a security interest in, or sell his share in the Partnership or

in its capital, assets, or property or any part thereof, or enter into any agreement as

a result of which any person shall become interested with him in the Partnership;

or

g. do any act detrimental to the best interests of the Partnership, or which would

make it impossible to carry on the ordinary business of the Partnership.

14. Retirement. The Partners shall have the right to retire from the Partnership at the end of

any fiscal year. Written notice of intention to retire shall be served by the Partner retiring

upon the other Partner at the place of business of the Partnership at least ________

months before the end of such fiscal year. In case of the retirement of a Partner, the other

Partners shall have the right to continue the Partnership business or to dissolve the

Partnership. If the remaining Partners elect to purchase the interest of the retiring

Partner, they shall serve written notice of such election upon the retiring Partner at the

office of the Partnership within __________ months after receipt of notice of his

intention to retire. The purchase price for the interest of the retiring Partner shall be

computed in the manner set forth herein.

15. Expulsion of a Partner. A Partner may be expelled from the Partnership for any of the

following:

a. Willful breach of any provision contained in this Agreement;

b. Conduct adversely affecting the Partnership business;

c. Conduct relating to Partnership matters which make continuation of the

Partnership unreasonable if such Partner remains a member. A Partner shall be

expelled upon unanimous vote of all other Partners. The other Partners shall

serve the expelled Partner with a written notice stating the grounds for an

effective date of the expulsion and bearing all such Partners' signatures. Within

__________ days after the expulsion becomes effective, the expelled Partner shall

be entitled to receive the value of that Partner's Partnership interest. The value of

the expelled Partner's Partnership interest shall be determined in the manner set

forth herein as of the close of business on the day the expulsion becomes

effective, less the value of Partnership goodwill, and less any damages sustained

by the other Partners because of the breach, if any, of this Agreement by the

expelled Partner.

16. Withdrawal of a Partner. Any Partner may voluntarily withdraw from the Partnership by

giving all other Partners at least ______ days notice of intention to do so.

General Partnership Agreement, Page 3

17. Option to Purchase Terminated Interest. In the event of death, disability or withdrawal of

a Partner, the remaining Partners shall have an option to purchase the interest of the

deceased, terminated, or withdrawing Partner in the assets and goodwill of the

Partnership business by paying to that Partner or the person legally entitled thereto the

value of that Partner's interest, determined as provided in this Agreement. The remaining

Partners shall give written notice of their exercise of this option within __________ days

to that Partner or to that Partner's personal representative or trustee.

18. Purchase Price of Partnership Interest. On exercise of the option to purchase an outgoing

Partner's Partnership interest, the remaining Partners shall pay to the person legally

entitled thereto, in the manner specified herein, the value of the outgoing Partner's

interest, determined as follows:

a. The remaining Partners, at the time they give notice in the manner specified

herein of their exercise of the option to purchase, shall appoint an appraiser.

Within ______ days after receiving such notice, the person legally entitled to

receive the value of the Partnership interest being purchased shall appoint an

appraiser. If the two appraisers so appointed are unable to agree on the value of

the interest within ________ days, they shall appoint a third appraiser. The

decision in writing of any two of the three appraisers so appointed shall be

binding and conclusive on the parties hereto and on any person entitled to receive

the value of such deceased, withdrawing, or terminated Partner's interest.

b. In determining the value of the Partner's interest to be purchased, the appraisers

shall value:

(i) All items of inventory at their actual cost to the Partnership;

(ii) All tangible assets of the Partnership, including lands, buildings, fixtures,

machinery, automobiles, and equipment, at their fair cash market value;

(iii) All accounts receivable due the Partnership that are not more than ninety

(90) calendar days old and not barred by the statute of limitations at one-

half their face value;

(iv) All accounts receivable due the Partnership that are less than ninety (90)

calendar days old at their full face value; and

(v) Goodwill and other intangible assets of the Partnership at their fair market

value.

19. Payment of Purchase Price. On exercise of the option to purchase the Partnership interest

of a deceased, withdrawing, or terminated Partner, the remaining Partners shall pay to the

person legally entitled thereto the value of the interest, in the following manner:

One half in cash on receipt of the appraisers' report provided for herein, and the balance

in twelve (12) equal monthly installments commencing not later than thirty (30) days

after receipt of that report. Each monthly installment shall be applied first to interest at

the rate of ______ percent per annum on the then remaining unpaid principal balance of

the purchase price from the date the appraisers' report was received by the remaining

Partners and then to the reduction of principal.

General Partnership Agreement, Page 4

20. Purchase by Less Than All Remaining Partners. If any remaining Partner is unable or

unwilling to exercise the option to participate in the purchase of an outgoing Partner's

interest, the option may be exercised and the interest purchased by the other remaining

Partners. No remaining Partner shall be denied a right to participate in any such purchase

if that Partner delivers to all other Partners a written declaration of intent to participate.

This written declaration shall be delivered before the appraisers' report is delivered.

21. Admission of Partners. Additional Partners may be admitted to the Partnership on such

terms as may be agreed on in writing between the Partners and such new partners. The

terms so agreed on shall constitute an amendment to this Partnership Agreement.

22. Restrictions on Transfers. Except as otherwise provided in this Agreement, no Partner

may sell, assign, transfer, encumber, or otherwise dispose of any interest in the

Partnership, Partnership property, or assets of the Partnership without the prior written

consent of all other partners.

23. Dissolution of Partnership. The Partnership may be dissolved at any time by agreement

of the Partners, or in the event the remaining Partners choose not to purchase the interest

of the decedent or retiring Partner in the Partnership, in which event the Partners shall

proceed with reasonable promptness to wind up and dissolve the business of the

Partnership. The Partnership name shall be sold with the other assets of the business. The

assets of the Partnership business shall be used and distributed in the following order:

a. to pay for all Partnership liabilities and liquidating expenses and obligations;

b. to equalize the income accounts of the Partners;

c. to discharge the balance of the income accounts of the Partners;

d. to equalize the capital accounts of the Partners; and

e. to discharge the balance of the capital accounts of the Partners.

24. Notices. All notices between the Partners shall be in writing and shall be deemed duly

served when personally delivered to a Partner, or, in lieu of such personal service, when

deposited in the United States mail, certified, first-class postage prepaid, addressed to the

Partner at the address of the principal place of business of the Partnership.

25. Consents and Agreements. Any and all consents and agreements provided for or

permitted by this Agreement shall be in writing. Signed copies of all such consents and

agreements shall be filed and kept with the books of the Partnership.

26. Sole Agreement. This instrument contains the sole agreement of the parties relating to

their Partnership and correctly sets forth the rights, duties, and obligations of each to the

others as of its date. Any prior agreements, promises, negotiations, or representations not

expressly set forth in this Agreement are of no force and effect.

THE PARTNERS have Executed this Agreement on this ____ day of _________ , 20 __ .

Partner 1 Partner 2

General Partnership Agreement, Page 5

Practical advice on preparing your ‘General Partnership Agreement Pdf’ online

Are you weary of the trouble of handling paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and businesses. Bid farewell to the monotonous process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign paperwork online. Utilize the powerful tools integrated into this user-friendly and budget-friendly platform and transform your approach to document handling. Whether you need to authorize forms or gather signatures, airSlate SignNow manages it all seamlessly, with just a few clicks.

Follow this detailed guide:

- Log into your account or initiate a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form library.

- Open your ‘General Partnership Agreement Pdf’ in the editor.

- Click Me (Fill Out Now) to finish the document on your end.

- Insert and designate fillable fields for others (if needed).

- Continue with the Send Invite settings to request eSignatures from others.

- Save, print your copy, or convert it into a multi-use template.

Don’t fret if you need to collaborate with your colleagues on your General Partnership Agreement Pdf or send it for notarization—our solution provides everything you need to carry out such tasks. Register with airSlate SignNow today and enhance your document management to a new level!