Document Tracking Identifier ______ _____________________ OMB 0970 -0154

June 2015 Form 3N051

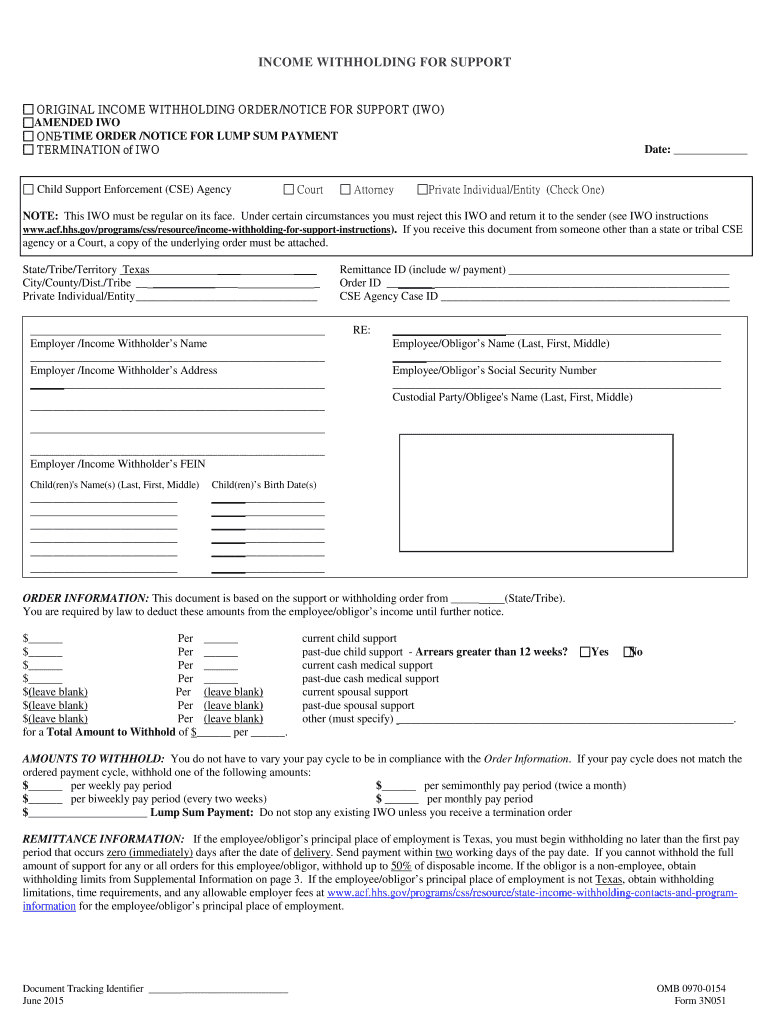

INCOME WITHHOLDING FOR SUPPORT

ORIGINAL INCOME WITHHOLDING ORDER/NOTICE FOR SUPPORT (IWO)

AMENDED IWO

O NE -TIME ORDER /NOTICE FOR LUMP SUM PAYMENT

TERMINATION of IWO Date: ______ _______

NOTE: This IWO must be regular on its face. Under certain circumstances you must reject this IWO and return it to the sender (see IWO instruct ions

www.acf.hhs.gov/programs/css/resource/income-withholding -for -support -instructions ). If you receive this document from someone other than a s tate or tribal CSE

agency or a Court, a copy of the underlying order must be attached.

State/Tribe/Territory Texas ____ ____ Remittance I D (include w/ payment) __ ______ __ ___ _____ __________ ___________

City/County/Dist./Tribe __ ___________ ____ _ Order ID ________ __________________________________ __________________

Private Individual/Entity _______ _________________________ CSE Agency Case I D ________ ________________ _____________ _____________ _

_____________________________ _______________________

Employer /Income Withholder’s Name

_______ _____________________________________________

Employer /Income Withholder’s Address

____________________________________________________ ____________________________________________________

_______________________________________ _____________

____________________________________________________

Employ er /Income Withholder’s F EIN RE:

__________________________________________________________

Employee/Obligor’s Name (Last, First, Middle)

__________________________________________________________

Employee/Obligor’s Social Security Number

__________________________________________________________

Custodial Party/Obligee's Name (Last, First, M iddle)

Child(ren)'s Name (s) (Last, First, M iddle) Child(ren)’s Birth Date(s)

__________________________ ____________________

__________________________ ____________________

__________________________ ____________________

__________________________ ____________________

__________________________ ____________________

__________________________ ____________________

ORDER INFORMATION: This document is based on the support or withholding order from _____ (State/Tribe).

You are required by law to deduct these amounts from the employee/obligor’s income until further notice.

$ ______ Per ______ current child support

$______ Per ______ past -due child support - Arrears greater than 12 weeks? Y es N o

$ ______ Per ______ current cash medical support

$ ______ Per ______ past -due cash medical support

$(leave blank) Per (leave blank ) current spousal support

$(leave blank) Per (leave blank ) past -due spousal support

$(leave blank) Per (leave blank ) other (must specify) ___________________________________________________________.

for a Total Amount to Withhold of $______ p er ______.

AMOUNTS TO WITHHOLD: You do not have to vary your pay cycle to be in compliance with t he Order Information . If your pay cycle does not match the

ordered payment cycle, withhold one of the following amounts:

$ ____ __ per weekly pay period $____ __ per semimonthly pay period (twice a month)

$ ____ __ per biweekly pay period (every two weeks) $ ____ __ per monthly pay period

$ _____________________ Lump S um Payment : Do not stop any existing IWO unless you receive a termination order

REMITTANCE INFORMATION: If the employee/obligor’s principal place of employment is Texas, you must begin withholding no later than the first pay

period that occurs zero (immediately) days after the date of delivery . Send payment within two working days of the pay date. If you cannot withhold the full

amount of support for any or all orders for this employee/obligor, withhold up to 50% of disposable income. If the obligor is a non-employee, obtain

withholding limits from Supplemental Inform ation on page 3. If the employee/obligor’s principal place of employment is not Texas , obtain withholding

limitations, time requirements, and any allowable employer fees at www.acf.hhs.gov/programs/css/resource/state-income-withholding -contacts -and-program -

information for the employee/obligor’s principal place of employment.

OMB Expiration Date – 0 7/31/201 7. The OMB Expiration Date has no bearing on the termination date of the IWO; it identifies the version of the form currently in use. June 2015 Form 3N051

Employer’s Name: ___________________________________________ Employer FEIN: ___________________________________________

Employee/Obligor’s Name: ____________________________________ SSN: ____________________________________________________

CSE Agency Case Identifier: ___________________________________ Order Identifier: ______ _____________________________________

For electronic payment requirements and centralized payment collection and disbursement facility information ( State Disbursment Unit [SDU]), see

www.acf.hhs.gov/programs/css/employers/electronic -payments

.

Include the Remittance I D with the payment and if necessary this FIPS code: ______

Remit payment to

At:

□ Return to Sender [Completed by Employer/Income Withholder]. Payment must be directed to an SDU in accordance with 42 USC

§666(b)(5) and (b)(6) or Tribal Payee (see Payments to SDU below). If payment is not directed to a n SDU/Tribal Payee or this IWO is not

regular on its face, you must check this box and return the IWO to the sender.

Signature of Judge/Issuing Official (if Required by State or Tribal law) :

P rint Name of Judge/Issuing Official: ________________________

Title of Judge/ Issuing Official: ________________________

Date of Signature ________ _____________________________

If the employee/obligor works in a s tate or for a tribe that is different from the s tate or tribe that issued this order, a copy of this IWO must be provided to the

employee/obligor.

If checked, the employer/income withholder must provide a copy of this form to the employee/obligor.

ADDITIONAL INFORMATION TO EMPLOYERS/INCOME WITHHOLDERS

State-specific contact and withholding information can be found on the Federal Employer Services website located at:

www.acf.hhs.gov/programs/css/resource/state-income-withholding -contacts -and-program -information

Priority: Withholding for support has priority over any other legal process under State law against the same income (42 USC §666(b)(7)). If a f ederal tax

levy is in effect, please notify the sender .

Combining Payments: When remitting payments to an SDU or t ribal CSE agency, you may combine withheld amounts from more than one

employee/obligor’s income in a single payment. You must, however, separately identify each employee/obligor ’s portion of the payment.

Payments to SDU: You must send child support payments payable by income withholding to the appropriate SDU or to a t ribal CSE agency. If this IWO

instructs you to send a payment to an entity other than an SDU (e.g., payable to the custodial party, court, or attorney), you must check the box above and

return this notice to the sende r. Exception: If this IWO was sent by a c ourt, attorney, or p rivate individual/ entity and the initial order was entered before

January 1, 1994 or the order was issued by a t ribal CSE agency, you must follow the “Remit payment to” instructions on this form .

Reporting the Pay Date: You must report the pay date when sending the payment. The pay date is the date on which the amount was withheld from the

employee/obligor’s wages. You must comply with the law of the s tate (or tribal law, if applicable) of the employee/obligor's principal place of employment

regarding time periods within which you must implement the withholding and forward the support payments.

Multiple IWOs: If there is more than one IWO against this employee/obligor and you are unable to fully honor all IWOs due to federal, state, or t ribal

withholding limits, you must honor all IWOs to the greatest extent possible, giving priority to current support before payment of any past -due support. Follow

the state or t ribal law/procedure of the employee/obligor’s principal place of employment to determine the appropriate allocation method.

Lump Sum Payments: You may be required to notify a s tate or tribal CSE agency of upcoming lump sum payments to this employee/obligor such as bonuses,

commissions, or severance pay. Contact the sender to determine if you are required to report and/or withhold lump sum payments.

Liability: If you have any doubts about the validity of this IWO, contact the sende r. If you fail to withhold income from the employee/obligor’s income as the

IWO directs, you are liable for both the accumulated amount you should have withheld and any penalties set by s tate or tribal law/procedure.

________________________________________________________________________________________________________________________________

Anti -discrimination: You are subject to a fine determined under s tate or tribal law for discharging an employee/obligor from employment, refusing to

employ, or taking disciplinary action against an employee/obligor because of this IWO .

_________________ _______________________________________________________________________________________________________________

OMB 0970-0154

June 2015 Form 3N051

Employer’s Name: ___________________________________________ Employer FEIN: ___________________________________________

Employee/Obligor’s Name: ____________________________________ SSN: ____________________________________________________

CSE Agency Case Identifier: ___________________________________ Order Identifier: ______________ _____________________________

Withholding Limits: You may not withhold more than the lesser of: 1) the amounts allowed by the Federal Consumer Credit Protection Act (CCPA) (15

USC §1673 (b)); or 2) the amounts allowed by the s tate of the employee/obligor’s principal place of employment or tribal law if a tribal order (see

REMITTANCE INFORMATION). Disposable income is the net income after making mandatory deductions such as: s tate, federal, local taxes ; Social Security

taxes ; statutory pension contributions; and Medicare taxes. The federal limit is 50% of the disposable income if the obligor is supporting another family and

60% of the disposable income if the obligor is not supporting another family. However, those limits increase 5% - to 55% and 65% - if the arrears are greater

than 12 weeks. If permitted by the s tate or tribe , you may deduct a fee for administrative costs. The combined support amount and fee may not exceed the

limit indicated in this section.

For tribal orders, you may not withhold more than the amounts allowed under the law of the issuing t ribe. For tribal employers/income withholders who receive

a state IWO, you may not withhold more than the limit set by tribal law.

Depending upon applicable state or tri bal law, you may need to consider the amounts paid for health care premiums in determining disposable income and

applying appropriate withholding limits.

Arrears greater than 12 weeks? If the Order Information does not indicate that the arrears are greater than 12 weeks, then the e mployer should calculate the

CCPA limit using the lower percentage.

Supplemental information: Non -employee s’ withholding limitations are the same as that for employees unde r Texas Family Code

____________________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________

IMPORT ANT: The person completing this form is advised that the information may be shared with the employee/obligor.

NOTIFICATION OF EMPLOYMENT TERMINATION OR INCOME STATUS : If this employee/obligor never worked for you or you are no longer

withholding income for this employee/obligor, you must promptly notify the CSE a gency and/or the sender by returning this form to the address listed in the

c ontact information below :

This person has never worked for this employer nor received periodic income .

This person no longer works for this employer nor receives periodic income.

Please provide the following information for the employee /obligor:

Termination date: ________ Last known phone number _____________________________________

Last known address: __ _______________________________________________________________________________

_____________________________________________________________________________ _____________ ____

F inal payment date to SDU/ tribal Payee: ________________________________________ Final payment amount: ______________________

New employer's name: __________________________________________________________________________________________ ________________

New employer's address: _________ _______________ _______________________________________ ________________________________ _______

_________ _________________________________________________________________________________________ ____

CONTACT INFORMATION

To Employer /Income Withholder : If you have any questions, contact by phone at , by fax at , by e-mail or website at

www.employer. texasattorneygeneral.gov

Send termination/income status notice and other correspondence to:

Office of the Attorney General

Child Support Division

Central File Maintenance

P O Box 12048

Austin, TX 78711 -2048

To Employee/ Obligor: If the employee/obligor has questions, contact by phone at , by fax at , by e-mail or website at

http://texasattorneygeneral.gov/cs/

The Paperwork Reduction Act of 1995

This information collection and associated response are conducted in accordance with 45CFR 303.100 of the Child Support Enforcement Program. This form

is designed to provide uniformity and standardization. Public reporting burden for this collection of information is estimat ed to average 5 minutes per response

for Non-IV -D CPs; 2 minutes per response for employers; 3 seconds for e -IWO employers, including the time for reviewing instructions, gathering and

maintaining the data needed, and reviewing the collection of information.

An agency may not conduct or sponsor, and a person is not re quired to respond to, a collection of information unless it displays a currently valid OMB control

number.

Useful tips on finishing your ‘How To Complete An Income Withholding For Support Order ’ online

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the premier eSignature platform for individuals and small to medium-sized businesses. Say farewell to the labor-intensive routine of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Utilize the robust features included in this user-friendly and budget-friendly platform and transform your method of document management. Whether you need to approve forms or collect signatures, airSlate SignNow efficiently manages it all with just a few clicks.

Adhere to this comprehensive guide:

- Sign in to your account or register for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘How To Complete An Income Withholding For Support Order ’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

- Insert and designate fillable fields for others (if needed).

- Proceed with the Send Invite options to solicit eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

Don’t fret if you need to work with your colleagues on your How To Complete An Income Withholding For Support Order or send it for notarization—our solution provides everything you require to accomplish these tasks. Sign up with airSlate SignNow today and elevate your document management to new heights!