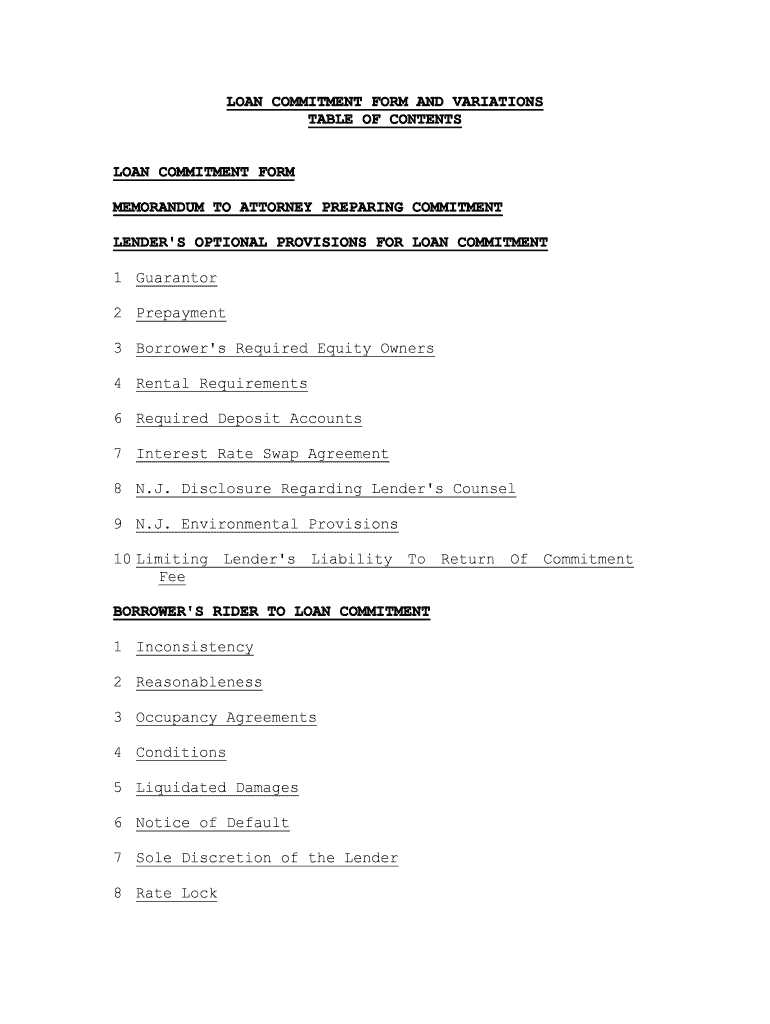

LOAN COMMITMENT FORM AND VARIATIONS

TABLE OF CONTENTS

LOAN COMMITMENT FORM

MEMORANDUM TO ATTORNEY PREPARING COMMITMENT

LENDER'S OPTIONAL PROVISIONS FOR LOAN COMMITMENT

1 Guarantor

2 Prepayment

3 Borrower's Required Equity Owners

4 Rental Requirements

6 Required Deposit Accounts

7 Interest Rate Swap Agreement

8 N.J. Disclosure Regarding Lender's Counsel

9 N.J. Environmental Provisions

10 Limiting Lender's Liability To Return Of Commitment

Fee

BORROWER'S RIDER TO LOAN COMMITMENT

1 Inconsistency

2 Reasonableness

3 Occupancy Agreements

4 Conditions

5 Liquidated Damages

6 Notice of Default

7 Sole Discretion of the Lender

8 Rate Lock

LOAN COMMITMENT FORM 1

___________________, 199_

{{{31/BORROWER}}} {{{32/ADDRESS OF BORROWER}}} Re: Loan in the amount of ${{{19/AMOUNT OF

Dear Ladies and Gentlemen: {{{1/LENDER}}} (the "Lender

") hereby offers to make a loan

to {{{31/BORROWER}}} (the "Borrower

"), subject to the terms and

conditions set forth in this commitment letter (called the "Commitment

"). This Commitment is also subject to: 1) all laws,

regulations, and governmental requirements which are (or may

hereafter be) applicable to the Lender, and 2) the Supplemental

Commitment Provisions attached to this Commitment as Schedule A

(the "Supplemental Commitment Provisions "), which are hereby

incorporated in and made a part of this Commitment.

1. Loan Amount

The amount of the loan to be made by the Lender to the

Borrower pursuant to this Commitment is ${{{19/AMOUNT OF LOAN}}} (the "Loan

").

2. Interest

1 This commitment is for a LIBOR rate loan. It follows the

conventional format now generally used by lenders, since it specifies the material "business" terms, and then provides that the remaining terms are specified in loan documents to be prepared by the Lender. An alternative form of commitment could be much shorter. Although it

would contain the material "business" terms, it would not include the "boilerplate" that typically appears in commitments. Instead, this alternative form of commitment would contain, as appendices, the loan documents that the Lender intends to use. This will also protect the lender against the common complaint by the borrower that the provisions of the closing documents are not spelled out in the commitment. While this might be objectionable to some lenders who believe that the time required to draft the loan documents would delay the issuance of the commitment, however, document assembly software simplifies the preparation of the initial draft of the loan documents. See Chapter 2 of the main text of this book for more details

regarding loan commitments generally. This Chapter may discuss variations of the following form which are not included in such form and which are applicable to your particular transaction.

The annual rate of interest on the Loan will be equal to

the sum of: 1) Adjusted LIBOR (defined below) plus 2)

{{{70.2.2.2/SPREAD OVER ADJUSTED LIBOR}}}% per annum (the sum of

the rates specified in 1) and 2) of this sentence being called

"Note LIBOR

"). "Adjusted LIBOR " is, with respect to each day

during each Interest Period (defined below), the annual rate of

interest (rounded to the next higher 1/100 of 1%) for U.S.

dollar deposits of {{{70.2.1.2.1/LIBOR PERIOD}}} maturity as

reported on Associated Press-Dow Jones Telerate page 3750 as of

11:00 a.m., London time, on the second London business day

("London Business Day

") before the relevant Interest Period

begins (or if not so reported, then as determined by the Lender

from another recognized source or interbank quotation), adjusted

for reserves by dividing that rate by 1.00 minus the LIBOR

Reserve %. "LIBOR Reserve %

" is the maximum percentage reserve

requirement (rounded to the next higher 1/100 of 1% and

expressed as a decimal) in effect for any day during the

Interest Period under the Federal Reserve Board's Regulation D

for Eurocurrency Liabilities as defined therein. Notwithstanding the foregoing, if the Borrower has hedged the

Note LIBOR by entering into an interest rate swap agreement with

the Lender, Adjusted LIBOR shall be rounded five decimal places

in accordance with the 1991 ISDA Definitions published by the

International Swaps and Derivatives Association, Inc. "Interest

Period " means, initially, the period commencing on the Closing

Date and ending on the first Re-Set Date, and thereafter, each

period commencing on the last day of the immediately preceding

Interest Period and ending one month thereafter, but in no event

after the Maturity Date. "Re-Set Date

" means the same day of

each month (except as provided below) during the term of the

Loan, the first of which Re-Set Dates shall be {{{70.2.5/FIRST

RE-SET DATE}}}. Each subsequent Re-Set Date shall be the same

day in each subsequent calendar month, provided, however, that

if such date in any such subsequent calendar month during the

Term shall not be a London Business Day, then the Re-Set Date

for such calendar month shall be the next succeeding London

Business Day, unless the next such succeeding London Business

Day would fall in the next calendar month, in which event the

Re-Set Date for such calendar month shall be the next preceding

London Business Day. Interest on the Loan will be calculated

daily, on the basis of the actual number of days elapsed, over a 360 day year, and shall be payable in arrears.

3. Amount Of Loan Payments

Subject to Section of this Commitment, monthly

installments of principal and interest shall be payable in an amount equal to the sum of:

(i) all interest, at an annual interest rate equal to

Note LIBOR, to the extent accrued during the applicable Interest Period, plus (ii) a principal payment equal to the principal

portion of the fixed payment that would be required to

repay the Loan in full, in substantially equal payments,

amortized over a hypothetical {{{73.2.1/AMORTIZATION

PERIOD}}}-year term at a fixed interest rate equal to the

interest rate on the Loan at the beginning of such

Interest Period (provided that the Lender may, at its

option, use a different point or points, at any time

during the Loan term, for choosing the interest rate that

will be the basis for calculating the amount of the Loan payments as provided in this paragraph).

In addition, the Borrower shall pay to the Lender, on the

Maturity Date, a final installment in the amount of the unpaid

principal balance, together with all accrued and unpaid interest

and all other sums due pursuant to the Loan Documents. If the

first Re-Set Date is other than the Closing Date, interest only

on the unpaid principal balance of the Loan from the Closing

Date to the first Re-Set Date shall be paid on the first Re-Set

Date. Thereafter, a monthly installment payment of principal

and interest (determined as provided above in this paragraph) will be payable on the last day of each Interest Period.

4. Loan Term

The Loan will mature on {{{25/MATURITY DATE}}} (the

"Maturity Date

"), at which time the unpaid principal balance of

the Loan, and all accrued interest, together with all unpaid

fees, expenses and other sums, if any, to the extent payable to

the Lender pursuant to the Loan Documents, will be due and payable.

5. Use Of Loan Proceeds

The proceeds of the Loan will be used by the Borrower as

follows: {{{99.2/USE OF LOAN PROCEEDS}}}. The Loan must, at all

times while the Loan is outstanding, be secured by a

{{{57/PRIORITY OF LENDER'S LIEN}}} mortgage on the real property

and improvements located at {{{53/ADDRESS OF REAL ESTATE}}} and

designated as {{{54/TAX MAP IDENTIFICATION OF REAL ESTATE}}}

(such real property and improvements being called the "Real

Estate "). The Loan must also be secured by all rents and other

proceeds from the Real Estate, and all tangible and intangible

property of the Borrower which is used in connection with, or which otherwise relates to, the Real Estate.

6. Manner Of Payment

The Borrower shall make all payments due under the Loan

Documents in unconditionally and immediately available federal

funds (not subject to any chargeback or credit) in such manner

as may be requested by the Lender. At the Lender's request, the

Borrower shall: 1) deliver to the Lender a written consent to

allow the Lender to debit the Borrower's account with the Lender

for each payment which is due and payable under the Loan

Documents, and 2) the Borrower shall deposit and maintain in

such account, from time to time such funds as shall be

sufficient to make all payments which are payable under the Loan

Documents from time to time. The minimum balance in such

account, at any given time, shall be not less than the amount

which shall be payable under the Loan Documents to the Lender

during the next 30 days. The Borrower shall remain personally

liable for all payments under the Loan Documents, even following

the deposit by the Borrower of funds into such account, provided

that the Borrower shall be credited with a payment on account of

its obligations under the Loan Documents as and to the extent

the Lender makes a debit to the account which is final against

the Borrower and all third parties and is not subject to any

other credit or chargeback or any other claim, counterclaim, right of recoupment, or defense of any party.

7. Commitment Fee

The Borrower hereby agrees to pay to the Lender a

nonrefundable commitment fee of ${{{20/COMMITMENT FEE}}} (the

"Commitment Fee

") in the following installments: (i)

${{{20.1/INSTALLMENT OF COMMITMENT FEE AT COMMITMENT}}} at the

time of execution by the Borrower of this Commitment; and (ii)

${{{20.2/INSTALLMENT OF COMMITMENT FEE AT CLOSING}}} on the

Closing Date. The Commitment Fee shall be deemed earned upon

the execution and delivery by the Borrower of this Commitment to

the Lender. The Borrower hereby acknowledges that the

Commitment Fee is a liquidated damages amount which is

reasonable in the light of the anticipated harm caused by any

breach by the Borrower of this Commitment, the difficulties of

proof of loss, and the inconvenience or nonfeasibility of

otherwise obtaining an adequate remedy. The Commitment Fee

represents reasonable compensation to the Lender for expenses,

work and services arising from the negotiation and preparation

of this Commitment and preparing the Loan for closing, as well

as loss of other investment opportunities by reason of allocating the amount of the Loan for the commitment period.

8. Environmental Report

This Commitment is conditioned upon the Lender's receipt of

a "Phase I" environmental report with respect to the Mortgaged

Property (defined below) (the "Environmental Report

"), in form

and substance satisfactory to the Lender, assessing the

environmental condition of the Mortgaged Property. The

Environmental Report must be prepared in accordance with ASTM

Standard E 1527-93 (or any successor or replacement provision),

and, at the option of the Lender, such other standards and

practices which may be recommended by ASTM, the International

Organization for Standardization ("ISO"), and other reputable

organizations. The Lender shall have the right to require

additional environmental assessments (including, without limitation, soil tests, tests for the presence of any storage

tank, tests of the integrity of any storage tank, an asbestos

survey, an air monitoring survey, and a "Phase II" environmental

assessment), which additional assessments shall be deemed to be

a part of the Environmental Report. The Lender shall have the

right not to fund the Loan, and to terminate its obligations

under this Commitment, if the Environmental Report discloses any

environmental contamination of the Security (defined below) by

any hazardous materials or any other material environmental

concern relating to the Mortgaged Property, as determined by the

Lender in its sole discretion. The Environmental Report will be

ordered by the Lender (except that any "Phase II" environmental

report may, at the Lender's discretion, be ordered by the

Borrower) from an environmental engineering company acceptable

to the Lender. The fee for the Environmental Report shall be

paid by the Borrower. Upon acceptance of this Commitment, the

Borrower shall pay to the Lender the sum of ${{{21/ENVIRONMENTAL

REPORT DEPOSIT}}} (the "Environmental Report Deposit

") on

account of the estimated cost of the Environmental Report. In

the event the actual cost of the Environmental Report exceeds

the Environmental Report Deposit, the Borrower shall pay such

excess cost to the Lender on its demand, but in no event later

than the Closing Date. In the event that the actual cost of the

Environmental Report is less than the Environmental Report

Deposit actually paid to the Lender, such excess shall be

credited against the balance of the Commitment Fee due at Closing or refunded to the Borrower, at the Lender's discretion.

9. Real Estate Inspection

The provisions of this Commitment are subject to and

conditioned upon the Lender's receipt of an engineering survey

(the "Real Estate Inspection

"), in form and substance

satisfactory to the Lender, which shall demonstrate that: 1)

there are no structural defects at the Mortgaged Property, and

2) all heating, plumbing, electrical, air-conditioning and

mechanical systems serving the Mortgaged Property are in proper

working order. The Real Estate Inspection shall also describe

the measurements and the gross and net square footage of each

building at the Mortgaged Property. The Real Estate Inspection

will be ordered by the Lender from an engineer acceptable to the

Lender. The fee for the Real Estate Inspection shall be paid by

the Borrower. Upon acceptance of this Commitment the Borrower

shall pay to the Lender the sum of ${{{22/REAL ESTATE INSPECTION

DEPOSIT}}} (the "Real Estate Inspection Deposit

") on account of

the estimated cost of the Real Estate Inspection. In the event

the actual cost of the Real Estate Inspection exceeds the Real

Estate Inspection Deposit, the Borrower shall pay such excess

cost to the Lender on demand, but in no event later than the

Closing Date. In the event that the actual cost of the Real

Estate Inspection is less than the Real Estate Inspection

Deposit actually paid to the Lender, such overpayment shall be

credited against the balance of the Commitment Fee due at Closing or refunded to the Borrower, at the Lender's discretion.

10. Appraised Value

The Lender's obligation to fund the Loan is subject to the

Lender's receipt of an independent appraisal of the Real Estate,

in form and substance satisfactory to the Lender (the "Appraisal

"). The Appraisal must demonstrate that the current

fair market value of the Borrower's interest in the Real Estate

(to the extent such interest is mortgaged to the Lender pursuant

to the Loan Documents) is not less than ${{{99.3/MINIMUM

APPRAISED VALUE OF REAL ESTATE}}}. The Appraisal must also

refer to the Environmental Report and Engineering Survey, and

must reflect the cost of each capital expenditure recommended by

the Environmental Report or the Engineering Survey. The

Appraisal will be ordered by the Lender from an appraiser

acceptable to the Lender. The fee for the Appraisal shall be

paid by the Borrower. On or before the date of the Borrower's

execution of this Commitment, the Borrower shall pay to the

Lender ${{{23/APPRAISAL DEPOSIT}}} (the "Appraisal Deposit

") on

account of the estimated cost of the Appraisal. In the event

the actual cost of the Appraisal exceeds the Appraisal Deposit,

the Borrower shall pay the difference to the Lender on demand,

but in no event later than the Closing Date. In the event that

the actual cost of the Appraisal is less than the Appraisal

Deposit actually paid to the Lender, such excess shall be

credited against the balance of the Commitment Fee due at Closing or refunded to the Borrower, at the Lender's discretion.

11. Lender's Legal Expenses

The Lender may engage legal counsel, at the Borrower's

expense, to prepare and review documents and information

relating to, and otherwise represent the Lender with respect to,

the Loan, the Loan Documents, and the Security (the "Lender's

Counsel ").

12. Borrower's Right To Prepay

The Loan may be prepaid in whole or in part on the last day

of an Interest Period, without penalty or premium; provided,

however, that any partial prepayments shall be in a principal

amount of not less than ${{{80.2/MINIMUM PREPAYMENT}}}, or

multiples thereof. Any prepayment must also be accompanied by

payment of all accrued and unpaid interest due to the date of

prepayment on the principal amount prepaid and all other fees,

expenses and other sums due and owing under the Loan Documents.

Any partial prepayment will be applied to installments of principal due in their inverse order of maturity.

13. Payments For Taxes And Insurance

At the option of the Lender, the Borrower will pay to the

Lender, at the time each installment of principal and interest

is due and payable under the Loan Documents, one twelfth (1/12)

of: 1) the annual taxes, assessments, and other governmental

charges levied or assessed against the Mortgaged Property (all

such taxes, assessments, and charges being called "Taxes

"), and

2) the annual premiums for property, liability, and other

insurance required to be maintained by the Borrower with respect

to the Security pursuant to the Loan Documents (such premiums

being called the "Premiums

"). Such payments by the Borrower on

account of Taxes and Premiums will be held by the Lender to be

used by the Lender on account of the payment of Taxes and

Premiums. All amounts paid to the Lender pursuant to this

paragraph, and all other reserves and deposit accounts held by

the Lender, and all other monetary collateral for the Loan, are

collectively called the "Reserves

." All Reserves may be

commingled with general funds of the Lender. The Lender shall

not have any obligation to pay any interest on the Reserves to

the Borrower, or to deposit the Reserves in an interest-bearing

account. However, if the Lender deposits any of the Reserves in

an interest-bearing account, then the interest on such Reserves

shall be payable to the Borrower, after deducting the Lender's

reasonable administrative expenses in connection with such

Reserves. At the Lender's request, the Borrower will also pay

to the Lender, on the Closing Date, a tax service fee (in the

amount specified by the Lender) for the purpose of defraying the

expense incident to monitoring the payment of Taxes. If the

Lender does not exercise its option specified above in this

paragraph to have payments made to the Lender on account of

Taxes and Premiums, then the Borrower shall promptly pay and discharge all Taxes and Premiums when due.

14. Default Payments By Borrower

From the earlier of: 1) the Maturity Date, or 2) any Event

of Default under the Loan Documents, the unpaid balance of the

Loan will, at the Lender's option, bear interest at a rate per

annum equal to the greater of: A) {{{78.1/FIXED DEFAULT RATE}}}%

per annum, or B) the sum of: 1) {{{78.2/SPREAD OVER PRE-DEFAULT

RATE}}}% per annum, plus 2) the interest rate per annum which

would be applicable, under the Loan Documents, to such unpaid

balance if such Maturity Date or Event of Default had not

occurred. In addition, if any payment of principal, interest,

or other charge pursuant to the Loan Documents is not received

by the Lender on or before the due date for such payment, then a

late charge of {{{77.1/LATE CHARGE %}}}% of such overdue payment

will be payable by the Borrower to the Lender on the earlier of

1) demand by the Lender, or 2) the next scheduled monthly payment under the Loan Documents.

15. Closing and Closing Date

The "Closing " means a closing at which the Loan (or any

part thereof) is initially advanced by the Lender, and the Loan

Documents (as hereinafter defined) are executed and delivered to

the Lender. The date on which the Closing occurs is called the

"Closing Date

." The Closing will take place at the offices of

{{{12/LENDER'S ATTORNEY}}}, {{{13/LAW FIRM OF LENDER'S ATTORNEY}}}, {{{14/ADDRESS OF LENDER'S ATTORNEY}}}, or at such

other location as may be designated by the Lender.

{{{27/OUTSIDE CLOSING DATE}}} (the "Outside Closing Date

") is

the date by which the Borrower is required to fulfill its

obligations under this Commitment and close the Loan. The

Borrower may give notice to the Lender scheduling a date and

time for the Closing, on or before the Outside Closing Date, by

giving at least ten (10) days prior notice to the Lender of such

date and time. If the Loan is not closed by the Outside Closing

Date (unless extended in writing by the Lender, or unless the

Closing does not occur as a result of the Lender's default under

this Commitment after notice of such default from the Borrower

and the Lender's failure to cure such default within thirty (30)

days after such notice), then this Commitment will terminate and

the Lender shall have no further obligations under this Commitment.

16. Borrower's Acceptance

The Lender will have no obligation under this Commitment

unless, within ten (10) days following the date of this

Commitment, the Borrower (and each Guarantor, if any) has

accepted this Commitment by signing the "Acceptance" attached

hereto on the enclosed duplicate counterparts of this Commitment

and returning such counterparts, together with checks in the

amount of the Commitment Fee (or the portion payable on or

before the date of this Commitment), the Appraisal Deposit, the

Environmental Report Deposit and the Real Estate Inspection

Deposit, as applicable, to the Lender. Until the Lender

receives the accepted Commitment and the foregoing fees, the Lender shall have no obligation under this Commitment.

17. No Trial By Jury; Borrower's Consent To Jurisdiction

THE BORROWER, EACH GUARANTOR (IF ANY), AND THE LENDER

KNOWINGLY, VOLUNTARILY AND IRREVOCABLY WAIVE ANY RIGHT THEY MAY

HAVE TO TRIAL BY JURY IN ANY ACTION OR PROCEEDING BETWEEN THE

BORROWER AND THE LENDER IN CONNECTION WITH OR ARISING OUT OF

THIS COMMITMENT AND THE TRANSACTIONS RELATED HERETO. THE

BORROWER IRREVOCABLY CONSENTS TO THE JURISDICTION OF THE COURTS

OF THE STATE OF {{{87/STATE WHOSE LAW GOVERNS}}} AND ANY UNITED

STATES DISTRICT COURT LOCATED IN THE STATE OF {{{87/STATE WHOSE

LAW GOVERNS}}} IN ANY ACTION OR PROCEEDING IN CONNECTION WITH OR ARISING OUT OF THIS COMMITMENT.

If the terms and conditions set forth in this Commitment

are acceptable, please sign and return the enclosed copy of this Commitment in accordance with Section

of this Commitment above.

Very truly yours,

{{{1/LENDER}}}

ACCEPTANCE BY BORROWER

Intending to be legally bound, the Borrower hereby accepts

the foregoing Commitment, including the terms and conditions of

the Supplemental Commitment Provisions attached as Schedule A

to

the Commitment. WITNESS/ATTEST:

____________________ {{{31/BORROWER}}}

Consented and Agreed to by each Guarantor:WITNESS/ATTEST:

____________________ {{{61/GUARANTOR}}}

Dated:_____________________

The Borrower represents that its federal taxpayer identification

number (or social security number, in the case of an individual Borrower) is: {{{43/BORROWER'S TAXPAYER ID NO.}}}.

The Guarantor represents that its federal taxpayer identification number (or social security number, in the case of

an individual Guarantor) is: {{{64.2/GUARANTOR'S TAXPAYER ID NO.}}}.

The Borrower represents that its legal counsel is:

{{{46/BORROWER'S ATTORNEY}}}, {{{47/LAW FIRM OF BORROWER'S ATTORNEY}}}, {{{48/ADDRESS OF BORROWER'S ATTORNEY}}}.

The Guarantor represents that its legal counsel is: {{{65/GUARANTOR'S ATTORNEY}}}, {{{66/LAW FIRM OF GUARANTOR'S ATTORNEY}}}, {{{67/ADDRESS OF GUARANTOR'S ATTORNEY}}}.

SCHEDULE A

Supplemental Commitment Provisions

In addition to the terms and conditions set forth in the

Commitment made by {{{1/LENDER}}} and accepted by

{{{31/BORROWER}}} to which this Schedule A

is annexed (such

Commitment, together with this Schedule A

and all other

Schedules thereto, being collectively called the "Commitment

"),

the Loan shall be subject to the terms and conditions set forth

below. All capitalized terms not otherwise defined in this

Schedule A

shall have the same meanings given to such terms in

the Commitment.

18. Loan Documents and Security

The Borrower's obligation to repay the Loan will be

evidenced or secured, as applicable, by such documents,

instruments, certificates, opinions and assurances as the Lender

or its counsel may reasonably request including, without

limitation, each of the following loan documents (all such

documents, instruments, certificates, opinions and assurances

being collectively called the "Loan Documents

"), each of which

must be in form and substance satisfactory to the Lender and its counsel:

1.1Loan Agreement

. If requested by the Lender, a loan

agreement executed by the Borrower and the Lender (the "Loan Agreement

").

1.2 Promissory Note

. A promissory note made by the

Borrower to the Lender in the original principal amount of the Loan (the "Promissory Note

").

1.3 Mortgage And Security Agreement

. A valid

{{{57/PRIORITY OF LENDER'S LIEN}}} lien mortgage and

security agreement (such mortgage and security

agreement being collectively called the "Mortgage

")

against: 1) the Real Estate, 2) all improvements now

or hereafter constructed on the Real Estate, 3) all

fixtures and personal property of the Borrower now

or hereafter located on the Real Estate or used in

connection with the Real Estate, and 4) all Reserves

(the Real Estate, and such improvements, fixtures,

personal property, and Reserves being collectively called the "Mortgaged Property

").

1.4 Assignment of Rents . An absolute assignment of

leases and rents (the "Assignment of Rents

")

providing for the assignment to the Lender by the

owner of the Mortgaged Property of: 1) all of its

right, title and interest in and to all leases,

tenancies, and other occupancy agreements, now

existing or hereafter arising, relating to the

Mortgaged Property (or any part thereof or interest

therein) (all such leases, tenancies, and occupancy

agreements being collectively called the "Occupancy

Agreements "), and 2) all rents, deposits, issues and

profits arising under the Occupancy Agreements or

otherwise from the Mortgaged Property (or any part thereof or interest therein).

1.5 Lien Documents

. The Borrower will grant a lien on,

and a security interest in, all security for each

obligation of the Borrower under the Loan Documents

(all such security being called the "Security

"). If

the Borrower is not the sole owner of the Security,

then the Borrower shall arrange for the owner of

each interest in the Security, other than the

Borrower, to grant such lien and security interest

to the Lender, and the Borrower shall also provide

such assurances and insurance to the Lender as it

may request in its sole discretion confirming that

such lien and security interest are not available or subject to the rights of any third party.

1.6 UCC-1s

. Uniform Commercial Code financing statements

granting to the Lender a perfected {{{57/PRIORITY OF

LENDER'S LIEN}}} lien on and security interest in

all fixtures, machinery, equipment, books and

records and other tangible and intangible personal

property which are now owned or hereafter acquired

by the owner of the Mortgaged Property and which are

located on or used in connection with the

construction, operation or maintenance of the Mortgaged Property.

1.7 Deposit and Debit Agreement

. A Deposit and Debit

Agreement (the "Deposit and Debit Agreement

")

providing that: 1) the Borrower shall maintain in an

account with the Lender a minimum balance which, at

each time during the term of the Loan, shall be

sufficient to pay all amounts which are due and

payable under the Loan Documents during the next

thirty (30) days, and 2) the Lender is authorized to

charge such account for all payments due under the Loan Documents or in connection with the Loan.

1.8 Resolutions and Certificate Of Borrower . The

Borrower's resolutions and certificate that all of

its representations and warranties in the Loan

Documents are true and complete, containing, as

appendices, copies of the Borrower's organizational

documents, as amended to the Closing (certified as

being true and complete copies by the Borrower, and

if any counterpart of any such document has been

filed with a governmental office, then also

certified by such governmental office as a true and

complete copy). The Borrower is, and, while the

Loan is outstanding, will continue to be, {{{40/TYPE OF BORROWER}}}.

1.9 Legal Opinion Of Borrower's Counsel

. A legal

opinion of the Borrower's independent counsel. The

identity of the law firm providing such opinion must

be reasonably satisfactory to the Lender, and such

opinion shall contain such provisions as the Lender may reasonably request.

1.10 Additional Items

. Each of the other documents,

certificates and instruments set forth in the

Supplemental Commitment Provisions, which documents,

certificates and instruments are incorporated in this Commitment by reference.

19. Occupancy Agreements

2.1 Lender's Approval . All Occupancy Agreements which are

effective on or after before the Closing Date must be submitted

to the Lender for review and approval at least ten (10) business

days prior to the Closing Date. All proposed Occupancy

Agreements must be submitted to the Lender for its review and

approval prior to execution. All Occupancy Agreements must be

in writing and subordinate to the lien of the Mortgage and

contain terms and conditions acceptable to the Lender. However,

at Lender's option, the Lender may subordinate its lien to any

Occupancy Agreement. The Lender shall have no obligation to grant rights of nondisturbance to any tenant.

2.2 Tenant Estoppel Certificates

. The Borrower shall

deliver to the Lender, on or before the Closing Date, an

estoppel certificate, in the form required by the Lender, from each tenant and other occupant of the Mortgaged Property.

2.3 Rent Roll

. The Borrower represents and

acknowledges that the rent roll for the Mortgaged Property,

attached to this Commitment as Schedule B

(the "Rent Roll "), is

true, correct and complete as of the date of this Commitment,

and there is no material omission from such Rent Roll. A pre-

condition to the Closing is that the Rent Roll shall continue to

be true, correct and complete in all respects as of the Closing

Date. The Lender shall have no obligation to fund the Loan if

the rents from the Mortgaged Property, as of the Closing Date, are less than the rents set forth on the Rent Roll.

20. Other Closing Documents

The provisions of the Commitment are subject to and

conditioned upon the Borrower's obtaining, at its expense, and

submitting to the Lender and its counsel, at least ten (10)

business days prior to the Closing Date, the following

documents, each of which must be in form and substance satisfactory to the Lender and its counsel:

3.1 Title Commitment

. A title insurance commitment issued

by a title insurance company ("Title Insurance Company

")

acceptable to the Lender, together with copies of all documents

identified therein, and pursuant to which the Title Insurance

Company agrees to issue to the Lender on the Closing Date an

ALTA form (or such other form which is reasonably required by the Lender) 2

of Loan Policy acceptable to the Lender insuring the

Mortgage as a valid {{{57/PRIORITY OF LENDER'S LIEN}}} lien for

the full amount of the Loan, free and clear of all liens and

encumbrances, whether of record or otherwise, and subject only

to such exclusions from coverage and such exceptions to title as

may be approved by the Lender in writing, and containing such

endorsements as the Lender may require (and, if required by the

Lender, with co-insurance or reinsurance with direct access

agreements issued by such title insurance companies as are

acceptable to the Lender). The title commitment shall specify

that the Borrower is the sole owner of the Real Estate. The

title commitment shall also name the Lender, its successors and

assigns, as the insured under the Loan Policy and shall include

county and upper court judgment and bankruptcy court searches,

tax and assessment searches, and county and state financing

statement searches. Title to the Real Estate shall be good and marketable and insurable.

3.2 Survey

. An "as-built" boundary and location survey

of the Real Estate prepared for the Lender by a land surveyor

licensed in the State of {{{56/STATE IN WHICH REAL ESTATE IS

LOCATED}}} and acceptable to the Lender. Such survey must be

based on an inspection of the Real Estate (and such survey must

2 Note that some states, such as California, New York, and Texas, require special

title insurance forms. See Chapter 7 of the main text of this book regarding title

insurance requirements.

be dated, or redated as of a date which is) not earlier than

three (3) months prior to the Closing. Such survey must also be

certified to the Title Insurance Company and the Lender, and

their respective successors and assigns, and insurable by the

Title Insurance Company. Further, the survey must: 1) comply

with the minimum detail requirements for an Urban Survey as

adopted by the American Land Title Association and American

Congress on Surveying and Mapping, 2) be otherwise satisfactory

to the Lender, and 3) show: (i) the boundaries of the Real

Estate by courses and distances, together with a metes and

bounds description corresponding to such survey; (ii) the

location of all improvements; (iii) the location and width of

all easements, utility lines, rights-of-way and building set-

back lines and notes referencing the book and page numbers for

the instruments granting the same; (iv) the location of all

encroachments and restrictions, if any, affecting the Real

Estate; (v) the location of all adjoining streets, the distance

to and names of the nearest intersecting streets, and (vi) the

certification of the surveyor as to (A) whether the roads

abutting the Real Estate are publicly dedicated, (B) the acreage

of the Real Estate, (C) whether the parcels comprising the Real

Estate (if applicable) are contiguous without any gores, gaps,

overlaps or strips of land separating them, and (D) such other

matters as reasonably requested by the Lender or its counsel.

An existing survey (which is more than three (3) months old as

of the Closing) with a survey affidavit of no change may be used only if approved by the Lender.3.3 Property, Liability, and Other Insurance

. Original

policies of insurance, each in effect for a period of not less than one (1) year following the Closing Date, as follows:

[a] Comprehensive "all-risk" fire and extended

coverage hazard insurance (including the following

endorsements: i) vandalism, ii) malicious mischief, iii)

"Operation of Building Laws," "Demolition Costs" and

"Increased Cost of Construction Endorsements," iv) an

"agreed amount" endorsement waiving all co-insurance

provisions, and v) an "Ordinance or Law Coverage" or

"Enforcement" endorsement if any of the improvements on

the Mortgaged Property are legal non-conforming uses or

structures) covering the Mortgaged Property in an

aggregate amount not less than one hundred per cent

(100%) of the agreed upon full insurable replacement

value of the Mortgaged Property (including coverage for

loss of contents owned by the Borrower), with a waiver of

depreciation, and insuring the Lender as the first mortgagee under a standard mortgagee endorsement clause;

[b] comprehensive general public liability insurance

covering injury and damage to persons and property, on an

"occurrence" rather than a "claims made" basis, with

limits and other terms which are acceptable to the

Lender, and naming the Lender as a certificate holder,

and covering at minimum the following risks: i) premises

and operations, ii) products and completed operations on

an "if any" basis, iii) independent contractors, iv)

blanket contractual liability for all written and oral

contracts, and v) contractual liability pursuant to the

indemnities in the Loan Documents to the extent such

contractual liability coverage for indemnities is commercially available at reasonable premiums;

[c] if the Real Estate is located within a flood

hazard area or flood zone (as determined by the Lender),

then flood insurance in the maximum available amount

through the Federal Flood Insurance Program (and such

private flood insurance as the Lender may request) and

insuring the Lender as the first mortgagee under a standard mortgagee endorsement clause;

[d] insurance which complies with the workers'

compensation and employers' liability laws of all states in which the Borrower shall have employees;

[e] business income insurance sufficient to pay, for

a period of not less than twelve (12) months, normal

operating expenses of or gross income from the Mortgaged

Property, and designating the Lender as the first

mortgagee, and containing an extended period of indemnity

endorsement which provides that after any loss to the

improvements on the Mortgaged Property (and any personal

property located thereon) has been repaired, the

continued loss of income will be insured until such

income either returns to the same level it was at prior

to the loss, or the expiration of twelve (12) months from

the date of the loss, whichever first occurs, and

notwithstanding that the policy may expire before the end of such period;

[f] boiler and machinery insurance in such amounts as

the Lender shall require, provided the Mortgaged Property contains equipment of such nature;

[g] during each period when there is any construction

on or alteration of the Mortgaged Property or any

improvements thereto, i) owner's contingent or protective

liability insurance covering claims not covered by or

under the commercial general liability insurance policy

specified in subparagraph above, and ii) the insurance

provided in subparagraph above written in a "builder's

risk" completed value form (on a non-reporting basis, and

including permission to occupy the Mortgaged Property); and[h] such other insurance as the Lender may require

from time to time including, without limitation,

earthquake insurance (if any of the Mortgaged Property is

located in an area with a material risk of seismic

activity), mine subsidence insurance, and environmental

liability insurance, in amounts and with carriers reasonably satisfactory to the Lender.

The Borrower shall furnish each policy on or prior to the

Closing Date, and thereafter, upon renewal of such policies,

either the policy itself or a certificate (provided the

Mortgaged Property is identified and specifically allocated

insurance amounts are shown). In addition, each insurance

policy shall include a provision that such policy will not be

cancelled, altered, or in any way limited in coverage or reduced

in amount, unless the Lender is notified in writing at least

thirty (30) days prior to such cancellation or change. Each

insurance policy must be written, on such forms as are

reasonably acceptable to the Lender, by insurance companies

authorized or licensed to do business in the State of

{{{56/STATE IN WHICH REAL ESTATE IS LOCATED}}}. Each such

insurance company must have a rating, which is not less than the

minimum rating required by the Lender, from a reputable rating

agency selected by the Lender, and each such insurance company must be otherwise acceptable to the Lender.

3.4 Coastal, Flood, and Wetland Zones

. Satisfactory

evidence that the Real Estate is not located within a coastal

hazard area, flood hazard area, flood zone, or wetland (as determined by the Lender).

3.5 Formation Documents

. Copies of the organizational

documents of the Borrower and each Guarantor, if any, as amended

to the Closing Date, including, without limitation, (i) the

partnership agreement and certificate of partnership if the

Borrower or any Guarantor is a general partnership, (ii) the

certificate of limited partnership and limited partnership

agreement if the Borrower or Guarantor is a limited partnership,

(iii) the certificate of incorporation and bylaws if the

Borrower or any Guarantor is a corporation, and (iv) the

certificate of formation and the operating agreement if the

Borrower or any Guarantor is a limited liability company. With

respect to each such certificate which is filed in a

governmental office, the Borrower and each Guarantor shall

deliver to the Lender a copy of such certificate as filed in

such office. If the Borrower or any Guarantor is an entity with

respect to which a certificate of good standing is available

from any jurisdiction in which such entity was organized or in

which it has qualified to do business, then such entity shall

deliver to the Lender a good standing certificate, dated not

more than 30 days before the Closing Date, from each such

jurisdiction attesting that such entity is in good standing in such jurisdiction.3.6 C/O, Building, and Zoning

. Evidence in the form of,

but not limited to, environmental permits, use permits, zoning

permits, certificates of occupancy and certificates of no

building violations, that the use and occupancy of the Mortgaged

Property is in compliance with all laws, ordinances and

regulations (including all applicable environmental, zoning,

building, use and subdivision laws, ordinances and regulations).

All approvals and permits must: 1) be legally valid, 2) be

current as of the Closing, 3) cover all improvements to the Real

Estate, and 4) remain in full force and effect throughout the

term of the Loan. In the event that any of such approvals or

permits is invalidated, rescinded or suspended, the Lender will

not be obligated to close the Loan during the period that any invalidation, rescission or suspension continues.

3.7 Additional Searches

. A current search (dated not

more than thirty (30) days before the Closing) against each

Guarantor, if any, for suits and judgments, tax liens, UCC

financing statements, or bankruptcy filings (such search to be

in form and substance satisfactory to the Lender), indicating

that there are no outstanding judgments, suits, tax liens, UCC- 1s, or pending bankruptcy filings applicable to such Guarantor.

3.8 Agreements

. A management agreement (if the Mortgaged

Property is not occupied by the Borrower exclusively for the

conduct of its business), and all service agreements (such as,

for example, elevator and boiler maintenance, garbage removal,

and utilities) which are reasonably necessary for the normal

operation and maintenance of the Mortgaged Property, each of

which must expressly provide that they may not be modified or

terminated without the Lender's approval. Each such agreement

specified in this subparagraph (collectively called the "Service

Agreements ") must be in form and substance satisfactory to the

Lender.

3.9 Other Documents

. Such other documents, instruments

and certificates including, without limitation, proofs, opinions

and other assurances, as the Lender or the Lender's Counsel may reasonably require.

21. Terms and Conditions Of Closing Documents

The Commitment is subject to the execution (by the Borrower

and each Guarantor, if any) of the Loan Documents. The Lender

may require the Loan Documents to contain such representations,

warranties, affirmative and negative covenants, indemnities,

closing conditions, defaults, events of default and remedies as

are typically required by the Lender for transactions such as

the Loan. The Lender also has the right to modify its standard

forms from time to time, such as in order to reflect changes in

the law or lending practices. The Lender may also make such

changes as it may deem appropriate, in its sole discretion, to

reflect the particular circumstances relating to the Loan. The

Borrower acknowledges that not every provision imposing duties,

burdens or limitations on the Borrower has been set forth in the

Commitment. The failure of the Borrower and the Lender to reach

agreement on such provisions shall not be deemed a breach by the

Lender of the Commitment. Such provisions shall include, among

other things, the following (however, even if any particular

provision is not specified below or in this Commitment, the

Lender may nonetheless include such provision in the Loan

Documents so long as such provision is included in the Lender's

standard forms, as the same may be modified or extended as

provided above, or such provision is reasonably required by the Lender or its counsel):

4.1 Loan to Value Percentage

. The Borrower shall

maintain a Loan to Value Percentage of not more than

{{{75.2/MAXIMUM LOAN TO VALUE %}}}%. "Loan to Value Percentage

"

means the outstanding balance of the Loan at the time in

question divided by the then current fair market value of the

Borrower's interest in the Mortgaged Property, as determined by the Lender in its reasonable judgment.

4.2 No Subordinate Lien

. Neither the Borrower nor any

Guarantor shall pledge, grant a security interest in, mortgage,

assign, encumber or otherwise create a lien on any of its

respective property (whether tangible or intangible, and whether

now owned or hereafter acquired) in favor of any person or

entity other than the Lender, except for those liens, security

interests and encumbrances existing on the date of this

Commitment and previously disclosed in writing to, and approved in writing by, the Lender.

4.3 No Loan By Borrower Or Any Guarantor

. Neither the

Borrower nor any Guarantor shall make any loan or advance to any

other person or entity, including, without limitation, officers,

directors, shareholders, principals, partners or affiliates of the Borrower or any Guarantor (if any).

4.4 No Other Debt Of Borrower Or Any Guarantor . Neither

the Borrower nor any Guarantor shall create, incur or assume any

indebtedness for borrowed money other than existing indebtedness previously disclosed to and approved by the Lender in writing.

4.5 No Other Guarantee

. Neither the Borrower nor any

Guarantor shall assume, guarantee, endorse or otherwise become

directly or contingently liable for the obligations of any other

person or entity except by endorsement of negotiable instruments

for deposit into such person's account, for collection in the ordinary course of business.

4.6 No Transfer Of Interests In Borrower

. No Guarantor,

or any other person or entity, shall, whether voluntarily,

involuntarily or by operation of law, sell, transfer, convey,

assign, pledge, encumber or grant a security interest in, any

ownership interests in the Borrower to or in favor of any person or entity other than the Lender.

4.7 Due On Sale Or Transfer

. The owner of the Mortgaged

Property shall not cause or permit any transfer of all or any

portion of the Mortgaged Property, whether voluntarily, involuntarily or by operation of law, without the prior written

consent of the Lender. A "transfer

" includes: (i) the direct

or indirect sale, transfer or conveyance of the Mortgaged

Property or any portion thereof or interest therein; (ii) the

execution of an installment sale contract or similar instrument

affecting all or any portion of the Mortgaged Property; (iii) if

the owner of the Mortgaged Property, or any general partner

thereof, is a corporation, partnership, or other entity, the

transfer (whether in one transaction or a series of transactions) of any stock, partnership, or other ownership

interests in such entity; (iv) if the owner of the Mortgaged

Property, or any general partner thereof, is a corporation or

other entity, the creation or issuance of new stock or other

ownership interests by which an aggregate of more than 10% of

such entity's stock or other ownership interests shall be vested

in a party or parties who are not now stockholders or holders of

ownership interests; and (v) an agreement by the owner of the

Mortgaged Property leasing all or a substantial part of the

Mortgaged Property (for other than actual occupancy by a space

tenant thereunder) or a sale, assignment or other transfer of,

or the grant of a security interest in and to, any Occupancy Agreements.

4.8 No Subordinate Lien

. The owner of the Mortgaged

Property shall not create, or permit to exist, any mortgage,

pledge, lien, security interest (including, without limitation,

a purchase money security interest), encumbrance, attachment,

levy, distraint or other judicial process on or against all or

any portion of the Mortgaged Property (including, without

limitation, fixtures and other personalty), without the prior

written consent of the Lender. If any lien or encumbrance is

filed or entered without the consent of the owner of the

Mortgaged Property, then such lien or encumbrance shall be

removed of record within fifteen (15) days after it is filed or entered.4.9 Right To Apply Insurance or Condemnation Proceeds To

Loan . In the event of partial or total condemnation or damage

to or destruction of the Mortgaged Property, the insurance

proceeds or condemnation award will be payable to the Lender and

the Lender will have the option, in its sole discretion, of

applying all or any portion of such proceeds or award to (i)

reduction of the outstanding principal balance of the Loan, (ii)

restoration, replacement or repair of the Mortgaged Property in

accordance with the Loan Documents and the Lender's standard

construction loan disbursement conditions and requirements; or

(iii) the owner of the Mortgaged Property, subject to the rights of third parties.

4.10 New Appraisals

. The Lender shall have the right

during the term of the Loan to conduct or have conducted, at the

Borrower's expense, updated appraisals of the Mortgaged Property

in form and substance satisfactory to the Lender; provided,

however, that the Borrower shall not be required to pay for such

updated appraisals so long as: (i) no event of default exists

under the Loan Documents; and (ii) such updated appraisal is not

required by applicable law, rule or regulation or the

interpretation or administration thereof by any governmental

authority or comparable agency charged with the interpretation or administration thereof.

4.11 Environmental Report

. The Lender reserves the right

during the term of the Loan to conduct or require the Borrower

to conduct, at the Borrower's expense, such environmental

inspections, audits and tests, and such tests for Hazardous

Substances (defined below) as the Lender shall deem necessary or

advisable from time to time; provided, however, that the

Borrower shall not be required to pay for such environmental

inspections, audits and tests so long as: (i) no event of

default exists under the Loan Documents; and (ii) the Lender has

no cause to believe in its sole reasonable judgment that there

has been a release or a threatened release of any Hazardous

Substance at the Mortgaged Property or that the Borrower or the

Mortgaged Property is in violation of any applicable

Environmental Rule (defined below). "Hazardous Substance

" means

any material or substance that, whether by its nature or use, is

now or hereafter defined or regulated as a hazardous waste,

hazardous substance, pollutant or contaminant under any

Environmental Rule, or which is toxic, explosive, corrosive,

flammable, infectious, radioactive, carcinogenic, mutagenic or

otherwise hazardous or which is or contains petroleum, gasoline,

diesel fuel, another petroleum hydrocarbon product, asbestos,

asbestos-containing materials or polychlorinated biphenyls.

"Environmental Rules

" mean all present and future laws,

statutes, common law, ordinances, rules, regulations, orders,

codes, licenses, permits, decrees, judgments, directives (or the

equivalent) of or by any Public Body (defined below) and

relating to or addressing the protection of the environment or

human health or safety, including, without limitation, the

Comprehensive Environmental Response, Compensation, and Liability Act of 1980, as amended (42 U.S.C. Sections 9601, et

seq.), the Hazardous Materials Transportation Act, as amended

(49 U.S.C. Sections 1801 et seq.), and the Resource Conservation

and Recovery Act, as amended (42 U.S.C. Sections 6901, et seq.),

and the regulations adopted and publications promulgated

pursuant thereto. "Public Body

" includes each of the following:

1) the federal government, 2) any state or local government or

any political subdivision of any state or local government, or

3) any agency, court or body of either the federal government,

or any state or local government or any other political

subdivision of any state or local government, exercising

executive, legislative, judicial, regulatory or administrative functions.

4.12 Defaults By Obligors

. In addition to any defaults

described in the Commitment, each action or omission specified

below in this Section

shall be deemed to be a default by the

Borrower and by each Guarantor (if any) under each of the Loan

Documents (each action or omission specified below being called an "Event of Default

"):

[a] Non-payment when due of any sum required to be

paid to the Lender under any of the Loan Documents.

[b] A breach of any covenant in the Loan Documents

relating to the maintenance of insurance, the payment of

taxes, the restrictions on transfer of title and creation

of liens, the giving of required notices, the

restrictions relating to leases and rents, the

restrictions on organizational restructurings, the maintenance of business operations, and certain financial covenants.

[c] A breach by the Borrower, or any Guarantor, or

any other person providing collateral pursuant to or

obligated to perform under any Loan Document (the

Borrower, each Guarantor, and each such other person

being collectively called the "Obligors

") of any other

term, covenant, condition, obligation or agreement under

any Loan Document, and the continuance of such breach for a period of fifteen (15) days after written notice.[d] Any representation or warranty made by the

Borrower or any Obligor in any Loan Document or to induce

the Lender to enter into the transactions contemplated

under this Commitment proves to be false, incorrect or

misleading in any material respect as of the date when made.

[e] With respect to any Obligor, the filing of a

voluntary or involuntary bankruptcy petition; an

assignment for the benefit of creditors; the appointment

of a custodian, receiver, liquidator or trustee, or any

action to effect any of the foregoing; insolvency

(however defined), or not paying one's debts generally as they become due.

[f] The death, dissolution, liquidation, merger,

consolidation or reorganization of any Obligor, or the

institution of any proceeding to effect any of the foregoing.

[g] A default under any other obligation by any

Obligor in favor of the Lender, including, without

limitation, obligations arising under swap agreements (as

defined in 11 U.S.C. § 101, or any successor or

replacement provision), or under any document securing or

evidencing such obligation, whether or not such obligation is secured by the Mortgaged Property.

[h] There is any material adverse change to any of

the Mortgaged Property.

[i] A material deterioration in the financial

condition of any Obligor or the occurrence of any event

which, in the reasonable opinion of the Lender, impairs

the financial responsibility of any Obligor and its or their ability to repay the Loan.

[j] The filing, entry or issuance of any judgment,

execution, garnishment, attachment, distraint or lien against any Obligor or its or their property.

[k] A default under any other obligation secured by

the Mortgaged Property or any part thereof.

[l] A default by any Obligor under any term,

provision or condition of the Swap Agreement

documentation.

4.13 Lender's Right To Offset

. Upon the occurrence of an

Event of Default, the Lender shall have the right immediately

and without notice or other act, to offset (as against the

obligations of any Obligor to the Lender) any sum owed by the

Lender or any affiliate in any capacity to such Obligor, or any

property of such Obligor in the possession of the Lender or any affiliate.

22. Financial Disclosures

So long as there is either any outstanding indebtedness of

the Borrower to the Lender pursuant to the Loan Documents, or

any obligation of the Lender pursuant to the Loan Documents,

then the Borrower and each Guarantor (if any) shall furnish to

the Lender the following information, prepared in accordance

with generally accepted accounting principles consistently

applied and otherwise in form and substance satisfactory to the Lender in its sole discretion:

5.1 Not later than one hundred twenty (120) days after the

end of each fiscal year, annual financial statements of the

Borrower including, without limitation, statements of financial

condition, income and cash flows, a reconciliation of net worth,

a listing of all contingent liabilities, notes to financial

statements, and any other information requested by the Lender,

certified by a certified public accountant acceptable to the

Lender as being in accordance with generally accepted accounting principles.

5.2 Not later than one hundred twenty (120) days after the

end of each interim fiscal half year, management prepared

financial statements of the