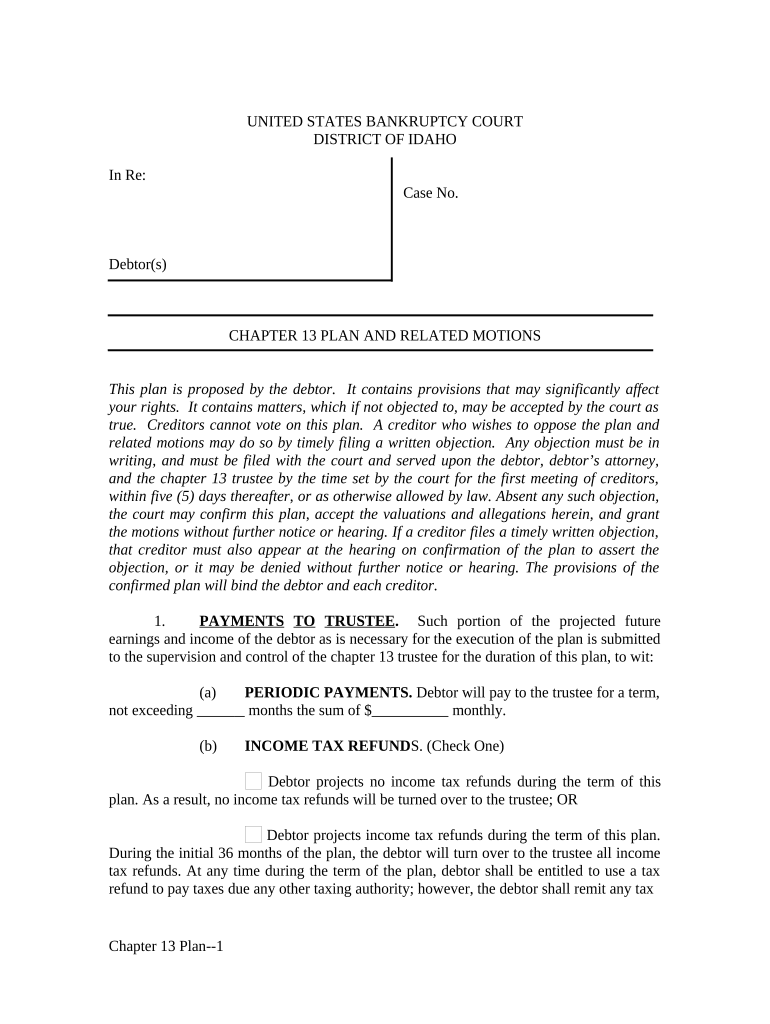

UNITED STATES BANKRUPTCY COURT

DISTRICT OF IDAHO

In Re:

Case No.

Debtor(s)

CHAPTER 13 PLAN AND RELATED MOTIONS

This plan is proposed by the debtor. It contains provisions that may significantly affect

your rights. It contains matters, which if not objected to, may be accepted by the court as

true. Creditors cannot vote on this plan. A creditor who wishes to oppose the plan and

related motions may do so by timely filing a written objection. Any objection must be in

writing, and must be filed with the court and served upon the debtor, debtor’s attorney,

and the chapter 13 trustee by the time set by the court for the first meeting of creditors,

within five (5) days thereafter, or as otherwise allowed by law. Absent any such objection,

the court may confirm this plan, accept the valuations and allegations herein, and grant

the motions without further notice or hearing. If a creditor files a timely written objection,

that creditor must also appear at the hearing on confirmation of the plan to assert the

objection, or it may be denied without further notice or hearing. The provisions of the

confirmed plan will bind the debtor and each creditor.

1. PAYMENTS TO TRUSTEE . Such portion of the projected future

earnings and income of the debtor as is necessary for the execution of the plan is submitted

to the supervision and control of the chapter 13 trustee for the duration of this plan, to wit:

(a) PERIODIC PAYMENTS. Debtor will pay to the trustee for a term,

not exceeding months the sum of $ monthly.

(b) INCOME TAX REFUND S. (Check One)

Debtor projects no income tax refunds during the term of this

plan. As a result, no income tax refunds will be turned over to the trustee; OR

Debtor projects income tax refunds during the term of this plan.

During the initial 36 months of the plan, the debtor will turn over to the trustee all income

tax refunds. At any time during the term of the plan, debtor shall be entitled to use a tax

refund to pay taxes due any other taxing authority; however, the debtor shall remit any tax

Chapter 13 Plan-- 1

refund balance to the trustee. Upon the trustee’s recommendation or upon notice and

hearing, the Court may enter an order entitling the debtor to retain, in whole or in part,

income tax refunds owing during the term of the plan to facilitate the terms of this plan or

meet the other reasonable or necessary needs of the debtor.

(c) EARLY PAYOF F. This plan may not be paid in less than thirty-six

(36) months by debtor without notice to interested parties and an opportunity for hearing

before the Court.

(d) WAGE DEDUCTION ORDE R. Debtor acknowledges that if the

debtor is ever more than thirty (30) days delinquent on any payment due under section 1(a)

of this plan, upon request of the trustee a wage deduction order to debtor’s employer may

immediately issue.

2. DEFERRAL OF PAYMENTS FOR CAUSE . The trustee for cause may

defer not more than two monthly payments per calendar year without further notice to

parties or hearing before the Court.

3. POST - CONFIRMATION RECOVERY OF PROPERTY . Debtor elects

as follows:

(Check One) The trustee shall retain the right, post-confirmation, to

recover monies, to recover property and avoid liens

pursuant to 11 USC §541, et. seq. Any such recovery or

avoidance shall, when liquidated, be disbursed to

creditors as additional disposable income, in accordance

with 11 USC §1325(b); OR

The debtor has calculated the right to recover monies, to

recover property and avoid liens pursuant to 11 USC

§541, et seq. in the plan payment. As a result, the trustee

shall not retain such further rights, post-confirmation.

4. DISBURSEMENTS & PLAN TREATMENT BY TRUSTEE . From the

payments so received, the trustee shall make disbursements as follows:

(a) PROVISIONS FOR PRIORITY CREDITORS. Full payment of

allowed claims entitled to priority under 11 USC §507 in deferred cash payments as

follows:

(1) Trustee. Fees to the trustee as provided by 28 USC §586.

(2) Attorney. Fees to the debtor's attorney in the total amount of

$ in equal monthly installments over the initial months.

Maintenance/Child Support. Unless the holder of the claim agrees

Chapter 13 Plan-- 2

otherwise, upon confirmation of the plan and the filing of an allowed claim, any allowed

unsecured claims of a spouse, former spouse, or child of debtor, for delinquent

maintenance or child support shall be paid:

(Check One) during the initial months of the plan;

in equal monthly installments over the term of the plan;

OR

not applicable.

(4) Taxes. Unless the holder of the claim agrees otherwise, upon

confirmation of the plan and the filing of an allowed claim, any allowed unsecured priority

claims of governmental units shall be paid:

(Check One) during the initial months of the plan; OR

in equal monthly installments over the term of the plan.

(b) PROVISIONS FOR CREDITORS HOLDING SECURED

CLAIMS

(1) Modification of rights of holders of secured claims. To each

of the following named creditors, the full value of the allowed secured claim held,

provided a timely allowed claim is filed. Each creditor holding an allowed secured claim

shall retain its lien on the collateral securing that claim until the allowed secured value has

been paid, at which time the lien shall be released. The allowed secured value is defined as

the lesser of the amount of a creditor’s claim or the market value of the creditor’s

collateral, as set forth in this plan . The allowed secured value shall be amortized at the rate

of interest (simple interest, direct reducing), in equal monthly installments over the term of

the plan, unless otherwise provided. No pre-confirmation interest shall be paid, unless

otherwise provided. Upon payment of the allowed value of the secured claim, the secured

creditor's lien shall be released, void of any further effect, including void of any further

security interest. Any portion of the debt owed to a creditor in excess of the allowed value

of the collateral will be treated in this plan as an unsecured claim. Unless otherwise

ordered by the Court, payments shall commence upon filing of an allowable claim and

pursuant to the terms of the Order of Confirmation of the plan. The Projected Total

Payments constitute the debtor’s best estimate of the total of all payments made to the

secured creditor on the secured portion of such creditor’s claims. At the discretion of the

trustee, allowed secured values of $500 or less may have payment accelerated.

Secured creditor rights and claims will be modified in accordance with the values and terms

provided for herein by debtor. An order valuing the secured portion of a claim, at less than

the total amount of the claim, voids the creditor’s lien to the extent of the unsecured portion of

the claim..

Chapter 13 Plan-- 3

The debtor hereby MOVES the court for an order so fixing the value of the collateral as

follows:

CREDITOR DESCRIPTION OF

COLLATERAL ALLOWED

SECURE VALUE RATE OF

INTEREST PROJECTED

TOTAL

PAYMENTS

If a secured creditor objects to this provision, debtor will nevertheless ask the Court, at the

hearing on confirmation, to confirm the plan over such creditor's objection, pursuant to 11

USC §1325(a)(5)(B). In the event that any such secured creditor fails to timely file a

secured claim, a late filed claim shall be allowed for purposes of distributing payments for

the secured portion of its claim. In the event that such creditor’s late filed claim has an

unsecured portion in its proof of claim, no distribution shall be allowed for the unsecured

portion of the claim.

(2) Curing of Default in Long Term Secured Claims. To each

of the below named creditors, the debtor does not propose to pay, in full, their allowed

secured claim during the term of this Plan. Each creditor shall retain its lien on the

collateral securing the claim until the allowed secured claim is paid in full. The debtor will

continue the regular monthly contract payments outside of the plan. Each post-petition

payment shall be paid by debtor as it comes due. The initial payment shall commence on

the first full month following the filing of this bankruptcy by debtor. The periodic

payments under this plan, shall be applied by creditor to the earliest payment for which a

portion of the payment is due. Payments shall commence upon filing of an allowable claim

and pursuant to the terms of the Order of Confirmation of the plan. Unless otherwise

provided, the frequency of payments shall be in approximate equal monthly amounts,

during the term of the plan. . The Total in Default provided hereinafter represents the

debtor’s projection of the total amount necessary to cure the default. In the event that the

creditor’s allowed claim provides otherwise, the allowed claim shall control. Each such

creditor shall further be entitled to receive interest on their claim, as allowed by law. Such

interest rate shall be the non-default contract rate of interest provided in the promissory

note between each creditor and debtors.

CREDITOR REGULAR PAYMENT TOTAL IN DEFAULT

Chapter 13 Plan-- 4

(c) PROVISIONS FOR UNSECURED CLAIMS

(1) Classification of Unsecured Claims. Unless otherwise

provided, the following unsecured claims will receive the indicated dollar amounts, in

equal monthly installments during the term hereof, on their allowed claim. Payments shall

commence upon confirmation of this plan and filing of an allowed claim.

CREDITOR AMOUNT TO BE PAID

CLASS “A”—Co-signed obligations owing to:

CLASS “B”—Student loans owing to:

CLASS “C”—Other obligations owing to:

(2) General Unsecured Claims. Upon confirmation, and at

times consistent with the other provisions of this plan, the Trustee will, from funds

available after payment of priority and secured claims, pay pro-rata dividends to all

creditors who have filed timely allowed unsecured claims.

5. DISBURSEMENTS & PLAN TREATMENT BY DEBTOR . Debtor

shall make disbursements directly to creditors and provides to treat claims as follows:

(a) Long Term Secured Claims Not in Default and Not Included in

this Plan. To secured creditors to whom the last payments are due beyond the term of the

plan, whose rights are not being modified pursuant to 11 USC §1322(b)(2) and are not

otherwise impaired, the secured claim of each shall be paid directly by debtor according to

the terms of the outstanding agreements with each creditor. Each of the following named

secured creditors shall retain their lien on the collateral securing the debt until their

allowed claim is paid in full. The debtor will pay these creditors directly as follows:

CREDITOR COLLATERAL

DESCRIPTION ESTIMATED

BALANCE OWING PAYMENT

OUTSIDE OF PLAN

(b) Surrender of Collateral. The debtor will surrender debtor’s interest

in the following collateral securing each allowed secured claim filed by the following

creditors. After surrender of the collateral such creditor's deficiency, if any, after

liquidation of the collateral, will be paid as an unsecured claim under the provisions for

Chapter 13 Plan-- 5

general unsecured creditors if such creditor amends its secured claim to an unsecured claim

for such deficiency. Upon the entrance of the order confirmation this plan, the automatic

stay imposed by 11 USC §362(a) shall be terminated pursuant to 11 USC §362(d).

CREDITOR COLLATERAL TO BE SURRENDERED

(c) Assumption Or Rejection Of Unexpired Leases Or Executory

Contracts. The debtor assumes or rejects the following unexpired leases and/or executory

contracts in accordance with 11 USC §365.

CREDITOR DESCRIPTION OF LEASED

PROPERTY ASSUME OR REJECT

(d) Judicial Lien Avoidance. The debtor hereby MOVES, pursuant to

11 USC §522(f)(1)(A), to avoid the judicial liens of the following creditors. Absent a

timely written objection from the creditor by the time set by the court for the first meeting

of creditors or within five (5) days thereafter, the order of confirmation will avoid its lien,

and its claim will be treated under section 4(c)(2) of this plan. Debtor asserts the property

is exempt under I.C. §55-1001, et seq.

CREDITOR DESCRIPTION OF

JUDGMENT LIEN COUNTY &

INSTRUMENT

NUMBER

(e) Other Lien Avoidanc e. The debtor hereby MOVES, pursuant to 11

USC §522(f)(1)(B), to avoid the nonpossessory nonpurchase money security interests of

the following creditors. Absent a timely written objection from the creditor by the time set

by the court for the first meeting of creditors or within five (5) days thereafter, the order of

confirmation will avoid its lien, and its claim will be treated under section 4(c)(2) of this

plan.

Chapter 13 Plan-- 6

CREDITOR DESCRIPTION OF

EXEMPT PROPERTY EXEMPTION STATUTE

6. VESTING OF PROPERTY OF THE ESTATE : Subject only to the liens

provided for in this plan and upon confirmation of this plan, all property of the estate:

(Check One) shall vest in the debtor; OR

shall not vest in the debtor.

DATED:

____________________________________

DEBTOR

____________________________________

DEBTOR

Chapter 13 Plan-- 7

Valuable tips for finalizing your ‘Idaho Chapter 13’ digitally

Are you fed up with the inconvenience of dealing with paperwork? Your solution is airSlate SignNow, the premier eSignature solution for both individuals and businesses. Bid farewell to the tedious process of printing and scanning documents. With airSlate SignNow, you can conveniently complete and sign documents online. Utilize the powerful features integrated into this user-friendly and cost-effective platform and transform your method of document management. Whether you need to approve forms or gather signatures, airSlate SignNow manages everything effortlessly, needing just a few clicks.

Adhere to this comprehensive guide:

- Access your account or initiate a complimentary trial with our service.

- Select +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘Idaho Chapter 13’ in the editor.

- Click Me (Fill Out Now) to ready the form on your end.

- Insert and designate fillable fields for other participants (if needed).

- Proceed with the Send Invite options to solicit eSignatures from others.

- Save, print your version, or transform it into a reusable template.

Don’t fret if you need to collaborate with others on your Idaho Chapter 13 or send it for notarization—our platform equips you with all the tools necessary to accomplish these tasks. Register for an account with airSlate SignNow today and elevate your document management to another level!