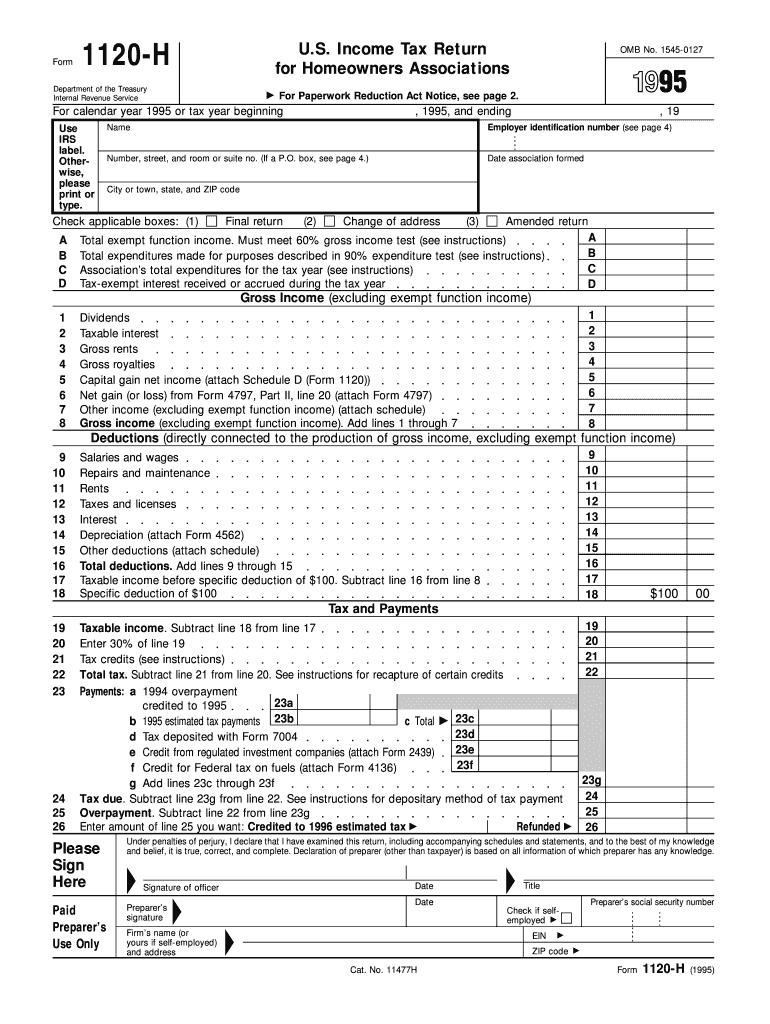

Fill and Sign the Income Tax Return for Homeowners Associations for Paperwork Reduction Act Notice See Page 2 Form

Useful suggestions for finalizing your ‘Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice See Page 2’ online

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the premier eSignature platform for individuals and organizations. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can easily finalize and authorize paperwork online. Utilize the powerful features embedded in this intuitive and budget-friendly platform and transform your method of document management. Whether you need to authorize forms or collect signatures, airSlate SignNow simplifies the process, needing just a few clicks.

Follow this detailed guide:

- Log into your account or sign up for a complimentary trial with our service.

- Click +Create to upload a document from your device, cloud, or our template repository.

- Edit your ‘Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice See Page 2’ in the workspace.

- Select Me (Fill Out Now) to prepare the document on your behalf.

- Add and designate fillable fields for other participants (if required).

- Advance with the Send Invite settings to solicit eSignatures from others.

- Download, print your version, or transform it into a reusable template.

No need to fret if you need to work with others on your Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice See Page 2 or submit it for notarization—our platform provides all the tools necessary to achieve these goals. Sign up with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

What is the Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2?

The Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2 is a form that homeowners associations must complete to comply with federal tax regulations. This form outlines the requirements for reporting income and expenses, ensuring transparency and accountability within the association. Utilizing airSlate SignNow can streamline this process, allowing for efficient eSigning and document management.

-

How does airSlate SignNow simplify the Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2 process?

airSlate SignNow simplifies the Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2 process by providing an intuitive platform for eSigning and document preparation. Users can easily create, send, and manage their forms online, reducing the time spent on paperwork. This can help homeowners associations stay organized and compliant with tax regulations.

-

What features does airSlate SignNow offer for handling the Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2?

airSlate SignNow offers a variety of features specifically designed for managing the Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2. These include customizable templates, automated workflows, and secure eSigning capabilities. These tools enable associations to efficiently handle their tax documentation and ensure timely submissions.

-

Is there a cost associated with using airSlate SignNow for the Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for homeowners associations. Pricing plans vary based on features and usage, allowing organizations to choose a package that best fits their needs. The investment in airSlate SignNow can lead to signNow time savings and improved compliance for the Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2.

-

Can I integrate airSlate SignNow with other software for filing the Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2?

Yes, airSlate SignNow offers seamless integrations with various software platforms, enhancing the filing process for the Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2. This means you can connect it with accounting or management software to streamline data entry and ensure accuracy. Such integrations facilitate a more efficient workflow for homeowners associations.

-

What are the benefits of using airSlate SignNow for the Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2?

Using airSlate SignNow for the Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2 provides numerous benefits, including reduced paperwork, faster processing times, and improved compliance. The platform allows associations to track their documents in real-time, ensuring nothing is overlooked. Overall, it enhances operational efficiency and reduces the stress associated with tax documentation.

-

How secure is airSlate SignNow when handling the Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2?

airSlate SignNow prioritizes security, implementing robust measures to protect sensitive information related to the Income Tax Return For Homeowners Associations For Paperwork Reduction Act Notice, See Page 2. The platform utilizes encryption, secure access controls, and compliance with data protection regulations. This ensures that your documents are safe during the signing and filing processes.

Find out other income tax return for homeowners associations for paperwork reduction act notice see page 2 form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles