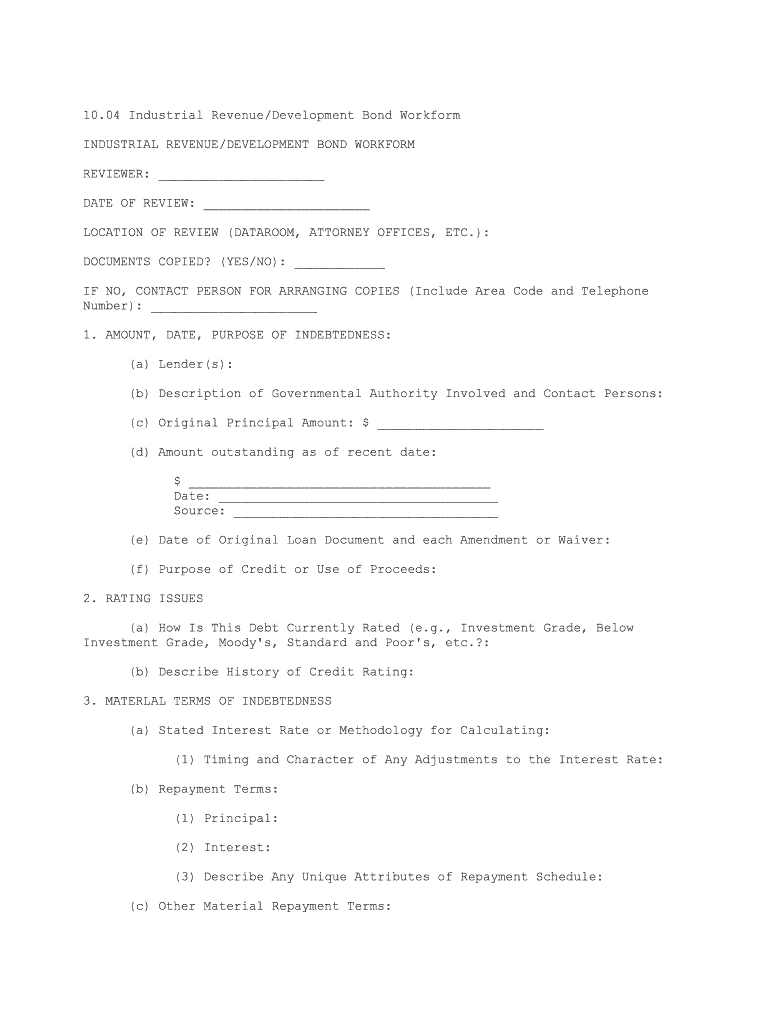

Fill and Sign the Industrial Revenue Bondstexas Economic Development Form

Valuable insights on preparing your ‘Industrial Revenue Bondstexas Economic Development ’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature platform for individuals and businesses. Bid farewell to the tedious process of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign paperwork online. Utilize the robust features integrated into this user-friendly and cost-effective platform and transform your document management strategies. Whether you need to authorize forms or gather eSignatures, airSlate SignNow manages everything seamlessly, with just a few clicks.

Follow this comprehensive guide:

- Log into your account or register for a complimentary trial with our service.

- Select +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘Industrial Revenue Bondstexas Economic Development ’ in the editor.

- Select Me (Fill Out Now) to finalize the document on your end.

- Add and allocate fillable fields for others (if needed).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

Don’t worry if you need to collaborate with others on your Industrial Revenue Bondstexas Economic Development or send it for notarization—our solution provides everything you need to accomplish such tasks. Create an account with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

What are Industrial Revenue Bonds in the context of Texas Economic Development?

Industrial Revenue Bonds (IRBs) are tax-exempt bonds issued by local governments to finance the acquisition, construction, or improvement of industrial facilities. In Texas Economic Development, these bonds help stimulate investment in local businesses and create jobs. By offering favorable financing terms, IRBs encourage economic growth in Texas communities.

-

How can Industrial Revenue Bonds benefit my business in Texas?

Industrial Revenue Bonds can provide signNow financial advantages for businesses in Texas, including lower interest rates and potential tax savings. By utilizing IRBs, companies can access capital for expansion or development projects, ultimately enhancing their competitiveness in the market. This form of financing is a strategic tool for Texas Economic Development.

-

What is the process for applying for Industrial Revenue Bonds in Texas?

The application process for Industrial Revenue Bonds in Texas typically involves submitting a request to a local governmental authority or economic development corporation. You'll need to provide details about your project, financial projections, and the expected benefits to the community. This process is designed to ensure that the issuance of IRBs aligns with Texas Economic Development goals.

-

Are there specific eligibility requirements for Industrial Revenue Bonds in Texas?

Yes, eligibility for Industrial Revenue Bonds in Texas often includes criteria such as the type of business, the location of the project, and the expected job creation or retention. Additionally, the project must serve a public purpose to qualify for IRB financing. Understanding these requirements is essential for effective participation in Texas Economic Development.

-

What types of projects are typically financed with Industrial Revenue Bonds in Texas?

Projects financed with Industrial Revenue Bonds in Texas can range from manufacturing facilities to research and development centers. These bonds are designed to support initiatives that contribute to economic growth and job creation in local communities. Businesses seeking to invest in sustainable development often leverage IRBs for Texas Economic Development.

-

How do Industrial Revenue Bonds impact Texas communities?

Industrial Revenue Bonds can have a profound impact on Texas communities by facilitating economic development, creating jobs, and attracting new businesses. When companies utilize IRBs, they often invest in local infrastructure and workforce development, which contributes to a healthier economy. This aligns with the overarching goals of Texas Economic Development initiatives.

-

What are the costs associated with issuing Industrial Revenue Bonds in Texas?

The costs of issuing Industrial Revenue Bonds in Texas can include underwriting fees, legal expenses, and administrative costs from the issuing authority. While these costs may seem signNow, they are often outweighed by the financial benefits of lower interest rates and the potential for tax exemptions. Businesses should evaluate these factors when considering IRBs for Texas Economic Development.

The best way to complete and sign your industrial revenue bondstexas economic development form

Find out other industrial revenue bondstexas economic development form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles