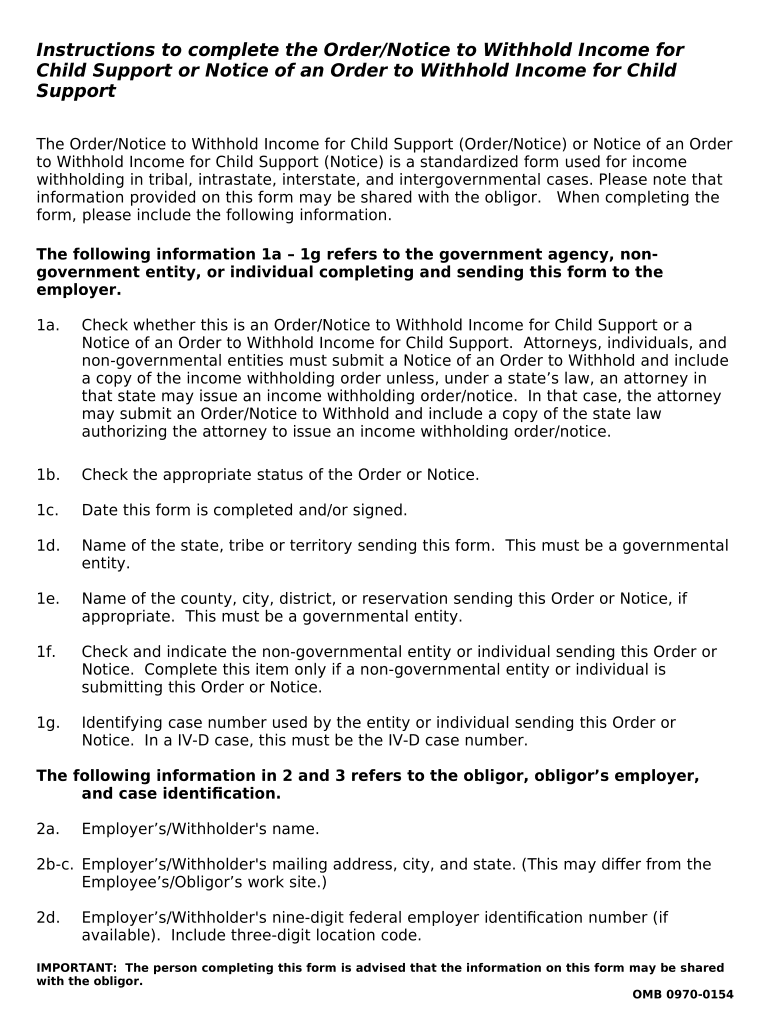

Instructions to complete the Order/Notice to Withhold Income for

Child Support or Notice of an Order to Withhold Income for Child

Support

The Order/Notice to Withhold Income for Child Support (Order/Notice) or Notice of an Order

to Withhold Income for Child Support (Notice) is a standardized form used for income

withholding in tribal, intrastate, interstate, and intergovernmental cases. Please note that

information provided on this form may be shared with the obligor. When completing the

form, please include the following information.

The following information 1a – 1g refers to the government agency, non-

government entity, or individual completing and sending this form to the

employer.

1a. Check whether this is an Order/Notice to Withhold Income for Child Support or a

Notice of an Order to Withhold Income for Child Support. Attorneys, individuals, and

non-governmental entities must submit a Notice of an Order to Withhold and include

a copy of the income withholding order unless, under a state’s law, an attorney in

that state may issue an income withholding order/notice. In that case, the attorney

may submit an Order/Notice to Withhold and include a copy of the state law

authorizing the attorney to issue an income withholding order/notice.

1b. Check the appropriate status of the Order or Notice.

1c. Date this form is completed and/or signed.

1d. Name of the state, tribe or territory sending this form. This must be a governmental

entity.

1e. Name of the county, city, district, or reservation sending this Order or Notice, if

appropriate. This must be a governmental entity.

1f. Check and indicate the non-governmental entity or individual sending this Order or

Notice. Complete this item only if a non-governmental entity or individual is

submitting this Order or Notice.

1g. Identifying case number used by the entity or individual sending this Order or

Notice. In a IV-D case, this must be the IV-D case number.

The following information in 2 and 3 refers to the obligor, obligor’s employer,

and case identifcation.

2a. Employer’s/Withholder's name.

2b-c. Employer’s/Withholder's mailing address, city, and state. (This may difer from the

Employee’s/Obligor’s work site.)

2d. Employer’s/Withholder's nine-digit federal employer identifcation number (if

available). Include three-digit location code.

IMPORTANT: The person completing this form is advised that the information on this form may be shared

with the obligor.

OMB 0970-0154

3a. Employee’s/Obligor's last name, frst name, and middle initial.

3b. Employee’s/Obligor's Social Security Number (if known).

3c. The case identifer used by the order issuing state or tribe for recording payments.

(Should be the same as #21.) In a IV-D case, this must be the IV-D case number.

3d. Custodial Parent's last name, frst name, and middle initial (if known).

ORDER INFORMATION - The following information in 4 -14e refers to the dollar

amounts taken directly from the child support order.

4. Name of the state or tribe that issued the support order.

5a-b. Dollar amount to be withheld for payment of current child support, time period that

corresponds to the amount in #6a (such as month, week, etc.).

6a-b. Dollar amount to be withheld for payment of past-due child support, time period that

corresponds to the amount in #6a (such as month, week, etc.).

7a-b. Dollar amount to be withheld for payment of current cash medical support, as

appropriate, based on the underlying order, time period that corresponds to the

amount in #7a (such as month, week, etc.).

8a-b. Dollar amount to be withheld for payment of past-due cash medical support, if

appropriate,

based on the underlying order and the time period that corresponds to the amount

in #8a (such as month, week, etc.).

9a-b. Dollar amount to be withheld for payment of spousal support (alimony), if

appropriate, based on the underlying order, time period that corresponds to the

amount in #9a (such as month, week, etc.).

10a-b.Dollar amount to be withheld for payment of past-due spousal support (alimony), if

appropriate, based on the underlying order, time period that corresponds to the

amount in #10a (such as month, week, etc.).

11a-c.Dollar amount to be withheld for payment of miscellaneous obligations, if

appropriate, based on the underlying order, time period that corresponds to the

amount in #11a (e.g., month, week, etc.), and description of the miscellaneous

obligation.

12a. Total of #5a, #6a, #7a, #8a, #9a, #10a, and # 11a.

12b. Time period that corresponds to the amount in #12a (e.g., month).

13. Check this box if arrears greater than 12 weeks.

14a. Amount an employer should withhold if the employee is paid weekly.

14b. Amount an employer should withhold if the employee is paid every two weeks.

14c. Amount an employer should withhold if the employee is paid twice a month.

14d. Amount an employer should withhold if the employee is paid once a month.

REMITTANCE INFORMATION

15. The state, tribe, or territory from which this Order/Notice or Notice of an Order is

sent.

16. Number of days in which the withholding must begin pursuant to the issuing state's

or tribe’s laws/procedures.

17. The efective date of the income withholding.

18. Number of working days within which an employer or other withholder of income

must remit amounts withheld pursuant to the issuing state's law.

19. The percentage of income that may be withheld from the employee’s/obligor’s

income. For state orders, you may not withhold more than the lesser of: 1) the

amounts allowed by the Federal Consumer Credit Protection Act (15 U.S.C. §

1673(b)); or 2) the amounts allowed by the state of the employee's/obligor's

principal place of employment. The federal limit applies to the aggregate disposable

weekly earnings (ADWE). ADWE is the net income left after making mandatory

deductions such as: state, federal, local taxes, Social Security taxes, statutory

pension contributions, and Medicare taxes.

For tribal orders, you may not withhold more than the amounts allowed under the

law of the issuing tribe. For tribal employers who receive a state order, you may not

withhold more than the amounts allowed under the law of the state that issued the

order.

20. The state, tribe, or territory from which the Order or Notice is sent.

21. Name of the State Disbursement Unit, individual, tribunal/court, or tribal child

support enforcement agency specifed in the underlying income withholding order to

which payments are required to be sent. This form may not indicate a location other

than that specifed by an entity authorized under state or tribal law to issue an

income withholding order. Please include the case identifer used to record payment

(should be the same as 3c). In a IV-D case, this must be the IV-D case number.

22. Address of the State Disbursement Unit, tribunal/court, tribal child support

enforcement agency, or individual identifed in #21. This information is shared with

the obligor. Be sure to safeguard confdential addresses.

Complete only for EFT/EDI transmission.

23a. Telephone number of contact to provide EFT/EDI instructions.

IMPORTANT: The person completing this form is advised that the information on this form may be shared

with the obligor.

OMB 0970-0154

23b. Federal Information Process Standard (FIPS) code for transmitting payments through

EFT/EDI. The FIPS code is fve characters that identify the state, county or tribe. It is

seven characters when it identifes the state, county, and a location within the

county. It is necessary for centralized collections.

23c. Receiving agency's bank routing number.

23d. Receiving agency's bank account number.

IV-D agencies, courts, and attorneys (with authority to issue an income withholding

order/notice) sending an Order/Notice to Withhold Income for Child Support must complete

24a-e.

24a. Print name of the government ofcial authorizing this Order or Notice to Withhold.

24b. Print title of the government ofcial authorizing this Order or Notice to Withhold.

24c. Signature of Government Ofcial authorizing this Order/Notice to Withhold and date

of signature. This line may be optional only if the Withholding Order/Notice includes

the name and title of a government ofcial (line 24a, 24b) and a signature of the

ofcial (line 24c) is not required by state or tribal law. Provide a signature if

required by state or tribal law.

24d. Check the appropriate box to indicate whether a child support enforcement agency

(IV-D) or court is authorizing this Order or Notice for withholding.

24e. Check the box if you are an attorney with authority to issue an order or notice under

state law.

Attorneys, individuals, and private entities sending a Notice of an Order to

Withhold Income for Child Support complete 25a-d.

25a. Print name of the individual or entity sending this Notice.

25b. Print title of the individual sending this Notice, if appropriate

25c. Signature of the individual sending this Notice and date of signature.

25d. Please check the appropriate box to indicate whether you are an attorney,

individual, or private entity sending this Notice of an Order.

The following information refers to federal, state, or tribal laws that apply to

issuing an income withholding order/notice or notice of an order to the

employer. Any state or tribal specifc information may be included in space

provided.

26. Check the box if the state or tribal law requires the employer to provide a copy of

the Order or Notice to the employee.

27. Use this space to provide additional information on the penalty and/or citation for an

employer who fails to comply with the Order or Notice. The law of the obligor’s

principal place of employment governs the penalty.

28. Use this space to provide additional information on the penalty and/or citation for an

employer, who discharges, refuses to employ, or disciplines an employee/obligor as

a result of the Order or Notice. The law of the obligor’s principal place of employment

governs the penalty.

29. Use this space to provide the child(ren)’s names listed in the support order and/or

additional information regarding this income withholding Order or Notice of an Order.

Please provide the following contact information to the employer. Employers may need

additional information to process the Order or Notice.

30a. Name of the contact person sending the Order or Notice of an Order that an

employer and/or employee/obligor may call for information regarding the Order or

Notice of an Order.

30b. Telephone number for the contact person whose name appears in #30a.

30c. Fax number for the person whose name appears in #30a.

30d. Internet address for the person whose name appears in #30a.

If the employer is a Federal Government agency, the following instructions apply.

Serve the Order or Notice of an Order upon the governmental agent listed in 5

CFR part 581, appendix A.

Sufcient identifying information must be provided in order for the obligor to be

identifed. It is, therefore, recommended that the following information, if known

and if applicable, be provided:

(1) full name of the obligor; (2) date of birth; (3) employment number,

Department of Veterans Afairs claim number, or civil service retirement claim

number; (4) component of the government entity for which the obligor works,

IMPORTANT: The person completing this form is advised that the information on this form may be shared

with the obligor.

OMB 0970-0154

and the ofcial duty station or worksite; and (5) status of the obligor, e.g.,

employee, former employee, or annuitant.

You may withhold from a variety of incomes and forms of payment, including

voluntary separation incentive payments (buy-out payments), incentive pay, and cash

awards. For a more complete list see 5 CFR 581.103.

******************************************

The Paperwork Reduction Act of 1995

This information collection is conducted in accordance with 45 CFR 303.100 of the child

support enforcement program. Standard forms are designed to provide uniformity and

standardization for interstate case processing. Public reporting burden for this collection

of information is estimated to average one hour per response. The responses to this

collection are mandatory in accordance with 45 CFR 303.7. This information is subject to

State and Federal confdentiality requirements; however, the information will be fled with

the tribunal and/or agency in the responding State and may, depending on State law, be

disclosed to other parties. An agency may not conduct or sponsor, and a person is not

required to respond to, a collection of information unless it displays a currently valid OMB

control number.

1a ORDER/NOTICE TO WITHHOLD INCOME FOR CHILD SUPPORT

NOTICE OF AN ORDER TO WITHHOLD INCOME FOR CHILD SUPPORT

Original Amended Termination #1b Date: #1c

State/Tribe/Territory #1d

City/Co./Dist./Reservation #1e

Non-governmental entity or Individual #1f

Case Number #1g

#2a

Employer’s/Withholder's Name RE : #3a

#2b Employee’s/Obligor’s Name (Last, First, MI)

Employer’s/Withholder's Address #3b

#2c Employee’s/Obligor’s Social Security Number

#3c

Employee’s/Obligor’s Case Identifer

#2d #3d

Employer’s/Withholder's Federal EIN Number (if known) Obligee’s Name (Last, First, MI)

ORDER INFORMATION : This document is based on the support or withholding order from [State /Tribe] #4

.

You are required by law to deduct these amounts from the employee’s/obligor’s income until further notice.

$ # 5a Per # 5b current child support #13

$ # 6a Per # 6b past-due child support - Arrears greater than12 weeks? yes no

$ # 7a Per # 7b current cash medical support

$ # 8a Per # 8b past-due cash medical support

$ # 9a Per # 9b spousal support

$ #10a Per #10b past-due spousal support

$ #11a Per #11b other (specify) #11c

for a total of $ #12a per #12b to be forwarded to the payee below.

You do not have to vary your pay cycle to be in compliance with the support order. If your pay cycle does

not match the ordered payment cycle, withhold one of the following amounts:

$ # 14a per weekly pay period. $ # 14c per semimonthly pay period (twice a month).

$ # 14b per biweekly pay period (every two weeks).$ # 14d per monthly pay period.

REMITTANCE INFORMATION : When remitting payment, provide the pay date/date of withholding and the

case identifer. If the employee’s/obligor’s principal place of employment is #15 , begin

withholding no later than the frst pay period occurring #16 days after the date of #17 . Send

payment within #18 working days of the pay date/date of withholding. The total withheld amount,

including your fee, may not exceed #19 % of the employee's/obligor's aggregate disposable weekly

earnings.

If the employee’s/obligor’s principal place of employment is not #20 , for

limitations on withholding, applicable time requirements, and any allowable employer fees, follow the laws

and procedures of the employee’s/obligor’s principal place of employment (see #3 and #9, ADDITIONAL

INFORMATION TO EMPLOYERS AND OTHER WITHHOLDERS).

Make check payable to: Oklahoma Department of Human Services Send check to: Oklahoma

Centralized Support Registry, P. O. Box 268809, Oklahoma City, OK 73126-8809 If remitting

payment by EFT/EDI, call 405-522-2273 before frst submission. Use this FIPS code: 4000000 :

Bank routing number: 103000648 Bank account number: 010251577 .

If this is an Order/Notice to Withhold: If this is a Notice of an Order to

Withhold:

24a Print Name 25a Print Name

24b Title of Issuing Ofcial Mandatory 25b Title (if appropriate)

24c Signature and Date (if required by state or tribal law) 25c Signature and Date

24d IV-D Agency Court 25d Attorney Individual Private Entity

24e Attorney with authority under state law to issue order/notice.

NOTE: Non-IV-D Attorneys, individuals, and non-governmental entities must submit a Notice of an Order to

Withhold and include a copy of the income withholding order unless, under a state’s law, an attorney in that

state may issue an income withholding order. In that case, the attorney may submit an Order/Notice to

IMPORTANT: The person completing this form is advised that the information on this form may be shared

with the obligor.

OMB 0970-0154

Withhold and include a copy of the state law authorizing the attorney to issue an income withholding

order/notice.

ADDITIONAL INFORMATION TO EMPLOYERS AND OTHER WITHHOLDERS

#26 If checked, you are required to provide a copy of this form to your employee/obligor. If your employee works

in a state that is diferent from the state that issued this order, a copy must be provided to your

employee/obligor even if the box is not checked.

1. Priority: Withholding under this Order or Notice has priority over any other legal process under state law (or

tribal law, if applicable) against the same income. If there are federal tax levies in efect, please notify the

contact person listed below. (See 10 below.)

2. Combining Payments: You may combine withheld amounts from more than one employee’s/obligor's income

in a single payment to each agency/party requesting withholding. You must, however, separately identify the

portion of the single payment that is attributable to each employee/obligor.

3. Reporting the Paydate/Date of Withholding: You must report the paydate/date of withholding when

sending the payment. The paydate/date of withholding is the date on which the amount was withheld from the

employee's wages. You must comply with the law of the state of employee’s/obligor’s principal place of

employment with respect to the time periods within which you must implement the withholding and forward the

support payments.

4. Employee/Obligor with Multiple Support Withholdings: If there is more than one Order or Notice against

this employee/obligor and you are unable to honor all support Orders or Notices due to federal, state, or tribal

withholding limits, you must follow the state or tribal law/procedure of the employee's/obligor's principal place of

employment. You must honor all Orders or Notices to the greatest extent possible. (See 9 below.)

5. Termination Notifcation: You must promptly notify the Child Support Enforcement (IV-D) Agency and/or the

contact person listed below when the employee/obligor no longer works for you. Please provide the information

requested and return a complete copy of this Order or Notice to the Child Support Enforcement (IV-D) Agency

and/or the contact person listed below. (See 10 below.)

THE EMPLOYEE/OBLIGOR NO LONGER WORKS FOR:

EMPLOYEE'S/OBLIGOR'S NAME: CASE IDENTIFIER:

DATE OF SEPARATION FROM EMPLOYMENT:

LAST KNOWN HOME ADDRESS:

NEW EMPLOYER/ADDRESS:

6. Lump Sum Payments: You may be required to report and withhold from lump sum payments such as bonuses,

commissions, or severance pay. If you have any questions about lump sum payments, contact the Child Support

Enforcement (IV-D) Agency.

7. Liability: If you have any doubts about the validity of the Order or Notice, contact the agency or person listed

below under 10. If you fail to withhold income as the Order or Notice directs, you are liable for both the

accumulated amount you should have withheld from the employee’s/obligor's income and any other penalties

set by state or tribal law/procedure.

#27 The payor is liable for any amount up to the accumulated amount that should have been withheld and paid,

and may be fned up to Two Hundred Dollars ($200.00) for each failure to make the required deductions if the

payor: a. fails to withhold or pay the support in accordance with the provisions of the income assignment notice,

or b. fails to notify the person or agency designated to receive payments as required. 12 O.S. 1171.3 (B)(9) and

56 O.S. 240.2 (D) (10)

8. Anti-discrimination: You are subject to a fne determined under state or tribal law for discharging an

employee/obligor from employment, refusing to employ, or taking disciplinary action against any

employee/obligor because of a child support withholding.

# 28 Any payor who violates this section shall be liable to the obligor for all income, wages, and employment

benefts lost by the obligor from the period of unlawful discipline, suspension, discharge, or refusal to promote

until the time of reinstatement or promotion. 12 O.S. 1171.3 (B)(15) 56 O.S. 240.2 (D)(15)

9. Withholding Limits: For state orders, you may not withhold more than the lesser of: 1) the amounts allowed by

the Federal Consumer Credit Protection Act (15 U.S.C. § 1673(b)); or 2) the amounts allowed by the state of the

employee's/obligor's principal place of employment. The federal limit applies to the aggregate disposable

weekly earnings (ADWE). ADWE is the net income left after making mandatory deductions such as: state,

federal, local taxes, Social Security taxes, statutory pension contributions, and Medicare taxes. The Federal

CCPA limit is 50% of the ADWE for child support and alimony, which is increased by 1) 10% if the employee does

not support a second family; and/or 2) 5% if arrears greater than 12 weeks.

For tribal orders, you may not withhold more than the amounts allowed under the law of the issuing tribe. For

tribal employers who receive a state order, you may not withhold more than the amounts allowed under the law

of the state that issued the order.

Child(ren)’s Names and Additional Information : #29

10. If you or your employee/obligor have any questions, contact #30a by telephone at

#30b by Fax at #30c or by internet at #30d .

IMPORTANT: The person completing this form is advised that the information on this form may be shared

with the obligor.

OMB 0970-0154