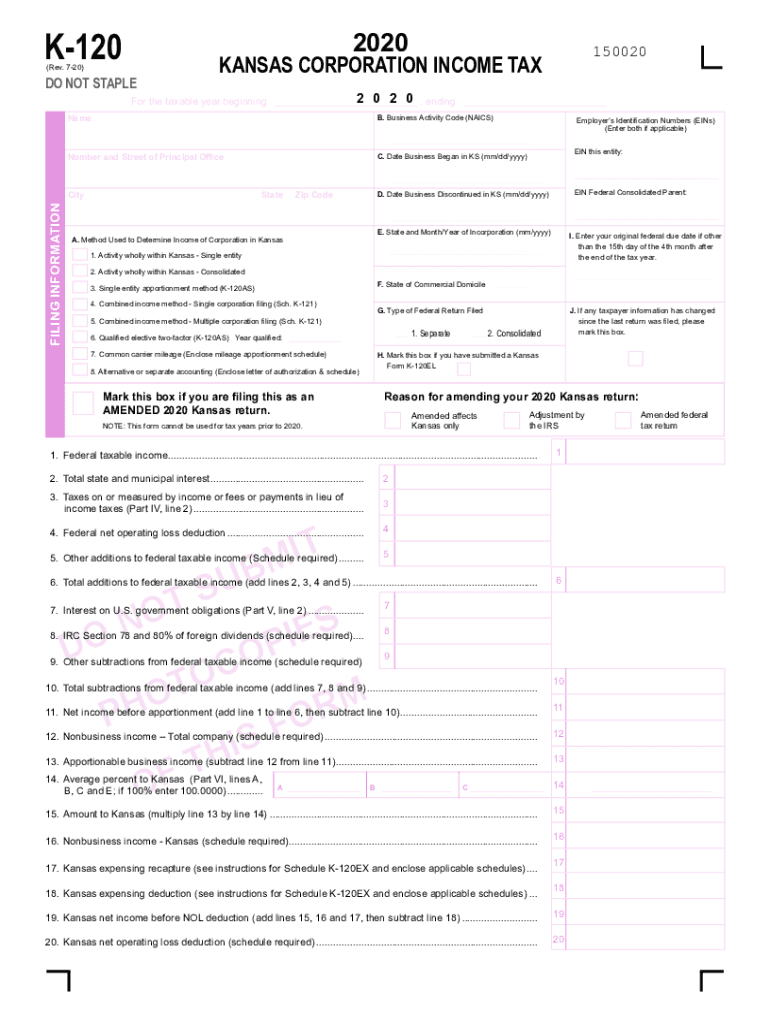

Fill and Sign the K 120 Corporation Income Tax Return Rev 7 20 a Kansas Corporate Income Tax Return Must Be Filed by All Corporations Doing Form

Practical advice on finalizing your ‘K 120 Corporation Income Tax Return Rev 7 20 A Kansas Corporate Income Tax Return Must Be Filed By All Corporations Doing’ online

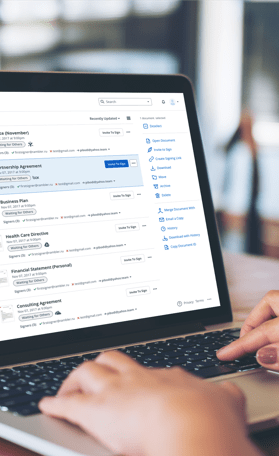

Are you fatigued by the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature tool for individuals and businesses. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can seamlessly complete and authorize documents online. Take advantage of the powerful features integrated into this user-friendly and budget-friendly platform and transform your approach to document administration. Whether you need to validate forms or gather eSignatures, airSlate SignNow manages it all effortlessly, requiring just a few clicks.

Adhere to this comprehensive guide:

- Sign in to your account or register for a complimentary trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template library.

- Access your ‘K 120 Corporation Income Tax Return Rev 7 20 A Kansas Corporate Income Tax Return Must Be Filed By All Corporations Doing’ in the editor.

- Click Me (Fill Out Now) to finish the form on your end.

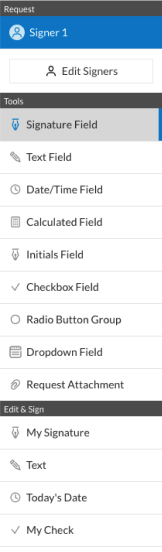

- Add and allocate fillable fields for others (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

Don’t be concerned if you need to collaborate with your colleagues on your K 120 Corporation Income Tax Return Rev 7 20 A Kansas Corporate Income Tax Return Must Be Filed By All Corporations Doing or send it for notarization—our solution provides everything you need to complete these tasks. Sign up with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

What is the K 120 Corporation Income Tax Return Rev 7 20?

The K 120 Corporation Income Tax Return Rev 7 20 is a form that must be filed by all corporations doing business in or deriving income from sources within Kansas. This return is essential for corporations required to file a federal income tax return, whether or not they have income in Kansas. Understanding this form is crucial for compliance with state tax regulations.

-

Who needs to file the K 120 Corporation Income Tax Return Rev 7 20?

All corporations that are doing business in Kansas or deriving income from Kansas sources must file the K 120 Corporation Income Tax Return Rev 7 20. This requirement applies regardless of whether the corporation is required to file a federal income tax return. Ensuring timely filing helps avoid penalties and interest.

-

What are the benefits of using airSlate SignNow for filing the K 120 Corporation Income Tax Return Rev 7 20?

Using airSlate SignNow simplifies the process of filing the K 120 Corporation Income Tax Return Rev 7 20 by allowing businesses to eSign and send documents securely. This cost-effective solution streamlines document management, ensuring compliance and reducing the risk of errors. Additionally, it enhances collaboration among team members involved in the filing process.

-

How does airSlate SignNow integrate with accounting software for tax filing?

airSlate SignNow offers seamless integrations with various accounting software, making it easier to manage the K 120 Corporation Income Tax Return Rev 7 20. These integrations allow users to import necessary data directly into the tax return, reducing manual entry and minimizing errors. This feature enhances efficiency and accuracy in tax preparation.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow provides robust features for document management, including eSigning, document templates, and secure storage. These features are particularly beneficial when preparing the K 120 Corporation Income Tax Return Rev 7 20, as they ensure that all necessary documents are organized and easily accessible. This streamlines the filing process and enhances overall productivity.

-

Is airSlate SignNow a cost-effective solution for businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. By reducing the time and resources needed to manage documents and file the K 120 Corporation Income Tax Return Rev 7 20, businesses can save money while ensuring compliance. The platform offers various pricing plans to fit different budgets and needs.

-

Can airSlate SignNow help with compliance for the K 120 Corporation Income Tax Return Rev 7 20?

Absolutely! airSlate SignNow helps ensure compliance with the K 120 Corporation Income Tax Return Rev 7 20 by providing tools for accurate document preparation and secure eSigning. The platform also keeps users informed about filing deadlines and requirements, helping businesses avoid penalties associated with late or incorrect submissions.

Related searches to k 120 corporation income tax return rev 7 20 a kansas corporate income tax return must be filed by all corporations doing form

Find out other k 120 corporation income tax return rev 7 20 a kansas corporate income tax return must be filed by all corporations doing form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles