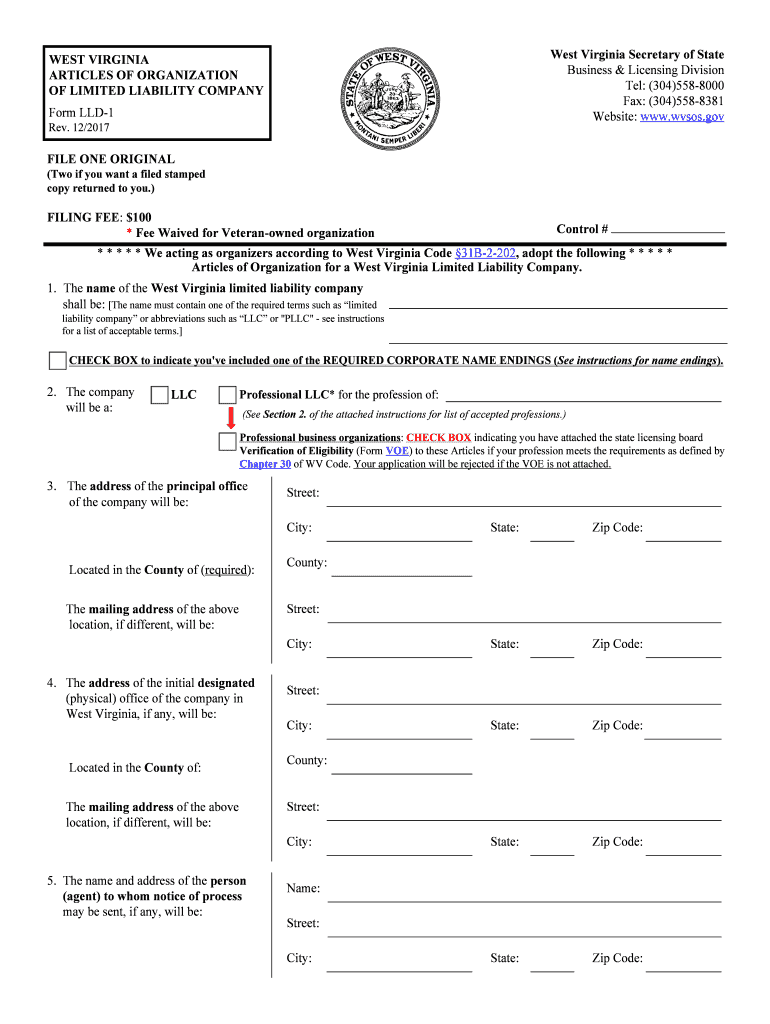

FILE ONE ORIGINAL

(Two if you want a filed stamped

copy returned to you.)

FILING FEE: $100

* Fee Waived for Veteran-owned organizationControl #

* * * * * We acting as organizers according to West Virginia Code

§31B-2-202 , adopt the following * * * * *

Articles of Organization for a West Virginia Limited Liability Company.

1.

The name of the West Virginia limited liability company

shall be:

[The name must contain one of the required terms such as “limited

liability company” or abbreviations such as “LLC” or "PLL\

C" - see instructions

for a list of acceptable terms.]

3. The address of the principal offic e

of the company will be:

Located in the County of (required):

Street:

City:

Street:

State: Zip Code:

The mailing address of the above

location, if different, will be:

4. The address of the initial designated

(physical) office of the company in

West Virginia, if any, will be:

Zip Code: State: City:

Street:

Zip Code: State: City:

Located in the County of:

Street:

The mailing address of the above

location, if different, will be:

Zip Code: State: City:

5. The name and address of the person

(agent) to whom notice of process

may be sent, if any, will be:

Zip Code: State: City:

Street:

Name:

2. The company

will be a:

LLC Professional LLC* for the profession of:

(See Section 2. of the attached instructions for list of accepted professions.)

CHECK BOX to indicate you've included one of the REQUIRED CORPORATE NAME\

ENDINGS (

See instructions for name endings).

County:

County:

Professional business organizations: CHECK BOX indicating you have attached the state licensing board

Verification of Eligibility (Form VOE

) to these Articles if your profession meets the requirements as define\

d by

Chapter 30

of WV Code. Your application will be rejected if the VOE is not attached.

West Virginia Secretary of State Business & Licensing Division Tel: (304)558-8000

Fax: (304)558-8381

Website:

www.wvsos.gov

WEST VIRGINIA

ARTICLES OF ORGANIZATION

OF LIMITED LIABILITY COMPANY

Form LLD-1 Rev. 12/2017

13. The purpose(s) for which this limited liability company is formed is as follows:

[Describe the type(s) of business activity which will be condu\

cted, for example, “real estate,” “construction of residential \

and commercial

buildings,” “commercial painting,” “professional pra\

ctice of law" (see Section 2. for acceptable "professional" business activities). Purpose

may conclude with words “…including the transaction of any\

or all lawful business for which corporations may be incorporated in We\

st

Virginia.”]

9. The name(s) and address(es) of the organizer(s) is (You must list at least ONE organizer .):

Name No. & Street Address City State Zip Code

WEST VIRGINIA ARTICLES OF ORGANIZATION OF LIMITED LIABILITY COMPANY Page 2

7. Website address of the business, if any ( ex: yourdomainname.com):

6. E-mail address where business correspondence may be received:

10. The company will be:

(required) an AT-WILL company, conducting business for an indefinite period.

a TERM company, conducting business for the term of years.

b. Located in how many West Virginia counties? If "Yes"... a. How many businesses?

Yes No Decline to answer 8. Do you own or operate more than one

business in West Virginia? * Answer a. and b. below.

11. a. List the name(s) and address(es) of the MEMBER(S) of the company (required; Note: The application will be rejected if

member information is not provided below. Attach additional pages if necessary):

Member Name No. & Street Address City State Zip Code

Manager Name No. & Street Address City State Zip Code

MEMBER-MANAGED [All member information must be entered under 11a. above.]

MANAGER-MANAGED [All manager information must be entered in the spaces below

if selecting this management structure. Attach additional pages if neces\

sary.]

b. The company will be -

CHECK ONE (required):

- Those persons who are liable in their capacity as members for all debt\

s,

obligations or liability of the company have consented in writing to \

the

adoption of the provision or to be bound by the provision.

12. All or specified members of a limited liability

company are liable in their capacity as

members for all or specified debts, obliga-

tions or liabilities of the company ( required): No - All debts, obligations and liabilities are those of the company.

Yes

17. The requested effective date is

[

Requested date may not be earlier than filing nor

later than 90 days after filing in our office .]

Page 3

19. Contact and Signature Information* (See below Important Legal Notice Regarding Signature ):

a. Contact person to reach in case there is a problem with filing:

*Important Legal Notice Regarding Signature: Per West Virginia Code §31B-2-209 . Liability for false statement in filed record.

If a record authorized or required to be filed under this chapter contains a false statement, one who suffers loss by reliance on the statement may

recover damages for the loss from a person who signed the record or caused another to sign it on the person's behalf and knew the statement to be

false at the time the record was signed .

Important Note: This form is a public document. Please do NOT provide any personal identifiable information on this form such as social

security number, bank account numbers, credit card numbers, tax identifi\

cation or driver's license numbers.

WEST VIRGINIA ARTICLES OF ORGANIZATION OF LIMITED LIABILITY COMPANY

16. The number of pages attached and included in these Articles is:

the date and time of filing in the Secretary of State's Office.

the following date and time \

.

Phone:

Date: c. Signature:

Title/Capacity of signer: b. Print or type name of signer:

18. Is the organization a "

veteran-owned" organization?

National Personnel Records Center

Military Personnel Records

1 Archives Drive

St. Louis, MO 63138

Toll free: 1-86-NARA-NARA or 1-866-272-6272

Phone: 314-801-0800

www.archives.gov/veterans/military-service-records

You may obtain a copy

of your Veterans Affairs

Form DD214 by

contacting:

Yes (If "Yes," attach

Form DD214)

No

CHECK BOX indicating you have attached Veteran Affairs Form DD214

Effective JULY 1, 2015, to meet the requirements for a “veteran-owned” organization, the entity filing the registration must meet

the following criteria per West Virginia Code §59-1-2a

: 1. A “veteran” must be honorably discharged or under honorable conditions, and

2. A “veteran-owned business” means a business that meets one of the following criteria:

o Is at least fifty-one percent (51%) unconditionally owned by o\

ne or more veterans; or

o In the case of a publicly owned business, at least fifty-one per\

cent (51%) of the stock is unconditionally owned by one or

more veterans.

Per WV Code 59-1-2(j) effective July 1, 2015, the registration fee is waived for entities that meet the requirements as a "veteran-owned"

organization . See attached instructions to determine if the organization qualifies for this waiver. In addition, a "veteran-owned" entity will have

four (4) consecutive years of Annual Report fees waived AFTER the organization's initial formation [see WV Code 59-1-2a(m)

].

15. Other provisions which may be set forth in the operating agreement \

or matters not inconsistent with law:

[See instructions for further information; use extra pages if ne\

cessary.]

14. Is the business a Scrap Metal Dealer?

Yes [If "Yes," you must complete the Scrap Metal Dealer Registration Form (Form SMD-1 ) and proceed to Section 15.]

No [Proceed to Section 15.]

INSTRUCTIONS FOR FILING ARTICLES OF ORGANIZATION

BEFORE you fill out the application : The company name you select will be approved only if it is available - that is, if the name is not the same as and is

distinguishable from any other name which has been reserved or filed. I\

f you prepare LLC papers without applying for and receiving a name reser\

vation, you

do so at your own risk. A telephone check on availability of a name is \

not a guarantee of name availability. You may apply for a name reservation in writing,

accompanied by a $15 fee made payable to the WV Secretary of State, mail\

ed to the address shown above. Once approved, you are guaranteed exclus\

ive use

of the name for 120 days, enough time to prepare and submit the articles\

. If you plan to do business under any name, other than the name on your\

certificate of

organization, you must register that trade name with the Secretary of St\

ate. Failure to do so could result in a fine or imprisonment.

FILLING OUT THE APPLICATION

Section 1. Enter the exact name of the company and be sure to include one of the required corporate name endings: “\

limited liability company,”

“limited company,” or the abbreviations “L.L.C.,” “LLC,”\

“L.C.,” or “LC.” “Limited” may be abbreviated as “\

Ltd.” and “Company” may be abbreviated as

“Co.” [WV Code §31B-1-105

] Professional companies must use “professional limited liability co\

mpany,” “professional L.L.C.,” “professional LLC,”

“P.L.L.C.,” or “PLLC.” [WV Code §31B-13-1303

]

Section 2. LLC vs. PLLC - Check the first box unless your company qualifies as a Professional L\

LC. A Professional LLC may be organized only by

one or more persons licensed or otherwise legally authorized to provide \

the same or compatible professional services or to practice together within the state.

No person may be a member of the PLLC who is not licensed or otherwise l\

egally authorized to render the professional service for which the PLLC \

was

organized. Only the following professions listed below under the specified article\

s of Chapter 30

of West Virginia Code may form a PLLC. If you are

a member of another profession, please contact your licensing board befo\

re attempting to establish your business as a regular LLC.

Attorneys-at-law

[Article 2] Physicians & Podiatrists [ Article 3]

Dentists

[Article 4] Optometrists [ Article 8]

Accountants

[Article 9]

Veterinarians \

[ Article 10]

Architects

[Article 12] Engineers

[Article 13 ]

Land Surveyors

[Article 13a] Osteopathic Physicians and Surgeo\

ns [ Article 14

]

Chiropractors

[Article 16] Psychologists \

[Article 21

]

Social Workers

[Article 30 ] Acupuncturists [Article 36

]

***Important*** For PLLC's: CHECK BOX indicating you have attached Verification of Eligibility (Form VOE) to these Articles if your profession

meets the requirements as defined by Chapter 30

of the WV Code. The Secretary of State cannot complete your filing until verification is\

received from

the appropriate State licensing board that the licenses of your members \

are current and in full effect. A PLLC is required to carry at all times\

$1

million of professional limited liability insurance [See WV Code §31B-13-1305

]. Your application will be rejected if the VOE is not attached.

Section 3. The principal office address need not be in WV, but is the principal place of business for the compa\

ny. This is generally the address where

all corporate documents (records) are maintained. You may change the p\

rincipal office address by filing with the Secretary of State an Applica\

tion to Appoint

or Change Address, Agent, or Officers [Form AAO] (fee $15).

The county in which the principal office address is located is required to be listed.

The principal mailing address need not be in WV, but is the principal place of business for the compa\

ny. This is the address to which all

correspondence from our office is mailed. You may change the principal m\

ailing address by filing with the Secretary of State an Application to A\

ppoint or

Change Address, Agent, or Officers [Form AAO] (fee $15).

Section 4. The designated (physical) office location need not be the principal place of business. You may change t\

he designated (physical) office by

filing with the Secretary of State an Application to Appoint or Change A\

ddress, Agent, or Officers [ Form AAO] (fee $15).

The county in which the designated (physical) office address is located.

The mailing address of the designated (physical) office address, if different from the designated (physical) office address.

Section 5. You may wish to maintain an “ agent for service of process” in West Virginia who can receive service of a summons or complaint.\

The

agent may be an individual resident, a corporation, or another limited l\

iability company. You may change your agent by filing with the Secretar\

y of State an

Application to Appoint or Change Address, Agent, or Officers [ Form AAO] (fee $15).

Section 6. List an e-mail address (yourname@domainname.com) where you can receive important e-mail notifications (e.g., Annual Report notices).

Section 7. List the website address (domainname.com) of the business , if any. DO NOT list a physical mailing address.

Section 8. Indicate whether or not you own or operate more than one business in West Virginia. If “Yes"...

a. List the total number of businesses in West Virginia in the space provided.

b. List the total number of counties in West Virginia in which the businesses conduct operations.

Section 9. One or more persons may organize a limited liability company. The name and address of each organizer having authority to execute

instruments on behalf of the limited liability company is required.

Section 10. An AT-WILL company will continue to exist until voluntarily terminated or administratively dissolved. A TERM company is one in which

its members have agreed to remain members until the expiration of a term specified in the articles. If neither box is marked, or if the length of term is not

specified, the company will be established as an at-will company.

Section 11. a. You must list the name and address of each MEMBER having authority to execute instruments on behalf of the limited liability company (see

WV Code §31B-2-203

).

b. Select the type of management structure of the limited liability company. For a MEMBER-managed company, the authority to transact

business and execute instruments is in the hands of the members, and any member may act to carry on the ordinary course of the company's business as an

agent of the company. If choosing MEMBER-managed, list all MEMBER information in the spaces provided under item #11a. For a MANAGER-managed

company, a manager, who may or may not be a member, is an agent of the company for the purpose of its business. If choosing MANAGER-managed, list

all MANAGER information in the spaces provided under this section (item #11b.). See WV Code

§31B for more information about the authority of members

& managers .

Section 12. DO NOT check "Yes" to this question UNLESS and UNTIL you have in hand the written consent of those members who are liable

for all debts, obligations and liabilities of the company agreeing to the adoption of or to be bound by this provision in the operating agreement. The

liabilities may not be assigned on the belief that members will consent.\

Section 13. The State Tax Department requests that you describe the purposes of the limited liability company clearly to insure you receive all the

necessary information about registering with the required state agencies. Please note that filing Articles of Organization alone does not qualify you to do

business in West Virginia. You must obtain a business license from the West Virginia Department of Tax and Revenue, and you may be required to

meet other licensing requirements to conduct the type of business you in\

tend. Attach additional pages if necessary.

Section 14. If the business activities include “Scrap Metal Dealer”, check “Yes” and complete the Scrap Metal Dealer Registration Form (Form

SMD-1) [per revised West Virginia Business Code §61-3-49-(b)(4)

] and submit with your application. Proceed to Section 15. If “ No,” proceed to Section 15.

Section 15. The articles may include provisions permitted to be set forth in an operating agreement [but may not vary the non-waivable provisions of WV

Code §31B-1-103(b)

] and other matters not inconsistent with law. If any provision of the operating agreement is inconsistent with the articles of organization,

the articles control as to persons other than managers, members and thei\

r transferees who reasonably rely on the articles to their detriment.

Section 16. List the number of attached pages to insure your complete filing is reco\

rded.

Section 17. You may accept the date of filing by the Office of Secretary of State as your effective date, or assign a future date and time when the company

will be activated. If the date you give is more than 90 days after the filing date by the Secretary of State, the active date will be the 90th

day after filing. If

you do not specify a time, the filing is effective at the close of busin\

ess on that date.

Section 18. Check the appropriate box indicating whether or not the organization is "veteran-owned." Effective JULY 1, 2015, t he following criteria

must be met in order to qualify as a "veteran-owned" entity: (1) veteran must be "honorably discharged or under honorable conditions;" and (2) if a publicly-

owned entity, at least fifty-one per cent (51%) of the stock must be unconditionally owned by one or more veterans [see WV Code 59-1-2a(12)-(13)(A)(B)

].

If "Yes," you must include with this application a copy of your Veteran Affairs Form DD214.

Section 19. AN ORGANIZER MUST SIGN THE APPLICATION . Listing a contact person and phone number is optional, however listing\

a person to

contact in case of a problem with filing may help to speed the filing pr\

ocess along and avoid possible rejection of the document.

ANNUAL REPORT NOTICE: WV Code 59-1-2a (see also 31B-2-211 ) requires every limited liability company [both domestic (in-state) and foreign (out-of-state)] to

file an annual report and pay the annual report filing fee between January 1 and July 1 of each year following the calendar year in which the business was registered

with the Office of the Secretary of State. The $25 annual report fee is waived for Veteran-owned entities for the following four (4) years after initial formation [see WV

Code 59-1-2a(m)

]. Failure to file may result in revocation of the organization's legal authority to transact business in the state. Notification of the filing requirement

will be sent, but the company is responsible for filing the annual report as required by WV Code. You may file the annual report online at https://onestop.wv.gov . You

must register a User Account Login ID and Password to create a personal “Filing Cabinet” to file the annual report.

FILING THE ARTICLES - ONE ORIGINAL REQUIRED - AND PAYING THE FEE

Send an additional original if you want a filed date-stamped copy return\

ed to you at no additional cost.

The filing fee will consist of paying a registration fee. If requesting \

a certified copy, an additional fee of $15 per certified copy requested \

is required.

Registration fee - $100

* Veteran-owned entity registration FEE WAIVED - $0

Registration fee* _______________ [Registration fee is waived for "veteran-owned" entity effective July 1, 2015 per WV Code

59-1-2(j)

; Be sure to attach the veteran proof of status Veteran Affairs Form DD214\

$15 per certified copy: + _______________ when claiming "veteran-owned" status .]

Total fee: =_______________

**** Make your checks payable to West Virginia Secretary of State. ****

TEXT ALERTS: Stay up-to-date regarding filing deadlines and changes to business, charity, notary, private investigation, and security guard laws. To sign up, visit

the Secretary of State online at www.wvsos.gov and select Text Alerts

. Next, under the heading, “Choose SMS Subscription,” click the down arrow and select

“Business and Licensing.” Then enter your ten-digit mobile phone number and your cellular carrier. Click Subscribe. This will allow you to get important information

delivered right to your mobile phone. Please note, standard text messagi\

ng rates apply and you may unsubscribe at any time.

TERMINATION: A limited liability company is a legal entity which can only be termi\

nated through formal action - not by a letter or phone call. You remain\

liable for all

taxes, assessments, fines, penalties and interest until you receive a ce\

rtificate of termination from the Secretary of State. Contact us for mo\

re information.

CHOOSE ONE OF THE FOLLOWING PROCESSING SERVICES:

1 EXPEDITED SERVICE (24-hour, 2-hour and 1-hour; *Requires standard filing fee plus additional expedite fee, see below)

West Virginia Secretary of State

Business & Licensing Division Tel: (304) 558-8000

Fax: (304) 558-8381

Website:

www.wvsos.gov

Filing Submission Instructions - Business Division

SUBMIT THE COMPLETED APPLICATION WITH THE CUSTOMER ORDER REQUEST FORM TO ONE OF THE

OFFICES BELOW. CHOOSE EXPEDITED OR STANDARD PROCESSING SERVICE. IF NOT U\

SING THE CUSTOMER

ORDER REQUEST FORM AND YOU ARE REQUESTING EXPEDITED SERVICE, YOU MUST IN\

CLUDE THE WORD

"EXPEDITE" AND THE LEVEL OF EXPEDITED SERVICE BEING REQUESTED (24-HOUR,\

2-HOUR OR 1-HOUR) IN

YOUR CORRESPONDENCE. BE SURE TO INCLUDE THE CORRECT ADDITIONAL EXPEDITED\

FEE. THIS FEE IS IN

ADDITION TO THE REGULAR FILING FEE ( SEE FEES BELOW).

BUSINESS SERVICE CENTERS Standard and Expedited Filings

Charleston Office

One-Stop Business Center

1615 Washington Street East

Charleston, WV 25311

Phone: (304) 558-8000

Fax: (304) 558-8381

Hours: Mon. - Fri. 8:30a - 5:00p EST Clarksburg Office

North Central WV Business Center

200 West Main Street

Clarksburg, WV 26301

Phone: (304) 367-2775

Fax: (304) 627-2243

Hours: Mon. -Fri. 9:00a - 5:00p EST

IMPORTANT: READ ALL INSTRUCTIONS CAREFULLY BEFORE COMPLETING FORMS.

Please follow the instructions included with the application. Failure to\

include any of the required information on the form may

cause the filing to be rejected.

All forms may be downloaded from our web site www.wvsos.gov

.

Rev. 9/2018

*Fee

$ 25.00

$250.00

$500.00 Expedite Service

24-Hour

2-Hour

1-Hour EXPEDITED SERVICE requests may be submitted by:

- E-mail to efilings@wvsos.gov

- Fax

- Walk in delivery

2 STANDARD PROCESSING (5-10 business days)

SUBMIT COMPLETED FILING TO ONE OF THE BUSINESS CENTERS BELOW:

INCLUDE PAYMENT:

Be sure to enclose the correct filing fee with your filing. If paying by\

credit card, be sure to include the e-Payment Authorization

form with your filing. Your filing will be rejected if the payment is not included or if the e-\

Payment Authorization form is not

included if paying by credit card.

Standard filing fees apply.

STANDARD PROCESSING requests may be submitted by:

- E-mail to CorpFilings@wvsos.gov

- Fax

- Walk in delivery (drop off service only filed within 5-10 business da\

ys)

Martinsburg Office

Eastern Panhandle Business Center

229 E. Martin Street

Martinsburg, WV 25401

Phone: (304) 356-2654

Fax: (304) 260-4360

Hours: Mon. - Fri. 9:00a - 5:00p EST

READ CAREFULLY BEFORE SUBMITTING - Expedite service is NOT AVAILABLE for the following filings:

West Virginia Secretary of State

Business & Licensing Division Tel: (304)558-8000

Fax: (304)558-8381

Website:

www.wvsos.gov

Customer Order Request SUBMIT THIS COMPLETED FORM WITH YOUR FILING.

Order Processing Requested*: * * * Expedite Processing Requires Additional Fees * * * \

Standard Processing** 24-HOUR Expedite *** 2-HOUR Expedite 1-HOUR Expedite

Name of Entity:

Return filing to:

(Return Address)

Contact Name: Phone:

Return Delivery Options: Email or Fax options do not receive a copy via mail; must be ordered separately.

Email to: Fax to:

Hold for Pick Up

UPS: Acct # Other (explain below):

(additional $500.00 fee included)

(additional $25.00 fee included) (additional $250.00 fee included)

FedEx: Acct # Mail to Return Address above

Order Description (include items being ordered and fee breakdown):

* PLEASE NOTE: Original paperwork is kept by this office. Include a copy of the origin\

al filing if

you want a file stamped copy returned to you at no extra charge. Certified copy requests are an

additional $15 per certified copy being requested. Total Amount:

Payment Method:

Cash (Do Not mail cash) Pre-paid Acct #:

Credit Card (Must attach e-Payment Authorization request form including payment information. ) Check/Money Order

*"Processing" indicates the filing will be completed and registered in th\

e Secretary of State registration database.

**Standard Processing applications received by E-MAIL or FAX must include the e-Payment Authorization form with credit card informati\

on.

***NOTE: Orders filed in person through any Secretary of State office location \

requesting the filing be processed will be assessed a 24-HOUR

Expedite fee of $25.00 per order.

(Avg. processing turnaround

5-10 business days )

Rev. 9/2018

Attach signed pre-paid slip.

>> Tax Department filings including Sole Proprietorships, General Partnersh\

ips, and Associations

>> Dissolution or Withdrawal of Corporation, Voluntary Association or Busi\

ness Trust

Email to: CorpFilings@wvsos.gov Email to: eFilings@wvsos.gov

24-hour, 2-hour and 1-hour

Expedite Service Guidelines

MAC WARNER

Secretary of State

State Capitol Building

Charleston, WV 25305

Phone: (304) 558-6000

Website: www.sos.wv.gov

IMPORTANT: To ensure expedited service, please mark “EXPEDITE” in\

a conspicuous place at

the top of the service request. Please indicate method of delivery.

24-HOUR EXPEDITE SERVICE

The Secretary of State offers a 24-hour expedite service on most busines\

s organization filings processed by this office. If you choose to utilize this service, please enclose with your filing the \

additional expedite fee. Please note that this expedite

fee is in addition to the standard fee charged on each filing and/or ord\

er. You must mark the document with your “ 24-HOUR

EXPEDITE” request. If using a cover letter, note that you are requesting 24-hour \

expedited service, and include your

telephone number and return information. Each filing will be returned b\

y U.S.P.S. regular mail unless other arrangements

are made. This office does not fax confirmation of a 24-hour expedite.

The fee for 24-hour handling is $25.00 in addition to the usual fee for \

service. Please consult our fee schedules for the appropriate fee. If you require assistance, please contact this office.\

Time Constraints: Under most circumstances, each filing submitted receives same day fili\

ng date and may be picked up in

the office by the end of the same business day. Filings to be mailed th\

e next business day if received by 2:00 pm of receipt

date and no later than the 2nd business day if received after 2:00 pm. \

Expedite period begins when filing or service request

is received in this office in acceptable fileable form .

2-HOUR EXPEDITE SERVICE

The Secretary of State offers a 2-hour expedite service on most filings \

processed by this office. If you choose to utilize the

2-hour expedite service, please enclose with your filing an additional $\

250.00 per filing and/or order. Please note that this

expedite fee is in addition to the standard fee charged on each filing a\

nd/or order. Complete and submit the 2-hour

customer order instruction form. If not using our order form, state cle\

arly in your cover letter that you are requesting 2-hour

expedited service and include your telephone number and return informati\

on. Attach the order form or cover sheet to the

top of your filing and submit to this office. Each filing will be returned\

by U.S.P.S. regular mail unless other arrangements

are made.

1-HOUR EXPEDITE SERVICE

The Secretary of State offers a 1-hour expedite service on most filings \

processed by this office. If you choose to utilize the 1-hour expedite service, please enclose with your filing an additional $\

500.00 per filing and/or order. Please note that this

expedite fee is in addition to the standard fee charged on each filing a\

nd/or order. Complete and submit the 1-hour

customer order instruction form. If not using our order form, state cle\

arly in your cover letter that you are requesting 1-hour

expedited service and include your telephone number and return informati\

on. Attach the order form or cover sheet to the

top of your filing and submit to this office. Each filing will be returned\

by U.S.P.S. regular mail unless other arrangements

are made.

1-Hour and 2-Hour Time Constraints: Each filing submitted for either 1-hour or 2-hour expedite receives same\

day filing

date and will be acknowledged by fax or e-mail within expedite service t\

ime. Failure to indicate method of acknowledgement

(fax or e-mail) or to provide a correct fax number or e-mail address m\

ay prevent the Secretary of State from acknowledging

the filing of such documents. Filings may be picked up within the exped\

ite service period. Filings to be mailed will be mailed

out no later than the next business day following receipt. Expedite per\

iod begins when filing or service request is received in

this office in fileable form.

The Secretary of State reserves the right to extend the expedite period \

in times of extreme

volume, staff shortages or equipment malfunction. These extensions are \

few and will rarely

extend more than a few hours.

WV Secretary of State Expedite Guidelines

Effective: 8-31-17

e-Payment Authorization

Credit Card Number:

Card Type:

Service Type: Fax Mail E-mail

Visa Mastercard Discover American Express

Payment Information Storage Authorization

Year:

Entity Name:

Name as it appears on the account

Billing Address

City State Zip Code

Telephone Ext.

I authorize the Secretary of State to store this payment information for\

future payment transactions processed by Secretary of State:

Authorized Signature

X (required) (optional) Date

This document contains confidential financial information and will be pr\

operly shredded after payment

has been processed by this office. Electronic storage of payment informa\

tion is only permitted by signed

authorization below which may be retracted at any time by written reques\

t by the authorized party.

Not to Exceed Amount: USD $

Date

Month:

V Code*

* 3-digit number on back of VISA, MasterCard and Discover cards.

4-digit number on front right side of American Express card.

NOTICE: For security and verification purposes, all credit card payments must in\

clude the 3- or 4-digit CVV2 code (V Code) number

located on the credit card. Failure to include this code will result in \

the rejection of your filing or service request.

Rev. 11/2017

USE BLACK INK ONLY - DO NOT HIGHLIGHT

Payment by Card (card holder name and billing address required below)

Credit Card Expiration Date:

Amount to Charge Card: USD $

Order Information (required)

Card Holder Information:

Payment Authorization

I authorize the Secretary of State to bill an amount not to exceed the f\

ollowing to be charged to the above listed account(s): Authorized Signature

X

West Virginia Secretary of State Business & Licensing Division Tel: (304)558-8000

Fax: (304)558-8381

Website:

www.wvsos.gov