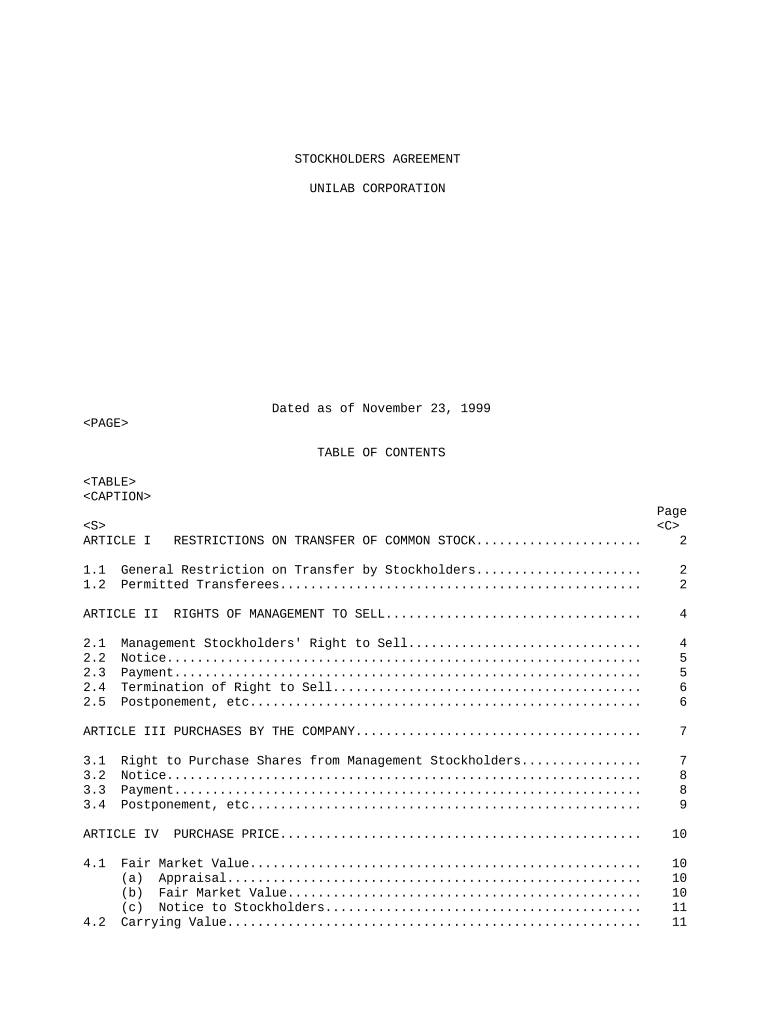

STOCKHOLDERS AGREEMENT

UNILAB CORPORATION

Dated as of November 23, 1999

TABLE OF CONTENTS

Page

ARTICLE I RESTRICTIONS ON TRANSFER OF COMMON STOCK...................... 2

1.1 General Restriction on Transfer by Stockholders...................... 2

1.2 Permitted Transferees................................................ 2

ARTICLE II RIGHTS OF MANAGEMENT TO SELL.................................. 4

2.1 Management Stockholders' Right to Sell............................... 4

2.2 Notice............................................................... 5

2.3 Payment.............................................................. 5

2.4 Termination of Right to Sell......................................... 6

2.5 Postponement, etc.................................................... 6

ARTICLE III PURCHASES BY THE COMPANY...................................... 7

3.1 Right to Purchase Shares from Management Stockholders................ 7

3.2 Notice............................................................... 8

3.3 Payment.............................................................. 8

3.4 Postponement, etc.................................................... 9

ARTICLE IV PURCHASE PRICE................................................ 10

4.1 Fair Market Value.................................................... 10

(a) Appraisal....................................................... 10

(b) Fair Market Value............................................... 10

(c) Notice to Stockholders.......................................... 11

4.2 Carrying Value....................................................... 11

4.3 Certain Defined Terms................................................ 12

(a) Cause........................................................... 12

(b) Good Reason..................................................... 12

(c) Disability...................................................... 13

ARTICLE V PROHIBITION ON PURCHASES...................................... 13

5.1 Prohibited Purchases................................................. 13

ARTICLE VI SALES TO THIRD PARTIES........................................ 15

6.1 General.............................................................. 15

6.2 Right of First Refusal............................................... 16

6.3 Agreements to Be Bound............................................... 17

Page

6.4 Involuntary Transfers................................................ 18

6.5 Tag and Drag Along Rights............................................ 18

(a) Tag-Along Rights................................................ 19

(b) Drag-Along Rights............................................... 20

ARTICLE VII REGISTRATION RIGHTS.......................................... 22

7.1. Demand Registration.................................................. 22

7.2. Piggyback Registration............................................... 24

7.3. Expenses............................................................. 26

7.4. Holdback and Other Agreements........................................ 26

ARTICLE VIII CHARTER DOCUMENTS AND BOARD OF DIRECTORS..................... 26

8.1 Charter Documents.................................................... 27

8.2 Board of Directors................................................... 27

ARTICLE IX TERMINATION.................................................. 29

9.1 Cessation of Ownership of Common Stock............................... 29

9.2 Other Termination Events............................................. 29

ARTICLE X MISCELLANEOUS PROVISIONS..................................... 30

10.1 Stock Certificate Legend............................................. 30

10.2 Option Plan.......................................................... 30

10.3 New Management Stockholders.......................................... 31

10.4 Fee.................................................................. 31

10.5 Future Sales of Capital Equity by the Company........................ 31

10.6 No Other Arrangements or Agreements.................................. 31

10.7 Amendment and Modification........................................... 32

10.8 Assignment........................................................... 32

10.9 Recapitalizations, Exchanges, etc. Affecting the Common Stock........ 33

10.10 Transfer of Common Stock............................................ 33

10.11 Further Assurances.................................................. 34

10.12 Governing Law....................................................... 34

10.13 Invalidity of Provision............................................. 34

10.14 Notices............................................................. 34

10.15 Headings; Execution in Counterparts................................. 35

10.16 Entire Agreement; Effect on Certain Other Agreements................ 36

10.17 Injunctive Relief................................................... 36

10.18 Attorneys' Fees..................................................... 36

ii

================================================================================

STOCKHOLDERS AGREEMENT

UNILAB CORPORATION

Dated as of November 23, 1999

STOCKHOLDERS AGREEMENT

----------------------

STOCKHOLDERS AGREEMENT, dated as of November 23, 1999, among UNILAB

CORPORATION, a Delaware corporation (the "Company"), Kelso Investment Associates

VI, L.P., a Delaware limited partnership ("KIA VI"), KEP VI, LLC, a Delaware

limited liability company ("KEP VI" and, together with KIA VI, "Kelso"), Persons

(as defined in Section 10.22) who are parties to this Agreement pursuant to

Section 10.21 of this Agreement, including, to the extent included thereby, Eos

Partners, L.P., a Delaware limited partnership and stockholder of the Company

("Eos") and Pequot Scout Fund L.P., a Delaware limited partnership and

stockholder of the Company ("Pequot", and together with Eos, the "Roll-Over

Investors"; the Roll-Over Investors, together with other such Persons if they

are or become parties to this Agreement pursuant to Section 10.21 of this

Agreement and each of their respective permitted transferees, are referred to

herein, collectively, as the "Third Party Investors") and the stockholders and

optionholders of the Company listed in the Schedule of Management Stockholders

attached hereto (such management stockholders and optionholders, together with

any persons who become parties to this Agreement pursuant to Sections 10.2 and

10.3 of this Agreement and each of their respective permitted transferees, are

referred to herein, collectively, as the "Management Stockholders"). Such

Schedule shall be updated from time to time to include each Management

Stockholder who becomes a party to this Agreement after the date hereof. Kelso,

the Third Party Investors and the Management Stockholders are hereinafter

referred to collectively as the "Stockholders".

WHEREAS, pursuant to an Agreement and Plan of Merger, dated as of May

24, 1999, between the Company and UC Acquisition Sub, Inc., a Delaware

corporation and a direct wholly owned subsidiary of Kelso ("Merger Sub"), as

amended on July 8, 1999, July 30, 1999 and August 10, 1999 (the "Merger

Agreement"), Merger Sub will merge with and into the Company, pursuant to which

holders of Common Stock, par value $.01, of the Company (the "Common Stock"),

other than the Roll-Over Stockholders in respect of their Roll-Over Shares (as

such terms are defined in the Merger Agreement), will receive $5.85 in cash per

share, and the Roll-Over Stockholders will retain all or a portion of their

outstanding shares of Common Stock (the "Recapitalization");

WHEREAS, concurrently with or after the consummation of the

Recapitalization on the date hereof (the "Closing"), the Company may offer and

sell additional shares of Common Stock to certain other persons and to employees

of the Company and its subsidiaries, including upon the exercise of employee

stock options, both currently outstanding and hereinafter granted, and it is

contemplated that such persons and employees will become parties to this

Agreement pursuant to Sections 10.2, 10.3 and 10.21 hereof; and

WHEREAS, the Stockholders believe it to be in their respective best

interests and in the best interests of the Company that they enter into this

Agreement providing for certain rights and restrictions with respect to the

shares of Common Stock owned by them or their permitted transferees.

NOW, THEREFORE, in consideration of the mutual covenants and

obligations set forth in this Agreement, the parties hereto agree as follows:

ARTICLE I

RESTRICTIONS ON TRANSFER

OF COMMON STOCK.

1.1 General Restriction on Transfer by Stockholders. (a) Prior to

-----------------------------------------------

the closing of a bona fide public offering pursuant to an effective registration

statement, other than a registration statement on Form S-4 or S-8 or any

successor forms and other than a registration statement registering the sale of

shares of Common Stock only to employees of the Company (a "Registration"),

under the Securities Act of 1933 (the "Act"), filed after the Closing that

covers shares of Common Stock (an "IPO"), no shares of Common Stock now or

hereafter owned by any Stockholder or any interest therein may, directly or

indirectly, be sold, assigned, mortgaged, transferred,

2

pledged, hypothecated or otherwise disposed of or transferred (collectively

"Transferred"), except for (i) Transfers to a transferee pursuant to Section 1.2

(a "Permitted Transferee"), (ii) sales of shares of Common Stock to the Company

or Kelso, or to their designees pursuant to Article II or III, (iii) Transfers

by any of KIA VI, KEP VI or any of their Permitted Transferees to any Person of

shares of Common Stock, provided that such Transfers shall comply with Article

--------

VI to the extent expressly provided therein or (iv) Transfers to a third party

by a Third Party Investor after the fifth anniversary of the Closing to the

extent permitted by, and in accordance with, Article VI.

(b) The period of time from the date of this Agreement until the

earlier of the fifth anniversary of the Closing and an IPO shall hereinafter be

referred to as the "Restricted Period".

1.2 Permitted Transferees. (a) Subject to paragraph (b) of this

---------------------

Section 1.2,

(i) each of KIA VI and KEP VI may Transfer any shares of Common

Stock or any interest therein or its rights to subscribe for the same to

any of its affiliates (as defined in Section 1.2(c));

(ii) any Management Stockholder may Transfer any shares of Common

Stock or any interest therein or his rights to subscribe for the same, if

any, (A) to a trust, partnership, limited liability company or corporation

the beneficiaries, partners, members or stockholders of which are such

Management Stockholder, his spouse, parents, members of his immediate

family or his lineal descendants provided that the foregoing shall be

--------

subject to the limitation that the Company's Board of Directors (the

"Board") acting in good faith does not conclude that such Transfer together

with all other Transfers made after the Closing could result in or create a

"significant risk" that the Company may become subject to, or after any

Registration will continue by reason thereof to be subject to, the informa-

3

tional requirements of the Securities Exchange Act of 1934, as amended (the

"Exchange Act")or the registration requirements of the Investment Company

Act of 1940 (the "40 Act") and provided, further that a Management

-------- -------

Stockholder shall give advance notice to the Company in the event of any

Transfer to any permitted transferee set forth in this clause (A), (B) in

case of his death, by will, by transfer in trust or by the laws of

intestate succession to executors, trustees, administrators, testamentary

trustees, legatees or beneficiaries, or (C) with the prior written consent

of the Board and Kelso, to any transferee, including, without limitation,

to one or more Management Stockholders or to any employee who is, in the

judgment of the Board, a current member of management of the Company or any

of its subsidiaries, provided that any such Transfer pursuant to this

--------

clause (C) shall, unless Kelso and the Company determine otherwise in the

case of a transferee who is an employee, or is to become an employee, of

the Company, be subject to the provisions of Section 6.2;

(iii) each of the Third Party Investors may Transfer (A) any

shares of Common Stock or any interest therein or its rights to subscribe

for the same to any of its affiliates (as defined in Section 1.2(c)) or (B)

a total of 25% of the shares of Common Stock held by it on the date hereof

to a charitable organization qualifying under Section 501(c)(3) of the

Internal Revenue Code of 1986, as amended;

provided, however, that all or any portion of the shares of Common Stock owned

- -------- -------

by any Stockholder may be pledged to the Company or Kelso and any such shares

may be otherwise transferred to the Company or Kelso pursuant to any such

pledge. In addition to the foregoing, any transferee of a Stockholder described

above may Transfer shares of Common Stock back to such Stockholder or to another

Permitted Transferee of such Stockholder. For the purposes of this Section 1.2,

a "significant risk", as referred to above, shall be deemed to arise when the

number of "holders of record" (as determined in accor-

4

dance with the Exchange Act and the rules and regulations thereunder or the

registration requirements of the 40 Act) is greater than 80% of the number of

"holders of record" that would cause the application or continued application of

the informational requirements of the Exchange Act under the then existing

circumstances.

(b) Any Transfer of shares of Common Stock made pursuant to paragraph

(a) of this Section 1.2 to a Permitted Transferee shall be permitted and shall

be effective only if such Permitted Transferee shall agree in writing to be

bound by the terms and conditions of this Agreement in the same manner and

capacity as its transferor, unless such Permitted Transferee is already a

Stockholder, pursuant to an instrument of assumption reasonably satisfactory in

form and substance to the Company.

(c) An "affiliate" of, or a person "affiliated" with, a specified

person, is a person that directly or indirectly through one or more

intermediaries, controls, or is controlled by, or is under common control

with, the person specified. In addition, in the case of KIA VI or KEP VI, the

term "affiliate" shall be deemed to include, without limitation, any partner of

such entity or any director, officer or employee of Kelso & Company, Inc., any

individual retirement account of any such partner, director, officer or

employee, any family member of any such partner, director, officer or employee,

or any trust or family partnership for the benefit of any such partner,

director, officer or employee or family member thereof. In the case of the

Third Party Investors, affiliate shall be deemed to include any partner or

member of such Person or any director, officer or employee of such Person, any

individual retirement account of any such partner, director, officer or

employee, any family member of any such partner, director, officer or employee

or any trust or family partnership for the benefit of any such partner,

director, officer or employee or family member thereof.

5

ARTICLE II

RIGHTS OF MANAGEMENT TO SELL

2.1 Management Stockholders' Right to Sell. Subject to all provisions

--------------------------------------

of this Article II and Article V, each Management Stockholder shall have the

right to sell to the Company, and the Company shall have the obligation to

purchase (or, in the event that such purchase is not made by the Company, Kelso

(or its designee(s)) shall have the option, but not the obligation, within 10

days of such failure, to purchase) from such Management Stockholder, all, but

not less than all, of such Management Stockholder's shares of Common Stock

(a) at the fair market value of such shares, as determined

pursuant to Section 4.1 ("Fair Market Value") if the employment of

such Management Stockholder with the Company and all subsidiaries

thereof is terminated as a result of (i) the retirement of such

Management Stockholder upon or after reaching the age of 65 or, if

different, the Company's normal retirement age ("Retirement"),(ii) the

death or Disability (as defined in Section 4.3) of such Management

Stockholder, (iii) the termination by the Company of such employment

of such Management Stockholder without Cause (as defined in Section

4.3), or (iv) the resignation of such Management Stockholder for Good

Reason (as defined in Section 4.3);

(b) at the lesser of (i) the Fair Market Value of such shares,

and (ii) the Carrying Value (as defined in Section 4.2) of such shares

if such Management Stockholder's employment with the Company and all

subsidiaries thereof is terminated as a result of the resignation of

such Management Stockholder without Good Reason.

6

Notwithstanding anything to the contrary herein, David C. Weavil shall have no

rights pursuant to the foregoing provisions of this Section 2.1 to sell to the

Company the shares of Common Stock held by him at or after such time as his

consulting contract with the Company expires pursuant to its terms or the terms

of any renewal thereof.

2.2 Notice. If any Management Stockholder intends to sell shares of

------

Common Stock pursuant to Section 2.1, he (or his estate, as the case may be)

shall give the Company and Kelso notice of such intention not more than 30 days

or, in the case of a termination under clause (ii) of Section 2.1(a), 90 days,

after the occurrence of the event giving rise to such Management Stockholder's

right to sell his shares of Common Stock and shall therein specify the number of

shares of Common Stock such Management Stockholder owns and, subject to Section

2.3, is selling to the Company.

2.3 Payment. (a) Subject to Article V and Section 2.6, payment for

-------

shares of Common Stock sold by a Management Stockholder pursuant to Section 2.1

shall be made on the date that is the 15th business day following the date of

the determination of Fair Market Value pursuant to Section 4.1.

(b) Any payments based on Fair Market Value required to be made by

the Company under this Section 2.3 shall accrue interest at 6% simple interest

per annum from the date of termination of employment to the date the Company (or

Kelso or its designee(s)) makes such payments.

2.4 Termination of Right to Sell. A Management Stockholder's right

----------------------------

to sell to the Company and the Company's obligation to purchase such Management

Stockholder's shares of Common Stock pursuant to Section 2.1 shall terminate on

the closing of an IPO.

7

2.5 Postponement, etc. The date of payment and closing of any

------------------

purchase and sale under this Article II may be postponed to the extent necessary

to permit such purchase and sale under the Hart-Scott-Rodino Antitrust

Improvements Act of 1976, as amended, and the regulations promulgated thereunder

(the "HSR Act"). No party shall be required to consummate any purchase and sale

under this Article II until such time as such transaction would not violate

applicable law, other than violations which would not have a direct or indirect

material adverse effect on such party.

2.6 Pre-existing Options. The provisions of this Article II shall

---------------------

apply to Pre-existing Options (as defined in Section 4.1) held by a Management

Stockholder to the same extent Article II applies to such person's shares of

Common Stock, subject to any limitations contained herein, in the relevant stock

option plan governing such Pre-existing Options or in such Pre-existing Options

themselves.

ARTICLE III

PURCHASES BY THE COMPANY

3.1 Right to Purchase Shares from Management Stockholders. Subject

-----------------------------------------------------

to all provisions of this Article III, the Company shall have the right to

purchase (and, if the Company does not exercise such right by giving notice

within the 30-day period referred to in Section 3.2, Kelso (or its designee(s))

shall have the right by giving notice not later than the end of the succeeding

10-day period to purchase) from a Management Stockholder, and such Management

Stockholder shall have the obligation to sell to the Company (or Kelso or its

designee(s) if such right is exercised by Kelso or its designee(s)), all, but

not less than all, of such Management Stockholder's shares of Common Stock:

(a) at the Fair Market Value of such shares if such Management

Stockholder's employment with the Company and all subsidiaries thereof is

terminated as a result of (i) the

8

termination by the Company of such employment without Cause, (ii) the

resignation of such Management Stockholder for Good Reason, (iii) the

Retirement of such Management Stockholder, or (iv) the death or Disability

of such Management Stockholder;

(b) at the lesser of (i) the Fair Market Value of such shares,

and (ii) the Carrying Value (as defined in Section 4.2) of such shares if

such Management Stockholder's employment with the Company and all

subsidiaries thereof is terminated as a result of the resignation of such

Management Stockholder without Good Reason; and

(c) at the lesser of the Fair Market Value and Carrying Value

(as defined in Section 4.2) of such shares, if such Management

Stockholder's employment with the Company and all subsidiaries thereof is

terminated as a result of the termination by the Company of such employment

with Cause.

Notwithstanding anything to the contrary herein, the Company shall have no

rights pursuant to the foregoing provisions of this Section 3.1 to purchase from

David C. Weavil the shares of Common Stock held by him at or after such time as

his consulting contract with the Company expires pursuant to its terms or the

terms of any renewal thereof.

3.2 Notice. If the Company desires to purchase shares of Common

------

Stock from a Management Stockholder pursuant to Section 3.1, it shall notify

such Management Stockholder (or his estate, as the case may be) not more than

45 days after the occurrence of the event giving rise to the Company's right to

acquire such Management Stockholder's shares of Common Stock. If the Company

does not deliver such notice within such 45-day period and Kelso (or its

designee(s)) desires to purchase such shares, then Kelso (or its designee(s))

shall notify

9

such Management Stockholder (or his estate, as the case may be) not later than

the end of the succeeding 10-day period.

3.3 Payment. (a) Subject to Section 3.6 and Article V, payment for

-------

shares of Common Stock purchased pursuant to Section 3.1 shall be made on the

date that is the 15th business day following the date of the determination of

Fair Market Value pursuant to Section 4.1.

(b) Any payments based on Fair Market Value required to be made by

the Company under this Section 3.3 shall accrue interest at 6% simple interest

per annum on the amounts not paid from the date of termination of employment to

the date the Company (or Kelso or its designee(s)) makes such payments.

3.4 Postponement, etc. The date of payment and closing of any

-----------------

purchase and sale under this Article III may be postponed to the extent

necessary to permit such purchase and sale under the HSR Act. No party shall be

required to consummate any purchase and sale under this Article III until such

time as such transaction would not violate applicable law, other than violations

which would not have a direct or indirect material adverse effect on such party.

3.5 Pre-existing Options. The provisions of this Article III shall

---------------------

apply to Pre-existing Options (as defined in Section 4.1) held by a Management

Stockholder to the same extent Article III applies to such person's shares of

Common Stock, subject to any limitations contained herein, in the relevant stock

option plan governing such Pre-existing Options or in such Pre-existing Options

themselves.

ARTICLE IV

PURCHASE PRICE

4.1 Fair Market Value.

-----------------

(a) Appraisal. The Company shall, at the request of Kelso, engage,

---------

to the extent practicable, on an annual basis or otherwise from time to time as

required, an independent valuation consultant or

10

appraiser of recognized national standing (an "Appraiser") satisfactory to Kelso

and the Company (it being agreed that Houlihan, Lokey, Howard & Zukin, Inc. is

satisfactory to Kelso and the Company) to appraise the Fair Market Value of the

shares of Common Stock as of the last day of the fiscal year then most recently

ended or as of any more recent date (the "Appraisal Date") and to prepare and

deliver a report to the Company describing the results of such appraisal (the

"Appraisal").

(b) Fair Market Value. For the purposes of this Agreement, the "Fair

-----------------

Market Value" of any share of Common Stock being purchased by or sold to the

Company, Kelso or their respective designees, pursuant to this Agreement shall

be the fair market value of the entire Common Stock equity interest of the

Company taken as a whole, divided by the number of outstanding shares of Common

Stock, all calculated on a fully diluted basis, without additional premiums for

control or discounts for minority interests or restrictions on transfer, and

shall be determined by Appraisal as of the applicable date of termination of

employment with the Company or the date of transfer to an Involuntary Transferee

(as defined in Section 6.4) (each of such dates, a "Determination Date"), which

Appraisal the Company shall have caused to have been undertaken, in accordance

with Section 4.1(a), promptly but no later than 30 days following (i) the date

of receipt by the Company of the notice described in Section 2.2 (in the case of

purchases of Common Stock pursuant to Article II), (ii) the date on which the

Company gives the notice described in Section 3.2 (in the case of purchases by

the Company of Common Stock pursuant to Article III) or the date on which Kelso

(or its designees) gives the notice described in Section 3.1 (in the case of

purchases of Common Stock by Kelso (or its designees) pursuant to Section 3.2)

and (iii) the date of receipt by the Company of the Notice described in Section

6.4 (in the case of purchases of Common Stock pursuant to Section 6.4);

provided, however, that the Fair Market Value will be determined as of the most

- -------- -------

recent existing Appraisal unless (i) such existing Appraisal is not as of a date

within 6 months of the applicable Determination Date and the relevant repurchase

involves more than one percent (1%) of the Common Stock outstanding, in which

case the Company shall order an additional Appraisal under Section 4.1(a) or

(ii) in the Company's judgment there has been a material change in the Company,

its

11

operations or its value since such existing Appraisal, in which case the Company

may, in its sole discretion, order an additional Appraisal. Fair Market Value of

an employee stock option issued prior to the Closing or issued in exchange for

an option issued prior to the Closing ("Pre-existing Option") but which has not

been exercised at the time of the relevant calculation is the Fair Market Value

of the Common Stock underlying such Pre-existing Option minus the aggregate

exercise price of such Pre-existing Option (the "Spread").

(c) Notice to Stockholders. After notice has been given pursuant to

----------------------

Section 2.2, 3.2 or 6.4, the Company shall promptly deliver a copy of the letter

as to value included with the most recent existing Appraisal or any Appraisal

thereafter received, as the case may be, to Kelso and to each Stockholder whose

Common Stock or Pre-existing Options are to be purchased pursuant to Section

2.1, 2.6, 3.1, 3.5 or 6.4.

(d) Withdrawal of Exercise Following Appraisal. Any party to this

------------------------------------------

Agreement who has exercised its option either to purchase or sell shares of

Common Stock or Pre-existing Options, pursuant to Article II or Article III, may

withdraw its notice or demand to purchase or sell such shares within 10 business

days following the receipt of the letter referred to in Section 4.1(c) or the

determination of the Fair Market Value as set forth in Section 4.1(b).

4.2 Carrying Value. For the purposes of this Agreement, "Carrying

--------------

Value" of any share of Common Stock, other than shares issued upon the exercise

of Pre-existing Options, being purchased by the Company shall be equal to the

price paid by the selling Management Stockholder for any such share ("Cost")

plus simple interest at a rate per annum equal to 6% which shall be deemed to be

the carrying cost, from the date of the acquisition of the Common Stock by the

Management Shareholders through the date of such purchase pursuant to Article II

or III, less the amount of dividends paid to such Management Stockholder in

respect of any such share (to the extent that the amount of such dividends does

not exceed such simple interest). Notwithstanding anything to the contrary

herein, (i) in the case of any share of Common Stock outstanding prior to, and

which remains outstanding following, the Closing or that was

12

issued in exchange for any share of Common Stock outstanding prior to the

Closing, Cost shall be deemed to be $5.85, and the Carrying Value shall be

calculated as set forth above commencing from the date of the Closing through

the date of purchase by the Company pursuant to Article II or III, (ii) in the

case of any Pre-existing Option which has not been exercised at the time of the

calculation of the Cost thereof, Cost shall be deemed to be the product of (x)

$5.85 minus the per share exercise price of such Pre-existing Option (the "Cost

Spread") and (y) the number of shares of Common Stock subject thereto, and the

Carrying Value shall be calculated as set forth above commencing from the date

of the Closing through the date of purchase by the Company pursuant to Article

II or III and (iii) in the case of any share of Common Stock that was issued

upon the exercise of any Pre-Existing Option, Cost shall be deemed to be $5.85

and the Carrying Value shall be calculated as set forth above, except that

interest shall accrue from the date of Closing through the date of exercise on

the Cost Spread of such Pre-existing Option and shall accrue on $5.85 from the

date of exercise through the date of purchase by the Company pursuant to Article

II or III.

4.3 Certain Defined Terms. As used in this Agreement, the following

---------------------

terms shall have the meanings ascribed to them below (which meanings shall be

independent of and unaffected by the meanings of similar terms used in any

employment contracts between the Company and Management Stockholders, in the

event such latter meanings differ from those following):

(a) Cause. The term "Cause" used in connection with a termination of

-----

employment of a Management Stockholder (other than David C. Weavil) shall mean a

termination of such Management Stockholder's employment by the Company or any of

its subsidiaries due to (i) the continued willful failure, after reasonable

advance written notice specifying details of such failure, by such Management

Stockholder substantially to perform his duties with the Company or any of its

subsidiaries (other than any such failure resulting from incapacity due to

reasonably documented physical or mental illness), or (ii) the engaging by such

Management Stockholder in fraudulent, willful or bad faith conduct that causes,

or in the good faith judgment of the Board may cause, harm (financial or

otherwise) material to the

13

Company or any of its subsidiaries or harm material to the conduct of such

Management Stockholder's employment, including, without limitation, the improper

or unlawful disclosure of material secret, proprietary or confidential

information of the Company or any of its subsidiaries. In the case of David C.

Weavil, the term "Cause" used in connection with a termination of his employment

shall mean the termination or cancellation by the Company of his consulting

contract with the Company pursuant to Section 6 thereof and "without Cause"

shall mean the termination or cancellation by the Company of his consulting

contract with the Company other than pursuant to Section 6 thereof.

(b) Good Reason. A termination of a Management Stockholder's

-----------

employment with the Company or any of its subsidiaries shall be for "Good

Reason" if such Management Stockholder (other than David C. Weavil) voluntarily

terminates his employment with the Company or any of its subsidiaries as a

result of either of the following:

(i) without the Management Stockholder's prior consent, a

material reduction by the Company or any of its subsidiaries in his current

salary, other than any such reduction which is part of a general salary

reduction or other concessionary arrangement affecting all employees or

affecting the group of employees of which the Management Stockholder is a

member; or

(ii) the taking of any action by the Company or any of its

subsidiaries that would substantially diminish the aggregate value of the

benefits provided him under the Company's or any such subsidiary's medical,

health, accident, disability, life insurance, thrift and retirement plans

in which he was participating on the date of his execution of this

Agreement, other than any such reduction which is (A) required by law, (B)

implemented in connection with a general concessionary arrangement

affecting most employees or affecting substantially the entire group of

employees of which the Management Stockholder is a member, (C) generally

applicable to all beneficiaries of such plans or (D) a result of a

14

decrease in the value of the Company or its equity; or

(iii) a substantial and material reduction in his then

current duties, authority or responsibilities.

In the case of David C. Weavil, the termination of his employment shall be for

"Good Reason" if he terminates or cancels his consulting contract with the

Company pursuant to Section 6 thereof, and the termination of his employment

shall be "without Good Reason" if he terminates or cancels his consulting

contract with the Company other than pursuant to Section 6 thereof.

(c) Disability. The termination of the employment of any Management

----------

Stockholder by the Company or any of its subsidiaries shall be deemed to be by

reason of a "Disability" if, as a result of such Management Stockholder's

incapacity due to reasonably documented physical or mental illness, such

Management Stockholder shall have been unable for more than six months within

any 12 month period to perform his duties with the Company or any of its

subsidiaries on a full time basis and within 30 days after written notice of

termination has been given to such Management Stockholder, such Management

Stockholder shall not have returned to the full time performance of his duties.

The date of termination in the case of a termination for "Disability" shall be

the last day of the aforementioned 30-day period.

ARTICLE V

PROHIBITION ON PURCHASES

5.1 Prohibited Purchases. Notwithstanding anything to the contrary

--------------------

herein, the Company shall not be obligated to purchase any shares of Common

Stock from a Management Stockholder pursuant to Section 2.1 to the extent (i)

the Company is prohibited from purchasing such shares (or incurring debt to

finance the purchase of such shares) by any debt instruments or other agreements

(the "Agreements") entered into by the Company or any of its subsidiaries or by

applicable law, (ii) an event of default under any Agreement has occurred and is

15

continuing or a condition exists which would, with notice or lapse of time or

both, result in an event of default under any Agreement or (iii) the purchase of

such shares (including the incurrence of any debt which in the judgment of the

Board is necessary to finance such purchase) (A) could in the judgment of the

Board result in the occurrence of an event of default under any Agreement or

create a condition which would or might, with notice or lapse of time or both,

result in an event of default under any Agreement, (B) would, in the judgment of

the Board, be imprudent in view of the financial condition (present or

projected) of the Company and its subsidiaries, taken as a whole, or the

anticipated impact of the purchase of such shares on the Company's or any of its

subsidiaries' ability to meet their respective obligations, including under any

Agreement, or to satisfy and make their planned capital and other expenditures

and projections or (C) could, in the judgment of the Board, constitute a

fraudulent conveyance or transfer or render the Company insolvent under

applicable law or violate limitations in the Delaware General Corporation Law on

repurchases of stock. If shares of Common Stock which the Company has the right

or obligation to purchase on any date exceed the total amount permitted to be

purchased on such date pursuant to the preceding sentence (the "Maximum

Amount"), the Company shall purchase on such date only that number of shares of

Common Stock up to the Maximum Amount (and shall not be required to purchase

more than the Maximum Amount) in such amounts as the Board shall in good faith

determine, applying the following order of priority:

(a) first, the shares of Common Stock of all Management Stockholders

whose shares of Common Stock are being purchased by the Company by

reason of termination of employment due to death or Disability up to

the Maximum Amount and, to the extent that the number of shares of

Common Stock that the Company is obligated to purchase from such

Management Stockholders exceeds the Maximum Amount, such shares of

Common Stock pro rata among such Management Stockholders on the basis

of the number of shares of Common Stock held by each of such

Management Stockholders that the Company is obligated or has the right

to purchase, and

16

(b) second, to the extent that the Maximum Amount is in excess of the

amount the Company purchases pursuant to clause (a) above, the shares

of Common Stock of all Management Stockholders whose shares of Common

Stock are being purchased by the Company by reason of termination of

employment without Cause or due to Retirement or resignation for Good

Reason up to the Maximum Amount and, to the extent that the number of

shares of Common Stock that the Company is obligated to purchase from

such Management Stockholders exceeds the Maximum Amount, such shares

of Common Stock pro rata among such Management Stockholders on the

basis of the number of shares of Common Stock held by each of such

Management Stockholders that the Company is obligated or has the right

to purchase, and

(c) third, to the extent the Maximum Amount is in excess of the

amounts the Company purchases pursuant to clauses (a) and (b) above,

the shares of Common Stock of all other Management Stockholders whose

shares of Common Stock are being purchased by the Company up to the

Maximum Amount and, to the extent that the number of shares of Common

Stock that the Company is obligated to purchase from such Management

Stockholders exceeds the Maximum Amount, the shares of Common Stock of

such Management Stockholders in such order of priority and in such

amounts as the Board in its sole discretion shall in good faith

determine to be appropriate under the circumstances.

For the purposes of the foregoing (a), (b) and (c), Pre-existing Options shall

be treated, at the Company's election, as the equivalent of the Common Stock

underlying such Pre-existing Options.

Notwithstanding anything to the contrary contained in this Agreement,

if the Company is unable to make any payment when due to any Management

Stockholder under this Agreement by reason of this Article V, the Company shall

make such payment at the earliest practicable date permitted under this Article

V and any

17

such payment shall accrue simple interest (or if such payment is accruing

interest at such time, shall continue to accrue interest) at 6% per annum from

the date such payment is due and owing to the date such payment is made;

provided, however, that such interest shall be reduced by the amount of any

- -------- -------

interest otherwise accruing on such payment by the Company by reason of the

definition of "Carrying Value" set forth in Section 4.2. All payments of

interest accrued hereunder shall be paid only at the date of payment by the

Company for the shares of Common Stock being purchased.

ARTICLE VI

SALES TO THIRD PARTIES

6.1 General. An "Excluded Transaction" shall mean any Transfer by

-------

KIA VI or KEP VI or any of their Permitted Transferees to any affiliate (as

defined in Section 1.2(c) thereof) or any Permitted Transferee thereof, or

pursuant to an IPO.

6.2 Right of First Refusal. (a) If a Third Party Investor or

----------------------

Management Stockholder (the "Offering Stockholder") who is entitled to sell

shares of Common Stock to third parties pursuant to Section 1.1 shall have

received a bona fide offer or offers from a third party or parties to purchase

for cash any shares of Common Stock (other than from any Permitted Transferee of

such stockholder, except in the case of clause (C) of Section 1.2 (a)(ii), or by

reason of the application of Sections 6.5 (a), 6.5 (b) or 7.2), then prior to

selling such shares of Common Stock to such third party or parties such Offering

Stockholder shall deliver to the Company a letter signed by such Offering

Stockholder setting forth:

(i) the name or names of the third party or parties;

(ii) the prospective purchase price per share of Common Stock;

(iii) all material terms and conditions contained in the offer of

the third party or parties;

18

(iv) the Offering Stockholder's offer (which shall be

irrevocable by its terms for 30 days following receipt) to sell to the

Company or, if the Company declines such offer, to Kelso, all, but not less

than all, of the shares of Common Stock covered by the offer of the third

party or parties, for a purchase price per share of Common Stock, and on

other terms and conditions, not less favorable to the Company or Kelso, as

the case may be, than those contained in the offer of the third party or

parties (an "Offer"); and

(v) closing arrangements and a closing date (not less than 45

nor more than 60 days following the date of such letter) for any purchase

and sale that may be effected by the Company or Kelso, as the case may be,

or any of their assignees pursuant to this Section 6.2.

The Company or its designee(s) shall, within 10 days following receipt of such

letter, have the right to elect to purchase such shares of Common Stock. To the

extent the Company declines such offer, Kelso shall have until the later of (i)

5 days from the end of such ten day period and (ii) 10 days from the day Kelso

receives notification in writing from the Company that it is declining such

offer being made to the Company to elect to purchase such shares of Common

Stock. In the event the Company declines the offer set forth in the letter, the

Company shall promptly notify Kelso and the Offering Stockholder in writing of

its decision.

(b) If, upon the expiration of 30 days following receipt by the

Company of the applicable letter described in Section 6.2(a), neither the

Company nor Kelso, as applicable, on behalf of itself or any designee(s)

thereof, shall have accepted the Offer in full, the Offering Stockholder may

sell to such third party or parties all (but not less than all) of the shares of

Common Stock covered by the Offer, for the purchase price and on the other terms

and conditions contained in the Offer. If the Company or Kelso, as applicable,

on behalf of itself or its designee(s), shall accept such Offer, the closing of

the purchase and sale pursuant to such acceptance shall take place as set forth

in the letter of such Stockholder to the Company pursuant to subparagraph (v) of

Section 6.2(a).

19

6.3 Agreements to Be Bound. Notwithstanding anything contained in

----------------------

this Section 6, any sale to a third party or any Involuntary Transfer (as

defined in Section 6.4) to an Involuntary Transferee (as defined in Section 6.4)

shall be permitted under the terms of this Agreement only if such third party or

Involuntary Transferee, as the case may be, shall agree in writing to be bound

by the terms and conditions of this Agreement pursuant to an instrument of

assumption reasonably satisfactory in form and substance to the Company.

6.4 Involuntary Transfers. In the case of any transfer of title or

---------------------

beneficial ownership of shares of Common Stock upon default, foreclosure,

forfeit, divorce, court order, or otherwise than by a voluntary decision on the

part of a Stockholder (an "Involuntary Transfer"), the Company shall have the

right to purchase such shares pursuant to this Section 6.4. Upon the

Involuntary Transfer of any shares of Common Stock, such Stockholder shall

promptly (but in no event later than two days after such Involuntary Transfer)

furnish written notice (the "Notice") to the Company indicating that the

Involuntary Transfer has occurred, specifying the name of the person to whom

such shares have been transferred (the "Involuntary Transferee") and giving a

detailed description of the circumstances giving rise to, and stating the legal

basis for, the Involuntary Transfer. Upon the receipt of the Notice, and for 30

days thereafter, the Company (or its designee(s)) shall have the right to

purchase, and the Involuntary Transferee shall have the obligation to sell, all,

but not less than all, of the shares of Common Stock acquired by the Involuntary

Transferee for a purchase price equal to (subject to the following paragraph)

the lesser of (i) the Fair Market Value of such shares of Common Stock on the

date of transfer to the Involuntary Transferee and (ii) the amount of the

indebtedness or other liability that gave rise to the Involuntary Transfer plus

the excess, if any, of the Carrying Value of such shares of Common Stock over

the amount of such indebtedness or other liability that gave rise to the

Involuntary Transfer.

Notwithstanding the foregoing, the Board may, for good cause shown by

the Stockholder who made the Involuntary Transfer, determine that payment of a

purchase price equal to the Fair Market Value of such

20

shares of Common Stock on the date of transfer to the Involuntary Transferee

would be appropriate under the circumstances, and direct that payment be made in

such amount.

6.5 Tag and Drag Along Rights.

-------------------------

(a) Tag-Along Rights. None of KIA VI, KEP VI and their Permitted

----------------

Transferees (collectively, the "Kelso Group") shall, individually or

collectively, in any one transaction or any series of related transactions,

Transfer any shares of Common Stock in an amount which when taken together with

all previous Transfers by them would exceed 10% of the Common Stock held by them

at the time of the transaction in question(which in the case of a series of

related transactions is the most current transaction in such series), except

pursuant to an Excluded Transaction or pursuant to Section 6.5(b), to any third

party or parties that are not affiliates of Kelso & Company, L.P or any

investment fund organized by or at the direction of Kelso & Company, L.P. (a

"Third Party"), unless the Management Stockholders, the Third Party Investors,

and their respective Permitted Transferees (collectively, the "Offerees"), are

offered the right, at the option of each Offeree, to include in such Transfer to

the Third Party such number of shares of Common Stock owned by each such Offeree

as determined in accordance with this Section 6.5(a). If any member of the

Kelso Group receives from a Third Party a bona fide offer or offers to Transfer,

or proposes to Transfer to a Third Party, shares of its or their Common Stock,

such member (the "Transferor") shall provide written notice (the "Tag-Along

Notice") to each of the Offerees, setting forth the consideration per share to

be paid by such Third Party and the other material terms and conditions of such

transaction. The Tag-Along Notice shall offer the Offerees the opportunity to

participate in the proposed Transfer of shares to the Third Party according to

the terms and conditions of this Section 6.5(a) and for the same type of

consideration and for an amount of consideration per share not less than that

offered to the Transferor by the Third Party. At any time within 15 days after

its receipt of the Tag-Along Notice, each of the Offerees may irrevocably (but

subject to the terms and conditions of such offer) accept the offer included in

the Tag-Along Notice for up to such number of shares of Common Stock as is

determined in accordance with the

21

provisions of this Section 6.5(a) by furnishing written notice of such

acceptance to the Transferor. Promptly following such acceptance by an Offeree,

each such Offeree shall deliver to the Transferor the certificate or

certificates representing the shares of Common Stock to be Transferred pursuant

to such offer by such Offeree, together with a limited power-of-attorney

authorizing the Transferor to sell or otherwise dispose of such shares of Common

Stock pursuant to the proposed Transfer to the Third Party.

Each Offeree shall have the right to participate in the proposed

Transfer to the Third Party by Transferring in connection therewith shares of

Common Stock equal to the product of (x) the total number of shares to be

acquired by the Third Party, times (y) a fraction, the numerator of which shall

be the total number of shares of Common Stock owned by such Offeree, and the

denominator of which shall be the number of shares of Common Stock owned by the

Kelso Group plus the total number of shares of Common Stock owned by all

Offerees in the aggregate. The maximum number of shares of Common Stock that

may be Transferred by each Offeree to the Third Party in accordance with this

Section 6.5(a) shall be the total number of shares of Common Stock then owned by

such Offeree.

If within 15 days after the delivery of the Tag-Along Notice, any

Offeree has not accepted the offer contained in the Tag-Along Notice, such

Offeree will be deemed to have waived any and all rights with respect to, or to

participate in, the Transfer of Common Stock described in the Tag-Along Notice.

The Transferor shall have 45 days following such delivery in which to Transfer

Common Stock held by it plus any Common Stock of any Offerees who accept the

offer described in the Tag-Along Notice in accordance with the provisions of

this Section 6.5(a), in the aggregate not more than the amount of Common Stock

described in the Tag-Along Notice, for an amount and type of sales price

consideration per share not more favorable to the Transferor than was set forth

in the Tag-Along Notice, provided that the type of consideration to be received

--------

by the Transferor may be different than the type set forth in the Tag-Along

Notice so long as it is not materially more favorable to the Transferor. The

number of shares of Common Stock held by the Transferor which the Transferor is

entitled to

22

transfer pursuant to this Section 6.5(a) shall not be subject to reduction by

reason of any Offeree who has not accepted the offer described in the Tag-Along

Notice. If, at the end of 60 days following the delivery of the Tag-Along

Notice, the Transferor has not completed the Transfer of Common Stock of the

Transferor and Common Stock of any Offeree, the Transferor shall return to such

Offeree all certificates representing shares of Common Stock which such Offeree

delivered for Transfer pursuant to this Section 6.5(a), and all the restrictions

on sale or other disposition contained in this Agreement with respect to Common

Stock owned by the Transferor shall again be in effect.

To the extent practicable, all Offerees whose shares of Common Stock

are to be Transferred in accordance with this Section 6.5(a) shall receive the

consideration in respect of their shares substantially simultaneously with the

receipt by the Transferor of the consideration in respect of the shares of

Common Stock of the Transferor. In the event that the Offerees do not receive

their consideration substantially simultaneously with the Transferor, as

promptly as practicable (but in no event later than 10 days) after the

consummation of the Transfer of Common Stock of the Transferor and Common Stock

of the Offerees to the Third Party in accordance with this Section 6.5(a), the

Transferor shall notify the Offerees thereof, shall remit to each of the

Offerees the total consideration in respect of the shares of Common Stock of

such Offeree which were so Transferred, and shall furnish such other evidence of

the completion and time of completion of such Transfer and the terms thereof as

may be reasonably requested by the Offerees.

(b) Drag-Along Rights. If any member or members of the Kelso Group

-----------------

shall, individually or collectively, propose to Transfer at least 75% of all

shares of Common Stock collectively owned by the Kelso Group to a Third Party,

then (in addition to the rights of the Management Stockholders, the Third Party

Investors, and their respective Permitted Transferees to participate in such

Transfer pursuant to Section 6.5(a) hereof) the Kelso Group may, at its option,

require the Management Stockholders, the Third Party Investors, and their

respective Permitted Transferees (collectively, the "Remaining Holders") to

include in such Transfer to the Third Party such number of shares of Common

Stock owned

23

by each of them, as determined in accordance with this Section 6.5(b); provided

--------

that if the Kelso Group sends the Drag-Along Notice referred to below, Section

6.5(a) shall not apply to the Transfer.

The Kelso Group shall send written notice (the "Drag-Along Notice") of

the exercise of their rights pursuant to this Section 6.5(b) to each of the

Remaining Holders, setting forth the sales price consideration per share to be

paid by the Third Party and the other material terms and conditions of such

transaction. The Drag-Along Notice shall state that the Remaining Holders shall

be required to participate in the proposed Transfer of shares to the Third Party

according to the terms and conditions of this Section 6.5(b) and for the same

type of sales price consideration and for an amount of sales price consideration

per share not less than that offered to any member of the Kelso Group by the

Third Party. Within 15 days following the receipt of the Drag-Along Notice, each

of the Remaining Holders shall deliver to a representative of the Kelso Group

designated in the Drag-Along Notice certificates representing all shares of

Common Stock held by such Remaining Holder, duly endorsed, together with all

other documents required to be executed in connection with such transaction. In

the event that any Remaining Holder should fail to deliver such certificates to

the Kelso Group, the Company shall cause the books and records of the Company to

show that such shares are bound by the provisions of this Section 6.5(b) and

that such shares may be Transferred only to the Third Party.

Each Remaining Holder shall be required to participate in the proposed

Transfer to the Third Party by Transferring in connection therewith shares of

Common Stock equal to the product of (x) the total number of shares to be

acquired by the Third Party, times (y) a fraction, the numerator of which shall

be the total number of shares of Common Stock owned by such Remaining Holder,

and the denominator of which shall be the total number of shares of Common Stock

owned by the Kelso Group plus the total number of shares of Common Stock owned

by all Remaining Holders in the aggregate. The maximum number of shares of

Common Stock that may be Transferred by each Remaining Holder to the Third Party

in accordance with this Section 6.5(b) shall be the total number of

24

shares of Common Stock then owned by such Remaining Holder.

If, within 90 days after the Kelso Group gave the Drag-Along Notice,

they shall not have completed the Transfer of all the shares of Common Stock of

the Remaining Holders in accordance with this Section 6.5(b), the Kelso Group

shall return to each of the Remaining Holders all certificates representing

shares of Common Stock that such Remaining Holder delivered for Transfer

pursuant hereto and that were not purchased pursuant to this Section 6.5(b);

provided that the Kelso Group shall be permitted, but not obligated, to complete

- --------

the sale by all non-defaulting Remaining Holders if one or more of the Remaining

Holders default; provided further that completion of the sale by the Kelso Group

-------- -------

and/or such Remaining Holders shall not relieve a defaulting Remaining Holder of

liability for its breach.

The obligations of the Remaining Holders pursuant to this Section

6.5(b) are subject to the satisfaction of the following conditions:

(i) if any Stockholder is given an option as to the form and amount of

consideration to be received, all Stockholders will be given the

same option (except that the Third Party Investors shall not be

required in any circumstance to accept consideration in a form other

than cash, cash equivalents or securities listed for trading on any

national securities exchange or traded on the National Market System

of NASDAQ);

(ii) no Remaining Holder shall be required to make any out-of-pocket

expenditure prior to the consummation of such transaction (excluding

expenditures for its own postage, copies, etc. and the fees and

expenses of its own counsel and other advisors retained by it, which

amounts shall be the sole responsibility of such Remaining Holder in

any event), and no Remaining Holder shall be obligated to pay more

than its or his pro rata share (based upon the consideration to be

received in such transaction) of expenses incurred by

25

the Company or for the benefit of all Stockholders, provided that a

Remaining Holder's liability for its or his pro rata share of such

allocated expenses shall in no event exceed the total purchase price

received by such Remaining Holder in such transaction;

(iii) in the event that the Remaining Holders are required to provide any

representations or warranties in connection with such transaction,

each Remaining Holder shall only be required to represent and

warrant as to its or his title to its or his Stock to be Transferred

and such holder's authority, power, and right to enter into and

consummate such transaction without violating any other agreement or

legal requirement and other matters relating to such holder, and in

the event that the Remaining Holders are required to provide any

indemnities in connection with such transaction, then each Remaining

Holder shall not be liable for more than his or its pro rata share

(based upon the amount of consideration to be received in such

transaction) of any liability for indemnity and such liability shall

not exceed the total purchase price received by such Remaining

Holder in such transaction; provided that, with respect to the

--------

foregoing representations or warranties given by the Remaining

Holders, a Remaining Holder may be liable for any and all losses

resulting from a breach of such representations or warranties and

there shall be no cap by reason of this Agreement on the liability

of the relevant Remaining Holder with respect to breaches of such

representations or warranties.

To the extent practicable, all Remaining Holders whose shares of Common

Stock are to be Transferred in accordance with this Section 6.5(b) shall receive