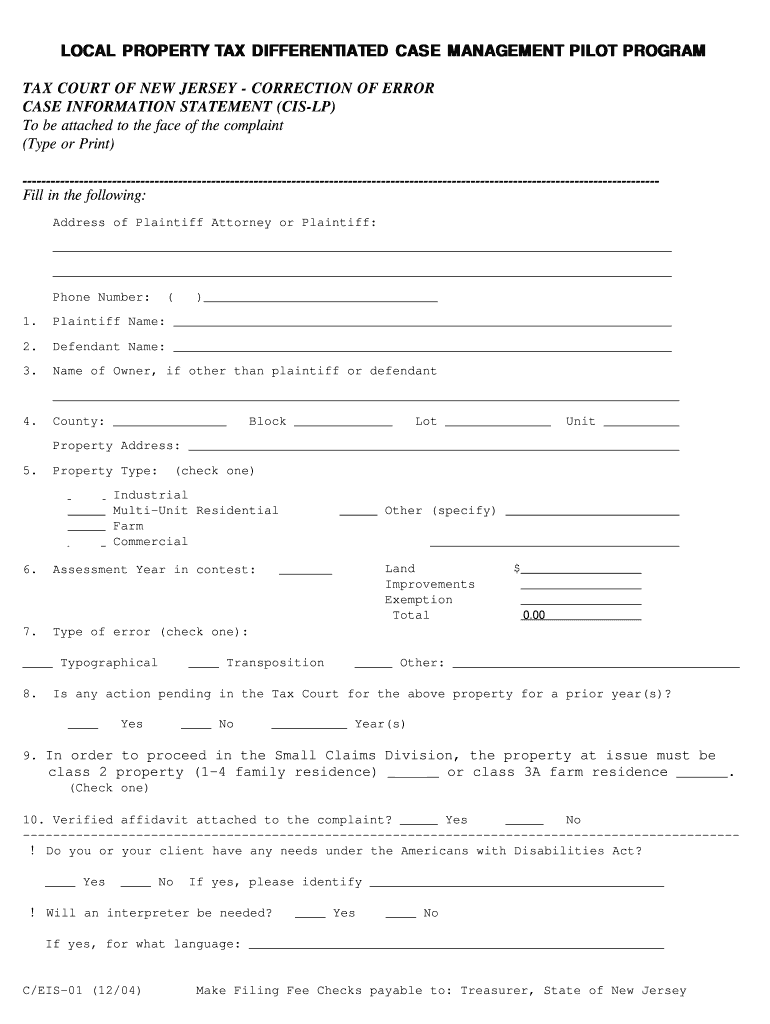

Fill and Sign the Local Property Tax Differentiated Case Management Pilot Program Form

Helpful tips for preparing your ‘Local Property Tax Differentiated Case Management Pilot Program’ online

Are you fed up with the burden of handling paperwork? Look no further than airSlate SignNow, the leading eSignature platform for individuals and businesses. Say farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can effortlessly fill out and sign documents online. Take advantage of the robust features integrated into this user-friendly and cost-effective platform and transform your method of document management. Whether you need to approve forms or collect electronic signatures, airSlate SignNow manages it all effortlessly, with just a few clicks.

Follow these detailed instructions:

- Log into your account or sign up for a free trial with our service.

- Click +Create to upload a file from your device, cloud, or our template library.

- Open your ‘Local Property Tax Differentiated Case Management Pilot Program’ in the editor.

- Click Me (Fill Out Now) to complete the form on your end.

- Add and designate fillable fields for others (if necessary).

- Proceed with the Send Invite settings to request eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

No need to worry if you need to collaborate with others on your Local Property Tax Differentiated Case Management Pilot Program or send it for notarization—our platform provides you with everything required to complete these tasks. Register with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

What is the LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM?

The LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM is an initiative designed to streamline the management of property tax cases. It aims to improve efficiency and ensure that property tax assessments are handled fairly and effectively. This program is essential for local governments looking to enhance their property tax processes.

-

How can airSlate SignNow support the LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM?

airSlate SignNow provides a robust platform for managing documents related to the LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM. With features like eSigning and document tracking, it simplifies the workflow for local governments. This ensures that all necessary documents are processed quickly and securely.

-

What are the key features of airSlate SignNow for property tax management?

Key features of airSlate SignNow for property tax management include customizable templates, secure eSigning, and real-time document tracking. These features are particularly beneficial for the LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM, as they enhance collaboration and reduce processing times. Additionally, the platform is user-friendly, making it accessible for all stakeholders.

-

Is airSlate SignNow cost-effective for local governments implementing the LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM?

Yes, airSlate SignNow is a cost-effective solution for local governments implementing the LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM. The pricing plans are designed to fit various budgets, ensuring that even smaller municipalities can benefit from its features. This affordability helps local governments allocate resources more efficiently.

-

What benefits does the LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM offer to local governments?

The LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM offers numerous benefits, including improved case resolution times and enhanced transparency in property tax assessments. By utilizing airSlate SignNow, local governments can further streamline their processes, leading to better service for residents. This program ultimately fosters trust and accountability in local tax administration.

-

Can airSlate SignNow integrate with other software used in the LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM?

Absolutely, airSlate SignNow offers seamless integrations with various software applications commonly used in the LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM. This includes accounting software, CRM systems, and document management tools. These integrations enhance the overall efficiency of property tax management workflows.

-

How does airSlate SignNow ensure the security of documents in the LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM?

airSlate SignNow prioritizes document security, employing advanced encryption and compliance with industry standards. This ensures that all documents related to the LOCAL PROPERTY TAX DIFFERENTIATED CASE MANAGEMENT PILOT PROGRAM are protected from unauthorized access. Local governments can trust that sensitive information remains confidential and secure.

The best way to complete and sign your local property tax differentiated case management pilot program form

Find out other local property tax differentiated case management pilot program form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles