Exhibit AMANUGISTICS GROUP, INC.

EMPLOYEE STOCK OPTION PLAN

1. PURPOSE. This Employee Stock Option Plan (the "Plan") is intended to encourage stock ownership by employe es of

Manugistics Group, Inc. (the "Corporation") or any of its subsidiary corporations as that term is defi ned in Section 4 of the

Internal Revenue Code of 1986, as amended (the "Code") (the "Subsidiaries") so that such employe es may acquire or increase

their interest in the success of the Corporation and Subsidiaries and so that they may be encouraged to remain in the employ of

the Corporation or its Subsidiaries.

2. ADMINISTRATION. The Plan shall be administered by a committee appointed by the Board of Directors of the

Corporation (the "Committee"). The Committee shall consist of not less than two me mbers of the Corporation's Board of

Directors, who are "disinterested persons" as such term is defined in Rule 16b-3(c)(2)(i) of the Sec urities Exchange Act of

1934, as amended (the "Exchange Act"). The Board of Directors may from time to time remove members from, or add members

to, the Committee. Vacancies on the Committee, howsoever caused, shall be fill ed by the Board of Directors; provided,

however, that any individual appointed to the Committee shall be a Director who is a "disinterested person." The Committee

shall hold meetings at such times and places as it may determine. If the Committee consists of three or more members, the

Committee shall select one of its members as Chairman. Acts by a majori ty of the Committee at a meeting at which a quorum is

present, or acts reduced to or approved in writing by a majority of the members of t he Committee, shall be the valid acts of the

Committee. No person while a member of the Committee shall receive a disc retionary grant or award under any stock plan of

the Corporation, other than pursuant to a stock plan where such grant or award is determined unde r a formula meeting the

requirements of Rule 16b-3(c)(2)(ii) of the Exchange Act. The Committee shall from time to time in its discretion designate the

employees who shall be granted options and the amount of stock to be issued upon exercise of such options. The Committee

shall have the final authority to determine these matters. The interpretati on and construction by the Committee of any provisions

of the Plan or of any option granted under it shall be final. No member of the Board of Dire ctors or the Committee shall be

liable for any action or determination made in good faith with respect to the Plan or any option granted under it.

3. ELIGIBILITY. The persons who shall be eligible to receive options shall be all full time em ployees (including officers,

whether or not they are directors) of the Corporation or its Subsidiaries and certain individua ls who were employees of the

Corporation or its Subsidiaries who are specifically granted options by the Board. An optionee may hold more than one option

but only on the terms and subject to the restrictions hereinafter set forth.

4. STOCK . The stock subject to the options shall be shares of the Corporation's authorized, but unissued or reacquired,

common stock (the "Common Stock"). The aggregate number of shares which may be issued under options granted under the

Plan shall not exceed 1,622,025 shares of Common Stock. The limitation established by the prec eding sentence shall be subject

to adjustment as provided in Article 5(g) of the Plan. In the event that any outstanding opt ion granted under the Plan for any

reason expires or is terminated, the shares of Common Stock allocable to such option ma y again be subject to an option grant

under the Plan.

5. TERMS AND CONDITIONS OF OPTIONS. When the Committee shall have granted options to employees, a Notice

of Grant of Stock Option (the "Notice") shall be given to each employee in such form as the Committee shall from time to time

approve, which Notice shall comply with and be subject to the following terms and conditions:

(a) Number of Shares. Each Notice shall state the number of shares of Common Stock to which it pertai ns. The

Committee shall award employees options for shares of Common Stock in accordance with the following:

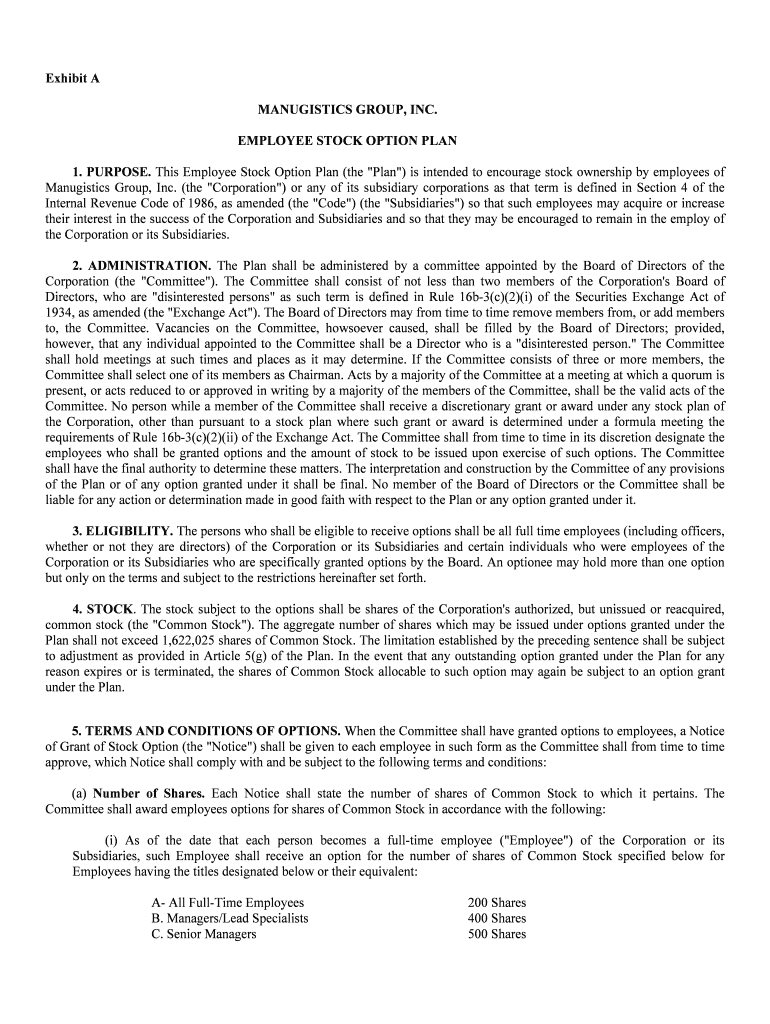

(i) As of the date that each person becomes a full-time employee ("Employee") of the Corporation or its

Subsidiaries, such Employee shall receive an option for the number of shares of Common Stock spec ified below for

Employees having the titles designated below or their equivalent:

A- All Full-Time Employees 200 Shares

B. Managers/Lead Specialists 400 Shares

C. Senior Managers 500 Shares

D. Officers & Directors 600 Shares

(ii) Any Employee who is promoted to the level of Manager/Lead Specialist, Senior Mana ger or Officer and Director

(or their equivalent) shall receive an option at the time of such promotion for an additional number of shares of Common

Stock equal to the difference between the number of shares previously granted under an option or options pursuant to this

Article 5(a)(i) and the number of shares which the Employee would have received had suc h promotion been effective as of

the date such person became an Employee of the Corporation or its Subsidiaries.

(iii) Such other amounts as are determined by the Committee from time to time in its discreti on.

(b) Option Price. Each Notice shall state the option price, which shall not be less than one hundred percent (100%) of the

fair market value per share of the Common Stock on the date of the grant of the opt ion. During such time as the Common Stock

is not listed upon an established stock exchange or traded in the over-the-counter ma rket, the fair market value per share shall be

determined by the Committee at least annually by relying upon whatever evidence it deems appropriate which may include, but

need not be limited to, recent sales of the Common Stock, opinions of professional appraise rs and recent sales of stock of other

comparable companies. If the Common Stock is traded in the over-the-counter market, suc h fair market value per share shall be

the average of the high and low prices of the Common Stock in the over-the-counter marke t on the date previous to the date that

the option is granted, as reported by the National Association of Securities Dealers, Inc. If the Common Stock is listed upon an

established stock exchange or exchanges such fair market value per share shall be deem ed to be the average of the high and the

low price of the Common Stock on such stock exchange or exchanges on the day previous to the dat e that the option is granted

or if no sale of the Common Stock shall have been made on any stock exchange on that da y, on the next preceding day on

which there was a sale of such Common Stock. Subject to the foregoing, the Commit tee, in fixing the option price, shall have

full authority and discretion.

(c) Medium and Time of Payment. Each option shall be exercised by giving written notice to the Corporation, addressed

to the attention of its Secretary at its principal corporate office, which notic e shall specify the number of shares of Common

Stock to be purchased and shall be accompanied by payment in full for the shares of Common Stock being purchased. Unless

otherwise specified in the Notice pursuant to Section 6 hereof, the option price shall be payable by cash or check in United

States dollars upon the exercise of the option.

(d) Term and Exercise of Options.

(i) All options granted hereunder shall vest and become exercisable in the following m anner: twenty-five

percent (25%) per year commencing twelve (12) months after the date of the grant of the option.

(ii) Options may only be exercised by an optionee for so long as the optionee is employed by the Corporation

or its Subsidiaries except as otherwise provided in Articles 5(e) and 5(f) of the Plan. Notwi thstanding the foregoing,

if an employee who was granted options on or after July 17, 1990 is terminated involuntaril y without cause within

one (1) year after a consolidation or merger in which the Corporation is not the surviving Corporation, the options

may be exercisable as of the date of such consolidation or merger. In no event shall an option granted under this Plan

be exercisable more than ten (10) years after the date of the grant of the option.

(iii) Not less than fifty (50) shares may be purchased upon exercise of an option at any one ti me unless the

number purchased is the total number at the time purchasable under the option.

(iv) During the lifetime of the optionee, the option shall be exercisable only by the optionee and shall not be

transferred, assigned, pledged or otherwise disposed of by the optionee and no other person shall acquire any rights

therein.

(e) Termination of Employment Except by Death or Disability. In the event that the employment of an optionee

by the Corporation or its Subsidiaries shall terminate for any reason other than the optionee 's death or disability, the

optionee may exercise any options held by such optionee for a period of thirty (30) days from the date of notice of such

termination to the extent that the optionee's right to exercise such options had a ccrued pursuant to section 5(d) on or before

the date of his or her notice of termination. Notwithstanding the foregoing, an optionee who, wi th the approval of the

Corporation, takes leave without pay for up to twelve (12) weeks for the purpose of caring for a m ember of his or her

family shall be permlitted to retain options granted to such optionee prior to t he first day of such leave. The Committee

shall determine whether such leave is taken for the purpose of caring for a member of the optionee's family, which

determination, unless overruled by the Board of Directors, shall be final and conclusive. Whet her any other authorized

leave of absence or absence for military or governmental service shall constitute te rmination of employment, for the

purposes of the Plan, shall be determined by the Committee, which determination, unle ss overruled by the Board of

Directors, shall be final and conclusive. If the optionee converts from full-time employme nt to part-time employment, such

conversion shall not affect such optionee's right to exercise any option.

(f) Death or Long-Term Disability of Optionee and Transfer of Option. (i) Notwithstanding any provision contained herein to the contrary, if the optionee shall die whi le in the employ

of the Corporation or a Subsidiary, the option shall remain exercisable by the executors or administrators of the

optionee or by any person or persons who shall have acquired the option directly from the optionee by bequest or

inheritance for a period of ninety (90) days following the date of the optionee's death to the extent that the optionee's

right to exercise such option had accrued pursuant to Section 5(d) as of the date of the optionee's death. No option

shall be transferable by the optionee other than by will or the laws of descent and distribution.

(ii) Notwithstanding any provision contained herein to the contrary, if the optionee shall become disabled while

in the employ of the Corporation or a Subsidiary, the option shall be exercisable by the optionee for a period of ninety

(90) days from the date of disability to the extent that the optionee's right to exercise such option had accrued pursuant

to Section 5(d) as of the date of disability, and the expiration of the option following such ninety (90) day period shall

thereafter be suspended until a date one (1) year from the date of disability, at which time the option shall termi nate,

unless the optionee shall return to work within such one (1) year period, in which case the option shall be restored for

all vesting purposes as if the disability of the optionee had not occurred-,

For purposes of this Plan, an optionee shall be considered disabled if the optionee is considere d disabled under

the Corporation's or its Subsidiaries' regular long-term disability provisions. However, the dete rmination of the

Committee as to whether an optionee is disabled shall be binding and conclusive for purposes of this Plan.

(g) Recapitalization. Subject to any required action by the shareholders of the Corporation, the number of shares

of Common Stock covered by each outstanding option, and the price per share thereof in eac h such option, shall be

proportionately adjusted for any increase or decrease in the number of issued shares of Common Stoc k of the

Corporation resulting from a subdivision or consolidation of shares or the payment of a stock divide nd (but only on

the Common Stock) or any other increase or decrease in the number of such shares effect ed without receipt of

consideration by the Corporation, so that the optionee's percentage of ownership of the total num ber of shares of

Common Stock outstanding is neither increased nor decreased.

Subject to any required action by the shareholders of the Corporation, if the Corporation shall be the surviving

corporation in any merger or consolidation, each outstanding option shall pertain to and appl y to the securities to

which a holder of the number of shares of Common Stock subject to the option would have been entitled.

In the event of a change in the Common Stock of the Corporation as presently constituted, which is limited to a

change of all of its authorized shares with par value into the same number of shares with a different par value or

withotit par value, the shares resulting from any such change shall be deemed to be the Common Stock within the

meaning of the Plan.

To the extent that the foregoing adjustments relate to stock or securities of the Corporation, such adjustments

shall be made by the Committee, whose determination in that respect shall be final, binding and conclusive .

Except as hereinbefore expressly provided in this Article 5(g), the optionee shall have no ri ghts by reason of any

subdivision or consolidation of shares of stock of any class or the payment of any stock dividend or a ny other increase

or decrease in the number of shares of stock of any class or by reason of any dissolution, liquidat ion, merger or

consolidation or spin-off of assets or stock of another corporation, and any issue by the Corporation of shares of stock

of any class, or securities convertible into shares of stock of any class, shall not affect, and no adjustment by reason

thereof shall be made with respect to, the number or price of shares of Common Stock subject to the option.

The grant of an option pursuant to the Plan shall not affect in any way the right or power of the Corporation to

make adjustments, reclassifications, reorganizations or changes of its capital or business structure or to merge or to

consolidate or to dissolve, liquidate or sell, or transfer all or any part of its business or assets.

(h) Rights as a Stockholder. An optionee or a permitted transferee of an option shall have no rights as a stockholder

with respect to any shares covered by the optionee's option until the date of the issuance of a stock certificate to t he

optionee for such shares following the exercise of such option. No adjustment shall be made for dividends (ordinary

or extraordinary, whether in cash, securities or other property) or distributions or other rights for which the record date

is prior to the date such stock certificate is issued, except as provided in Article 5(g) hereof

(i) Modification, Extension and Renewal of Options. Subject to the terms and conditions and within the

limitations of the Plan, the Committee may modify outstanding options granted under t he Plan, or accept the surrender

of outstanding options (to the extent not theretofore exercised). The Committee shall not, however, modify any

outstanding options so as to specify a lower price or accept the surrender of outstanding options and a uthorize the

granting of new options in substitution therefor specifying a lower price. Notwithstanding the foregoing, no

modification of an option shall, without the consent of the optionee, alter or impa ir any rights or obligations under any

option theretofore granted under the Plan.

(j) Investment Purpose . Each option granted under the Plan shall be granted on the condition that the purchases

of stock thereunder shall be for investment purposes and not with a view to resale or distri bution, except that in the

event the stock subject to such option is registered under the Securities Act of 1933, as amended (the "Securities

Act"), or in the event a resale of such stock without such registration would otherwise be pe rmissible, such condition

shall be inoperative if, in the opinion of counsel for the Corporation, such condition is not requi red under the

Securities Act or any other applicable law, regulation or rule of any governmental agency.

(k) Confidentiality Agreement. The Notice may provide that, as a condition of the employee's acceptance of t he

option, the employee shall agree to be bound by a confidentiality agreement with the Corporation containing such

terms as the Committee and Board of Directors shall deem advisable.

(1) Other Provisions. The Notice shall contain such other provisions, including, without limitation, restrict ions

upon the exercise of the option or the transfer of the shares received upon an exercise, as t he Committee and the

Board of Directors shall deem advisable.

6. PERMISSIBLE PROVISIONS. In addition to the other powers granted to the Committee and the Board of

Directors under this Plan, the Committee and the Board of Directors shall have the di scretion to include in any option

grant the right of the optionee (i) to pay for the Common Stock upon exercise of the option with Common Stock of the

Corporation, and/or (ii) to receive property at the time of exercise of the option if, i n the case of property other than

cash, Section 83 of the Code applies to such property.

7. GRANT OF OPTIONS. Options may be granted pursuant to the Plan from time to time until such time a s all

shares available under the Plan as set forth in Article 4 have been made subject to an option grant. If any outstanding

option granted under the Plan for any reason expires or is terminated, the shares of Comm on Stock allocable to the

option may again be subject to an option grant under the Plan.

8. INDEMNIFICATION OF COMMITTEE. In addition to such other rights of indemnification as they may

have as directors or as members of the Committee and the Board of Directors, the me mbers of the Committee and the

Board of Directors shall be indemnified by the Corporation against the reasonable expenses, including attorneys' fees

actually and necessarily incurred in connection with the defense of any action, suit or proceeding, or in connection

with any appeal therein, in which they or any of them may be a party by reason of any a ction taken or failure to act

under or in connection with the Plan or any option granted thereunder, and against all amount s paid by them in

settlement thereof (provided such settlement is approved by independent legal counsel selected by the Corporation) or

paid by them in satisfaction of a judgment in any such action, suit or proceeding exce pt in relation to matters as to

which it shall be adjudged in such action, suit or proceeding that such person is liable for gross negligence or

intentional misconduct in the performance of his or her duties; provided that within sixty (60) days after institution of

any such action, suit or proceeding such person shall in writing offer the Corporation the opportunity, a t its own

expense, to handle and defend the same.

9. AMENDMENT OF THE PLAN . The Board of Directors of the Corporation may, insofar as permitted by

law, from time to time, with respect to any shares at the time not subject t o options, suspend or discontinue the

Plan or revise or amend it in any respect whatsoever except that, without approval of the shareholders of the

Corporation, no such revision or amendment shall materially increase the number of shares of Common Stock

which may be issued pursuant to the Plan, materially increase the benefits accrui ng to participants under the

Plan, or otherwise materially modify the requirements for eligibility.

10. APPLICATION OF FUNDS . The proceeds received by the Corporation from the sale of Common Stock

issued pursuant to options will be used for general corporate purposes.

11. NO OBLIGATION TO EXERCISE OPTION. The granting of an option shall impose no obligation upon

the optionee to exercise such option.

12. CONTINUED EMPLOYMENT . The grant of an option pursuant to the Plan shall not be construed to

imply or to constitute evidence of any agreement, expressed or implied, on the part of t he Corporation or any

Subsidiary to continue to employ an employee, or to affect the right of the Corporation or a ny Subsidiary to

terminate the employment of any employee or to alter the responsibilities, duties or authority of any employee .

13. EFFECTIVE DATE AND TERM OF PLAN; STOCKHOLDER APPROVAL. This Plan shall have an

effective date of April 14, 1994 and shall have a term of ten (10) years. However, no option granted after the

effective date may be exercised unless this Plan is approved by the vote of a ma jority of the outstanding shares

of the Corporation's Common Stock present, or represented, and entitled to vote, at a m eeting of stockholders of

the Corporation held within twelve (12) months after the effective date of the Plan.

14. WITHHOLDING TAXES. The exercise of each option shall be subject to the condition that if, at any

time, the Corporation shall determine in its discretion that the satisfacti on of withholding tax or other

withholding liabilities is necessary or desirable as a condition of, or in connection wit h, the exercise or the

delivery or purchase of shares pursuant to the option, then in any such event, the exercise sha ll not be effective

unless such withholding shall have been effective or obtained free of any conditions not ac ceptable to the

Corporation, including withholding from other fees or sums otherwise due to the option holder from t he

Corporation.