Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

2008 Form IL-1040-X

Amended Individual Income Tax Return

/

or for fiscal year ending

0

9

REV 11

Step 1: Personal information

A

Do not write above this line.

Print or type your current Social Security number(s), name(s), and address.

–

Your Social Security number

Your first name and initial

–

–

Spouse’s Social Security number

Spouse’s first name (and last name - only if different)

Mailing address

B

C

D

E

–

Your last name

City

State

ZIP

If your Social Security number(s), name(s), or address listed above are different from your previously filed return, check the box.

Filing Status:

Residency:

Single or head of household

Resident

Married filing jointly

Nonresident

Married filing separately

Widowed

Part-year resident

Check the box that identifies why you are making this change. ** Attach a copy of your federal finalization. (See instructions.)

**Federal change accepted on

____ ___ ____

Month

Day

**NOL accepted on

Year

____ ____ ____

Month

Day

State change

Year

Step 2: Reason for filing

If you are changing your Illinois return due to a change to your federal return, do not file this form until you receive notification that

the IRS has accepted the changes. See ‘‘How long do I have to correct or amend my return?’’ in the Form IL-1040-X instructions.

Staple W-2 and 1099 forms here.

F

For the tax year you are amending, on what date did you file your original Form IL-1040 or your

latest Form IL-1040-X?

G

Did you file a U.S. Form 1040X?

yes

no

If you filed a U.S. Form 1040X, you must attach to this form

a copy of your U.S. Form 1040X, and

a copy of the notification you received from the Internal Revenue Service (IRS) stating that they accepted the changes

shown on your U.S. Form 1040X; e.g., a refund check, "Statement of Account," agreement, or judgment. You must write

the date the IRS notified you (not the date you filed your U.S. 1040X) in the appropriate space in Step 1, Line E. Failure

to provide this date could result in an assessment of a late-payment penalty.

H

Explain, in detail, the reason(s) for filing this amended return. Attach a separate sheet if necessary.

Total Tax

Net

Income

Exemptions

Subtractions

Income

Step 3: Financial information (Line numbers may not match your original return.)

Staple your check here.

______/______/______

1

2

3

4

5

6

7

8

9

10

Corrected Figures

Federal adjusted gross income

Federally tax-exempt interest and dividend income

Other additions (attach Schedule M with amended figures)

Total income. Add Lines 1 through 3.

Federally taxed Social Security and federally taxed retirement plan income

Illinois Income Tax overpayment included in U.S. 1040, Line 10 (attach U.S. 1040, page 1)

Other subtractions (attach Schedule M with amended figures)

Total subtractions – Add Lines 5 through 7.

Illinois base income. Subtract Line 8 from Line 4.

Number of exemptions: a yourself and your dependents (as corrected)

b 65 years or older or legally blind (as corrected)

c Add Lines 10a and 10b. This is your exemption allowance.

X $2000

X $1000

11 Residents only: Net income. Subtract Line 10c from Line 9.

12 Nonresidents and part-year residents only: Write your Illinois base

income from Schedule NR. (attach Schedule NR with amended figures)

12

1

2

3

4

5

6

7

8

9

10a

10b

10c

11

_____________|____

_____________|____

_____________|____

_____________|____

_____________|____

_____________|____

_____________|____

_____________|____

_____________|____

_____________|____

_____________|____

_____________|____

_____________|____

_____________|____

13 Residents: Multiply Line 11 by 3% (.03).

Nonresidents and part-year residents: Write the tax before recapture of investment credits from Schedule NR. 13 _____________|____

14 _____________|____

15 _____________|____

14 Recapture of investment tax credits. Attach Schedule 4255.

15 Total Tax. Add Lines 13 and 14.

IL-1040-X (R-12/08)

*861501110*

Official Use

Page 1 of 4

�Previous

Overpayments

Payments and

Refundable Credit

Corrected Figures

16 Total tax amount from Page 1, Line 15.

Nonrefundable Credits

Step 3 (Continued)

16 _____________|____

17 Credit from Schedule CR (attach Schedule CR with amended figures)

18 Property tax and K-12 education expense credit from Schedule ICR (attach Schedule ICR

17 _____________|____

with amended figures)

19 Credit from Schedule 1299-C (attach Schedule 1299-C with amended figures)

20 Nonrefundable credits. Add Lines 17 through 19.

21 Tax after nonrefundable credits. Subtract Line 20 from Line 16.

18

19

20

21

_____________|____

_____________|____

_____________|____

_____________|____

22 Total of all previous overpayments, refunds, or credit carryforward (whether or not you

22 _____________|____

23 _____________|____

received it), and original contributions. (See instructions)

23 Tax after previous overpayments. Add Line 21 and 22.

24

25

26

27

28

29

24

Estimated payments (IL-1040-ES, IL-505-I, and prior year credit)

25

Pass-through entity payments - nonresident and part-year residents only (attach Schedule K-1-P or K-1-T) 26

Earned income credit from Schedule ICR (attach Schedule ICR with amended figures)

27

Amount of tax paid with original return plus additional tax paid after it was filed. (See instructions)

28

Total payments and refundable credit. Add Lines 24 though 28.

29

Illinois Income Tax withheld (See instructions.)

_____________|____

_____________|____

_____________|____

_____________|____

_____________|____

_____________|____

Refund or

Balance Due

Step 4: Refund or Balance Due

30 Overpayment. If Line 23 is less than Line 29, subtract Line 23 from Line 29.

31 Underpayment. If Line 23 is greater than Line 29, subtract Line 29 from Line 23.

32 Penalty and interest. (See instructions) _____________|____ + _____________|____ =

Penalty amount

30 _____________|____

31 _____________|____

32 _____________|____

Interest amount

33 If Line 30 is greater than Line 32, subtract Line 32 from Line 30. This is your refund.

34 If Line 30 is less than Line 32, subtract Line 30 from Line 32. or

If you have an amount on Line 31, add Lines 31 and 32. This is the amount you owe.

33 _____________|____

34 _____________|____

Step 5: Sign and Date

Sign and Date

Under penalties of perjury, I state that I have examined this return, and, to the best of my knowledge, it is true, correct, and complete.

Your signature

Date

Daytime phone number

Your spouse’s signature

Date

Paid preparer’s signature

Date

Preparer’s phone number

Preparer’s FEIN, SSN, or PTIN

Mail to: Illinois Department of Revenue, P.O. Box 19007, Springfield, IL 62794-9007

*861502110*

DR

Page 2 of 4

ID

X3

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this information is REQUIRED. Failure to provide

information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-0074

Reset

Print

IL-1040-X (R-12/08)

�Supporting Documents for Form IL-1040-X

Do not mail this page with your Form IL-1040-X.

Federal Changes (including net operating loss (NOL) deductions)

If you file Form IL-1040-X because of a change to your federal return or because you are claiming an NOL carryback deduction, you must

wait to file this form until you receive a federal finalization notice from the Internal Revenue Service (IRS) stating that

they have accepted your change either by paying a refund or by final assessment, agreement, or judgment. You must

write the date the IRS notified you (not the date you filed your U.S. Form 1040X) in the appropriate space in

Step 1, Line E. Failure to provide this date could result in an assessment of a late-payment penalty.

attach proof of federal finalization to your Form IL-1040-X.

Acceptable proof of federal finalization includes a copy of the notification you received from the IRS that they accepted

your changes; e.g., a refund check, "Statement of Account," agreement, or judgment, and

a copy of your U.S. Form 1040X, if filed, or

a complete copy of your U.S. Form 1045, Application for Tentative Refund, including all pages of Schedules A and B,

along with a copy of your refund check, if you filed your federal amended return due to a NOL.

If you do not have a copy of this notification, please contact the IRS at 1 800 829-0922 to request a record of your account.

Line Changes

Attach the proper supporting documents, listed below, to your return.

If you changed any of the lines identified below and do not attach the required supporting documents to your return,

we may partially or totally deny your claim.

If you corrected:

Line 1

Federal adjusted gross income

U.S. Form 1040, 1040X, or 1045 (with Schedules A and B,

if completed) if a NOL,

U.S. Form 1040 Schedules C, E, and F, if filed, for loss

years

Schedule K-1-P or K-1-T, or any other notification that was

furnished to you for partnership, S corporation, estate, and

trust income

Proof of federal finalization as listed above

Line 3

Other additions

Schedule M with amended figures and any other required

support listed on Schedule M

Line 5

U.S. Form 1040 or 1040A, Page 1

Federally taxed Social Security

and federally taxed retirement plan income

Form W-2, if applicable

Line 6

U.S. Form 1040, Page 1

Form 1099-R, RRB-1099, or SSA-1099, if applicable

Illinois Income Tax overpayment included in

U.S. 1040, Line 10

Continued on the next page

IL-1040-X (R-12/08)

Page 3 of 4

�Supporting Documents for Form IL-1040-X (Continued)

Do not mail this page with your Form IL-1040-X.

If you corrected:

Line 7

Other subtractions

Schedule M with amended figures and any other required

support listed on Schedule M

Line 10

U. S. Form 1040X

Exemption allowance

Proof of federal finalization as shown above

Line 12

Schedule NR with amended figures

Nonresidents and part-year residents

Line 17

Schedule CR with amended figures

Credit for tax paid to other states

Out-of-state returns, schedules, and attachments and

W-2 forms to support any local taxes paid

Line 18

Schedule ICR with amended figures and any other required

support listed on Schedule ICR

Property tax and K-12 education expense

credit from Schedule ICR

Line 19

Receipts for home school expenses

Schedule 1299-C with amended figures

Schedule 1299-C Credits

Line 24

Illinois Income Tax withheld

All W-2 and 1099 forms, Form IL-4852, or letter, on

company letterhead, from employer

IL-1023-C

Line 26

Schedule K-1-P or K-1-T with amended figures

Pass-through entity payments

Line 27

Earned Income Credit

Page 4 of 4

U.S. Form 1040X, if changing federal EIC

Proof of federal finalization

IL-1040-X (R-12/08)

�

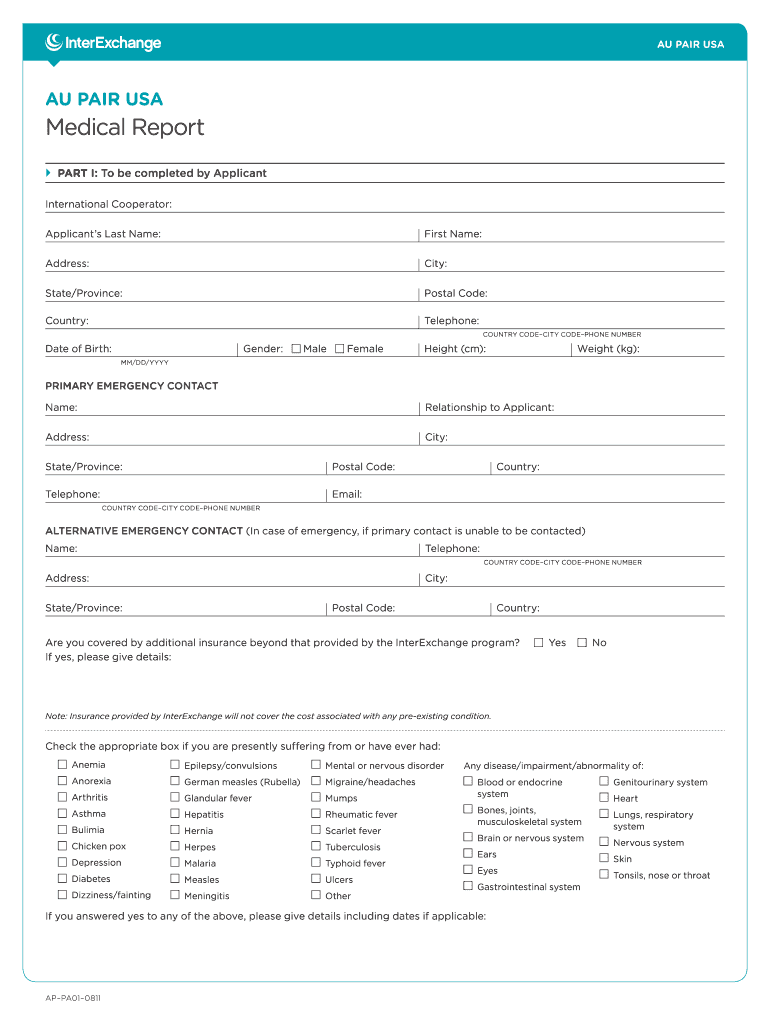

Useful suggestions for finalizing your ‘Medical Report Form 14211880’ digitally

Are you fatigued by the burden of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for both individuals and businesses. Bid farewell to the tedious procedure of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and endorse documents online. Utilize the extensive features embedded in this user-friendly and cost-effective platform and transform your method of document handling. Whether you need to authorize forms or collect signatures, airSlate SignNow manages everything seamlessly, all with just a few clicks.

Follow this detailed guide:

- Log into your account or initiate a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template collection.

- Access your ‘Medical Report Form 14211880’ in the editor.

- Hit Me (Fill Out Now) to finish the form on your side.

- Add and designate fillable fields for others (if necessary).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Download, print your version, or transform it into a multi-use template.

No need to worry if you need to collaborate with your colleagues on your Medical Report Form 14211880 or send it for notarization—our platform provides everything you require to accomplish such tasks. Register with airSlate SignNow today and enhance your document management to new levels!