Issue 13 December 2009

Investment Management Review

A Quarterly Update for the Investment Management Industry

Assessing Risk

• Oversight: Getting It Right with

Your Service Provider

• SEC v. Tambone: The First Circuit

Reconsiders Primary Liability for

“Implied Statements” under Rule 10b-5

• Reevaluating Mutual Fund Compliance

in Today’s Market Environment

• Preparing for Proposed Hedge Fund

Legislation

• Heightened Risk Management in the

Post-Crisis World

• Regulatory and Legislative Update

• Toward T+1 Settlement: The History of

Trade Matching in the Canadian Market

�Issue 13 December 2009

CONTENTS

2

Oversight: Getting It Right with Your Service Provider

8

SEC v. Tambone: The First Circuit Reconsiders Primary

Liability for “Implied Statements” under Rule 10b-5

Girard Healy, Managing Director, and Mike Kerrigan, Principal, Beacon Consulting Group,

discuss the opportunity to redefine and transform the oversight of outsourced functions.

Joel T. Shaw, Bernstein Shur Securities and Financial Services Industry Group reviews

this pending case and the possible implications for fund service providers and

fund distributors.

12

Reevaluating Mutual Fund Compliance in Today’s Market

Environment

The Regulatory Administration Group of Citi’s Fund Services offers excerpts from the

October and November issues of The Investment Lawyer where the team provides an

extensive analysis of the unprecedented regulatory challenges facing compliance

departments of mutual funds.

17

Preparing for Proposed Hedge Fund Legislation

22

Heightened Risk Management in the Post-Crisis World

26

Regulatory and Legislative Update

30

Toward T+1 Settlement: The History of Trade Matching in

the Canadian Market

Jennifer English, Senior Vice President, Regulatory and Compliance Services, Citi, and

Fred Schmidt, Senior Vice President, Regulatory and Compliance Services, Citi, discuss

the need for a robust compliance program in response to proposed regulation.

Lawrence Komo, Asia Pacific Head of Investor Services, Citi, discusses the renewed

focus on effective and robust risk management in Asia Pacific.

Bruce Treff, Managing Director of Regulatory and Compliance Services, Citi, and

Chuck Booth, Director, Regulatory and Compliance Services, Citi, review the third

quarter’s fund regulation landscape.

Ajmal Asif, Vice President Product Management, Citi, discusses the increased

settlement efficiency and the reduction of operational risk through timely

trade matching.

Investment Management Review

A Quarterly Update for the Investment Management Industry

�IMR UP FRONT

A New Regulatory Environment

for the New Year

As we enter the New Year, now is an opportune time to consider the macro

dynamics that our industry is facing—and will need to continue to address—

as we successfully adapt to a post-Lehman, post-Madoff marketplace.

By far, the most wide-ranging ramifications on our business will result from

the forthcoming, though still-unspecified, changes in the regulatory and

compliance environment—a theme that runs through this issue of Investment

Management Review.

For a comprehensive overview, Citi’s regulatory

and compliance specialists have produced

“Reevaluating Mutual Fund Compliance in Today’s

Market Environment,” a thorough analysis of the

increased oversight, additional regulation and

stricter reporting requirements that lie ahead

for mutual funds following the unprecedented

challenges of the recent global credit crisis.

Finally, Joel T. Shaw of Bernstein Shur discusses

the reconsideration by the U.S. First Circuit

Court of Appeals of primary liability for Implied

Statements under Rule 10b-5 in “SEC v. Tambone,”

and the “Regulatory & Legislative Update—3rd

Quarter 2009” presents a comprehensive roundup

of proposed and permanent rules specifically

pertinent to the asset management industry.

Oversight of a different kind is featured in

“Oversight: Getting It Right with Your Service

Provider,” by Girard Healy and Mike Kerrigan

of Beacon Consulting Group. In fund managers’

dealings with service providers, they write,

“The current market environment presents

an ideal opportunity to improve oversight and

to simultaneously achieve two critical goals:

managing operational risk and reducing costs.”

In 2010 and beyond, our industry will be broadly

affected by changes in regulatory and compliance

provisions to be shortly put into effect by

governing bodies around the world. We are very

interested in your views. To offer your comments

on the new regulations or to submit ideas for

future articles in Investment Management Review,

please contact Denise Grant at (212) 816-2174 or via

email at denise.grant@citi.com

The importance of a robust risk management

program is also highlighted in other articles in

this edition of IMR. Among other timely points,

Citi’s Lawrence Komo states in “Heightened Risk

Management in the Post-Crisis World” that “In the

new risk management paradigm,” which the recent

global credit crisis has brought about, “innovative

back- and middle-office outsourcing, backed

by seamless technology platforms, can enable

investment managers to make more informed

and actionable decisions.” Likewise, increased

operational efficiency and reduced operational

risk are key goals in “Toward T+1 Settlement: The

History of Trade Matching in the Canadian Market,”

by Citi’s Ajmal Asif.

Sincerely,

Bruce Treff

Managing Director of Regulatory and Compliance

Services

Citi

For your convenience, Investment Management Review is now available online. To download current and previous issues,

visit our website (https://www.citibank.com/transactionservices/home/sa/2009/imr_update/form.jsp).

IMR 1

�Oversight

GETTING IT RIGHT WITH

YOUR SERVICE PROVIDER

The right level of oversight

means striking a balance.

Now is the time to redefine and

transform the oversight of outsourced

functions. The current market

environment presents an ideal

opportunity to improve oversight and

to simultaneously achieve two critical

goals: managing operational risk and

reducing costs. Investment managers

may be assuming unnecessary risk

and/or missing out on cost savings if

they have not recently reviewed and

streamlined their oversight activities.

IMR 2

�Girard Healy

Managing Director

Beacon Consulting Group

Mike Kerrigan

Principal

Beacon Consulting Group

IMR 3

�Investment managers may be assuming unnecessary risk

Defining oversight is especially difficult in organizations

and/or missing out on cost savings if they have not recently

that have recently outsourced these functions as they may

reviewed and streamlined their oversight activities. Many

not have successfully planned the transition from “doers”

opportunities exist to improve the processing environment

to “reviewers” of service provider output. Oversight may

for outsourced or offshored fund accounting, fund

also be difficult in organizations that have a long-standing

administration and middle-office functions. The issue for

relationship with a service provider, as the natural

many investment managers is that they may be utilizing an

tendency is to grow the level of tasks performed in the

oversight model that has not changed since the outsourcing

name of oversight, irrespective of relative risks. Human

relationship began. A lot can change over the years and

factors also present barriers to effective oversight as

outdated models may not be focused on the range of risks

cultural resistance to change complicates the transition

that the current market environment has created.

from performing tasks to reviewing tasks.

The recent decline in assets under management and

Beacon’s experience indicates that effective

associated drop in revenue have prompted investment

oversight activities:

managers to respond with a variety of initiatives aimed at

reducing costs. Managers are merging funds, eliminating

• Are risk-based;

share classes, reducing staff and rationalizing their capital

• Ensure accountability;

spending. At the same time, operational risk and investor

• Embrace comprehensive planning and communication;

scrutiny has increased. Market volatility, increased

trading volumes and added investment complexity have

presented technology and operational challenges to many

overburdened investment support areas.

and

• Utilize skilled professionals.

Risk

Now is the time to redefine and transform the level of

Oversight activities should be designed and applied based

oversight of outsourced functions. The current market

on a comprehensive, process-based risk assessment. As

environment presents an ideal opportunity to improve

described in more detail below, a process-based approach

oversight and simultaneously achieve two critical goals:

ensures that risks, beginning with trade support and

managing operational risk and reducing costs.

ending with financial reporting, are identified and mitigated

throughout the investment life cycle. The recommended

approach includes an analysis of risk by activity and

Oversight

It is estimated that 85% of fund managers have outsourced

some or all of their fund accounting, fund administration

or middle-office activities. Even though these functions

are outsourced, investment managers retain a shared

a review of service provider capabilities. A risk-based

approach will reduce unnecessary duplication of service

provider activities and ensure that analytical reviews of

higher-risk transactions are performed by investment

manager personnel.

responsibility and liability for ensuring that routine tasks

are performed accurately and in accordance with regulatory

and industry standards. This objective is usually achieved

Accountability

via an oversight role. The ideal oversight model achieves the

Assumption of responsibility by the investment manager

efficiencies, scalability and cost savings that led to the initial

and service provider is an important element of oversight

decision to outsource these functions, without increasing

activities. Without accountability, the risk-based approach

operational risk. The right level of oversight means striking a

to oversight described above cannot work. There needs

balance between completely shadowing the service provider

to be commitment on both sides that agreed-upon

and inattentive acceptance of anything and everything the

procedures and controls will be followed. Investment

service provider delivers. For most investment managers,

defining that balance is more art than science.

IMR 4

�managers and service providers frequently speak about

In a challenging economic climate, retaining experienced

creating true partnerships, but few things create a true

professionals for oversight can improve the oversight

partnership and define accountability more effectively

process and accelerate decision-making when complex issues

than a comprehensive service level agreement (SLA). An

need to be resolved.

outsourcing relationship is a long-term proposition and

approaching it as a partnership yields far more benefits for

firms that view it as such over firms that view it as purely

a scorekeeping exercise. One-sided SLAs typically result in

a scorekeeping exercise — an SLA that obligates both sides

creates a true partnership.

Getting Oversight Right

Defining the investment manager’s oversight model requires

more analysis than simply saying, “If we performed the task

using ten people, then it should only take three to review

it.” Defining oversight is a continuous cycle of risk and

Planning and Communication

activity analysis, implementation, planning and monitoring.

(See accompanying illustration.) The objective is that the

Planning and communication are critical to the

expertise and time devoted to an oversight activity is

performance of successful oversight. The investment

commensurate with the risk.

manager should ensure that the service provider is aware

of operational changes, new technology, new products,

The risk and activity analysis entails identifying operational

portfolio strategy changes and major transactions

risk points and understanding exactly how the investment

well before they occur. A best practice is to convene

manager’s oversight personnel are spending their time.

weekly update calls with the service provider to track

To facilitate the analysis, the investment manager should

issues and monitor resolutions. Report cards that detail

identify all functional areas as for which oversight activities

key performance indicators should also be part of the

are performed and utilize a matrix to assist in the evaluation.

communication process. Significant transactions should be

treated like special projects and include a comprehensive

Beacon recommends that investment managers evaluate

project plan with milestones and assigned responsibilities.

the risks at the detailed activity level and assign a risk rating

Postmortems are also an important element of ensuring

of high, medium or low. Using the matrix, the investment

successful oversight.

manager can also specify the roles of the service provider

or the investment manager. Typical roles are “perform,”

“review,” “provide” or “joint responsibility.” The matrix can be

Utilization of Skilled Professionals

The investment manager should perform its oversight

activities with knowledgeable industry personnel who are

experienced in performing the analytical reviews required

to maintain a successful oversight model. These individuals

must understand and resolve complex fund accounting

and administration issues brought to their attention by

the service providers. The oversight professional staff

should consist of a mixture of individuals with deep

technical knowledge as well as experienced generalists who

understand the downstream ramifications of issues across

all functions. For instance, professionals who understand

and can communicate the impact to the tax function of an

issue identified during the financial reporting processes

designed to evaluate the entire enterprise or be customized

on a fund-by-fund basis. The assessment process should

identify material risks as well as evaluate instances where

nonmaterial risks can become material when aggregated.

The risks and activity analysis should be preceded by an

evaluation of unique fund characteristics and internal

capabilities, as well as external factors. The assessment should

take into account the complexity of each fund’s strategy and

product mix, trade volumes and historical issues.

The level of assigned risk is also dependent on the strengths

and weaknesses of the service provider. The investment

manager must have a thorough understanding of the service

would be beneficial.

IMR 5

�provider’s strengths and weaknesses in both technology and

personnel. The investment manager can leverage reports

such as a SAS 70 and, if available, internal audit reports

to expedite the review. Lack of knowledge of the service

provider’s capabilities could unintentionally direct oversight

activities to low-risk areas.

To become familiar with a service provider’s processes,

controls, cutoff times and technology capabilities, a site visit

to the service provider is recommended. Detailed knowledge

of the service provider will direct where the manager’s

oversight activities should be focused. For example,

transactions or activities that are manually uploaded from

the service provider’s ancillary systems to its core systems

should receive a higher degree of oversight than those

that are processed straight through. A complete inventory

of available reporting from the service provider should be

created. The reports should be analyzed for adequacy in

helping the manager meet its oversight role. Reporting gaps

• Achieves flexibility and scalability while maintaining a

risk-based approach

• Speeds operational oversight of new and complex

products

• Supports growth strategies

The investment manager’s oversight policies and

procedures should be documented to ensure adherence

to oversight activities. The procedures should specify the

party responsible for the tasks as well as the frequency

with which they should be performed. The procedures

should identify the specific review procedures, include

reasonableness tests and specify levels of materiality

that may require additional research or coordination with

the service provider (e.g., pricing, income and expenses).

Functional job descriptions for oversight personnel should

be developed to ensure that key functions are performed

and evaluate their oversight capabilities.

and related enhancements should be coordinated with the

service provider.

The investment manager should take the lead in

communication and planning with the service provider. The

Next, it is critical that investment managers understand

exactly where their personnel are spending their time.

The same matrix that is used to assess risk should also be

utilized to measure time spent on activities by the manager’s

investment manager is driving the business and the service

provider needs to be privy to upcoming strategic decisions

and operational changes that may impact its ability to

deliver quality services.

personnel.

An SLA should be revised or initiated with the service

Upon completion of the risk assessment steps, the manager

can overlay the risk profile against time spent. This analysis

is the best way to make adjustments and redirect oversight

activities to high-risk areas. An additional benefit from this

approach is that it may be helpful in allocating technology

spending, especially where low-risk, manual processes are

consuming a significant amount of time.

provider. Industry-standard SLAs typically include a list

of service requirements and identify the responsible

party and time frames by which the requirement must be

met. The SLA should include obligations by both parties

especially where the service provider’s compliance with the

SLA is dependent on action by the investment manager.

For example, the SLA might stipulate that the service

provider will book all trades on trade date, provided trades

Once the oversight roles are determined, implementation

activities can begin with the development of an oversight

are sent by the manager at the agreed-upon frequency and

prior to the cutoff time.

model. An operating model defines the scope of functions

performed by the firm and outlines how the oversight

processes would be logically organized into work groups to

deliver effective oversight. The ideal oversight model has the

following characteristics:

The process described above is a continuous process. New

risks are identified on almost a daily basis. The investment

manager’s oversight regimen should be structured so

that it can quickly anticipate risks and provide effective

oversight of new products.

IMR 6

�Conclusion

The appropriate levels and depth of oversight activities

should be designed and applied based on a comprehensive,

process-based risk assessment. A continuous assessment

process ensures that oversight activities can be directed

to significant risk areas. Understanding the details of the

service provider’s processes and controls is an integral part

of the assessment process. Developing good relationships

with service providers is important, as well as agreeing on

a mutual service level agreement. Applying a risk-based

approach is critical. Any other approach to oversight is

likely to result in a significant amount of ineffective, but

well-intended, activities performed in the name of oversight

and ultimately will conjure the story of the policeman who

one night spotted a man in the road on his hands and knees

looking for something.

“What are you doing?” asked the officer.

“I dropped a nickel a mile down the road,” said the man.

“Then why are you looking for it here?” asked the officer.

“Because the lighting is better here,” said the man.

How Many?

No examination of service provider oversight

would be complete without answering the

question: “How many professionals does

it take to perform adequate oversight?”

There is not a formulaic answer. The keys

to the right level of oversight lie in the

investment manager’s capacity to move

from performing core tasks to a culture

of performing analytical reviews, the

capabilities of the service provider, the

experience of the investment manager’s

staff and the volume and complexity of

the funds.

Interestingly, Beacon Consulting Group

recently completed a benchmarking study

that compares the relative performance

of the financial reporting process using

in-house staff versus outsourcing the

process. The firms that outsourced

the financial reporting process utilized

two-thirds fewer staff than those preparing

the financial reports in-house.

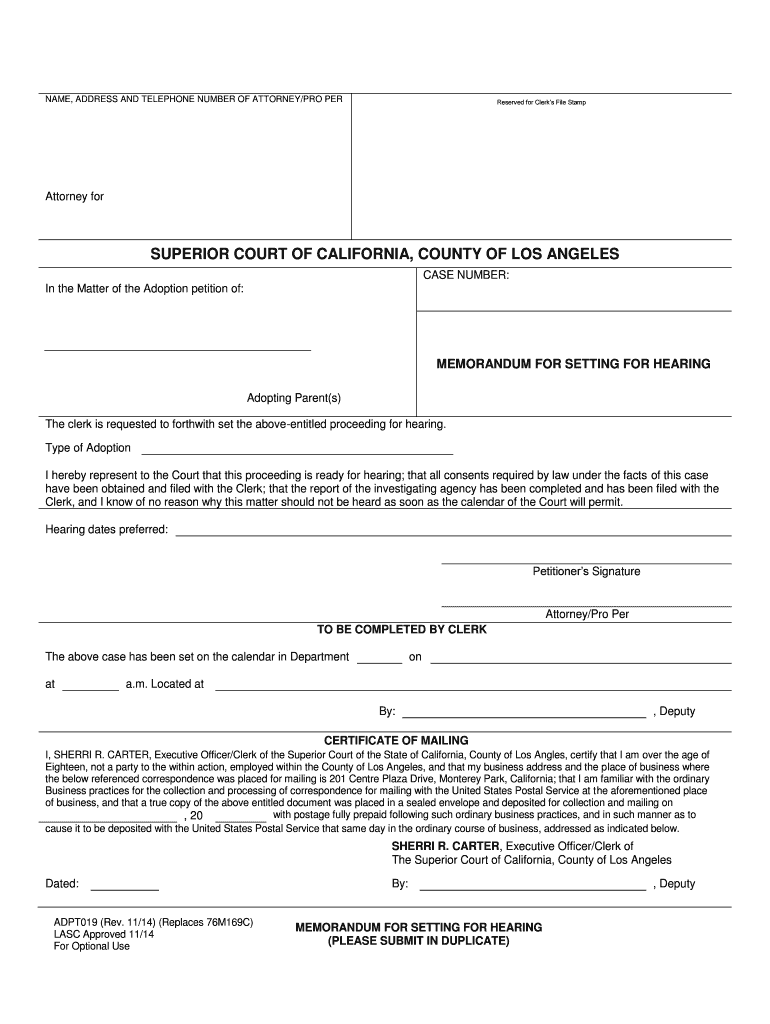

Getting Oversight Right Is a Continuous Process

•

•

•

•

•

Service Level Agreements

Key Performance Indicators

Deadlines

Reporting

Sanctions

• Changes in Product,

Strategy

• Project Orientation

• Communicate

Monitoring

Planning

Risk &

Activity

Analysis

• Activity-Oriented View

• Time Allocation

• Understand Service Provider

Capabilities and Technology

Implementation • Operating Model

• Policies and Procedures

• Job Descriptions

IMR 7

�Joel T. Shaw

Bernstein Shur

Securities and Financial

Services Industry Group

SEC v. Tambone:

The First Circuit Reconsiders Primary

Liability for “Implied Statements”

under Rule 10b-5

A Slippery Slope

On the morning of October 6, 2009, the First Circuit

Court of Appeals heard oral arguments pursuant

to a rehearing en banc in Securities and Exchange

Commission v. Tambone, et al., U.S. Court of Appeals,

First Circuit (Dec. 3, 2008). In what is expected to be

its final word in the case, the First Circuit will either

maintain the status quo with respect to the conduct

for which a defendant may be held primarily liable

under Rule 10b-5, as promulgated under the Securities

Exchange Act of 1934, as amended (the “Exchange

Act”), or expand it to include the novel concept of

“implied statements.”

Tambone is simply the latest in a line of cases that applies, directly

or indirectly, to the investment management industry and threatens

to shift the liability standards applied to fund service providers

and, at a minimum, raise the level of due diligence required of fund

distributors with respect to statements made in a fund prospectus.

Although the essential Tambone holding arguably applies only to fund

distributors, the question remains to be answered: Is the First Circuit

on the precipice of a slippery slope that will capture a broader range

of market participants?

IMR 8

�A Brief History

17(a)(2) of the Securities Act of 1933, as amended (the

“Securities Act”) and Section 10(b) of the Exchange Act and

Between 1998 and 2003, James R. Tambone and Robert

Hussey were each employed as senior executives of the

principal underwriter and distributor for the Columbia

family of mutual funds. In these capacities, they were

responsible for selling the securities and for disseminating

informational materials, including prospectuses, to

investors and potential investors. Although occasionally

Rule 10b-5 promulgated thereunder. The SEC subsequently

entered into a $140 million settlement agreement with

Columbia Management Advisors, Inc., Columbia Funds

Distributors, Inc., and three former employees. Hussey and

Tambone were not party to the settlement and, instead,

moved to dismiss the SEC claims against them.

involved in revising draft documents, neither defendant

was responsible for creating the original content. During

the same time period, the Columbia funds adopted various

The District Court Dismisses

disclosure statements for inclusion in the prospectuses

On two occasions, first in January 2006 and again in

regarding “market timing” activities. The Securities and

December 2006, the District Court for the District of

Exchange Commission (“SEC”) later alleged that Hussey

Massachusetts agreed with Hussey and Tambone and

co-led a working group, which recommended that all of

dismissed the SEC complaint and amended complaint.

the Columbia funds adopt a consistent position against

Addressing the question of primary liability, the court held

market timing. The SEC further alleged that Hussey and

that to be liable under Section 10(b) of the Exchange Act

Tambone each reviewed drafts of and offered comments to

and Section 17(a) of the Securities Act, the defendant must

the proposed disclosures. By 2001, all of the prospectuses

have personally made either an allegedly untrue statement

in the Columbia funds family did in fact reflect a consistent

or a material omission. Because neither defendant was

strict prohibition on market-timing activities.

responsible for creating the original content in the Columbia

funds’ prospectuses, in the eyes of the district court, “[t]he

Notwithstanding the disclosure statements, the SEC

major flaw with the SEC’s complaint was then, and continues

subsequently determined that, during the approximately

to be, a failure to attribute misleading statements to either

five-year period between 1998 and 2003, nearly $2.5 billion

Tambone or Hussey.”

of transactions were executed pursuant to market-timing

arrangements in the Columbia funds family with certain

preferred customers. The SEC claimed to have identified

The First Circuit Reverses

multiple market-timing arrangements that Hussey and

Tambone allegedly either affirmatively approved or

knowingly allowed each in violation of the strict prohibition

disclosures contained in the Columbia funds’ prospectuses.

On December 3, 2008, a three-judge panel of the First Circuit

Court of Appeals unceremoniously reversed the holding

of the district court, concluding that Hussey and Tambone

could be held primarily liable for using false or misleading

prospectuses to sell mutual fund shares under both Section

The SEC Acts

17(a)(2) and Rule 10b-5. In reaching its decision, the First

Based on its investigation of the above-described conduct

respect to primary liability in at least two respects.

Circuit panel challenged the current jurisprudence with

in the Columbia funds family, the SEC initiated an

enforcement action in 2005, alleging various violations

Section 17(a)(2) provides, in relevant part, that “[i]t shall be

of the anti-fraud provisions of the federal securities laws,

unlawful for any person in the offer or sale of any securities

including, but not limited to, primary violations of Section

… by the use of any means or instruments of transportation

IMR 9

�or communication in interstate commerce or by the use of

The First Circuit was persuaded by the SEC’s argument

the mails, directly or indirectly, to obtain money or property

that, as senior executives of the primary underwriter for

by means of any untrue statement of a material fact or any

the Columbia funds, they each had a legal duty to confirm

omission to state a material fact necessary in order to make

the accuracy and completeness of the prospectuses that

the statements made, in light of the circumstances under

they were responsible for distributing. In light of this duty,

which they were made, not misleading.” It is well settled that

the defendants made “implied statements” of their own

Section 17(a)(2) applies only to sellers of securities, and was

to potential investors within the meaning of Rule 10b-5(b)

thought to be well settled, at least to Hussey and Tambone,

that they had a reasonable basis to believe the information

that, for primary liability to attach, the untrue statement

in the prospectuses was truthful and complete. Having

or omission must be directly made by or attributable to the

decided that an “implied statement” was the functional

defendant. The First Circuit, however, adopted a compelling

equivalent of a “made statement,” the First Circuit

argument by the SEC that the wording of the statute “by

concluded that the SEC sufficiently alleged that both

means of any untrue statement” (emphasis added) does not

Hussey and Tambone made statements to investors about

require the seller to have actually uttered a word, provided

the market-timing practices of Columbia funds when they

that an untrue statement made by someone was used by

knew, or were reckless in not knowing, that the disclosure

the seller in connection with the transaction. In doing so,

statements in the prospectuses were false. The issue of

breaking from prior precedent, the First Circuit recognized the

primary liability attaching under Rule 10b-5(b) based on an

potential implication of its holding that Section 17(a) captures

implied statement theory is now subject to the rehearing

a broader scope of conduct than Section 10(b) and Rule 10b-5.

en banc in the First Circuit.

The panel’s ruling with respect to the Section 17(a)(2) claim

withstood the defendants’ motion for rehearing and for now is

the law of the case and the law of the First Circuit.

Although certain commentators have accepted, albeit

grudgingly, the Tambone decision as a logical interpretation

of Section 17(a), others, including Judge Selya in dissent,

accused the court of nothing short of a judicial rewriting of

Rule 10b-5. Rule 10b-5(b) provides that “[i]t shall be unlawful

for any person, directly or indirectly, to make any untrue

statement of a material fact or to omit to state a material

fact necessary in order to make the statements made, in the

light of the circumstances under which they were made, not

misleading.” Contrary to Section 17(a)(2), based on the plain

language of the rule, there was no reasonable dispute that

the SEC must allege and prove that Hussey and Tambone

actually made an untrue statement of material fact.

Consequently, the issue became how broadly could the SEC

convince the First Circuit to construe the concept of making

a statement? Unfortunately for Hussey and Tambone, thus

far, that answer appears to be very broadly.

IMR 10

The New Landscape

If allowed to stand, the First Circuit panel’s decision in

Tambone is feared to be the precipitating factor for one

of any number of unintended (or intended) consequences.

Most notable among these is the blurring of the line

between primary and secondary liability that the Supreme

Court attempted to carefully delineate in Central Bank of

Denver v. First Interstate Bank of Denver, U.S. Supreme

Court (1994). Following that seminal case, secondary

liability—more commonly known as “aiding and abetting”—

can no longer be the legal and factual basis for Rule 10b-5

liability in private rights of action. With so much at stake for

industry participants, an entire body of law has developed

around this critical line of demarcation. To further aid in

determining the outer limits of primary liability, courts

of appeals generally have either followed a “bright-line”

test (as relied on by the district court) or a “substantial

participation” test. By declining to follow either of the

�existing methods in favor of a third “implied statement” test,

correlate to the legal duty giving rise to the implied

which seemingly has the potential to characterize a much

statements triggering the potential applicability of Rule

broader array of conduct as “primary,” the First Circuit has

10b-5(b). As the legal duty increases and becomes more

introduced yet another theory of primary liability under Rule

fundamental to the fair and efficient operation of the

10b-5 to an existing split in the circuits. There is a growing

securities markets, the due diligence required to satisfy

belief that the Supreme Court will take its next opportunity

such duty should increase in a corresponding manner.

to settle the law.

Consequently, market participants should be asking

themselves the following questions: By virtue of our

Until the Supreme Court intervenes, however, without a

actions in the chain of distribution, do we have a legal duty

clear dividing line it may be virtually impossible to assess

to investors? What is the nature of our legal duty? Are we

the magnitude of the risk of private litigation associated

taking appropriate steps to satisfy our legal duty, including,

with certain conduct in the securities industry by concluding

without limitation, conducting appropriate due diligence

that it is either primary and within the reach of Rule

with respect to offering materials prepared by others?

10b-5, or secondary and outside the reach of Rule 10b-5.

And most importantly, can we document those steps in the

If the essential elements of the Tambone decision are

event of a claim by the SEC or by a private litigant?

reaffirmed by the full First Circuit, the immediate question

should be “How far-reaching are the effects on all market

participants?“ For underwriters, including any fund advisers

with affiliated distributors, the short answer is that they

will fall squarely within the crosshairs of the SEC, as well as

private litigants, for any material misstatements or omissions

in the offering materials that they distribute, regardless of

where the ultimate responsibility for drafting the documents

lies. Because the SEC, unlike private litigants, still has an

action for “aiding and abetting” in its arsenal, it is the

potential explosion of private liability that is most concerning

to the securities industry. Underwriters in particular need to

be prepared for the possibility of a significantly increased

due diligence burden, with an eye toward defending claims

based on material misstatements attributable to the issuer.

For others the answer will be less obvious. However,

for those market participants engaged in the chain of

distribution, no due diligence with respect to offering

materials will never be the correct approach. Based on the

And Now We Wait

The First Circuit panel’s “implied statement” theory in

Tambone indisputably captures a broader scope of conduct

subject to primary liability under Rule 10b-5 than exists

under current law. It is too soon to predict, however, how

far beyond underwriters the bounds of primary liability

could stretch under this new theory. If preserved in its final

decision, the court’s intense focus on the “essential role” of

the defendants as principal underwriters and the legal duty

that entails should temper the fear of a true slippery slope

that will inextricably blur the line between primary and

secondary liability under Rule 10b-5. Ultimately, resolution

of the appropriate manner to determine the outer limits of

primary liability appears to be on a one-way track back to

the Supreme Court. Until then, the industry will wait and

watch with keen interest for the decision of the full First

Circuit in Tambone.

existing Tambone decision, it is reasonable to conclude

that the appropriate level of due diligence should at least

IMR 11

�Reevaluating Mutual Fund Compliance

in Today’s Market Environment

In its October and November issues, The Investment Lawyer

published an extensive analysis, written by regulatory

and compliance specialists in Citi Fund Services, of the

unprecedented challenges—increased oversight, additional

regulation, greater frequency of SEC examinations and

enforcement actions, stricter reporting requirements, etc.—faced

by compliance departments of mutual funds. Below are excerpts

from that two-part article; if you’d like the complete article

please contact Maureen Hicks at maureen.hicks@citi.com.

IMR 12

�The effects of the recent economic crisis on the financial

services industry have been profound and widespread.

Banks have failed, storied institutions have collapsed or

been bailed out, financial scandals have been exposed and

the precipitous decline in the markets has severely reduced

the fortunes of individual investors and institutions alike.

Although nearly every financial institution in the country

has been affected by the crisis, the mutual fund industry

has been hit especially hard with tumbling stock prices and

increased redemptions causing mutual fund assets to drop

at one point by a staggering $2.5 trillion. This extraordinary

drop in fund assets ultimately reduced revenues for many

mutual fund sponsors, leading to reductions in staff and

other resources throughout the industry.

The crisis has created a unique set of challenges for

many mutual fund compliance departments. With the

unprecedented intervention by the federal government

in the financial services sector, compliance departments

have had to navigate through some unfamiliar waters.

The recent spike in examinations and enforcement actions

by the Securities and Exchange Commission (SEC) has

made these waters increasingly unfriendly. In addition,

the number of mergers, acquisitions and consolidations in

the financial services industry resulting from the crisis has

created a more complex web of affiliates. As a result, some

compliance departments have had to spend extraordinary

amounts of time evaluating recent industry changes to

ascertain new affiliations and to monitor for prohibited

affiliated transactions. These factors, coupled with the

recent significant reduction in revenues, have left many

compliance departments in the unenviable position of being

asked to accomplish more with fewer resources.

IMR 13

�In an effort to prevent cuts in compliance resulting

“the need for interim reviews in response to significant

from the crisis, the SEC staff has stressed the need for

compliance events, changes in business arrangements

compliance programs that are more robust than the current

and regulatory developments” should be considered.

industry standard. With mutual funds suffering prolonged

In light of the current market environment, along with

negative performance periods, the pressure to turn around

the fast-changing business and regulatory landscape,

performance results has only intensified, leading to increased

compliance departments should strongly consider, if they

potential for noncompliant or unethical behavior. As a result,

are not doing so already, performing one or more interim

now more than ever, the SEC considers the compliance

reviews of their funds’ compliance program.

function as being essential to mutual fund operations. In

fact, the SEC staff has directed mutual funds to view their

In performing a review of compliance programs, the SEC

compliance departments as vital to their survival and to fund

staff has advocated that compliance departments conduct

them accordingly.

comprehensive “risk assessments” to identify risks that

may affect their funds. In fact, one of the items the SEC

Given such a mandate, this article contends now is the time

staff routinely requests to review during fund examinations

for mutual funds to perform a comprehensive review of their

are documents evidencing that a risk assessment has

compliance programs to ensure they adequately deal with

the compliance risks that have surfaced, or received extra

attention, as a result of the recent market turmoil.

been performed. A risk assessment is a process by which

a compliance department analyzes a fund’s operations

and identifies issues, conflicts and other problems that are

unique to that particular fund, including a careful review of

the fund’s vulnerabilities. When identifying potential risks,

Time to Reevaluate Risks

compliance departments should also think “outside the

Pursuant to Rule 38a-1 under the Investment Company Act

their funds. In addition to identifying compliance risks, a

1940 Act, as amended (the 1940 Act), mutual funds are

risk assessment also includes assigning levels of risk and

required to maintain written policies and procedures that

identifying solutions. The greater the risk in an area, the

are reasonably designed to prevent, detect and correct

more compliance departments should focus on compliance

violations of securities laws by the fund, as well as provide

in that area. As new risks are identified, new controls

oversight of the compliance efforts of the fund’s service

should be implemented to reduce or eliminate such risks.

providers through which the fund conducts its business (that

As compliance programs have evolved, many compliance

is, adviser, transfer agent, distributor and administrator).

departments are conducting risk assessments on a

In addition, Rule 38a-1 requires funds to determine

quarterly basis, and even more frequently for higher-risk

the adequacy of their policies and procedures, and the

areas of a fund’s operations. And although not required,

effectiveness of their implementation, as well as those of

many chief compliance officers are now providing copies of

their service providers, on at least an annual basis. Although

risk assessment reports to the boards of their funds as part

only an annual review is required, the SEC has stated that

of their annual 38a-1 report.

IMR 14

box” and assess new areas that could significantly impact

�Compliance programs should be in a state of constant

improvement, continuing to identify and address new

and emerging risks, as well as changes in the dynamics

Maintaining Requisite

Compliance Resources

associated with existing risk areas. Due to the market

It has been over five years since the adoption of Rule 38a-1

events of the past year, a thorough and careful review

and mutual fund compliance programs continue to evolve as

by compliance departments of such risks is necessary to

compliance departments constantly seek the best methods

assure that compliance programs are “square on” today’s

to improve their programs. The recent economic crisis has

compliance risks. In fact, even the SEC’s own risked-based

made this process more challenging because of the new and

examination program will focus on areas that are

emerging risks that have been identified. In addition to the

particularly critical in today’s market environment. Several

seven SEC-identified areas of risk listed at left, others have

of the areas that SEC examiners will be focusing on affect

been brought to light. Many mutual funds have also identified

mutual funds and their service providers, and include,

emerging risks in the areas of business recovery, safety of

among other things:

customer assets, securities lending, use of pricing agents

1. Valuation;

and proxy voting, to name a few. Consequently, maintaining

an effective compliance program in today’s market and

2. Money market funds;

regulatory environment requires significant resources. As

3. Controls over nonpublic information, personal trading

compliance departments perform risk assessments of their

and codes of ethics;

4. Best execution;

compliance programs, whether or not to cut back on such

resources during these difficult economic times should be

given careful thought and consideration. If the SEC staff

5. Anti-money laundering;

finds a violation of securities laws caused by the absence of

6. Safety of customer information; and

compliance, then a fund and its adviser could face significant

7. Disclosure.

The compliance and regulatory experts at Citi Fund

Services have examined each of these focal points

identified by the SEC and have suggested ways that mutual

fund firms and their compliance professionals can help

ensure appropriate oversight and adherence. The full,

troubles—as well as even greater costs trying to repair the

damage done. While a reduction in compliance resources

may be unavoidable for some funds, these funds should

focus first on retaining the most trained and experienced

compliance personnel to help avoid any compliance

problems. As the SEC staff has stated, now is not the time to

ignore compliance.

two-part article that appeared in The Investment Lawyer’s

October and November issues, “Reevaluating Mutual

Fund Compliance in Today’s Market Environment,” can be

downloaded from Citi’s website at (insert URL).

IMR 15

�IMR 16

�PREPARING FOR

Proposed

Hedge Fund

Legislation

By Jennifer English

Senior Vice President, Regulatory

and Compliance Services, Citi

By Fred Schmidt

Senior Vice President, Regulatory

and Compliance Services, Citi

IMR 17

�Proposed Federal legislation and regulation will have a significant impact on the hedge fund

industry. It is clear that due to recent scandals and increasing enforcement action, the industry

will be subject to much greater focus and scrutiny regardless of what actual proposals become

law. Throughout the industry, there have been calls from investors and regulators to enhance

internal controls, compliance and risk management. The focus on improved corporate governance

will lead to the development of more robust compliance programs, which should evidence greater

transparency. For those hedge fund managers or investment advisers that are already registered

with the Securities and Exchange Commission (SEC), there will be a need to enhance existing

compliance programs. For those who are currently unregistered, there will be greater expectations

to be met regardless of the final decision on any registration requirements. Much of the controls,

reporting and transparencies of registered funds would be realized by requiring the registration of

investment advisers of hedge funds, and satisfying the requirements of the Investment Advisers

Act of 1940 (the “Advisers Act”).

Every investment adviser registered with the SEC must

to serve as chief compliance officer (CCO) to administer and

adopt and implement written compliance policies and

implement the compliance program and (c) evidence of an

procedures and develop a compliance program. Specifically,

annual review to determine the adequacy of the compliance

Rule 206(4)-7 under the Advisers Act requires (a) an

policies and procedures and the effectiveness of their

investment adviser to adopt and implement written

implementation. The objective of a well-designed compliance

compliance policies and procedures reasonably designed to

program is to prevent violations from occurring, detect

prevent violations of the Advisers Act (and rules thereunder)

violations that have occurred and correct promptly any

by the investment adviser or any of its supervised persons,

violations of the Advisers Act that have occurred.

(b) the designation and appointment of a qualified individual

Throughout the industry, there

have been calls from investors

and regulators to enhance internal

controls, compliance and risk

management.

IMR 18

�Major Aspects of Developing and

Maintaining a Compliance Program

The following key areas of compliance oversight have

While Rule 206(4)-7 does not enumerate specific elements

unregistered funds:

been identified by the SEC for registered investment

advisers and may be applicable to investment advisers of

that investment advisers must include in their compliance

policies and procedures, investment advisers have been

• Portfolio Management

instructed to identify conflicts and other compliance

• Trading Practices

factors creating risk exposure for the firm and its clients

in light of the firm’s particular operations and then design

• Accuracy of Disclosures

compliance policies and procedures that address those

• Safeguarding of Client Assets

risks. The SEC listed issues an investment adviser’s

• Creation and Maintenance of Records

compliance policies and procedures, at a minimum,

should address (to the extent that they are relevant to

• Solicitation Arrangements

that investment adviser) in the adopting release for Rule

• Valuation of Client Holdings

206(4)-7. Additional guidance has been provided via

• Privacy Protection

forums, correspondence and public speeches.

• Business Continuity

When developing a compliance program, the following

• Pricing of Portfolio Securities

steps may be appropriate:

• Identification of Affiliated Persons

• Develop a checklist of applicable Federal Securities Laws

• Protection of Nonpublic Information

• Document controls of the investment adviser and its

• Fund Governance Standards

service providers that support compliance with those

rules and regulations

• Map the controls to the rules and regulations and

determine existing control weaknesses and gaps

• Test and report on the effectiveness of the controls, and

update the risk assessment, based on the likelihood and

impact of a failure or occurrence, and compliance history

• Perform ongoing reviews to monitor changes to the

• Anti-Money Laundering Policy Development and

Oversight

• Personal Trading and Code of Ethics Review and

Reporting

• Use of Leverage

• Counterparty Credit Risk

• Performance Calculations

control environment through internal best practices and

• Regulatory Disclosure and Filings

regular participation in industry committees

• Brokerage Allocation

• Develop methods for monitoring new industry

developments, rule proposals, final rules and regulatory

• Investor Transactions and Recordkeeping

• Soft Dollars

guidance

• Develop standard review procedures and documentation

for procedure changes

IMR 19

�During the past year, the SEC has provided guidance and

accounts to generate soft-dollar credits rather than

discussed the examination process and focus areas. In

seeking best execution and misrepresenting investment

order to thoroughly evaluate a compliance program’s

performance of a fund to enhance its position in the

effectiveness, examiners need to obtain sufficient

competitive marketplace. Investment advisers may

information about the structure of an investment adviser’s

also have risks and conflicts of interest that are unique

organization and operations to (i) understand the risks and

as a result of the firm’s organizational arrangements,

conflicts of interest present at the firm and the policies

affiliations, business partners, diversity of client base,

and procedures implemented to address such risks and

conflicts, (ii) determine the ability of the compliance program

to prevent, detect and correct compliance problems and

(iii) evaluate the reasonableness of the firm’s compliance

monitoring processes and the remedial actions implemented

by the firm once problems have been identified.

products and services offered to clients, geographical

locations and personnel. To implement a compliance

program reasonably designed to prevent violations of

the Advisers Act and rules thereunder, each investment

adviser should identify the risks and conflicts of interest

that are relevant to its business.

Examiners also evaluate the frequency, severity and nature

of the problems identified by an investment adviser’s

compliance program. Investment advisers with effective

Portfolio management covers a broad array of advisory

activities. It includes the allocation of investment

compliance programs will generally have fewer compliance

opportunities among clients, the consistency of portfolios

breaches, problems that are not as egregious, fewer

with clients’ investment objectives, disclosures to client

repetitive compliance problems, issues identified on a timely

and consistency of operations with applicable regulatory

basis and problems that are promptly corrected.

requirements and the firm’s code of ethics. Because of

their importance, these areas are typically reviewed during

Investment advisers are exposed to numerous risks and

all examinations. Risks in the area of portfolio management

conflicts of interest that can result in harm to investors and

are greatly dependent on an investment adviser’s

may cause a firm to deviate from regulatory requirements.

operations, services, affiliations and the specificity of

Many risks and conflicts of interest are common among

guidelines and restrictions clients place on the firm

firms. Examples of such risks and problems include portfolio

regarding their individualized services. Also relevant is how

managers making decisions that are contrary to a client’s

the firm handles its receipt of nonpublic information, and

investment objectives, traders placing orders for clients’

how the firm maintains the confidentiality of information

regarding its clients.

IMR 20

�An investment adviser may choose to engage service

providers to perform a number of important services for

advisory clients, including management or contractual

responsibilities. Service providers often serve as

administrator, pricing agent, proxy voting agent and/

or fund accountant. These service providers may:

provide inancial reporting, tax and regulatory services;

create and maintain required books and records; value

portfolio securities and accounts; prepare regulatory

ilings; calculate client account expenses; vote client

proxies; and monitor arrangements with other service

providers. However, when a service provider is utilized, the

investment adviser still retains its fiduciary responsibilities

for the delegated services. As a result, investment advisers

should review each service provider’s overall compliance

program and should ensure that service providers are

complying with the applicable compliance policies and

procedures of the investment adviser.

In summary, management support at the top fosters

a strong compliance environment and sends a strong

message when regulators examine an investment adviser.

Compliance programs should be approached with a

Portfolio management

covers a broad array of

advisory activities. It includes

the allocation of investment

opportunities among clients,

the consistency of portfolios

with clients’ investment

objectives, disclosures to

client and consistency of

operations with applicable

regulatory requirements and

the firm’s code of ethics.

“what-if” mentality, looking for issues that may not have

previously occurred, but could in the future. Ideally, a

compliance program will be evergreen in nature, and

updated and enhanced as needed.

IMR 21

�Navigating in a

new environment:

HEIGHTENED RISK MANAGEMENT

In the Post-Crisis World

By Lawrence Komo

Asia Pacific Head of Investor Services, GTS,

Citi

IMR 22

�The global financial crisis has been a

wake-up call for the global investment

management industry. Irrespective

of geographic location, the turbulent

market environment has impacted the

entire investment management industry

and has drawn into sharp relief the

cornerstone role played by risk.

Discussions with investment managers indicate the morphing of risk

management strategies to the next level as a consequence of the financial

crisis and events including the Lehman Brothers’ collapse. A renewed focus

on effective and robust risk management structure capable of withstanding

external and internal shocks is sweeping the investment management

industry in Asia Pacific.

For investment managers across the region, a robust risk management

framework provides the base foundation to meet business objectives.

However, a risk management framework that comprehensively covers

the pre- and post-trade environment does come at a cost for investment

managers. As capital deployment remains tight and the objective for

investment managers remains skewed toward generating returns, custodians

have seen their role in providing effective and scalable risk management

solutions evolve significantly since the onset of the financial crisis.

The Risk Management Fallout

Significant capital investment and a high level of technological and

operational support is often necessary to drive market expansion, product

innovation or improved client service. Unfortunately, as a consequence, the

premium placed on risk management by investment managers across the

region proved to be inadequate to cope with the global financial turmoil.

Risk management strategies across credit risk, operational risk and liquidity

risk were woefully inadequate, prompting a sea change in both opinion and

strategy execution.

As a result, for investment managers severely burned by the financial

crisis, risk management is now front-and-center of concerns. In other

words, the market conditions since late 2008 have drawn attention to

capital preservation, which relies heavily on risk management techniques

throughout the trade and settlement cycles.

IMR 23

�According to a recent study by the IBM Institute of

Business Value, which surveyed global investment industry

participants, transparency has emerged as the largest

concern in today’s financial architecture. Approximately

35% of respondents listed transparency as the major focus

required to reconstruct the global financial infrastructure,

while a further 15% earmarked enhanced security as the

primary concern going forward.

The New Risk Management Value

Proposition

Although the future of the global investment management

space remains unclear at this stage, it is widely accepted

that market volatility will remain a fact of life for

investment managers for some time to come. As the most

recent financial crisis has shown the industry, market

volatility can be extreme when it occurs and when risk

The same selection of investment management participants

also painted a bleak picture of current risk management

management is concerned, traditional risk management

techniques tend to fall short.

platforms and devices. According to the IBM Institute of

Business Value, the same respondents rated their ability to

manage systemic risk and manage associated risks with new

products and markets as key priorities, but also recognized

weak proficiency in executing as inhibiting their plans.

For investment managers, selecting an effective partner

who can implement risk management solutions is key to

their ability to function in the most effective and efficient

manner. While mitigation solutions remain important to

any outsourced risk management relationship between an

This data does have defined implications for custodian banks.

In this environment, the traditional boundaries between

investment managers and their service providers—be

investment manager and a custodian, there are clearly new

variables required to enhance transparency and rebuild

lost confidence in processes.

they custodians, fund accountants, middle-office service

providers—have blurred.

Clearly, the cost and effectiveness of providing robust risk

management solutions correlates directly to a custodian’s

Clearly, to achieve effective and efficient risk management,

the ability of the entire investment management industry as

a whole, including internal and external service providers,

to function together as a seamless unit is key. This is in

stark contrast to the previous model, which functioned as

technology platform and ongoing investments to this

platform. To foster transparency and enhance security,

technology must seamlessly serve investment managers

and integrate both the pre- and post-trade space to provide

optimal risk management.

a random summation of what may be perfectly functioning

individual units. As the concept of engaging the best

solutions provider grows in acceptance in Asia Pacific, the

risk management focus clearly plays to the advantage of

proactive and innovative custodians, with the resources and

the experience of packing an effective solution to the client

rather than individual product silos.

In the new risk management paradigm, the true value

of technology is discovered in consideration of the new

premium being placed by custodians that provide these

outsourced services. For example, backed by seamless

technology platforms, innovative back- and middle-office

outsourcing can enable investment managers to make

more informed and actionable decisions.

IMR 24

�From where we stand, the role to be played by integrated

Clearly, investment management firms across Asia Pacific,

solutions in managing risks relies on closer interaction with

in their various business objectives, require innovative

investment managers. This is particularly true when unique

solutions straddling the investment life cycle from

concerns over transparency and security throughout the

presettlement to post-settlement. However, a unique

pre- and post-settlement cycle for each client are fully

understanding and trusted adviser approach is required to

considered. Investment managers clearly require their

cater to each individual investment manager and take into

custodians to have a complete view of their footprint, levels

account their unique characteristics.

of automation, processes, investments and future ambitions

to provide value-added risk management solutions.

By working closely with investment managers and combining

our comprehensive service platforms, we are able to

Citi has proactively addressed this evolution in the market.

help them achieve optimal risk management solutions.

As investment managers look to outsource more risk

Partnering with Citi provides investment managers access

management processes and focus on core competencies in

to market-leading technology, the most adaptable service

light of the new economic paradigm, personalized service

platforms and the comfort of the most personalized services

provides greater peace of mind.

to drive business growth while ensuring effective risk

management.

In other words, through a “client solutioning” approach,

solutions provided by custodians like Citi are evolving

and becoming less commoditized. Custodians like Citi

use a partnership and adviser approach to work with

investment managers to decide what processes they want

simplified and eliminated, what technology platforms can

be integrated and what risk management strategies can be

added to enhance existing processes and support future

expansion plans. This is truly where value is being added in

the new environment, where clients are turning, allowing

them to focus on core competencies.

The risk issues highlighted by the financial crises will not

disappear, but the responses to and strategies to manage

the same are continually evolving. The fallout of the crisis

has prompted many investment managers to reevaluate

their approach to risk management with a greater focus

on transparency and security. Increasingly, to achieve

these goals without sacrificing the primary objective of

generating investment returns, investment managers see

custodian-provided partner-based and integrated solutions

as the answer to address risk management concerns.

IMR 25

�BE ADVISED:

STRICTER REGULATIONS AHEAD

Financial reform continued to be the hot topic of

the quarter. While most unregistered investment

advisers have begrudgingly accepted that they will

be required to register with a regulatory agency,

most likely the SEC in some form or fashion, they

are still lobbying for relief from some of the more

onerous proposals being suggested.

IMR 26

�By Bruce Treff

Managing Director of Regulatory

and Compliance Services, Citi

By Chuck Booth

Director of Regulatory

and Compliance Services, Citi

Regulatory and Legislative Update—

Third Quarter 2009

Most of us watching the debate and following it on a regular basis

believe it will be a two- to three-year process for the legislative

and regulatory changes to become fully finalized and implemented.

However, 2010 promises to be a lively year for the unregistered

world and will almost certainly set the tone for many years to come.

All of this attention to hedge funds and unregistered advisers

would seem to likely result in a slowdown in regulatory activity on

the registered side of the house. Not true. The SEC, FinCEN, state

securities offices, the IRS and other regulators have seemed to

excel in their ability to sustain multiple agendas in their rule-making

and rule-proposal efforts this past quarter.

IMR 27

�Finalization of rule proposals and permanent rules to replace

The amendments also removed references to NRSROs

prior temporary and interim rules seemed to be at the

in Rules 5b-3 and 10f-3 under the ICA. The reference in

forefront of most regulatory activity in the third quarter.

Rule 5b-3 changed the conditions that allow a mutual

Of most significance, the SEC replaced temporary portfolio-

fund to look through to the collateral of a repurchase

holding reporting requirements under the U.S. Treasury’s

agreement, replacing it with a requirement for a fund’s

money market fund Guarantee Program by adopting Rule

Board (or its delegate) to determine if the collateral is

30(b)1-6T under the Investment Company Act of 1940 (the

liquid and presented minimal credit risk. The amendment

“ICA”) on September 18. The rule was effective immediately

to the definition of “Eligible Municipal Securities” in Rule

and requires that money market funds with market-based

10f-3 replaced the reference to NRSROs with a reference

net asset values below $0.9975 report portfolio-holdings

to securities that are: (i) sufficiently liquid to be sold at

information to the SEC on a weekly basis. The rule is set to

or near their carrying value within a reasonably short

expire on September 17, 2010, but, given the industry support

period of time; and (ii) subject to moderate credit risks

for the new rule, it is likely that the reporting requirement

(minimal credit risks for payers with less than three years

will be included when the amendments to Rule 2a-7

of operations.