Fill and Sign the Michigan Hunting Lease Form

Useful Suggestions for Finalizing Your ‘Michigan Hunting Lease Form’ Online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the leading electronic signature platform for individuals and organizations. Say farewell to the lengthy procedure of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign paperwork online. Take advantage of the powerful features embedded in this user-friendly and affordable platform and transform your document management strategies. Whether you need to approve forms or collect electronic signatures, airSlate SignNow manages it all effortlessly, with just a few clicks.

Follow these comprehensive steps:

- Access your account or sign up for a complimentary trial with our service.

- Click +Create to upload a document from your device, cloud, or our form repository.

- Edit your ‘Michigan Hunting Lease Form’ in the workspace.

- Select Me (Fill Out Now) to get the form ready on your end.

- Add and designate fillable fields for others (if required).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

Don't worry if you need to collaborate with your colleagues on your Michigan Hunting Lease Form or submit it for notarization—our solution provides everything you require to complete such tasks. Create an account with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

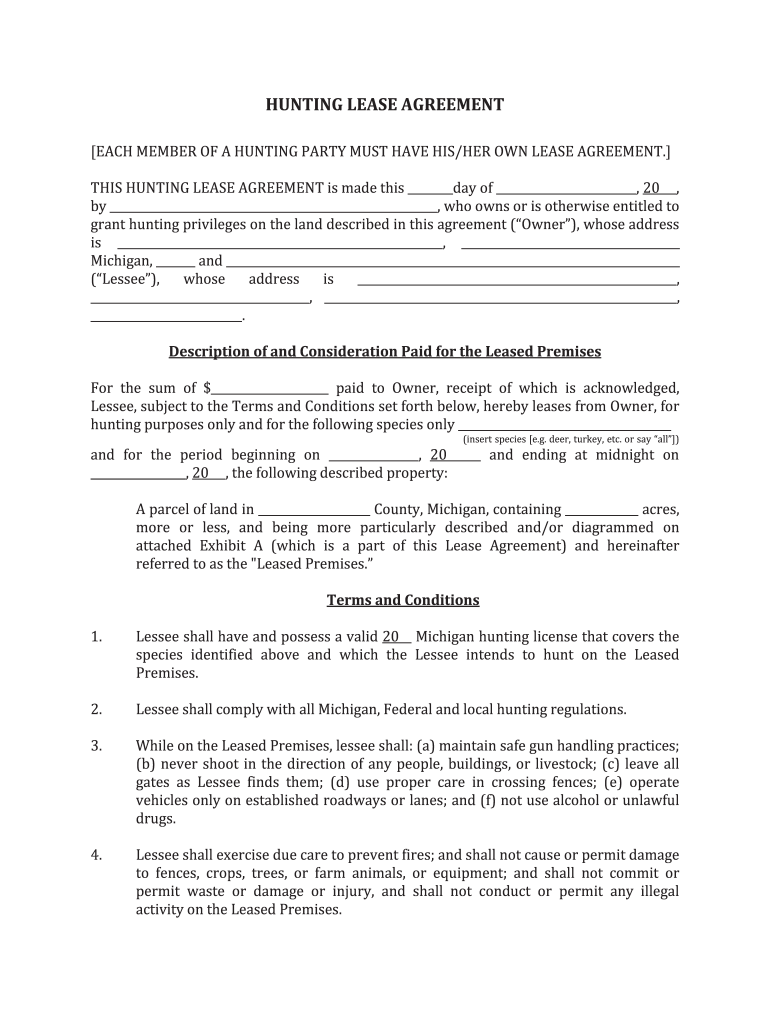

What is a Basic Hunting Lease Agreement?

A Basic Hunting Lease Agreement is a legal document that outlines the terms and conditions under which a landowner allows hunters to access and use their property for hunting purposes. This agreement typically includes details about the lease duration, payment terms, and rules governing hunting activities to ensure a smooth and respectful relationship between the landowner and hunters.

-

How can I create a Basic Hunting Lease Agreement using airSlate SignNow?

Creating a Basic Hunting Lease Agreement with airSlate SignNow is simple and efficient. You can start by selecting a customizable template, adding specific terms relevant to your situation, and then easily sending it for eSignature. Our platform allows you to manage the entire process online, ensuring that your agreement is legally binding and securely stored.

-

What are the benefits of using airSlate SignNow for a Basic Hunting Lease Agreement?

Using airSlate SignNow for your Basic Hunting Lease Agreement offers numerous advantages including ease of use, quick turnaround time for signatures, and the ability to track document status in real-time. Moreover, our solution is cost-effective, allowing you to save time and resources while ensuring your agreement is professionally managed.

-

Is airSlate SignNow secure for sending a Basic Hunting Lease Agreement?

Yes, airSlate SignNow implements top-tier security measures to protect your Basic Hunting Lease Agreement. Our platform utilizes encryption and secure cloud storage, ensuring that your sensitive information remains safe and confidential throughout the signing process.

-

Can I integrate airSlate SignNow with other tools for my Basic Hunting Lease Agreement?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and Microsoft Office. This allows you to easily store and manage your Basic Hunting Lease Agreement alongside other documents, streamlining your workflow and enhancing productivity.

-

What is the pricing model for airSlate SignNow when creating a Basic Hunting Lease Agreement?

airSlate SignNow offers a flexible pricing model that caters to various needs. You can choose from different subscription plans, each providing essential features for creating and managing your Basic Hunting Lease Agreement, all while remaining budget-friendly for individuals and businesses alike.

-

Can I customize the Basic Hunting Lease Agreement template?

Yes, airSlate SignNow allows complete customization of the Basic Hunting Lease Agreement template. You can modify terms, add clauses, and tailor the document to fit the specific needs of your hunting lease, ensuring that all essential details are accurately captured.

Find out other michigan hunting lease form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles