- 1 -

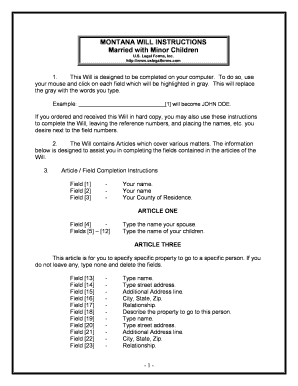

MONTANA WILL INSTRUCTIONS Married with Minor Children U.S. Legal Forms, Inc.

http://www.uslegalforms.com

1. This Will is designed to be completed on your computer. To do so, use

your mouse and click on each field which will be highlighted in gray. This will replace

the gray with the words you type.

Example: _____________________________[1] will become JOHN DOE.

If you ordered and received this Will in hard copy, you may also use these instru ctions

to complete the Will, leaving the reference numbers, and placing the names, etc. you

desire next to the field numbers. 2. The Will contains Articles which cover various matters. The information

below is designed to assist you in completing the fields contained in the articles of th e

Will. 3. Article / Field Completion Instructions

Field [1] - Your name.

Field [2] - Your name Field [3] - Your County of Residence.

ARTICLE ONE

Field [4] - Type the name your spouse.

Fields [5] – [12] Type the name of your children.

ARTICLE THREE

This article is for you to specify specific property to go to a specific person. If you

do not leave any, type none and delete the fields.

Field [13] - Type name.

Field [14] - Type street address.

Field [15] - Additional Address line.

Field [16] - City, State, Zip. Field [17] - Relationship.

Field [18] - Describe the property to go to this person.

Field [19] - Type name.

Field [20] - Type street address.

Field [21] - Additional Address line.

Field [22] - City, State, Zip. Field [23] - Relationship.

- 2 -

Field [24] - Describe the property

Field [25] - Type name.

Field [26] - Type street address.

Field [27] - Additional Address line.

Field [28] - City, State, Zip.

Field [29] - Relationship.

Field [30] - Describe the property ARTICLE FOUR

This article is for you to leave your homestead, if you have one on the date o f

death to persons designated.

Field [31] - Type name of your spouse. ARTICLE FIVE

This article is for you to leave all the rest and remainder of your property excep t

your homestead and any special items you listed in Article Three.

Field [32] - Type the name of your spouse. ARTICLE SIX

This article is to provide an alternate distribution of the rest and remainder of your

property should your spouse predecease you and the provisions for distribution

contained in Article Five cannot be carried out.

Field [33] Type the name of your child(ren).

Fields [34]-[36] Omitted

ARTICLE SEVEN

This article provides for the establishment of a trust for the benefit of minor

beneficiaries. Fields [37] Enter the age below which you desire that minor beneficiaries property be placed in trust.

Fields [38-41] Enter age at which property may be released from trust.

ARTICLE NINE

This article provides for the appointment of a Trustee and Successor Trustee.

Field [42] Type the name of the Trustee.

- 3 -

Field [43] Type the name of the Successor Trustee.

ARTICLE TEN

This article provides for the appointment of a guardian of minor children

Field [44] Type the name of your spouse. Field [45] Enter the age below which you desire a guardian be appointed for your children.

Field [46] Type the name of the guardian.

ARTICLE ELEVEN

This article is for you to name your personal representative. This must be an

adult and can be your spouse.

Field [47] - Type name of Personal Representative.

Field [48] - Type name of successor Personal Representative. ARTICLE FOURTEEN

This article provides instructions relating to the interpretation of your will. Field [49] - Type the name of your spouse. This clause is a common disaster clause and provides whose Will will

control if you both die in a common disaster.

ARTICLE FIFTEEN

All parts of Article 11 are optional. Complete as desired. Be sure to write your

initials for any of these items you desire to apply.

Field [50] - Type name of Cemetery.

Field [51] - Type County.

Field [52] - Type State.

ENDING AND SIGNATURE

Field [53] - Your name.

Field [54] - Your name.

Field [55] - Your name.

Field [56] - Your name.

Field [57] - Your name.

Field [58] - Your name. Field [59] - Your name.

- 4 -

All other blanks in the Will are typically completed by hand, such as the name s of

the witnesses, day, month and year executed, etc.

Once you have completed the Will, double check all entries and the n print. The

Will should be signed by you in front of two witnesses, not related to you . Please sign

all pages of the Will in the places designated. The self-proving affidavit is used to prove the Will and make the Wi ll subject to

probate. If the affidavit is not completed now, someone will have to loca te the

witnesses after your death and obtain an affidavit. Therefore, it is best to sign the Will in

the presence of two witnesses AND a notary public so that the affidavit can be

completed by the Notary.

You should keep your Will in a safe place once executed. It is also

recommended that you give a copy to your executor or other person as additional proof

of execution.

- 5 -

ADDITIONAL INFORMATION ABOUT YOUR WILL FORM

This section will briefly explain some of the articles of your will and prov ide other

information. Articles of the Will which are basically self explanatory are not discussed

here. In addition, information which is already provided in the instructions above is not

repeated.

First Paragraph: The first paragraph of the Will, provides your name,

residence information and provides that all prior Wills, if any, are revoked since y ou

have now made a new Will.

Article Three: Some people have specific property that they desire to leave

to a specific person, such as a ring or antique. This Article is for you to leav e such

property. You do not have to name specific property and may simply state none if no

property is to be left under this Article.

Article Eleven: This Article is for you to name a personal representative,

also called executor or executrix. The person named should be an ad ult and may be

your spouse or relative.

Article Twelve: If not waived, some Courts will require your Personal

Representative post a bond, and file an inventory, accounting and/or app raisal. All can

be costly and time consuming. This Article states your intention that your Personal

Representative not be required to post a bond or file an inventory or accounting.

Article Thirteen: This Article sets forth powers of your Personal

Representative and is designed to give broad powers without the requirement that Co urt

approval be sought for action by the Representative to the extent perm itted by the laws

of your State.

Article Fourteen: Th is article sets forth some legal construction intentions to

clarify some of the issues which may arise. It also contains a common disast er clause

which provides that if you and your spouse die in a common disaster, you r Will is to

have precedence. In cases where you and your wife are making Wi lls, you would only

include this paragraph in one Will, or state in both which Will is to control.

- 6 -

BASIC INFORMATION

What is a Will? A Will is a document which

provides who is to receive your property at death,

who will administer your estate, the appointment of

trustees and guardians, if applicable, and other

provisions.

Who may make a Will? Generally, any person 18

years or older of sound mind may make a Will.

(Some states allow persons under 18 to make a

Wil l)

What happens if I die without a Will? If you die

without a will you are an intestate. In such a case,

state laws govern who receives your property.

These laws are called "intestate succession laws".

If you die without a W ill, the Court decides who will

administer your estate. Generally, it is more

expensive to administer an estate of a person who

died without a Will, than a person who dies with a

Will.

General

When making a Will you need to consider who will

be named as your personal representative or

executor to administer your estate, who you will

name as guardian and trustee of minor children if

your spouse does not survive you and who will

receive your property. You should also consider tax

issues. The person appointed as executor or

administrator is often your spouse, but you should

also name an alternate, in case your spouse

predeceases you. The person you name should be

a person you can trust and who will get along with

the beneficiaries named in the Will.

In the event your spouse predeceases you, the

guardian you name will have actual custody of your

minor children unless a court appoints someone

else. The trustee you appoint to administer a trust

you established will be in charge of the assets of

the trust for the benefit of the minor beneficiaries.

Generally, a Will must be signed in the presence of

at least two witnesses (three for Vermont) who also

sign the W ill. A notary public will also need to sign

if the W ill contains a self-proving affidavit.

Generally, a self-proving affidavit allows the W ill to

be admitted to probate without other evidence of

execution.

Joint Property: Many people do not understand

that joint property may pass outside your Will and

also sometimes assume that it will pass through

their Will. They do not understand the significance

of joint ownership. The issue is common in the

following areas, provided as examples: (a) Real Estate:

Often, a husband and wife

will own real estate as joint tenants with rights of

survivorship. If one party dies, the surviving party

receives the property regardless of what the W ill

provides. This is common and generally

acceptable. However, if this is not your desire you

should change the ownership of the property to

tenants in common or other form of ownership. If

you own real estate as tenants in common, then

you may designate who will receive your share of

the property at your death. This issue can be a

problem when uninformed persons take title to real

estate as joint tenants with rights of survivorship but

really intended to leave their share to, for example,

children of a prior marriage. (b) Bank Accounts/Certificates of Deposit,

Stock, Retirement Plans, IRA’s and other type

Property: The same ownership as real

estate can be made of these investments. In fact,

many Banks routinely place Bank accounts and

Certificates of Deposit in the joint tenant with right

of survivorship form of ownership if more than one

person is on the account or CD, without advising

you of the consequence of same. In situations

where the persons are husband and wife and there

is no issue or concern over divorce or children

from previous marriages, this may be the best

course of action. However, with divorce on the

rise, premarital agreements and multiple marriages

being common, the parties may be doing

something that was not their intent. Another

common problematic situation is where a parent

has more than one child but only one child resides

in the hometown of the parent. The parent may

place the name of the child who resides there on

all account s, CD’s and other investments for

convenience reasons and establish a joint tenant

with right of survivorship situation without realizing

that only that child will be entitled to those assets

at the parent’s death. Simply put, you should be

aware when you acquire an asset or investment

exactly how it is titled.

- 7 -

For additional information, see the Law Summary and Information and Preview links in

the search results for this form. A Definitions section is also linked on the Information

and Preview page.

DISCLAIMER/LICENSE/LIABILITY LIMITATION

All forms in this package are provided without any warranty, express or imp lied, as

to their legal effect and completeness. Please use at your own risk. If you have a

serious legal problem we suggest that you consult an attorney. U.S. Legal Forms,

Inc. does not provide legal advice. The products offered by U.S. Legal Forms

(USLF) are not a substitute for the advice of an attorney.

Your Will starts on the next page.

Signed by Testator/Testatrix: __________________________________ - 1 -

LAST WILL AND TESTAMENT OF

___________________________________[1]

BE IT KNOWN THIS DAY THAT,

I, _____________________________[2] , of __________________[3] County, Montana,

being of legal age and of sound and disposing mind and memory, and not acting under duress,

menace, fraud, or undue influence of any person, do make, declare and publish this t o be my

Will and hereby revoke any Will or Codicil I may have made.

ARTICLE ONE

Marriage and Children

I am married to _____________________________[4] and have the following children

from said marriage: Name: _____________________________[5] Date of Birth: __________________[6]

Name: _____________________________[7] Date of Birth: ______________ ____[8]

Name: _____________________________[9] Date of Birth: _________________[10]

Name: ____________________________[11] Date of Birth: _________________[12]

ARTICLE TWO

Debts and Expenses

I direct my Personal Representative to pay all costs and expenses of my last i llness and

funeral expenses. I further direct my Personal Representative to pay all of my just debts that

may be probated, registered and allowed against my estate. However, this provision shall not

extend the statute of limitations for the payment of debts, or enlarge upon my legal obligation or

any statutory duty of my Personal Representative to pay debts.

ARTICLE THREE

Specific Bequests of Real and/or Personal Property

I will, give and bequeath unto the persons named below, if he or she survives me, the

Property described below:

Name Address Relationship

[13] [14]

[15]

[16] [17]

Property: [18]

Name Address Relationship

[19] [20]

[21]

[22] [23]

Property: [24]

Signed by Testator/Testatrix: __________________________________ - 2 -

Name Address Relationship

[25] [26

[27]

[28] [29]

Property: [30]

[LIST OR STATE NO PROPERTY LEFT UNDER THIS ARTICLE]

In the event I name a person in this Article and said person predeceases me, the

bequest to such person shall lapse and the property shall pass under the other provisions of this

Will. In the event that I do not possess or own any property listed abov e on the date of my

death, the bequest of that property shall lapse.

ARTICLE FOUR

Homestead or Primary Residence

I will, devise and bequeath all my interest in my homestead or primary residence, if I own

a homestead or primary residence on the date of my death that passes through this W ill, to my

spouse, _____________________________[31] , if he or she survives me. If he or she does

not survive me, then my homestead or primary residence shall pass under the residuary clause

of this Will.

ARTICLE FIVE

All Remaining Property – Residuary Clause

I will, devise, bequeath and give all the rest and remainder of my property and estate of

every kind and character, including, but not limited to, real and personal property in which I may

have an interest at the date of my death and which is not otherwise effect ively disposed of, to

my spouse, _____________________________[32] .

ARTICLE SIX

Contingent - All Remaining Property – Residuary Clause

In the event that my spouse shall predecease me, I will, devise, bequeath and give all the

rest and remainder of my property and estate of every kind and character, including, but not

limited to, real and personal property in which I may have an interest at t he date of my death

and which is not otherwise effectively disposed of (“Residuary Estate”), to my child(ren)

_______________________________________________________[33] . If I have more than

one child and any one of my children shall predecease me, then the equal share set apart for

that deceased child shall instead be distributed to his or her descendants, per sti rpes. If one of

my children shall predecease me leaving no descendants surviving, then the eq ual share set

apart for that deceased child shall instead be distributed to my other child, or if that child has

also predeceased me, then to his or her descendants, per stirpes.

ARTICLE SEVEN

Property To Vest In Trustee for Child Beneficiary

In the event that my spouse predeceases me as provided in Article Six, and any of my

children are under the age of __________________[37] years of age, then I direct that my

Signed by Testator/Testatrix: __________________________________ - 3 -

Personal Representative shall transfer, assign and deliver over to my Trustee, named bel

ow,

such beneficiary’s share of my estate and the objects of property described herein. I direct m y

Trustee to hold said Beneficiaries share of my estate on the following terms and condit ions:

A.

The Trustee shall hold and administer the assets of the Trust for the use an d benefit of

the Beneficiaries for the purpose of providing for their health, education a nd general welfare in

accordance with their accustomed standard of living as much as is possible, considering t he

value of the Trust property and their other sources of income.

B.

The Trustee, may in his or her discretion, distribute to or for the benefit of the named

Beneficiaries, such portions of the income and principal of the Trust as he or she in his or her

sole discretion shall determine to be necessary to accomplish the purposes of this Tr ust. The

Trustee may make such distributions as often or as seldom as he or she may deter mine in his

or her sole discretion without the necessity of any court authority or appr oval, this being a

private trust.

C.

As each Beneficiary herein reaches the age of __________________[38] years, the

Trustee shall distribute to said beneficiary his or her share of the trust principal and income as of

the distribution date. When the youngest Beneficiary reaches the age of

__________________[39] years, the Trustee shall distribute all of the remaining Trust property

including principal and accumulated income to the Beneficiary and this Trust shall te rminate. In

making said distributions, the Trustee may make distributions in kind a nd shall have the sole

discretion as to valuation of the Trust property in determining and apportion ing distributions

among the Beneficiaries.

D.

In the event of the death of any of the above named Beneficiary prior to the final date of

distribution, and said deceased Beneficiary shall leave living issue, the Trustee shall hold only

that portion of the Trust property attributable to said deceased Beneficiary be yond the

distribution dates as provided in Subparagraph C above, and administer said Trust p roperty for

the use and benefit of said living issue. When said youngest living issue r eaches the age of

__________________[40] years, the Trust as to said living issue shall terminate and the

Trustee shall distribute all of the remaining Trust property in equal shares to said living issue. In

the event of the death of any of the above named Beneficiaries prior to the final date of

distribution and said deceased Beneficiaries leave no living issue, then that porti on of the Trust

property to be distributed to the deceased Beneficiaries as provided for in Subpa ragraph C

above, shall instead be distributed to the surviving Beneficiaries in equal shares.

E.

Personal and real property may be maintained for my Beneficiaries or conv erted to cash

as my Trustee shall determine. I direct that my Trustee administer hereu nder any funds coming

into the hands of my Beneficiaries pursuant to any life insurance policy i nsuring my life.

Signed by Testator/Testatrix: __________________________________ - 4 -

F.

In the event that on the date of my death, my spouse shall have predeceased me an d my

youngest Beneficiary is over __________________[41] years of age, then this Trust shall be

inoperative and my entire estate shall be distributed to said Beneficiaries as provided in Article

Six.

ARTICLE EIGHT

Creditors of Beneficiaries

Neither the principal nor the income of any Trust provision contained in this W ill nor any

part of same shall be liable for the debts of any Beneficiary hereu nder, nor shall the same be

subject to seizure by any Creditor of any Beneficiary, and no Beneficiary the rein shall have any

power to sell, assign, transfer, encumber, or in any manner to anticipate or di spose of his or her

interest in the Trust fund, nor any part of same nor the income produced from said f und nor any

part of same.

ARTICLE NINE

Appointment of Trustee

I appoint _____________________________[42] , or if the appointee fails to qualify or

ceases to act, I appoint _____________________________[43] , as Trustee of the Trust

provisions of this Will to serve in said capacity with all the powers during the ad ministration of

the Trust as are granted to Trustees under Montana law including the power to sel l any of the

real or personal property of the Trust for cash or on credit or to mortg age it or to lease it, all to

be exercised without Court order. The Trustee named herein shall also have all powers as are

granted to my Personal Representative under the provisions of this Will dur ing the

administration of this private Trust.

ARTICLE TEN

Appointment of Guardian

In the event that my spouse, _____________________________[44] , dies without having

made just provision for the care and custody of our children who may be un der the age of

__________________[45] years, or in the event my spouse predeceases me, then on the date

of my death, I appoint _____________________________[46], as Guardian of said children.

ARTICLE ELEVEN

Appointment of Personal Representative, Executor or Executrix

I hereby appoint _____________________________[47], as Personal Representative of

my estate and this Will. In the event my Personal Representative shall predece ase me, or, for

any reason, shall fail to qualify or cease to act as my Personal Representativ e, then I hereby

appoint _____________________________[48] to serve as successor Personal Representative

of my estate and Will. The term “Personal Representative”, as u sed in this Will, shall be deemed to mean and

include “Personal Representative”, “Executor” or “Executrix”.

Signed by Testator/Testatrix: __________________________________ - 5 -

ARTICLE TWELVE

Waiver of Bond, Inventory, Accounting, Reporting and Approval

My Personal Representative and successor Personal Representative shall serve without

any bond, and I hereby waive the necessity of preparing or filing any inventory, acco unting,

appraisal, reporting, approvals or final appraisement of my estate.

ARTICLE THIRTEEN

Powers of Personal Representative, Executor and Executrix

I direct that my Personal Representative shall have broad discretion in the administra tion

of my Estate, without the necessity of Court approval. I grant unto my Personal Representative,

all powers that are allowed to be exercised by Personal Representatives by the laws of the

State of Montana and to the extent not prohibited by the laws of Montana, the following

additional powers: 1. To exercise all of the powers, rights and discretions granted by virtue o f any

"Uniform Trustees' Powers Law," and/or “Probate Code” adopted by the State of Montana.

2. To compromise claims and to abandon property which, in my Executor’s opinion is

of little or no value. 3. To purchase or otherwise acquire and to retain any and all stocks, bon ds, notes or

other securities, or shares or interests in investment trusts and common trust funds, or in any

other property, real, personal or mixed, as my Personal Representative may deem advi sable,

whether or not such investments or property be of the character permissible by fiduciaries,

without being liable to any person for such retention or investment.

4. To settle, adjust, dissolve, windup or continue any partnership or other en tity in

which I may own a partnership or equity interest at the time of my de ath, subject, however, to

the terms of any partnership or other agreement to which I am a party at the time of my death. I

authorize my Personal Representative to continue in any partnership or other ent ity for such

periods and upon such terms as they shall determine. My Personal Representative sha ll not be

disqualified by reason of being a partner, equity owner or title holder in such firm from

participating on behalf of my estate in any dealings herein authoriz ed to be carried on between

my Personal Representative and the partners or equity owners of any such part nership or other

entity.

5. To lease, sell, or offer on a lease purchase, any real or personal proper ty for such

time and upon such terms and conditions in such manner as may be deemed advisable, all

without court approval.

6. To sell, exchange, assign, transfer and convey any security or property , real or

personal, held in my estate, or in any trust, at public or private sale, at such time an d price and

upon such terms and conditions (including credit) as my Personal Representative m ay deem

advisable and for the best interest of my estate, or any trust. I hereby waiv e any requirement of

issuing summons, giving notice of any hearing, conducting or holding a ny such hearing, filing

bond or other security, or in any way obtaining court authority or approval for any such sale,

exchange, assignment, transfer or conveyance of any real or personal property.

Signed by Testator/Testatrix: __________________________________ - 6 -

7.

To pay all necessary expenses of administering the estate and any trust includ ing

taxes, trustees' fees, fees for the services of accountants, agents and attorneys, an d to

reimburse said parties for expenses incurred on behalf of the estate or any t rust hereunder.

8. Unless otherwise specifically provided, to make distributions (including the

satisfaction of any pecuniary bequest) in cash or in specific property, real or personal, or in an

undivided interest therein, or partly in cash and partly in other property, and t o do so with or

without regard to the income tax basis of specific property allocated to any beneficiary and

without making pro rata distributions of specific assets. 9. To determine what is principal and what is income with respect to all receipts and

disbursements; to establish and maintain reserves for depreciation, depletion, obsolescence,

taxes, insurance premiums, and any other purpose deemed necessary and proper by them and

to partite and to distribute property of the estate or trust in kind or in un divided interests, and to

determine the value of such property. 10. To participate in any plan of reorganization, consolidation, dissolution, redemption ,

or similar proceedings involving assets comprising my estate or any trust created hereunder,

and to deposit or withdraw securities under any such proceedings. 11. To perform such acts, to participate in such proceedings and to exercise s uch other

rights and privileges in respect to any property, as if she or he were the absolute ow ner thereof,

and in connection therewith to enter into and execute any and all agreements bi nding my estate

and any trust created hereunder. 12. To compromise, settle or adjust any claim or demand by or against my estate, or

any trust, to litigate any such claims, including, without limitation, any claims relating to estate or

income taxes, or agree to rescind or modify any contract or agreement.

13. To borrow money from such source or sources and upon such terms and

conditions as my Personal Representative shall determine, and to give such security t herefore

as my Personal Representative may determine.

All authorities and powers hereinabove granted unto my Personal Representative shall

be exercised from time to time in her or his sole and absolute discretion and wi thout prior

authority or approval of any Court, and I intend that such powers be construed in the broadest

possible extent.

ARTICLE FOURTEEN

Construction Intentions

It is my intent that this Will be interpreted according to the following provisi ons:

1. The masculine gender shall be deemed to include the feminine as well as the

neuter, and vice versa, as to each of them; the singular shall be deemed to include t he plural,

and vice versa. 2. The term “testator” as used herein is deemed to include me as Testator or

Testatrix.

Signed by Testator/Testatrix: __________________________________ - 7 -

3.

This Will is not a result of a contract between myself and any be neficiary,

fiduciary or third party and I may revoke this Will at any time. 4. If any part of this Will shall be declared invalid, illegal, or inoper ative for any

reason, it is my expressed intent that the remaining parts shall be effective an d fully operative

and it is my intent that any Court so interpreting same construct this Will and any provision in

favor of survival. 5. In the event that my spouse, _____________________________[49], and I die

under circumstances where it is difficult to determine who died first, I direct that I be deemed to

have survived her/him and the terms of my Will shall take precedence ov er any Will or Codicil

that he/she may have made, notwithstanding any provisions of the law to the contrary.

ARTICLE FIFTEEN

Misc. Provisions

I direct that this Will and the construction thereof shall be governed by the Laws of the

State of Montana.

(I have placed my initials next to the provisions below that I desire to adop t. Unmarked

provisions are not adopted by me and are not a part of this Will)

_______ If any person named herein is indebted to me at the time of my death and such

indebtedness be evidenced by a valid Promissory Note payable to me, then such

person’s portion of my estate shall be diminished by the amount of such debt.

_______ Any and all debts of my estate shall first be paid from my residuary estate. Any

debts on any real property left herein shall be assumed by the person to receiv e

such real property and not paid by my Personal Representative.

_______ I desire to be buried in the _____________________________[50] cemetery in

__________________[51] County, __________________[52] .

_______ I direct that my remains be cremated and that the ashes be disposed of

according to the wishes of my Executor.

I, ___________________________________[53], having signed this Will in the

presence of _____________________________ and ________________________________

who attested it at my request on this the _____ day of _____________, 20____ _ at

____________________________________________________________(address), declare

this to be my Last Will and Testament.

________________________________

_____________________________[54]

Testator/Testatrix

Signed by Testator/Testatrix: __________________________________ - 8 -

The above and foregoing Will of _____________________________[55] was declared

by _____________________________[56] in our view and presence to be his/her Will and was

signed and subscribed by the said _____________________________[57] in our view and

presence and at his/her request and in the view and presence of

_____________________________[58] and in the view and presence of each other, we, the

undersigned, witnessed and attested the due execution of the Will of

_____________________________[59] on this the _____day of __________________, 20___.

Witness Signature Witness Signature

Print Name: Print Name:

Address: Address:

City, State, Zip: City, State, Zip:

P hone: Phone:

Montana Self Proving Affidavit: Montana Code § 72-2- 524

Montana Self Proving Affidavit

I, __________________________________ , the Testator/Testatrix, sign my name to

this instrument this ________ day of ____________, 20 ________ and being first duly sworn, do

hereby declare to the undersigned authority that I sign and execute this instr ument as my Will

and that I sign it willingly, that I execute it as my free and volun tary act for the purposes therein

expressed, and that I am 18 years of age or older, of sound mind, and under no const raint or

undue influence. ____________________________________

Testator/Testatrix

Typed Name: __________________________________ \

We, __________________________________ , and

__________________________________ , the witnesses, sign our names to this instrument,

being first duly sworn, and do hereby declare to the undersigned authority that the

Testator/Testatrix signs and executes this instrument as her or his Last Wil l and that she or he

signs it willingly, that each of us, in the presence and hearing of the Test ator/Testatrix, hereby

signs the W ill as witness to the Testator’s/Testatrix’s signing, and that to the best of our

knowledge the Testator/Testatrix is 18 years of age or older, of sou nd mind, and under no

constraint or undue influence. ____________________________________

Witness ____________________________________

Witness

State of Montana

County of _______________

SUBSCRIBED, SWORN TO AND ACKNOWLEDGED before me by

__________________________________ , the Testator/Testatrix, and subscribed and sworn to

before me by the above-named witnesses, this ________ day of ____________ , ________ .

(SEAL) (Signed)___________________________________

__________________________________ \

(Official capacity of officer)