PARTNERS’ RESPONSE TO THE BOSTON GLOBE’S

DECEMBER 21ST SPOTLIGHT STORY

This response was delivered to the editor of The Globe and members of the Spotlight Team.

We have a number of fairness and accuracy concerns related to the December 21st

Spotlight story. This list is limited to major concerns.

1.

Charlie Baker’s quote is misleading

Charlie Baker is quoted as saying, “I think it’s reasonable to assume Partners

will expect MGH rates in Danvers.” This leaves the reader with the impression

that negotiations have yet to take place. It also leaves the reader with an

inaccurate perception of the likely outcome of those negotiations. In fact,

negotiations have taken place, reimbursement rates for our ambulatory care

centers were resolved prior to publication, and they are not at MGH rates.

2.

Charlie Baker conflict

The Globe fails to inform the reader that Charlie Baker sits on a Board

at Beth Israel Deaconess Medical Center, a Partners competitor (The

Boston Globe, November 22, 2007-“Harvard Pilgrim chief joins Beth

Israel board”).

3.

Massachusetts and Partners are not unique

The December 21 story fails to inform the reader that Partners effort to

build an integrated health care delivery system is similar to efforts around

the nation and, in fact, here in Massachusetts. Nationally, hospitals such

as the University of Pittsburgh Medical Center -- with 51 hospitals and

outpatient centers -- have built regional networks. The same is true for

local hospitals including Children’s and Beth Israel Deaconess.

4.

MetroWest Medical Center

The Globe fails to provide the reader with important facts about management

at MetroWest Medical Center -- a hospital that figures prominently in the

story. First, the story does not include the fact that MetroWest is a for-profit

hospital, which has been managed by three for-profit entities (Columbia/HCA,

Tenet,Vanguard) and has had six different CEOs since 1995. Second, the

story does not tell the reader that MetroWest patient satisfaction scores are

below the national average. In fact, according to publicly available data, only

63% of MetroWest patients would definitely recommend it. These facts were

discussed with The Globe.

5.

Assertions and omissions

Attached is a list of some of the story’s assertions concerning outpatient

market share and suburban projects, with Partners response to each of the

assertions or omissions. We believe that many assertions in the story

either lacked supporting evidence or did not include important context that

would have provided the reader with a full picture of the issues discussed.

These are listed in the order in which they appear in the story.

Page 1

�PARTNERS’ RESPONSE

GLOBE ASSERTION

1

“Partners, as the Globe reported last month,

receives markedly higher payments from

insurers for patient treatment; it can offer

doctors much higher pay than competing

community institutions; and it comes to

market with a multibillion dollar war chest the proceeds of those higher insurance rates

- to go with its coveted brand name.”

As Partners stated in its response to the

November 16 story:

“This assertion overstates the impact of

insurance contracts. Since 2004, only about

25% of Partners income has come from

operating margins, which are derived in part

from insurance reimbursement rates. The

other 75% comes from investment income,

philanthropy, and other non-operating

income.”

As The Globe reported on May 15, 2008,

after the Partners Community HealthCare,

Inc. (PCHI) contract with Beverly Hospital

was not renewed, Beverly Hospital was able

to negotiate similar rates for its physicians.

2

“…sending shivers down the spines of

nurses and doctors at nearby Caritas

Norwood Hospital, which already is nearly

$4 million in debt and poised to lose even

more.”

The article fails to inform the reader that

according to data from the Massachusetts

Division of Health Care Finance and Policy,

Caritas Norwood maintained an operating

margin of at least 4% for five consecutive

years (through 2007).

In fact, in 2007, Caritas Norwood’s

operating margin was in the top quartile for

all Massachusetts hospitals.

The article does not inform the reader of

recent management changes which may

have contributed to recently deteriorating

financial performance.

Page 2

�PARTNERS’ RESPONSE

GLOBE ASSERTION

3

“In Weymouth, Partners is part of a joint

venture that is building a cancer center to

compete with a similar facility two miles

away that opened only last year.”

Partners is collaborating with a local

community hospital—South Shore Hospital

in Weymouth—to build the cancer center in

cooperation with the Dana Farber Cancer

Institute.

The Globe previously reported on this

project following a state report that predicted

a shortage of such facilities by 2010 (The

Boston Globe, September 18, 2006).

The Globe also reported on the many

benefits of this project in the South Weekly

section (The Boston Globe, December 14,

2008).

The competitor The Globe refers to is

operated as a collaboration of Atrius Health

and Commonwealth Oncology and Alliance

Imaging – a for-profit company. This

project is being done with a physician

exemption letter permitting radiation

oncology services. (A physician exemption

letter allows the holder to bypass the

Department of Public Health’s regulatory

process). Partners is not aware of any

hospital affiliation with this center.

Page 3

�PARTNERS’ RESPONSE

GLOBE ASSERTION

4

“Over the 11 years that ended in 2007,

Partners' revenue from certain outpatient

procedures jumped 324 percent, to $1.7

billion, an increase partly due to the

acquisition of several suburban hospitals.

That compares to a 163 percent rise

statewide, according to the state Division

of Health Care Finance and Policy, which

collects the data from hospitals. Partners

now gets nearly one of every five dollars

spent on outpatient care statewide.”

This analysis is not calculated on a ‘samestore’ basis, which is the industry standard,

nor are the numbers adjusted for medical

inflation. A same store analysis also

adjusted for medical inflation shows that

Partners grew by less than half of what is

reported in the article over this time period.

(Partners: 324% would be 116%; state:

163% would be 74%)

Based on same-store, Partners is 17.8% of

all inpatient discharges statewide and 20%

of outpatient services, according to the

Massachusetts Division of Health Care

Finance and Policy.

Partners 20% dollar share of outpatient

services is consistent with its inpatient

market share and is not surprising given that

many of Partners outpatient procedures, such

as Proton Beam therapy, (The Boston Globe

Magazine, February 22, 1998) are more

expensive.

5

“According to Partners' own data produced

for bond holders, the network's outpatient

business is flourishing. From 2003 to 2007,

routine office visits, procedures such as

cardiac catheterization, scans, and

treatments such as chemotherapy have

grown to 4.3 million visits, procedures, and

treatments.”

This assertion implies a level of precision

when measuring outpatient business that

does not exist in the industry. There is no

precise way to measure outpatient business

for a single year, much less over a five-year

period. Partners provided 2007 data to The

Globe explaining that there is no standard

way to measure outpatient business, and that

the various data sources are therefore

inconsistent. See attached chart #1.

Partners is not unique in its development of

an outpatient network. For example, the

University of Pittsburgh Medical Center

offers a network of 51 community hospitals,

outpatient centers and other facilities. See

attached Chart #2.

Page 4

�PARTNERS’ RESPONSE

GLOBE ASSERTION

6

7

“Once a limited presence outside Boston,

Partners' outpatient network is now paid

four times as much as the number-two

system, Beth Israel Deaconess Medical

Center, state data show.”

This statement makes it look to the reader

like Partners rates are four times higher than

Beth Israel Deaconess.

“In early 2007 Partners kicked the Beverly

doctors out of its network. It said that

because the local hospital was referring

some patients needing advanced care to

non-Partners hospitals, it could no longer

ensure quality. The administrators said they

weren't being disloyal and only turned to

other hospitals for help on tough cases when

Partners' teaching hospitals wouldn't.”

Under the PCHI contracts, Northeast Health

Systems physicians were not obligated to

refer patients to Partners hospitals.

Partners, as a network of eight hospitals,

compared to one hospital, Beth Israel

Deaconess, is not an apples-to-apples

comparison.

As The Globe reported on January 27, 2007

on this topic, independent observers

indicated that:

''I don't think I'd characterize this just as a

power play. Partners really is seeking more

integration among its hospitals." - Paul

Ginsburg, Center for Studying Health

System Change

“Offering financial inducements to

physicians for referrals is illegal under

federal law. There are also are prohibitions

against forcing physicians to refer patients

to particular institutions, said William J.

Spratt, Jr. a health care lawyer in the Miami

office of Kirkpatrick & Lockhart Nicholson

Graham, LLP.

But there are exceptions to the rules when

the motivation for shaping referral patterns

is an effort to improve clinical care through

networks like Partners, Spratt said.

‘It is a balancing test of weighing the

independent medical judgment of a

physician against perhaps the benefit that

might be derived from the clinical

integration,’ he said.”

Page 5

�PARTNERS’ RESPONSE

GLOBE ASSERTION

8

“Anna Jaques Hospital lost market share in

four of its top five communities Newburyport, Amesbury, Merrimac, and

West Newbury, while Mass. General, Lahey

Clinic, and the Brigham picked up patients

in those communities.”

The article fails to inform the reader that

Anna Jaques lost market share because of

regional competitors in its own primary

service area.

Three of Anna Jaques’ main competitors

gained more significant market share in

Anna Jaques’ prime territory:

- Lawrence General (3 points)

- Holy Family (2 points)

- Lahey (1.7 points)

These three local hospitals gained a

combined total of 6.7 points, compared to

BWH and MGH combined total of just 3.4

points. (Source: Massachusetts Division of

Health Care Finance and Policy)

9

“But the hardest hit community hospital has

been MetroWest. It lost market share in five

of its most important communities, while

the number of patients from those towns

going to Partners hospitals increased by 32

percent, according to discharge statistics

from the Massachusetts Health Data

Consortium. Partners said patient demand

for quality is the driving force behind those

numbers. Beth Israel Deaconess Medical

Center saw a 67 percent gain in those towns,

although the hospital's raw number of

patients from the region is about one-third

that of Partners.”

Page 6

With regard to MetroWest, the article fails to

point out that:

• in its primary service area, a community

hospital gained 3.3 share points over the

1996-2006 time period.

• BWH and MGH combined gained 2.8

share points during this period.

The article also fails to point out to the

reader that patient satisfaction scores at the

hospital are below the national average.

According to US Centers for Medicare &

Medicaid Services (CMS) data, only 63% of

MetroWest patients would definitely

recommend it compared to the national

average of 68%.

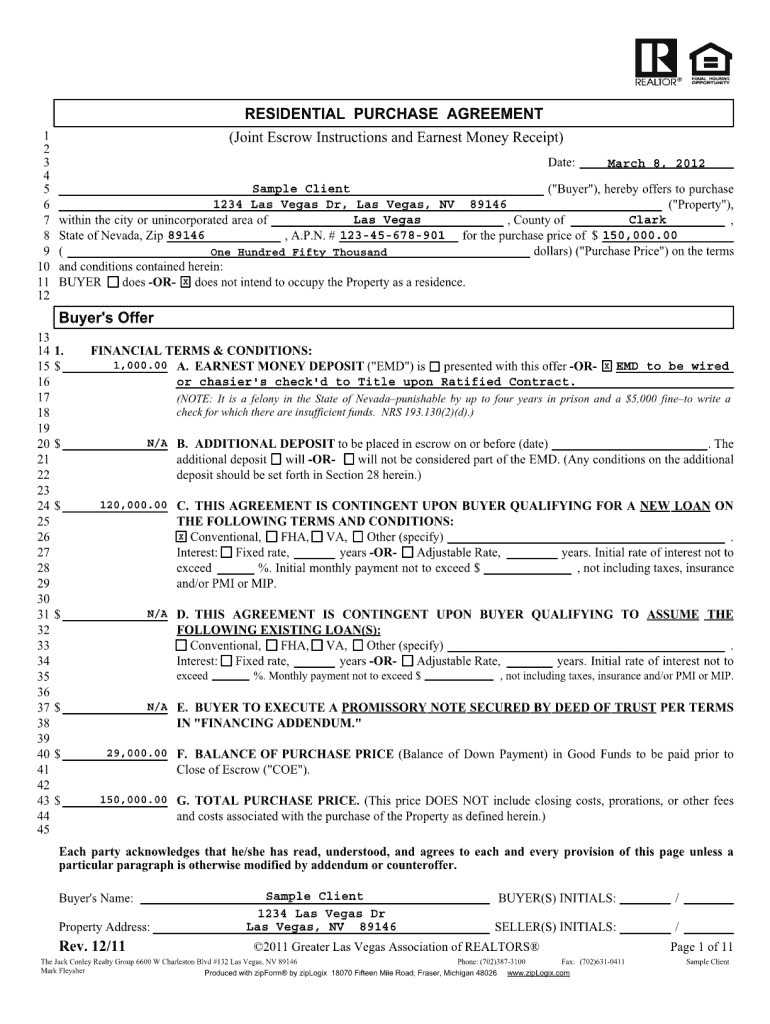

�Chart #1

Data sent to The Globe in an email on December 18.

Globe Question: How many outpatient visits did Partners have in 2006 and 2007, in each of the three categories (ER, routine visit and day

surgery)?

Partners Response: Attached, please find Partners statistics for 2007 in each of these categories as reported to publicly available sources. As you will

see, the numbers within these categories vary, as a result of different definitions established by each entity (AHA, 403, bond).

Boston Globe Spotlight

Comparison of Outpatient Statistics

2007

PHS Volume

AHA Survey

403 Total OPD Stats

6-Month Bond x 2*

340,269

331,070

273,002

Other "Visits"

2,092,208

1,479,705

1,084,464

Subtotal "Visits"

2,432,477

1,810,775

1,357,466

62,662

72,640

61,860

Emergency "Visits"

Day Surgeries

*Lizbeth Kowalczyk's Method

Page 7

�Chart #2

Examples of Suburban Investments by Our National Competitors

Baylor

Univ. of

Pitt

Medical

Center

Univ. of

Penn.

Health

System

9

1

1

3

1

3

5

15

5

13

--

8

--

Major Outpatient

Facilities*

4

2

2

38

5

16

4

Specialty Hospitals and

Other Major Facilities

4

1

3

--

1

2

--

13

18

10

51

6

26

4

Partners

NY

Presby.

Downtown Hospitals

2

Community Hospitals

Type of Facility

Totals (excludes

downtown hospitals)

*Excludes hospital licensed and affiliated community health centers

Source: Hospital Websites

Page 8

Cleveland

Clinic

Johns

Hopkins

�