Fill and Sign the Ohio Note 497322351 Form

Useful Suggestions for Finalizing Your ‘Ohio Note 497322351’ Online

Feeling overwhelmed by the burden of paperwork? Discover airSlate SignNow, the premier electronic signature solution for individuals and small to medium-sized businesses. Wave farewell to the tedious routine of printing and scanning documents. With airSlate SignNow, you can seamlessly finalize and sign documents online. Leverage the robust capabilities embedded in this user-friendly and cost-effective platform and transform your workflow for managing documents. Whether you require form approvals or need to collect digital signatures, airSlate SignNow manages everything efficiently, all with just a few clicks.

Adhere to this comprehensive tutorial:

- Access your account or register for a complimentary trial with our service.

- Select +Create to upload a file from your device, cloud storage, or our form collection.

- Open your ‘Ohio Note 497322351’ in the editor.

- Select Me (Fill Out Now) to set up the form on your end.

- Include and designate fillable fields for others (if required).

- Follow through with the Send Invite settings to solicit eSignatures from others.

- Save, print your version, or convert it into a reusable template.

Rest assured, if you need to collaborate with others on your Ohio Note 497322351 or require notarization—our platform has all the tools necessary to accomplish these tasks. Create an account with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

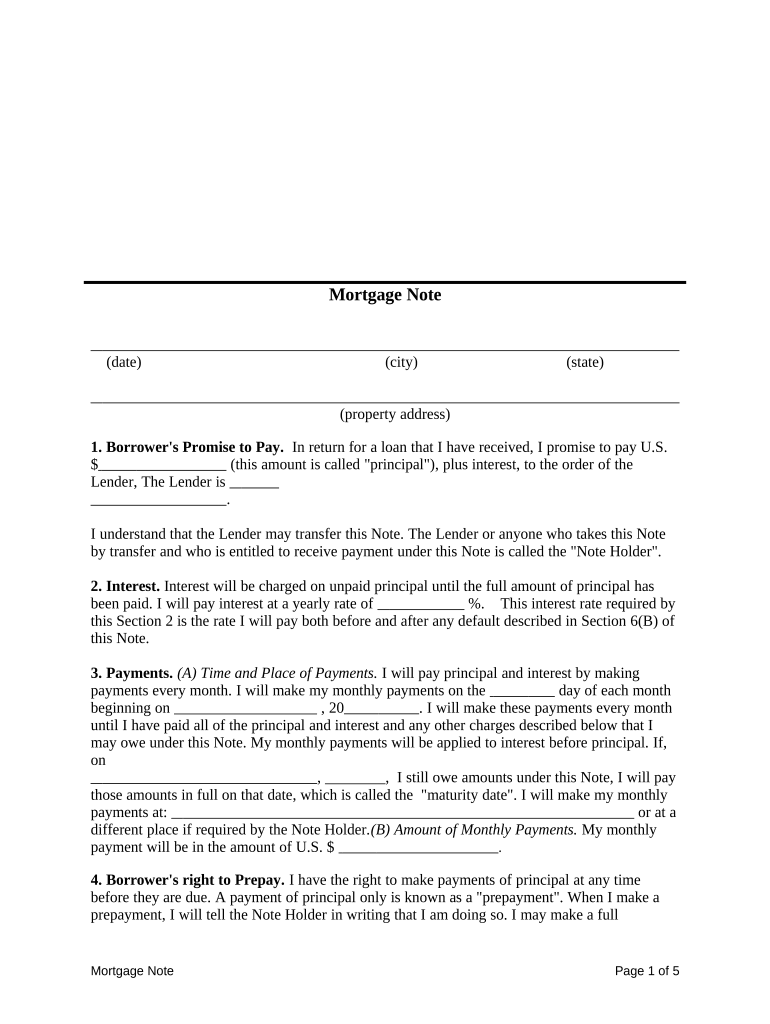

What is a mortgage note and how does it work?

A mortgage note is a legal document that outlines the terms of a loan secured by real estate. It specifies the amount borrowed, the interest rate, and the repayment schedule. Understanding your mortgage note is crucial for managing your finances and ensuring timely payments.

-

How can airSlate SignNow help with mortgage note management?

airSlate SignNow simplifies the management of mortgage notes by allowing you to easily send, sign, and store documents electronically. This streamlines the process, reduces paperwork, and enhances security, making it an ideal solution for both lenders and borrowers.

-

What features does airSlate SignNow offer for mortgage note eSigning?

Our platform offers a variety of features for mortgage note eSigning, including customizable templates, in-person signing options, and secure document storage. You can also track the signing process in real-time, ensuring that your mortgage notes are executed promptly.

-

Is airSlate SignNow cost-effective for managing mortgage notes?

Yes, airSlate SignNow is a cost-effective solution for managing mortgage notes, providing flexible pricing plans that suit businesses of all sizes. With our platform, you can reduce administrative costs and improve efficiency, making it an excellent investment for your operations.

-

Can I integrate airSlate SignNow with other software for mortgage note processing?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, including CRM systems and document management tools. This integration allows for efficient mortgage note processing and enhances overall workflow, saving you time and effort.

-

What security measures are in place for mortgage notes signed through airSlate SignNow?

airSlate SignNow prioritizes the security of your mortgage notes by employing advanced encryption protocols and secure cloud storage. Our platform also complies with industry standards, ensuring that your sensitive information remains protected throughout the signing process.

-

How can I track the status of my mortgage notes with airSlate SignNow?

With airSlate SignNow, you can easily track the status of your mortgage notes through our user-friendly dashboard. You'll receive real-time notifications when documents are viewed, signed, or completed, allowing you to stay informed at every step of the process.

The best way to complete and sign your ohio note 497322351 form

Find out other ohio note 497322351 form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles