SUCCESSION OF

[_COURT_]

[_DECEDENT_]

PARISH OF [_COURT_PARISH_]

PROBATE NO. ____________

STATE OF LOUISIANA

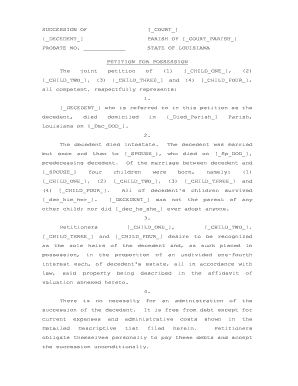

PETITION FOR POSSESSION

The

joint

petition

of

(1)

[_CHILD_ONE_],

(2)

[_CHILD_TWO_], (3) [_CHILD_THREE_] and (4) [_CHILD_FOUR_],

all competent, respectfully represents:

1.

[_DECEDENT_] who is referred to in this petition as the

decedent,

died

domiciled

in

[_Died_Parish_]

Parish,

Louisiana on [_Dec_DOD_].

2.

The decedent died intestate.

The decedent was married

but once and then to [_SPOUSE_], who died on [_Sp_DOD_],

predeceasing decedent.

[_SPOUSE_]

four

[_CHILD_ONE_],

children

(2)

were

[_CHILD_TWO_],

(4) [_CHILD_FOUR_].

[_dec_him_her_].

Of the marriage between decedent and

born,

(3)

namely:

[_CHILD_THREE_]

(1)

and

All of decedent's children survived

[_DECEDENT_] was not the parent of any

other child; nor did [_dec_he_she_] ever adopt anyone.

3.

Petitioners

[_CHILD_ONE_],

[_CHILD_TWO_],

[_CHILD_THREE_] and [_CHILD_FOUR_] desire to be recognized

as the sole heirs of the decedent and, as such placed in

possession, in the proportion of an undivided one-fourth

interest each, of decedent's estate, all in accordance with

law,

said

property

being

described

in

the

affidavit

of

valuation annexed hereto.

4.

There

is

no

necessity

succession of the decedent.

current

Detailed

expenses

and

Descriptive

for

an

administration of the

It is free from debt except for

administrative

List

filed

costs

herein.

shown

in

the

Petitioners

obligate themselves personally to pay these debts and accept

the succession unconditionally.

�5.

As

will

be

seen

from

the

Louisiana Inheritance Tax

Return and receipt, a copy of which is annexed hereto and

made part hereof, all inheritance taxes due the State of

Louisiana have been paid.

WHEREFORE, PETITIONERS PRAY THAT:

Petitioners,

[_CHILD_ONE_],

[_CHILD_TWO_],

[_CHILD_THREE_] and [_CHILD_FOUR_] be recognized as the sole

heirs of the decedent and, as such placed in possession, in

the proportion of an undivided one-fourth interest each, of

decedent's estate.

[_Firm_Name_]

Attorneys for

Petitioners

[_Firm_St_Add_]

[_Firm_City_St_Zip_]

[_Firm_Tel_No._]

BY:

_____________________________

[_Attorney_]

BAR ROLL NO. [_Bar_No._]

�STATE OF LOUISIANA

PARISH OF [_HEIR_AFF_PARISH_]

BEFORE ME, the undersigned authority, duly commissioned

and qualified in and for the PARISH OF [_HEIR_AFF_PARISH_],

State of Louisiana.

PERSONALLY CAME AND APPEARED:

[_AFFIANT_ONE_], a resident of [_Aff_1_Parish_] Parish,

Louisiana, of full age of majority, whose address is

[_Aff_1_Add_], and

[_AFFIANT_TWO_], a resident of [_Aff_2_Parish_] Parish,

Louisiana, of full age of majority, whose address is

[_Aff_2_Add_],

who after being duly sworn, did depose and say:

They were well acquainted with [_DECEDENT_], sometimes

hereafter

called

[_Died_Parish_]

decedent,

Parish,

who

died

Louisiana

domiciled

on

in

[_Dec_DOD_].

[_DECEDENT_] was married but once and then to [_SPOUSE_] who

died on [_Sp_DOD_], predeceasing decedent.

Of the marriage

between decedent and [_SPOUSE_], four children were born,

namely:

(1)

[_CHILD_ONE_],

(2)

[_CHILD_TWO_],

[_CHILD_THREE_] and (4) [_CHILD_FOUR_].

children

survived

[_dec_him_her_].

(3)

All of decedent's

[_DECEDENT_]

did

not

adopt any person and was not the parent of any child other

than those listed above.

[_DECEDENT_] died intestate.

donations

inter

vivos

nor

did

[_dec_he_she_] made no

[_dec_he_she_]

effect

any

transfer of property for an inadequate consideration, in

contemplation

of

death,

nor

within

one

year

of

[_dec_his_her_] death.

_____________________________

[_AFFIANT_ONE_]

_____________________________

[_AFFIANT_TWO_]

SWORN

AND

SUBSCRIBED

TO

BEFORE

ME

[_HEIR_AFF_DATE_].

_________________________________________

[_HEIR_AFF_NOT_], NOTARY PUBLIC

THIS

�SUCCESSION OF

[_COURT_]

[_DECEDENT_]

PARISH OF [_COURT_PARISH_]

PROBATE NO. ____________

STATE OF LOUISIANA

AFFIDAVIT OF VALUATION

AND

DETAILED DESCRIPTIVE LIST

Before

the

undersigned

Notary

or

Notaries

Public

personally appeared:

(1) [_CHILD_ONE_], [_C1_marital_stat_], whose mailing

address is [_C1_Add_], and whose social security

number is [_C1_SS#_],

(2)

[_CHILD_TWO_], [_C2_marital_stat_], whose mailing

address [_C2_Add_], and whose social security

number is [_C2_SS#_],

(3)

[_CHILD_THREE_],

[_C3_marital_stat_],

whose

mailing address is [_C3_Add_], and whose social

security number is [_C3_SS#_], and

(4)

[_CHILD_FOUR_], [_C4_marital_stat_], whose address

is [_C4_Add_], and whose social security number is

[_C4_SS#_],

who deposed that:

They are petitioners in the petition for possession in

this matter and all of the allegations contained in it are

true and correct.

In accordance with the provisions of LSA-R.S. 47:2408A

and of Article 3136 of the Code of Civil Procedure, they

present to the Court the following detailed descriptive list

of

all

items

[_DECEDENT_],

of

property

showing

the

comprising

location

the

of

succession

all

items

of

of

succession property and the fair market value of each item

at the date of death of the decedent:

(1)

[_1_Description_]

VALUE

(2)

[_2_Description_]

VALUE

(3)

[_2_Value_]

[_3_Description_]

VALUE

(4)

[1_Value_]

[_3_Value_]

[_4_Description_]

VALUE

TOTAL VALUE OF DECEDENT'S ESTATE

[_4_Value_]

[_Total_]

�DEBTS OF DECEDENT:

[_Debt_1_]

[_D_1_Amt_]

[_Debt_2_]

[_D_2_Amt_]

TOTAL DEBTS

[_Tot_Debt_]

The decedent made no donations or transfers of property

for an inadequate consideration within one year prior to

[_dec_his_her_] death, and [_dec_he_she_] did not transfer

any property prior to that time in contemplation of death or

in avoidance of taxes.

THUS

SIGNED

ON

[_Val_Date_]

at

[_Val_City_],

[_Val_Parish_] Parish, Louisiana, in the presence of the

undersigned

Notary

Public,

qualified

in

said

State

and

Parish, and the undersigned competent witnesses, who have

signed with the parties after due reading of the whole.

WITNESSES:

____________________________

______________________________

[_CHILD_ONE_]

____________________________

______________________________

[_CHILD_TWO_]

______________________________

[_CHILD_THREE_]

______________________________

[_CHILD_FOUR_]

_________________________________

[_VAL_NOTARY_], NOTARY PUBLIC

�SUCCESSION OF

[_COURT_]

[_DECEDENT_]

PARISH OF [_COURT_PARISH_]

PROBATE NO. _______________

STATE OF LOUISIANA

JUDGMENT OF POSSESSION

On considering the petition of the children and heirs

of the decedent herein to be recognized as such, and sent

into possession of the decedent's estate, satisfactory proof

having

been

submitted

to

the

Court

that

all

inheritance

taxes due to the State of Louisiana have been paid, and that

there

is

no

succession,

necessity

the

law

for

and

an

administration

evidence

being

of

in

this

favor

of

petitioners for reasons this day orally assigned:

IT

IS

ORDERED,

[_CHILD_ONE_],

(2)

ADJUDGED

AND

[_CHILD_TWO_],

DECREED

(3)

THAT

(1)

[_CHILD_THREE_]

and

(4) [_CHILD_FOUR_] be recognized as the sole heirs of the

decedent

and,

proportion

of

as

an

such

placed

undivided

in

possession,

one-fourth

interest

in

the

each,

of

decedent's property, said property being:

(1)

[_1_Description_]

(2)

[_2_Description_]

(3)

[_3_Description_]

(4)

[_4_Description_]

IT IS FURTHER ORDERED, ADJUDGED AND DECREED that any

individual,

money,

corporation

credits,

decedent

is

stock,

directed

or

institution

rights

to

or

deliver

having

property

same

to

any

other

belonging

the

heirs

to

of

decedent in accordance with the terms of this judgment, or

to make such disposition of same as may be directed by said

heirs.

JUDGMENT

[_Judg_City_],

READ,

RENDERED

AND

[_Judg_Parish_]

SIGNED

Parish,

in

Louisiana,

[_Judg_Date_].

__________________________________

DISTRICT JUDGE

* * * * * * * * * *

Chambers

at

on

�SECOND SPOUSE INTESTATE - PETITION, AFFIDAVIT OF HEIRSHIP,

AFFIDAVIT OF VALUATION AND JUDGMENT OF POSSESSION F2ANTES2:

See C.C.P. 3001 et seq.

This form covers the

death of the second spouse to die (for first, see F2ANTES1).

Succession is accepted unconditionally, but see LA R.S.

9:1421.

A Louisiana Inheritance Tax Return would also be

needed in most cases, and in some cases a federal Estate Tax

Return will be required.

Social Security numbers of heirs

are shown in the affidavit of valuation.

These will be

needed for the Louisiana Inheritance Tax Return.

See also

"GENERAL NOTES" in F2FINDME.

WORD KEY

EXPLANATION

[_COURT_]

[_DECEDENT_]

[_COURT_PARISH_]

[_CHILD_ONE_]

[_CHILD_TWO_]

[_CHILD_THREE_]

[_CHILD_FOUR_]

[_Died_Parish_]

[_Dec_DOD_]

Court in which proceeding filed.

Full name of decedent.

Parish where filed.

Name of first child.

Name of second child.

Name of third child.

Name of fourth child.

Parish of decedent's domicile at

death

Decedent's date of death.

[_SPOUSE_]

Name

[_Sp_DOD_]

[_dec_him_her_]

[_dec_he_she_]

[_Firm_Name_]

[_Firm_St_Add_]

[_Firm_City_St_Zip_]

[_Firm_Tel_No._]

of

decedent's

deceased

spouse.

Date of spouse's death.

Him or her, as appropriate for

decedent.

He or she, as appropriate for

decedent.

Name of law firm.

Law firm street address.

Law firm city, state and zip

code.

Telephone number of law firm.

[_Attorney_]

Name

of

pleading.

[_Bar_No._]

[_HEIR_AFF_PARISH_]

[_Aff_1_Add_]

[_AFFIANT_TWO_]

[_Aff_2_Parish_]

Attorney's bar number.

Parish

in

which

heirship

affidavit is signed.

Name of first affiant.

Parish in which first affiant

resides.

Address of first affiant.

Name of second affiant.

Parish in which second affiant

[_Aff_2_Add_]

resides.

Address of second affiant.

[_AFFIANT_ONE_]

[_Aff_1_Parish_]

attorney

signing

�[_Court_Parish_]

[_dec_his_her_]

[_HEIR_AFF_DATE_]

[_HEIR_AFF_NOT_]

[_C1_marital_stat_]

[_C1_Add_]

[_C1_SS#_]

[_C2_marital_stat_]

[_C2_Add_]

[_C2_SS#_]

[_C3_marital_stat_]

[_C3_Add_]

[_C3_SS#_]

[_C4_marital_stat_]

[_C4_Add_]

[_C4_SS#_]

Parish of decedent's domicile at

death.

His or her, as appropriate for

decedent.

Date heirship affidavit signed.

Notary

signing

heirship

affidavit.

Marital status of child one.

Address of child one.

Social Security Number of child

one.

Marital status of child two.

Address of child two.

Social Security Number

two.

Marital status of child

Address of child three.

Social Security Number

three.

Marital status of child

Address of child four.

Social Security Number

four.

of child

three.

of child

four.

of child

[_1_Description_]

Description, first asset.

[_1_Value_]

[_2_Description_]

[_2_Value_]

[_3_Description_]

[_3_Value_]

[_4_Description_]

[_4_Value_]

[_Total_]

[_Debt_1_]

[_D_1_Amt_]

[_Debt_2_]

$ value, 1st asset.

Description, 2nd asset.

$ value, 2nd asset.

Description, 3rd asset.

$ value, 3rd asset.

Description, 4th asset.

$ value, 4th asset.

$ total value, assets.

Creditor, 1st debt.

$ amount, 1st debt.

Creditor, 2nd debt.

[D_2_Amt]

[_Tot_Debt_]

$ amount, 2nd debt.

$ total of all debts.

[_Val_Date_]

[_Val_City_]

[_Val_Parish_]

Date of affidavit of valuation.

City where affidavit signed.

Parish in which affidavit is

signed.

[_VAL_NOTARY_]

Notary signing this (valuation)

affidavit.

City

in

which

judgment

of

possession signed.

[_Judg_City_]

[_Judg_Parish_]

Parish in which

possession signed.

judgment

of

�[_Judg_Date_]

Date

on

which

possession signed.

judgment

of

�