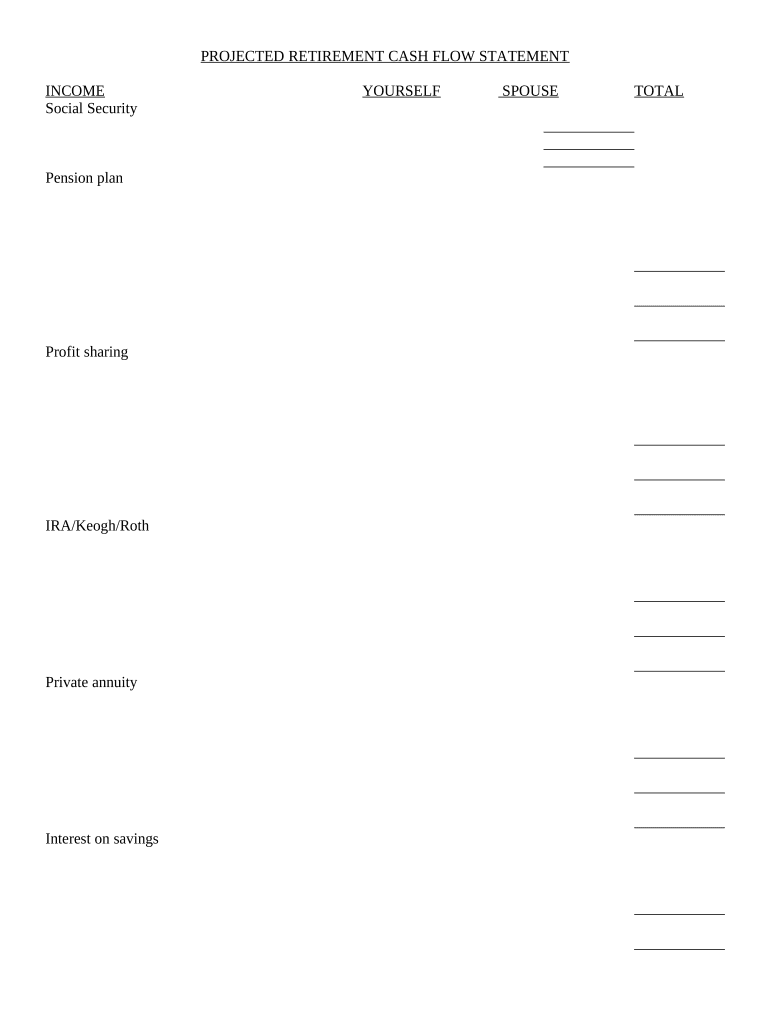

Fill and Sign the Retirement Cash Flow Form

Useful tips for completing your ‘Retirement Cash Flow’ online

Are you fed up with the complications of handling paperwork? Look no further than airSlate SignNow, the top electronic signature solution for individuals and small to medium-sized businesses. Bid farewell to the lengthy procedure of printing and scanning documents. With airSlate SignNow, you can effortlessly fill out and sign forms online. Take advantage of the extensive tools incorporated into this simple and cost-effective platform and transform your method of document management. Whether you need to approve documents or collect electronic signatures, airSlate SignNow manages everything easily, with just a few clicks.

Follow this detailed guide:

- Login to your account or register for a free trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template library.

- Open your ‘Retirement Cash Flow’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Insert and designate fillable fields for others (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your version, or convert it into a multi-use template.

Don’t worry if you need to work with your teammates on your Retirement Cash Flow or send it for notarization—our platform provides everything you need to accomplish such tasks. Register with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

What is Retirement Cash Flow and how can airSlate SignNow assist with it?

Retirement Cash Flow refers to the income you receive during retirement, which is essential for financial stability. airSlate SignNow can assist you by streamlining the document signing process for retirement planning and financial agreements, ensuring that all necessary documents are efficiently managed and signed.

-

How does airSlate SignNow enhance my Retirement Cash Flow planning?

With airSlate SignNow, you can easily create, send, and sign financial documents related to your Retirement Cash Flow. This helps you manage your retirement accounts and investment agreements swiftly and securely, allowing you to focus more on your financial strategies rather than paperwork.

-

Is airSlate SignNow cost-effective for managing Retirement Cash Flow documents?

Yes, airSlate SignNow offers a cost-effective solution for managing your Retirement Cash Flow documents. With flexible pricing plans, you can choose a package that fits your needs, ensuring that you have the right tools to manage your retirement documentation without breaking the bank.

-

What features does airSlate SignNow provide to support Retirement Cash Flow management?

airSlate SignNow includes features like customizable templates, real-time tracking, and secure eSigning that make managing your Retirement Cash Flow documents simple and efficient. These tools help you keep your financial agreements organized and accessible, ensuring smooth transactions.

-

Can I integrate airSlate SignNow with other financial tools for better Retirement Cash Flow management?

Absolutely! airSlate SignNow integrates seamlessly with various financial and accounting software, helping you coordinate your Retirement Cash Flow management more effectively. This integration allows you to automate workflows and maintain a comprehensive view of your financial landscape.

-

How secure is airSlate SignNow for handling Retirement Cash Flow contracts?

Security is a top priority for airSlate SignNow. We use bank-level encryption and secure servers to protect your Retirement Cash Flow contracts and sensitive financial information, ensuring that your documents remain private and secure throughout the signing process.

-

What customer support options are available for airSlate SignNow users focused on Retirement Cash Flow?

airSlate SignNow provides excellent customer support options, including live chat, email, and phone assistance, specifically for users managing Retirement Cash Flow. Our dedicated support team is ready to help you with any questions or issues you may encounter.

The best way to complete and sign your retirement cash flow form

Find out other retirement cash flow form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles