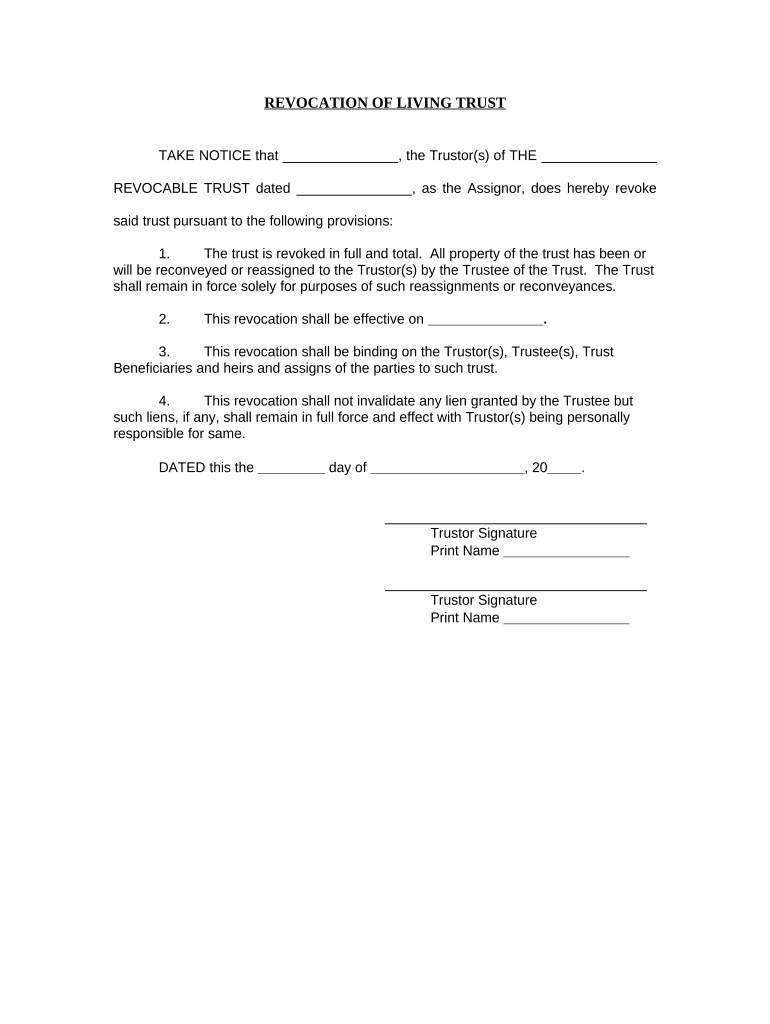

Fill and Sign the Revocation of Living Trust Hawaii Form

Useful Tips for Preparing Your ‘Revocation Of Living Trust Hawaii’ Online

Are you fed up with the burden of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature platform for individuals and businesses. Bid farewell to the tedious process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Utilize the comprehensive tools embedded in this user-friendly and economical platform to transform your document management approach. Whether you need to approve documents or collect electronic signatures, airSlate SignNow simplifies everything with just a few clicks.

Follow this comprehensive guide:

- Access your account or begin a free trial with our service.

- Select +Create to upload a document from your device, cloud, or our template library.

- Open your ‘Revocation Of Living Trust Hawaii’ in the editor.

- Click Me (Fill Out Now) to finalize the form on your end.

- Add and designate fillable fields for additional parties (if necessary).

- Proceed with the Send Invite settings to request eSignatures from others.

- Download, print your version, or convert it into a multi-usable template.

Don’t worry if you need to work together with your colleagues on your Revocation Of Living Trust Hawaii or send it for notarization—our solution has everything you need to accomplish these tasks. Sign up with airSlate SignNow today and elevate your document management to a new height!

FAQs

-

What is a revocable living trust in Hawaii?

A revocable living trust in Hawaii is a legal document that allows you to manage your assets during your lifetime and dictate how they are distributed after your death. This type of trust can be altered or revoked at any time, providing flexibility in estate planning. Establishing a revocable living trust in Hawaii can help avoid probate and ensure a smoother transfer of assets to your beneficiaries.

-

How does a revocable living trust benefit me in Hawaii?

Creating a revocable living trust in Hawaii offers several benefits, including avoiding probate, maintaining privacy, and providing flexibility in asset management. This trust allows you to control your assets while you are alive and ensures they are distributed according to your wishes after your passing. Additionally, it can help streamline the administration of your estate.

-

What are the costs associated with setting up a revocable living trust in Hawaii?

The costs for setting up a revocable living trust in Hawaii can vary depending on the complexity of your estate and whether you choose to create the trust yourself or hire an attorney. Generally, fees can range from a few hundred to several thousand dollars. It's crucial to consider the long-term savings on probate costs and the benefits of having a well-structured trust.

-

Can I change my revocable living trust in Hawaii?

Yes, one of the main features of a revocable living trust in Hawaii is that you can modify or revoke it at any time during your lifetime. This flexibility allows you to adjust your trust as your circumstances or wishes change. It’s advisable to review your trust periodically to ensure it remains aligned with your goals.

-

How does airSlate SignNow facilitate the creation of a revocable living trust in Hawaii?

airSlate SignNow offers an easy-to-use platform for electronically signing and managing documents, including those needed to establish a revocable living trust in Hawaii. Our solution allows you to securely send and eSign important legal documents, ensuring a smooth process. With our cost-effective tools, you can focus on your estate planning without the hassle of traditional paperwork.

-

What documents do I need for a revocable living trust in Hawaii?

To establish a revocable living trust in Hawaii, you typically need to prepare a trust agreement, which outlines the terms of the trust. Additionally, you may need to gather documents related to your assets, such as property deeds, bank statements, and investment accounts. Having these documents ready can simplify the trust creation process.

-

Is a revocable living trust in Hawaii the same as a will?

No, a revocable living trust in Hawaii is not the same as a will, although both are essential estate planning tools. A revocable living trust helps manage your assets during your lifetime and avoids probate, while a will outlines your wishes for asset distribution after death but must go through the probate process. Using both can provide comprehensive estate planning.

The best way to complete and sign your revocation of living trust hawaii form

Find out other revocation of living trust hawaii form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles