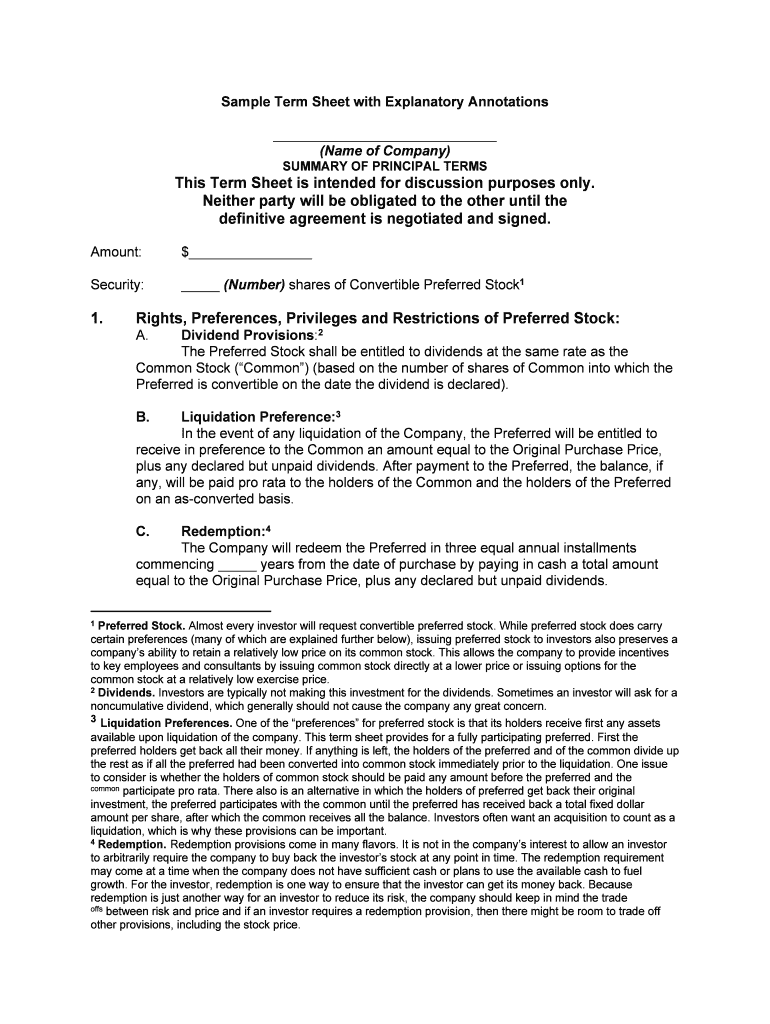

Sample Term Sheet with Explanatory Annotations_____________________________(Name of Company)

SUMMARY OF PRINCIPAL TERMS

This Term Sheet is intended for discussion purposes only.

Neither party will be obligated to the other until thedefinitive agreement is negotiated and signed.

Amount: $________________

Security: _____ (Number) shares of Convertible Preferred Stock 1

1. Rights, Preferences, Privileges and Restrictions of Preferred Stock: A.Dividend Provisions :2

The Preferred Stock shall be entitled to dividends at the same rate as the

Common Stock (“Common”) (based on the number of shares of Common into which the

Preferred is convertible on the date the dividend is declared).

B. Liquidation Preference: 3

In the event of any liquidation of the Company, the Preferred will be entitled to

receive in preference to the Common an amount equal to the Original Purchase Price,

plus any declared but unpaid dividends. After payment to the Preferred, the balance, if

any, will be paid pro rata to the holders of the Common and the holders of the Preferred

on an as-converted basis.

C. Redemption: 4

The Company will redeem the Preferred in three equal annual installments

commencing _____ years from the date of purchase by paying in cash a total amount

equal to the Original Purchase Price, plus any declared but unpaid dividends.

1 Preferred Stock. Almost every investor will request convertible preferred stock. While preferred stock does carry

certain preferences (many of which are explained further below), issuing preferred stock to investors also preserves a

company’s ability to retain a relatively low price on its common stock. This allows the company to provide incentives

to key employees and consultants by issuing common stock directly at a lower price or issuing options for the

common stock at a relatively low exercise price. 2 Dividends. Investors are typically not making this investment for the dividends. Sometimes an investor will ask for a

noncumulative dividend, which generally should not cause the company any great concern. 3 Liquidation Preferences. One of the “preferences” for preferred stock is that its holders receive first any assets

available upon liquidation of the company. This term sheet provides for a fully participating preferred. First the

preferred holders get back all their money. If anything is left, the holders of the preferred and of the common divide up

the rest as if all the preferred had been converted into common stock immediately prior to the liquidation. One issue

to consider is whether the holders of common stock should be paid any amount before the preferred and the common participate pro rata. There also is an alternative in which the holders of preferred get back their original

investment, the preferred participates with the common until the preferred has received back a total fixed dollar

amount per share, after which the common receives all the balance. Investors often want an acquisition to count as a

liquidation, which is why these provisions can be important. 4 Redemption. Redemption provisions come in many flavors. It is not in the company’s interest to allow an investor

to arbitrarily require the company to buy back the investor’s stock at any point in time. The redemption requirement

may come at a time when the company does not have sufficient cash or plans to use the available cash to fuel

growth. For the investor, redemption is one way to ensure that the investor can get its money back. Because

redemption is just another way for an investor to reduce its risk, the company should keep in mind the trade

offs between risk and price and if an investor requires a redemption provision, then there might be room to trade off

other provisions, including the stock price.

D. Conversion:5

The Preferred will be convertible at any time, at the option of the holder, into

shares of Common at an initial conversion price equal to the Original Purchase Price.

Initially each share of Preferred is convertible into one share of Common. The

conversion price will be subject to adjustment as provided in Paragraph E below.

E. Anti-dilution Provisions: 6

The conversion price of the Preferred will be subject

to adjustment to prevent dilution in the event that the Company issues additional shares

(other than the Reserved Employee Shares described under “Reserved Employee

Shares” below) at a purchase price less than the applicable conversion price. The

conversion price will be subject to adjustment on a weighted basis which takes into

account issuances of additional shares at prices below the applicable conversion

price.

F. Pay to Play :7

If any holder of Preferred fails to participate in the preemptive right

described below on a pro rata basis, then such holder will lose its antidilution protection

for all prior and future financings on all Preferred that it owns and will have the Preferred

it owns converted to Common (and lose its preemptive right to participate in future

financings and the right of first refusal described below, as well as any informational,

inspection, visitation and registration rights, but will remain subject to applicable lock- up

requirements). If such holder participates in its preemptive right but not to the full extent

of its pro rata share, then only a percentage of its Preferred will be converted into

Common (under the same terms as in the preceding sentence).

5 Automatic Conversion. It is important for a company to have all outstanding preferred converted to common at the

time of an initial public offering (“IPO”). Investors typically want to ensure that the IPO is sufficiently large before they

are obligated to convert. A typical provision will state that the IPO has to be for a per share price of at least some

multiple of the original stock purchase price and for an aggregate offering amount of some agreed-upon dollar

amount. It is easier to meet the aggregate offering amount, so try to eliminate the minimum per share price. It also is

important that if a certain percentage of the preferred has already converted or agreed to convert, the company have

the ability to cause the rest of the preferred to convert. A simple majority is most favorable to the company; investors

sometimes request higher percentages. 6 Antidilution. An antidilution provision is intended to preserve the economic value of an investor’s investment if the

company sells stock at a lower price than was paid by the investor. There are several flavors of antidilution

protection; the weighted average described in this term sheet is the most common and the fairest. The

mechanics are that the conversion price is adjusted so that upon conversion of the preferred, the investor

receives additional shares of common stock. The other type of antidilution protection sometimes seen is

“full ratchet.” A “full ratchet” tends to be overly generous to an investor and if an investor seeks a “full

ratchet” antidilution clause, the company should either seek to eliminate it or limit it to a short period of

time after the original preferred investment, after which the antidilution reverts to weighted average. 7 Pay to Play. The “pay to play” provision requires investors to stick with the company in order to maintain many of

the investor’s preferences. This term sheet says that the investor must participate pro rata in future financings or else

lose its antidilution protection and face mandatory conversion and loss of certain other rights. The specifics of any

“pay to play” provision can be negotiated, but the concept is that the company and the investor should consider the

relationship to be a long-term one and that continuing support for the company is one of the conditions for retaining

all the investor’s preferences.

G. Voting Rights:8

Except with respect to election of directors, the holder of a share

of Preferred will have the right to that number of votes equal to the number of shares of

Common issuable upon conversion of the Preferred at the time the record for the vote is

taken. Election of Directors will be as described under “Board Representation” below.

H. Protective Provisions: 9

Provided at least _________ shares of Preferred are

outstanding, consent of the holders of at least a majority of the Preferred will be required

for any sale by the Company of a substantial portion of its assets, any merger of the

Company with another entity, each amendment of the Company’s articles of

incorporation, and for any action which (i) alters or changes the rights, preferences or

privileges of the Preferred materially and adversely, (ii) increases the authorized number

of shares of Preferred Stock, (iii) creates any new class of shares having preference

over or being on a parity with the Preferred.

2. Information Rights:

The Company will timely furnish the investors with annual, quarterly and monthly

financial statements. Representatives of the investors will have the right to inspect the books

and records of the Company.

3. Registration Rights 10

:

A. Demand Rights: Beginning the earlier of five years after the Closing Date and

12 months after the Company’s initial public offering, if investors holding at least 50

percent of the Preferred (or Common issued upon conversion of the Preferred) request

that the Company file a Registration Statement covering at least 20 percent of the

Common issuable upon conversion of the Preferred with an anticipated aggregate

offering price of at least $10,000,000, the Company will use its best efforts to cause such

shares to be registered. The Company will not be obligated to affect more than two

registrations under these demand right provisions.

8 Protective Provisions . Another preference for preferred stock is the right to special class voting under applicable

corporate law. It is unusual for an investor to immediately obtain a majority position in any company. Therefore, the

investor is concerned that actions not be taken if those actions might impair the value of the investment. The key

things to keep in mind for this provision are: (a) the percentage of preferred required for the approval (from the

company’s perspective, a lower percentage is better), (b) the specific items that require the special consent

(again, fewer things are better than more things), and (c) this special voting privilege only continues so long as there is

at least some reasonable amount of shares of preferred outstanding. 9 Protective Provisions. Another preference for preferred stock is the right to special class voting under applicable

corporate law. It is unusual for an investor to immediately obtain a majority position in any company. Therefore, the

investor is concerned that actions not be taken if those actions might impair the value of the investment. The key

things to keep in mind for this provision are: (a) the percentage of preferred required for the approval (from the

company’s perspective, a lower percentage is better), (b) the specific items that require the special consent

(again, fewer things are better than more things), and (c) this special voting privilege only continues so long as there is

at least some reasonable amount of shares of preferred outstanding 10 Registration Rights. Registration rights often take up a substantial portion of any preferred stock purchase

documentation and are rarely invoked. The principal purpose for registration rights is to ensure that the investor has a

path to liquidity if the company conducts an IPO. The provisions outlined in this term sheet are fairly standard. The

issues to keep in mind are: (a) time limits for both the start and the termination of the registration rights, (b) the

demand rights are for a significantly sized offering so that the company avoids having to comply with this request for

insignificant offerings, and (c) asking the investors to allow founders or other key employees to also participate in the

registration rights.

B. Registrations on Form S-3: Holders of ____ percent or more of the Preferred

(or Common issued upon conversion of the Preferred) will have the right to require the

Company to file an unlimited number of Registration Statements on Form S-3 (but no

more than two per year).

C. Piggy-Back Registration: The investors will be entitled to “piggy-back”

registration rights on all registrations of the Company.

D. Registration Expenses: All registration expenses (exclusive of underwriting

discounts and commissions or special counsel fees of a selling shareholder) shall be

borne by the Company.

E. Lock-Up Provision: Upon request by the underwriter, the holders of all

registerable securities shall enter into agreements not to transfer any shares beginning

upon the date of the Company’s initial public offering and continuing for such period

thereafter up to 180 days as determined by the board of directors upon advice of

underwriters; provided each officer and director of the Company and all other holders of

at least 10 percent of the Company’s Common shall agree to execute a similar

agreement.

F. Termination: All registration rights terminate five years after the Company’s

initial public offering.

G. Transfer: Registration rights are transferable only with the transfer of all of a

holder’s registerable securities or to a majority-owned subsidiary of a holder or a

constituent partner of a holder.

H. Certain Employee Rights: Certain key employees to be named by the board of

directors shall have piggyback registration rights on any investor demand registrations,

subject to underwriter’s cutback and subordinate to the investors, and on Company

initiated registrations, subject to underwriter’s cutback and pro rata with investors.

4. Board Representation: The Board will consist of _______ members. The holders

of the Preferred will have the right to designate _____ directors, the holders of the Common

(exclusive of the Investors) will have the right to designate _______ directors, and the remaining

_____ directors will be unaffiliated persons elected by the Common and the Preferred voting as

a single class.

5. Key Man Insurance: As determined by the Board of Directors.

6. Preemptive Right to Purchase New Securities: 11

If the Company proposes to offer

additional shares (other than Reserved Employee Shares or shares issued in the initial public

offering or the acquisition of another company or shares issued upon conversion or exercise of

11 Preemptive Rights. Investors often ask for the first right to buy any new shares issued by the company. From the

company’s perspective, this is necessary if you have a “pay to play” provision and is often desirable. It is easier to put

together a deal with people you already know and love rather than having to start all over again with strangers.

However, unless there are appropriate procedures in the final documentation that put time limits on how long an

investor an take to make up its mind, a preemptive right provision may impair the company’s ability to

obtain new financing from third parties. It is important to be sure that the preemptive right does not apply to shares

reserved for incentive purposes, the IPO or for issuance of shares upon conversion or exercise of currently

outstanding securities.

outstanding securities), the Company will first offer all such shares to the investors on a pro rata

basis. This preemptive right will terminate upon an underwritten public offering of shares of the

Company.

7. Stock Restriction and Rights of First Refusal and Co-Sale:12

All present holders of

the Common Stock of the Company who are employees of the Company will execute a Stock

Restriction Agreement with the Company pursuant to which the Company will have an option to

buy back at cost a portion of the shares of Common Stock held by such person in the event that

such shareholder’s employment with the Company is terminated prior to the expiration of

____ months from the date of employment. _______ percent of the shares will be released each

year from the repurchase option based upon continued employment by the Company. In

addition, the Company and the Investors will have a right of first refusal with respect to any

employee’s shares proposed to be resold, or alternatively, the right to participate in the sale of

any such shares to a third party, which rights will terminate upon a public offering.

8. Reserved Employee Shares: 13

The Company may reserve up to _______ shares of

Common Stock for issuance to employees, directors and consultants of the Company (the

“Reserved Employee Shares”). The Reserved Employee Shares will be issued from time to time

under such arrangements, contracts or plans as recommended by management and approved

by the Board.

9. Non-Competition, Proprietary Information and Inventions Agreement: Each officer

and key employee of the Company designated by the Investors will enter into a non-competition

proprietary information and inventions agreement in a form reasonably acceptable to the

Investors.

10. The Purchase Agreement: The purchase of the Preferred will be made pursuant to a

Stock Purchase Agreement drafted by counsel to the Investors and reasonably acceptable to

the Company and the Investors, which agreement shall contain, among other things,

appropriate representations and warranties of the Company, covenants of the Company

reflecting the provisions set forth herein, and appropriate conditions of closing.

12 Stock Restriction. Investors often require that stock owned by employees be subject to some sort of vesting

agreement which states that the company can buy back the stock at the price paid by the employee if the employee

is no longer employed after a certain period of time. As time passes, the company’s right to buy lapses according to

an agreed- upon formula. In addition, investors almost always require that the company (and sometimes the

investors) have a right of first refusal on any employee’s stock that is sold. Both of these provisions are in the

company’s interest and ordinarily should have been put in place at formation. The only change that usually is required upon investment is adding the investor to the right of first refusal and adding the co-sale provision.

13 Reserved Employee Shares. It is in everybody’s best interest for the company to have an adequate amount of

shares reserved to provide incentives to employees, directors and consultants. The specific number of shares will

often be negotiated. The company should consider how many shares it thinks it will need to attract and retain the

number of employees it thinks it will have to hire over the year or two after the investment and be prepared to justify

that number to the investors.

11. Expenses: The Company will bear the legal fees and other out-of-pocket

expenses of the investors with respect to the transaction.

Valuable tips for preparing your ‘Sample Term Sheetthe Startup Garage’ online

Are you fed up with the annoyance of handling paperwork? Look no further than airSlate SignNow, the top eSignature solution for individuals and small to medium-sized businesses. Bid farewell to the tedious task of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign documents online. Utilize the extensive tools included in this user-friendly and cost-effective platform to transform your paperwork management approach. Whether you need to sign forms or collect eSignatures, airSlate SignNow simplifies the process with just a few clicks.

Follow these detailed instructions:

- Sign into your account or create a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form collection.

- Open your ‘Sample Term Sheetthe Startup Garage’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and designate fillable fields for others (if needed).

- Continue with the Send Invite options to solicit eSignatures from others.

- Save, print your version, or convert it into a reusable template.

No need to worry if you need to work with your colleagues on your Sample Term Sheetthe Startup Garage or send it for notarization—our platform provides all the necessary tools to accomplish these tasks. Sign up with airSlate SignNow today and enhance your document management experience to new levels!