Fill and Sign the San Francisco Rental Application Form

Useful tips for finishing your ‘San Francisco Rental Application Form’ online

Are you fed up with the annoyance of handling documents? Search no more than airSlate SignNow, the premier eSignature solution for individuals and small to medium-sized businesses. Bid farewell to the tedious process of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign documents online. Utilize the extensive features incorporated into this user-friendly and cost-effective platform to transform your method of document management. Whether you need to authorize forms or gather eSignatures, airSlate SignNow manages it all with ease, requiring only a few clicks.

Adhere to this step-by-step guide:

- Access your account or register for a complimentary trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our form library.

- Open your ‘San Francisco Rental Application Form’ in the editor.

- Click Me (Fill Out Now) to complete the form on your part.

- Add and designate fillable fields for others (if necessary).

- Proceed with the Send Invite settings to request eSignatures from others.

- Save, print your copy, or transform it into a multi-usable template.

No need to worry if you want to collaborate with your colleagues on your San Francisco Rental Application Form or send it for notarization—our platform provides everything you require to accomplish such tasks. Register with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

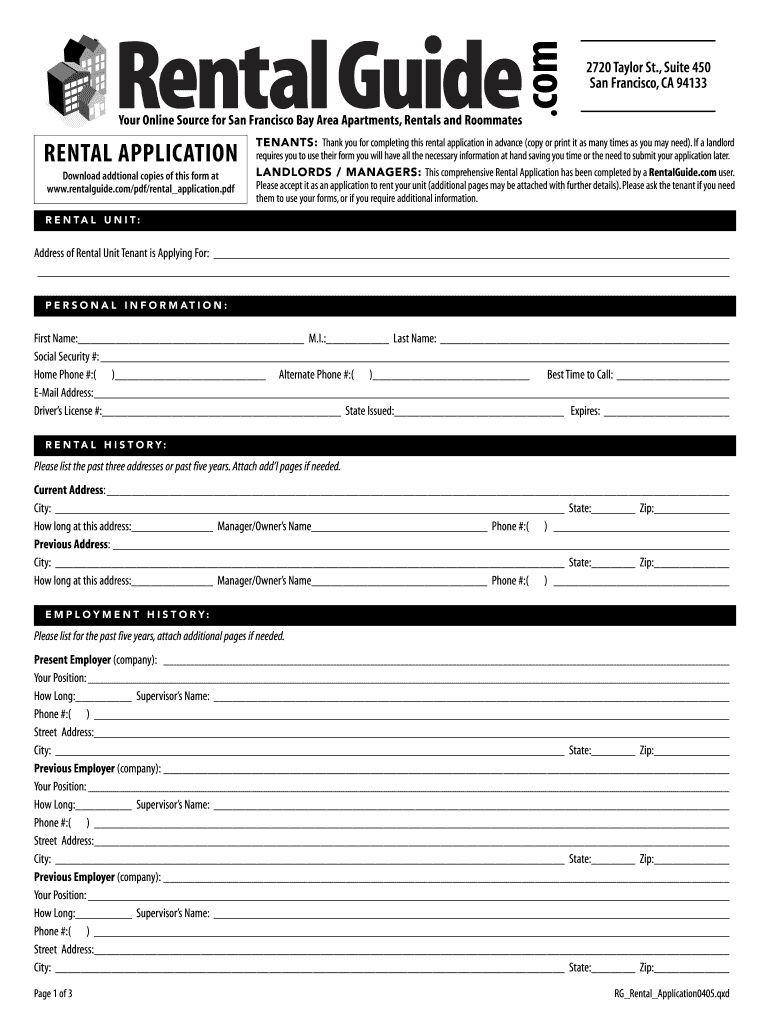

What is the San Francisco Rental Application Form?

The San Francisco Rental Application Form is a specialized document designed for potential tenants seeking to rent properties in San Francisco. This form typically collects essential information about the applicant's background, income, and rental history. Utilizing an efficient eSignature solution like airSlate SignNow simplifies the completion and submission process of this form.

-

How can airSlate SignNow improve my San Francisco Rental Application Form process?

airSlate SignNow streamlines the San Francisco Rental Application Form process by allowing users to easily send, sign, and manage documents electronically. With its intuitive interface, you can customize your application forms and track their progress in real-time. This not only saves time but also enhances the overall experience for both landlords and tenants.

-

Is there a cost associated with using the San Francisco Rental Application Form via airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow for the San Francisco Rental Application Form; however, the pricing is designed to be budget-friendly and competitive. Different plans are available to meet various business needs, ensuring you find an option that fits your budget. Investing in this solution can signNowly reduce the hassle of paper-based processes.

-

What features does airSlate SignNow offer for the San Francisco Rental Application Form?

airSlate SignNow offers various features tailored for the San Francisco Rental Application Form, including customizable templates, document tracking, and secure eSigning capabilities. Additionally, it provides automated reminders to ensure that applicants complete their forms on time. These features enhance efficiency and ensure that the application process runs smoothly.

-

Can I integrate airSlate SignNow with other tools for managing my San Francisco Rental Application Form?

Absolutely! airSlate SignNow offers seamless integrations with numerous applications, making it easy to connect your San Francisco Rental Application Form with tools like CRM systems and property management software. This integration streamlines your workflow, allowing you to manage applications and tenant communications in one place.

-

How does airSlate SignNow ensure the security of my San Francisco Rental Application Form?

Security is a top priority for airSlate SignNow when handling the San Francisco Rental Application Form. The platform employs advanced encryption protocols and complies with industry standards to protect sensitive information. This ensures that both landlords and tenants can trust the safety of their data during the application process.

-

What are the benefits of using airSlate SignNow for the San Francisco Rental Application Form?

Using airSlate SignNow for the San Francisco Rental Application Form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced applicant experience. The platform allows for quick turnaround times and minimizes the chances of errors in the application process. Overall, it supports a smooth and professional transaction between landlords and prospective tenants.

Find out other san francisco rental application form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles