Fill and Sign the Special Needs Trust Elder Law Ampamp Medicaid Planning Attorneys Form

Useful advice for preparing your ‘Special Needs Trust Elder Law Ampamp Medicaid Planning Attorneys’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier eSignature platform for individuals and organizations. Bid farewell to the extensive process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign paperwork online. Utilize the powerful features embedded in this user-friendly and economical platform and transform your method of document management. Whether you need to approve forms or collect electronic signatures, airSlate SignNow manages it all with ease, needing just a few clicks.

Adhere to this step-by-step guide:

- Sign in to your account or register for a complimentary trial of our service.

- Click +Create to upload a file from your device, cloud, or our template library.

- Open your ‘Special Needs Trust Elder Law Ampamp Medicaid Planning Attorneys’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and allocate fillable fields for others (if necessary).

- Continue with the Send Invite settings to request eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

No need to worry if you need to collaborate with others on your Special Needs Trust Elder Law Ampamp Medicaid Planning Attorneys or send it for notarization—our platform provides everything required to achieve such tasks. Create an account with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

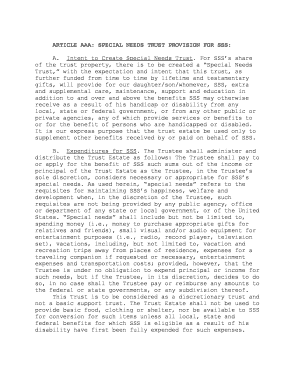

What is a Special Needs Trust and how can it benefit my family?

A Special Needs Trust is a legal arrangement that allows you to set aside funds for a person with disabilities without jeopardizing their eligibility for government benefits. By working with Special Needs Trust Elder Law & Medicaid Planning Attorneys, you can ensure that your loved one receives the necessary support while maintaining access to vital services.

-

How do Special Needs Trust Elder Law & Medicaid Planning Attorneys charge for their services?

Pricing for services provided by Special Needs Trust Elder Law & Medicaid Planning Attorneys can vary based on complexity and location. Typically, attorneys may charge a flat fee for creating a trust or an hourly rate for consultations. It's advisable to discuss fees upfront to understand the total cost involved.

-

What features should I look for in a Special Needs Trust?

When selecting a Special Needs Trust, look for features such as flexibility in fund management, clear guidelines on distributions, and compliance with Medicaid regulations. Consulting with Special Needs Trust Elder Law & Medicaid Planning Attorneys can help you identify the best features tailored to your family's needs.

-

How can a Special Needs Trust help with Medicaid planning?

A Special Needs Trust can be a crucial tool in Medicaid planning, as it allows individuals to preserve assets while still qualifying for Medicaid benefits. By working with Special Needs Trust Elder Law & Medicaid Planning Attorneys, you can navigate the complexities of Medicaid eligibility and ensure your loved one receives the care they need.

-

What are the benefits of using airSlate SignNow for managing Special Needs Trust documents?

Using airSlate SignNow for managing Special Needs Trust documents offers a secure and efficient way to eSign and store important legal documents. This cost-effective solution simplifies the process, allowing you to focus on what matters most—caring for your loved ones. Special Needs Trust Elder Law & Medicaid Planning Attorneys can also benefit from streamlined document management.

-

Can I integrate airSlate SignNow with other legal software?

Yes, airSlate SignNow offers integrations with various legal software platforms, enhancing your workflow and document management capabilities. This is particularly beneficial for Special Needs Trust Elder Law & Medicaid Planning Attorneys who need to streamline their processes and improve client communication.

-

What should I consider when choosing a Special Needs Trust Elder Law & Medicaid Planning Attorney?

When choosing a Special Needs Trust Elder Law & Medicaid Planning Attorney, consider their experience, client reviews, and familiarity with local laws. It's important to select an attorney who understands the nuances of Special Needs Trusts and Medicaid planning to ensure your family's needs are met effectively.

The best way to complete and sign your special needs trust elder law ampamp medicaid planning attorneys form

Find out other special needs trust elder law ampamp medicaid planning attorneys form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles