Fill and Sign the State of Hawaii Tax Form G 45 2017 2019

Helpful tips on setting up your ‘State Of Hawaii Tax Form G 45 2017 2019’ online

Are you fed up with the burden of handling paperwork? Look no further than airSlate SignNow, the premier electronic signature platform for individuals and small to medium-sized businesses. Bid farewell to the laborious task of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Take advantage of the extensive features integrated into this user-friendly and cost-effective platform and transform your method of managing paperwork. Whether you need to approve forms or gather eSignatures, airSlate SignNow manages it all seamlessly, with just a few clicks.

Adhere to this comprehensive guide:

- Sign in to your account or sign up for a complimentary trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template library.

- Open your ‘State Of Hawaii Tax Form G 45 2017 2019’ in the editor.

- Click Me (Fill Out Now) to finish the form on your end.

- Include and designate fillable fields for others (if required).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Save, print your copy, or convert it into a multi-useable template.

Don't fret if you need to collaborate with others on your State Of Hawaii Tax Form G 45 2017 2019 or send it for notarization—our solution offers everything you require to accomplish such tasks. Register with airSlate SignNow today and take your document management to a higher level!

FAQs

-

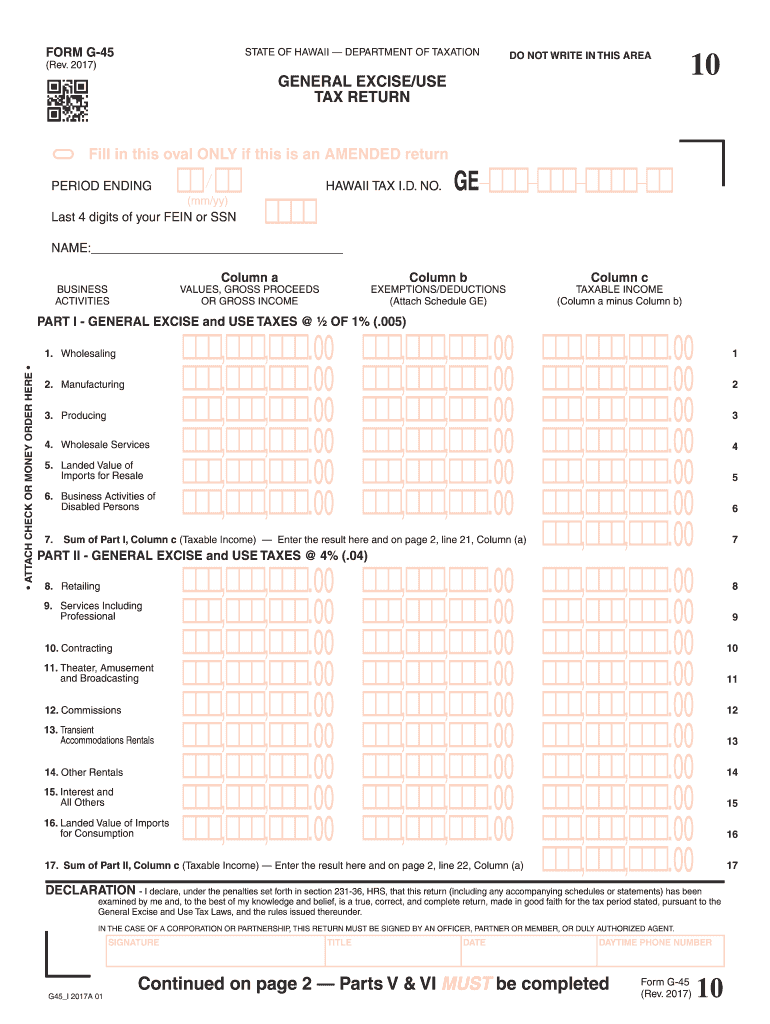

What is the State Of Hawaii Tax Form G 45?

The State Of Hawaii Tax Form G 45 is a tax return form used by businesses to report and pay their General Excise Tax (GET) liabilities. This form is essential for Hawaii businesses to ensure compliance with state tax regulations. With airSlate SignNow, you can easily prepare and eSign your State Of Hawaii Tax Form G 45, streamlining the filing process.

-

How can airSlate SignNow help me complete the State Of Hawaii Tax Form G 45?

airSlate SignNow offers a user-friendly platform that simplifies the process of completing the State Of Hawaii Tax Form G 45. You can fill out the form online, add your electronic signature, and securely send it to the appropriate tax authorities. This eliminates the hassle of paperwork and ensures that your submission is accurate and timely.

-

Is there a cost associated with using airSlate SignNow for the State Of Hawaii Tax Form G 45?

Yes, airSlate SignNow offers various pricing plans that cater to different user needs. While there is a cost to subscribe, the investment provides you with a comprehensive suite of tools to manage your documents, including the State Of Hawaii Tax Form G 45. This cost-effective solution can save you time and reduce the risk of errors in your tax submissions.

-

Can I integrate airSlate SignNow with my existing accounting software for the State Of Hawaii Tax Form G 45?

Absolutely! airSlate SignNow can seamlessly integrate with various accounting software, allowing you to import data directly into the State Of Hawaii Tax Form G 45. This integration helps streamline your financial processes and ensures that your tax calculations are accurate and up-to-date.

-

What features does airSlate SignNow offer for the State Of Hawaii Tax Form G 45?

airSlate SignNow provides features such as eSigning, document templates, and real-time tracking for the State Of Hawaii Tax Form G 45. These features enhance your ability to manage tax forms efficiently, ensuring you can quickly complete and submit your forms without any hassle.

-

Is it secure to use airSlate SignNow for my State Of Hawaii Tax Form G 45?

Yes, security is a top priority at airSlate SignNow. All documents, including the State Of Hawaii Tax Form G 45, are encrypted, and we comply with industry standards to protect your sensitive information. You can confidently eSign and send your tax forms knowing that your data is secure.

-

How do I get started with airSlate SignNow for the State Of Hawaii Tax Form G 45?

Getting started with airSlate SignNow is easy! Simply sign up for an account, choose a pricing plan, and you can begin creating and eSigning your State Of Hawaii Tax Form G 45 right away. Our intuitive interface and helpful resources will guide you through the process.

Find out other state of hawaii tax form g 45 2017 2019

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles